- Comparing Crypto Coin vs. Token

- Examples of Major Coin and Token Projects

- Crypto Coin vs. Token: Which Is Better to Create?

- Hard Fork or Create a New Blockchain?

- Coin Swaps: Moving from Token to Coin

- Conclusion

There are many terminologies for cryptocurrencies. Newer investors may find it difficult to distinguish between various categories. In this article, we look at the difference between crypto coin vs. token. We also examine some of the most relevant projects in each category and try to understand how some cryptocurrency projects migrate from digital tokens to digital coins.

Comparing Crypto Coin vs. Token

Yes, the number of different terminologies for cryptocurrency can be overwhelming for both new and experienced investors alike. However, there is one key distinction that makes the classification of crypto coin vs. token simple to understand.

The term coin generally refers to any cryptocurrency that has its own separate, standalone blockchain. The term token or digital tokens can refer to any cryptocurrency that is built on top of an existing blockchain.

For newer cryptocurrency investors, it might be best to think of these terms by using a simple metaphor. Essentially, coins represent a cryptocurrency that is similar to the foundation or framework of a building. In contrast, tokens represent a cryptocurrency that is added to an existing infrastructure. The process of building an entirely new blockchain and launching a coin is typically considered to be more complex and time-consuming.

Examples of Major Coin and Token Projects

Bitcoin is perhaps the best example of a coin. Bitcoin not only represents the world’s first cryptocurrency but also the world’s first blockchain. Since its launch in 2009, a number of new blockchains have emerged. Because Bitcoin’s code is open source software, a number of projects launched completely new blockchains by merely modifying a few technical components. Oftentimes, new projects feature improvements in scalability, block size, or other technical components. For example, Charlie Lee created Litecoin with this approach.

Determining whether or not a cryptocurrency is a coin or a token is not always simple. At first glance, looking at a project’s name appears to be an effective way to differentiate. For example, Bitcoin (BTC) and Litecoin (LTC) do have coin in their names and are coins. However, Binance Coin (BNB), is actually an Ethereum-based digital token. Typically, the best way to find out whether a project is a coin or a token is to look on the project website. It is important to note that even project teams themselves sometimes use these terms interchangeably.

Crypto Coin vs. Token: Which Is Better to Create?

Determining which type of cryptocurrency is better to create is really up to each project team. Certainly, coding a new blockchain is easier with the availability of open-source code. Nonetheless, designing a new blockchain to break past technical limitations of other existing blockchains does require a lot of time and effort.

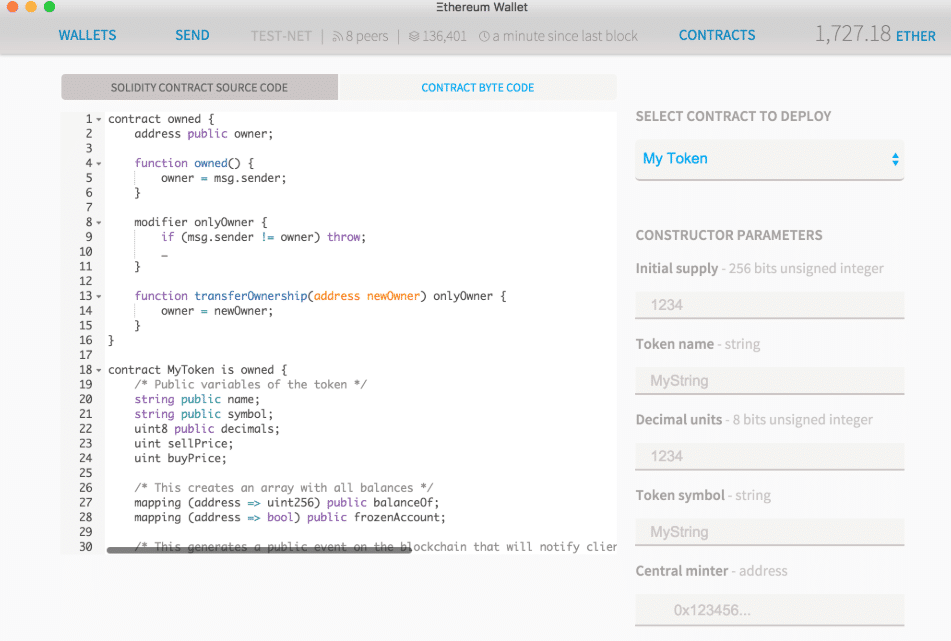

Tokens that are built upon existing blockchain networks serve an integral role in the cryptocurrency market. There are many projects listed high in the market cap rankings that do not have their own native blockchains (as of August 2018). For example, OmiseGo, 0x, Maker, and others utilize Ethereum’s blockchain to make major technical advancements, industry-specific integrations, and much more.

Ultimately, the biggest benefit to creating a new coin (and a new blockchain) vs. a new token (using an existing blockchain) is that there might be less reliance upon other teams to make regular technical improvements.

Hard Fork or Create a New Blockchain?

The reality is that not all project teams or open-source communities are 100 percent in agreement on all issues. Oftentimes, we see debates over which direction a blockchain, and its respective coin, should go. For example, Bitcoin Cash and Bitcoin Gold emerged as hard forks of the original coin, Bitcoin. In many cases, these hard forks create viable alternatives to existing blockchain projects.

While hard forks do add a competitive element to the cryptocurrency market, it is very possible for multiple cryptocurrencies originating from the same blockchain to exist in harmony. It’s important to note cryptocurrencies that originate from hard forks are coins, not tokens.

Coin Swaps: Moving from Token to Coin

While many hard fork coins are ranked high in terms of market cap, these projects do not represent a majority of cryptocurrencies. Most cryptocurrency projects on the market in 2018 actually start out by launching a digital token rather than a coin. There are several reasons why project teams do this.

Many blockchain projects issue tokens during their ICOs with the intention of creating their own blockchain in the future. The process of raising money during an ICO doesn’t require a new project to already have an existing, standalone blockchain. For project teams, it’s easier to raise funds and distribute tokens via an existing blockchain. This reduces potential technical issues and streamlines the entire ICO investment process.

Typically, project teams launch testnets of their own blockchains before releasing a publicly available cryptocurrency mainnet. Once a project team is ready to launch its mainnet, it usually conducts a coin swap. This is also known as a token swap. During this event, users are able to exchange their digital tokens for digital coins that can be used on the new, standalone blockchain. In 2018, EOS, Tron, VeChain Thor, and several other projects have completed this process.

For investors, it’s important to note that coin swaps could be done manually or automatically. Many exchanges like Binance, for example, have a feature that automatically swaps digital tokens for coins. For investors who store funds in an external wallet, it might be necessary to go through a few manual steps before receiving new coins.

Conclusion

Digital tokens and coins are both vital to the cryptocurrency market. While there really is only one main difference between these two cryptocurrency categories, knowing the difference between crypto coin vs. token is essential for understanding the goals and challenges of various project teams. In turn, having this technical knowledge can help potential investors to better evaluate both ICOs and existing cryptocurrencies.

[thrive_leads id=’5219′]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.