- Roll Your Own Cryptocurrency

- I’ll Have What He’s Having

- Standing On the Shoulders of Giants: Launching a Token

- Down to the Bottom Dollar

Creating Your Own Cryptocurrency

The first cryptocurrency emerged when Satoshi Nakamoto conceived Bitcoin in 2008. At the time, the world economy was approaching turmoil with the coming of the Great Recession. Economic crises typically result in centralized banks and governments buying themselves out of trouble by printing more money and flooding it into the economy. By contrast, Bitcoin created a financial system of limited supply with new coin mintage designated at strict ten minute intervals. This system ensures that a centralized authority never alters Bitcoin’s supply against its mathematically-based parameters to debase the currency through mass-inflation.

With its first iteration in Bitcoin, blockchain technology empowers all individuals to create their own cryptocurrency. So how would you go about doing this?

Roll Your Own Cryptocurrency

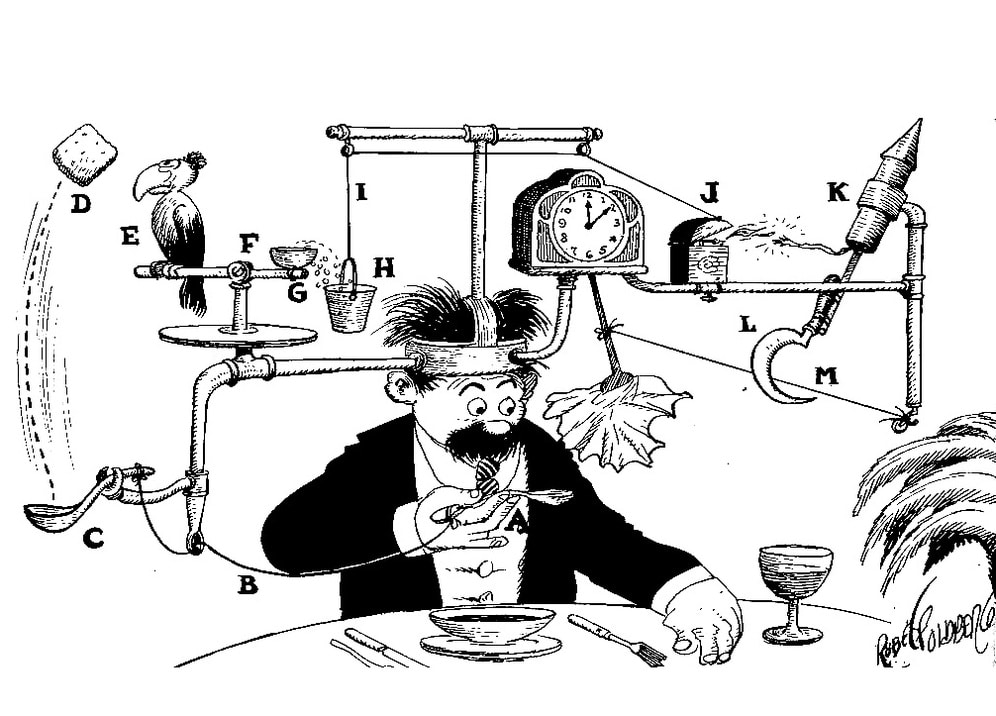

An engineer filled with enthusiasm might want to write all the code from scratch. Inspired with innovative concepts to solve existing, complex problems, he might want to pave his own path, proposing new solutions. This approach looms as a daunting challenge. It is not for the faint of heart. And it is not to be accomplished without powerful resources and time-consuming work.

I’ll Have What He’s Having

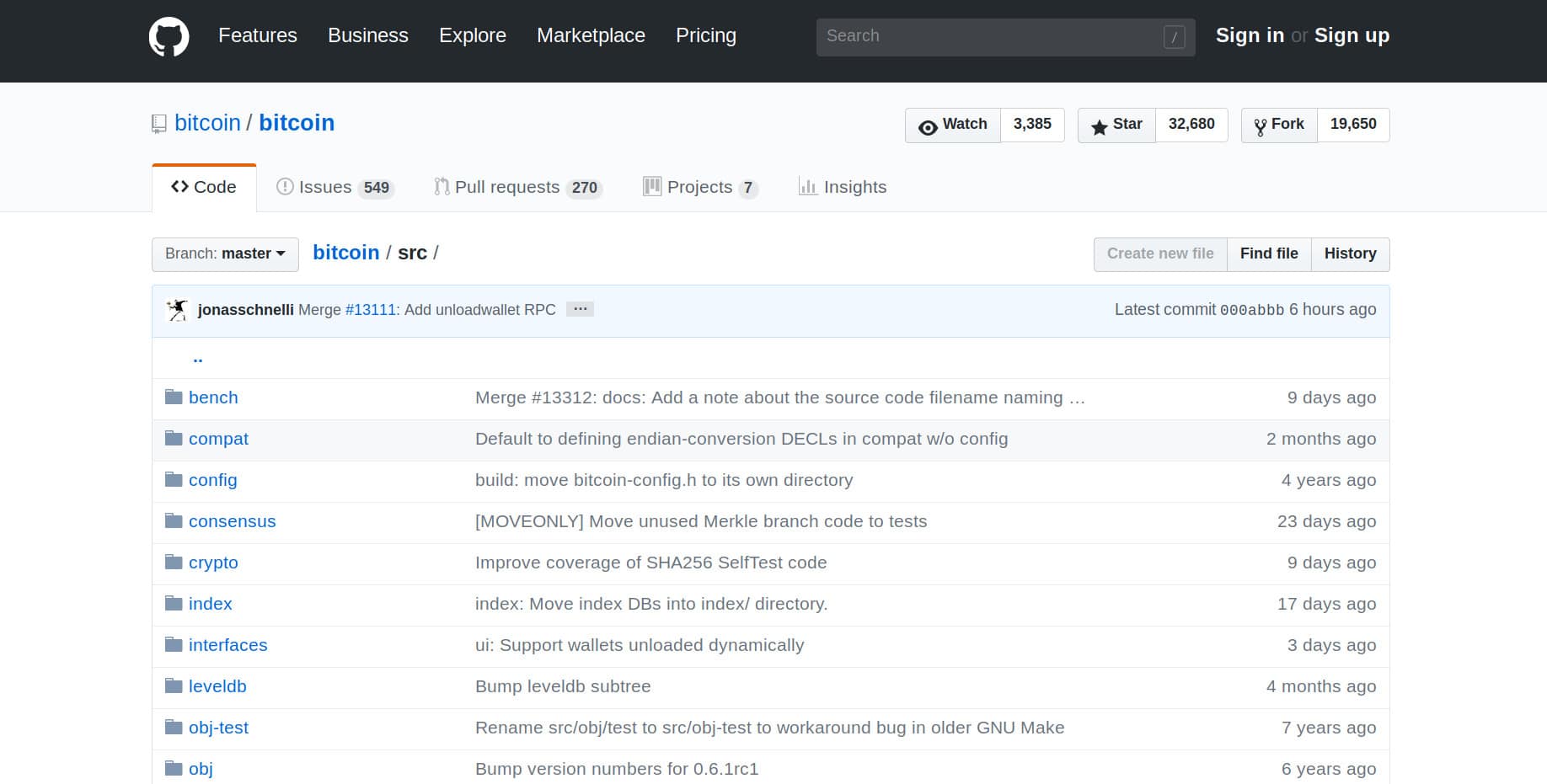

Alternatively, open source software provides a popular mechanism for programmers to publish their software and share their code. Projects maintained as open source release their source code to the public on repositories like GitHub. These projects permit anyone to use their software within any specified licensing agreement.

Bitcoin, for example, is an open source software that you can find on GitHub. Anyone can view the code, download it, modify it, and incorporate it into their own project. Consequently, anyone can take the Bitcoin code and use it as the basis for their own cryptocurrency project.

Implement a few modifications to the code and you now have your own new cryptocurrency. Any existing open source cryptocurrency project lends itself to this process.

Charlie Lee created Litecoin this way. He took the Bitcoin code, made minor modification to components like enlarging the block size, then released it as a new and separate project. Litecoin aspired to be a faster, cheaper version of Bitcoin that would facilitate payments and function as a currency to complement Bitcoin’s role as a store or value.

Source code forks lik Litecoin distinguish themselves from hard forks by establishing a new code base and running on a new set of network nodes. A hard fork is simply an upgrade of the original project; it updates the code base of its parent coin and uses the same network nodes as the original blockchain it forks from.

Litecoin also has its own GitHub.

Standing On the Shoulders of Giants: Launching a Token

The Ethereum network enables users to easily create their own cryptocurrency tokens without coding the entire system from scratch and without borrowing from the code of other coins. Ethereum’s ERC-20 standard defines a list of the functions programmers need to follow to create a new token that will operate on the Ethereum blockchain. ERC stands for Ethereum Request for Comment, while the number is an index to reference the proposal.

To implement the ERC-20 token standard to create your cryptocurrency, you would code all the elements required. These elements include a name for the currency and its symbol (e.g., the ticker for the currency, like BTC for Bitcoin and ETH for Ether). You would build code to determine the total supply of coins for your currency, and then you would program a function to return the current balance of a given account. Finally, you would also program functions to transfer coins from one account to another, as well as a variety of other necessary coding functions.

The benefits of this approach are that you do not have to implement your own blockchain. Your token will store on existing wallets; you will not have to create a new wallet or add a new feature to an existing wallet. From the word go, it will also operate on a viable network of active nodes.

The Ethereum Organization provides a step-by-step guide on how to do this from the beginning through the end stage of deployment.

The Waves platform makes launching your own token even easier. For Waves, you do not need to know how to program, and a new currency can be set up in a minute or so.

An Ethereum ERC-20 token can represent numerous tokenized assets (investment contracts, an IOU, a game token, etc.), but Waves focuses on creating tokens for trading money on an exchange. Tokens created on Waves are tied to a fiat currency, and they are then traded essentially as a stand-in for that currency. For example, a new Wave token called MyLovelyNewCoin might be tied to the U.S. dollar. Each MyLovelyTokenCoin represents one dollar. This reduces costs for the transfer and speeds-up the transaction. Alternatively, Waves can also use established cryptocurrencies such as Bitcoin to serve as the base behind a Waves token.

Down to the Bottom Dollar

Andy Warhol famously said that, in the future, everyone would be famous for fifteen minutes. Traditionally, only governments and powerful organizations have issued currency. But in this day and age, technology empowers everyone with the ability to create his/her own private currency. You can create your own economy, even if lasts for less than fifteen minutes.

Regardless of the process used, we’ll likely see individuals continue to add to the growing list of more than 1,500 cryptocurrencies currently in circulation. People may even do this if for no other reason than to stamp a coin with their own identity.

[thrive_leads id=‘5219’]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.