- Lots of Problems but Plenty of Potential

- Puerto Rico

- International Trade

- Hyperinflation, Dictators, and Investment Ops

- Abundant Crypto Trading Opportunities

- Bypassing Traditional Finance

- Bienvenidos

Latin America is huge. It stretches southward to the Patagonia areas of Chile and Argentina, eastward into the Caribbean, and northward to the US-Mexican border. Twenty nations and a dozen dependent territories comprise this culturally rich and diverse area. Nearly 650 million people call Latin America home. And, many of these individuals are becoming interested in the commercial and investment opportunities offered by cryptocurrencies. Blockchain technology in Latin America also has fantastic potential to help transform the economies of its developing nations.

Lots of Problems but Plenty of Potential

Latin America’s centuries-old historical record is no stranger to invading empires, economic exploitation, financial system chaos, widespread corruption, and endemic poverty. Can crypto and blockchain help lay the foundation for a more modern, prosperous, and peaceful future for Latin America’s inhabitants? Here’s a look at a real-life crypto city experiment in Puerto Rico and how blockchain is making international trade to Latin America more efficient.

Puerto Rico

Brock Pierce’s Sol project envisions a new, ultramodern city where all transactions occur in crypto. Smart contracts are the guiding force driving all key business and societal dynamics. Originally named Puertopia, the project has received mixed responses from Puerto Rican residents. The Sol group desires to acquire at least 250,000 acres of land upon which to build its island-based utopia. Given the widespread devastation caused by Category 5 Hurricane Maria (September 2017), Sol’s wealthy backers may be able to acquire that land at a bargain price. Some welcome the billions in potential post-Maria infrastructure investment, while others complain:

“We’re the tax playground for the rich,” she said. “We’re the test case for anyone who wants to experiment. Outsiders get tax exemptions, and locals can’t get permits”.

- Andrea Satz, Puerto Rican resident, quoted in the New York Times, February 2, 2018

Ax the Tax

Puerto Rico offers the potential for significant tax savings for wealthy investors. Of course, that was one of the main attractions for the Sol project’s backers (many being multi-millionaire crypto investors from California). Nevertheless, the Sol group certainly appears to have a generous, philanthropic side too. For example, the group plans to convert an old children’s museum into a clubhouse whose purpose is to “bring together Puerto Ricans with Puertopians.”

The Sol project also wants to help improve Puerto Rico’s ancient, failure-prone electrical grid. Such upgrades would help supply their own massive crypto mining and blockchain power needs while improving the lives of everyone else living on the island.

Smart Contracts and Digital Disinfectant

The US territory (native Puerto Rican residents are US citizens) has suffered from major political scandals. Since 1992, corrupt island administrations have cost Puerto Rican taxpayers enormous sums of money. Perhaps the introduction and widespread deployment of smart contracts will prove to be an important step in cleaning out all of the pockets of graft and corruption.

Every dollar, every expenditure, and every receipt of taxpayer funds would be accounted for on the blockchain. Blockchain technology could be a powerful antidote to government graft, not only in Puerto Rico but also worldwide.

Blockchain may also hold promise with intervention against the drug cartels that have ruined the lives of many Puerto Rican residents. For example, Luis Munoz Marin International Airport could mandate smart radio frequency identification (RFID) tags on all luggage, packages, and carryons, with all of them connected to the blockchain.

The same tactics could be implemented on all container cargo ship cargoes. Even the giant cruise ships that regularly call on San Juan could be subject to the same intense scrutiny. Travelers’ passports and other IDs could also be connected to the blockchain, along with key biometric details.

International Trade

Latin America is a huge trading partner of the United States, Europe and especially Asia. Enormous quantities of imported consumer goods enter the giant ports of Latin America. Buenos Aires, Callao (Lima), Caracas, Cartagena, Rio de Janeiro, San Antonio (Chile) and San Juan (Puerto Rico) are some of the majors. However, cargo transit times are longer than necessary. That’s because of the manual paperwork verification and signatures required at each key export/import checkpoint.

Until all of the paperwork gets manually validated, the goods remain in their shipping containers. Obviously, the containers and dock space can’t be used for other productive purposes. Even worse, highly paid union dock workers might stand idle due to the delays.

Digital Delivery Record

Enter blockchain to the rescue. With trustless, digital signatures made possible by the blockchain ledger, no one needs to walk half a mile to obtain the bosses signature. Embedded chips in shipping containers could automatically communicate with the blockchain as they arrive in the port. Additional sensors would verify the transfer of the containers onto delivery trucks.

When the containers are unloaded at warehouses or final customer delivery docks, the chips send an all-clear confirmation signal to the blockchain. No signatures or human verification are necessary. Even better, real-time tracking of every single item of import and export cargo can be accomplished via the blockchain.

[thrive_leads id=’5219′]

Hyperinflation, Dictators, and Investment Ops

Yep, Latin America’s got ’em all. Argentina’s recent bout with hyperinflation and currency devaluation has driven some residents to seek a safe haven in cryptos. Venezuela’s bad-boy, President Maduro, recently introduced a government-sponsored crypto called the Petro.

South Americans routinely park some of their wealth in US Dollars, Euros, gold, and collectibles, fearful of currency collapses. Cryptos may offer yet another way for prudent Latin American residents to protect their hard-earned savings.

Abundant Crypto Trading Opportunities

There are several large crypto exchanges operating in Latin America, including:

- Bitpagos (Argentina)

- Bitso (Mexico)

- Bitinka (Peru)

- Buda (Chile)

- Cryptofacil (Uruguay)

- Mercado Bitcoin (Brazil)

- OKCoin

- SatoshiTango (Argentina)

- SurBTC (Chile)

Buda is especially optimistic regarding the future of crypto in South America:

“In the next 10 years more than 200 million South American adults will enter the digital economy and Buda.com will be there to receive them.”

Bypassing Traditional Finance

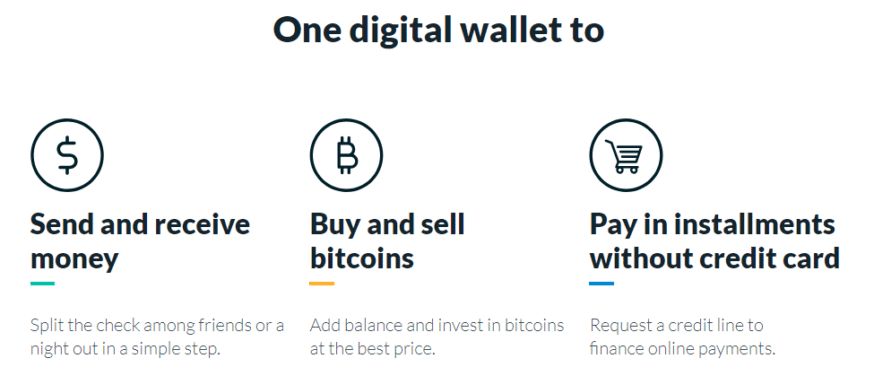

Ripio.com (Argentina) offers a digital wallet that allows users to transmit and receive funds, buy and sell bitcoins, and make installment payments without needing a credit card. They refer to this as financial inclusion, and their services are targeted for consumers without a traditional bank account. This is a major market waiting to be tapped, as some estimates put the number of unbanked adults in South America at nearly 65 percent.

Bienvenidos

For Latin America, cryptocurrencies and the blockchain may hold the keys that unlock a brighter and more prosperous, stable future. Businesses, consumers, and financial firms are enthusiastically embracing both technologies. Once Latin American government regulators also put out the welcome mat, both crypto and the blockchain will help pull this part of the world into the 21st-century.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.