Celsius was considered a top cryptocurrency interest account before suspending all customer withdrawals and filing for bankruptcy, owing its users $4.7 billion. Mashinsky stepped down from his role as CEO in late September. Prior to freezing withdrawals, Mashinsky withdrew $10M in tokens along with his wife Kristine Mashinsky and former chief strategy officer Daniel Leon withdrawing over $2m and roughly $7m, respectively. Mashinsky was arrested and charged with seven counts of fraud by the US Department of Justice in July 2023.

This interview was conducted and published in May 2020. Celsius would grow to 300,000 active users (over $100 in wallets) and more than 1.7 million registered users, prior to shutting down in 2022.

“Celsius is going after all the money in the world,” says Alex Mashinsky, the Founder of Celsius, who plans to make more than just a dent.

Investment banks are thriving despite bustling fintech startup activity and looming economic threats–JP Morgan celebrated its most profitable year ever in 2019 with a record $36.4 billion in net income, a bulk of which came from a very important strategy called Security (Sec) Lending– we’ll get into that soon enough.

Alex has made around 120 VC investments, holds 34 patents, raised over a billion dollars, and has achieved over $3 billion in exits. Alex is on his eighth startup company as a founder, and two of his companies, Arbinet and Transit Wireless are two of New York’s biggest venture-backed exits ever, with exits of $750M and $1.2B respectively. The core similarity between these exits is that the companies built a monopolistic hold in their industries and utilized groundbreaking technology to pioneer business models assumed to be impossible.

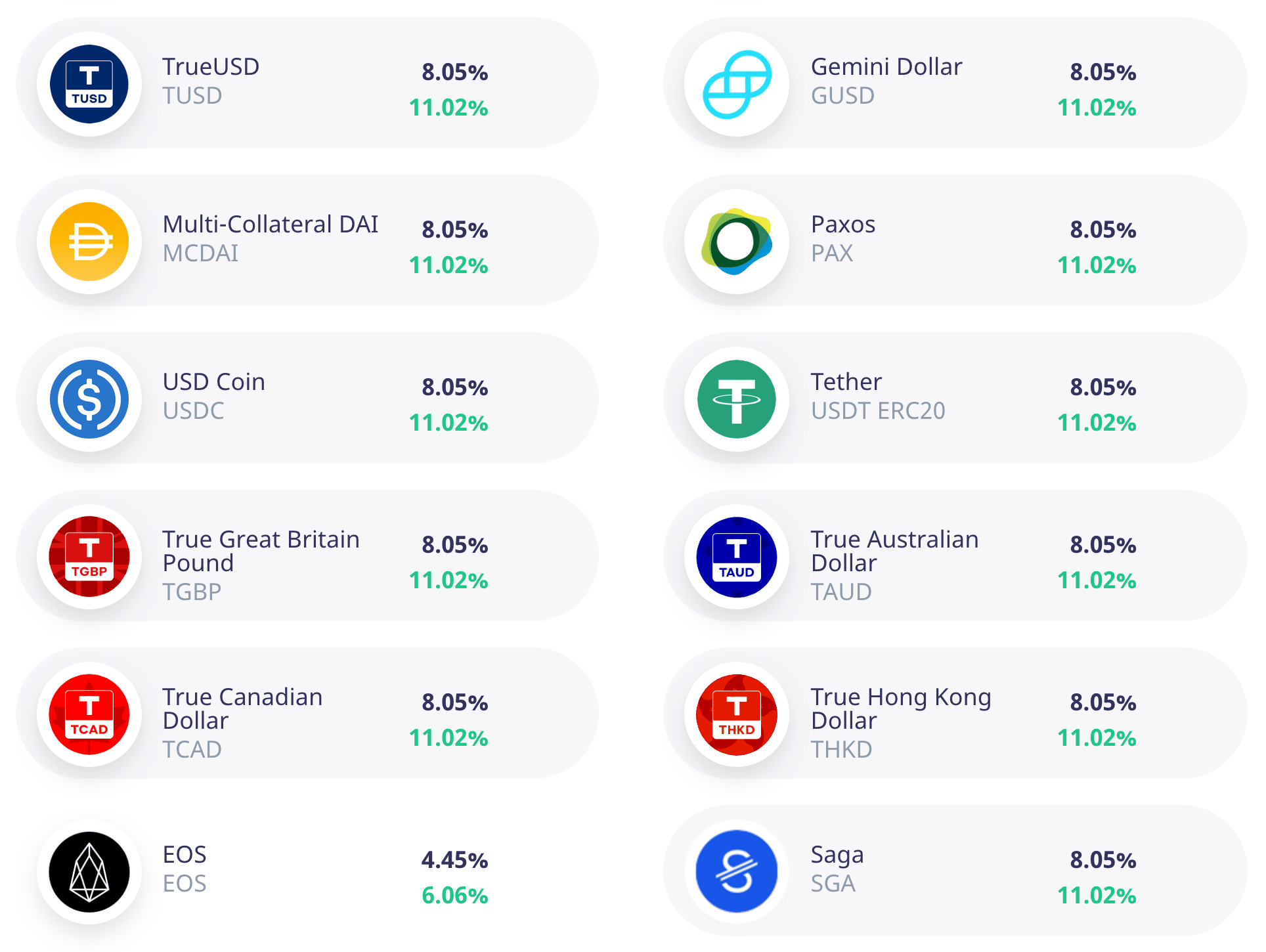

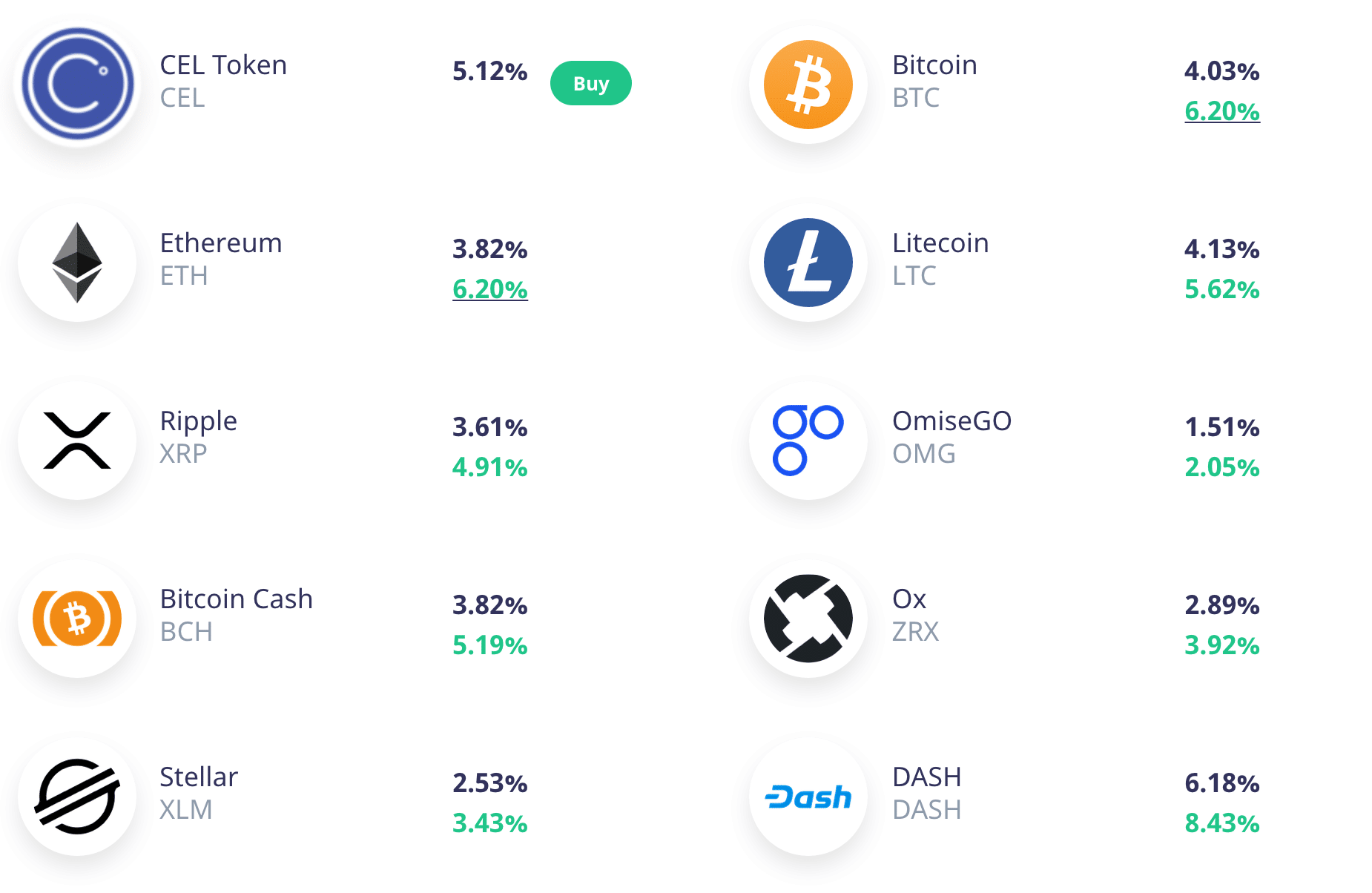

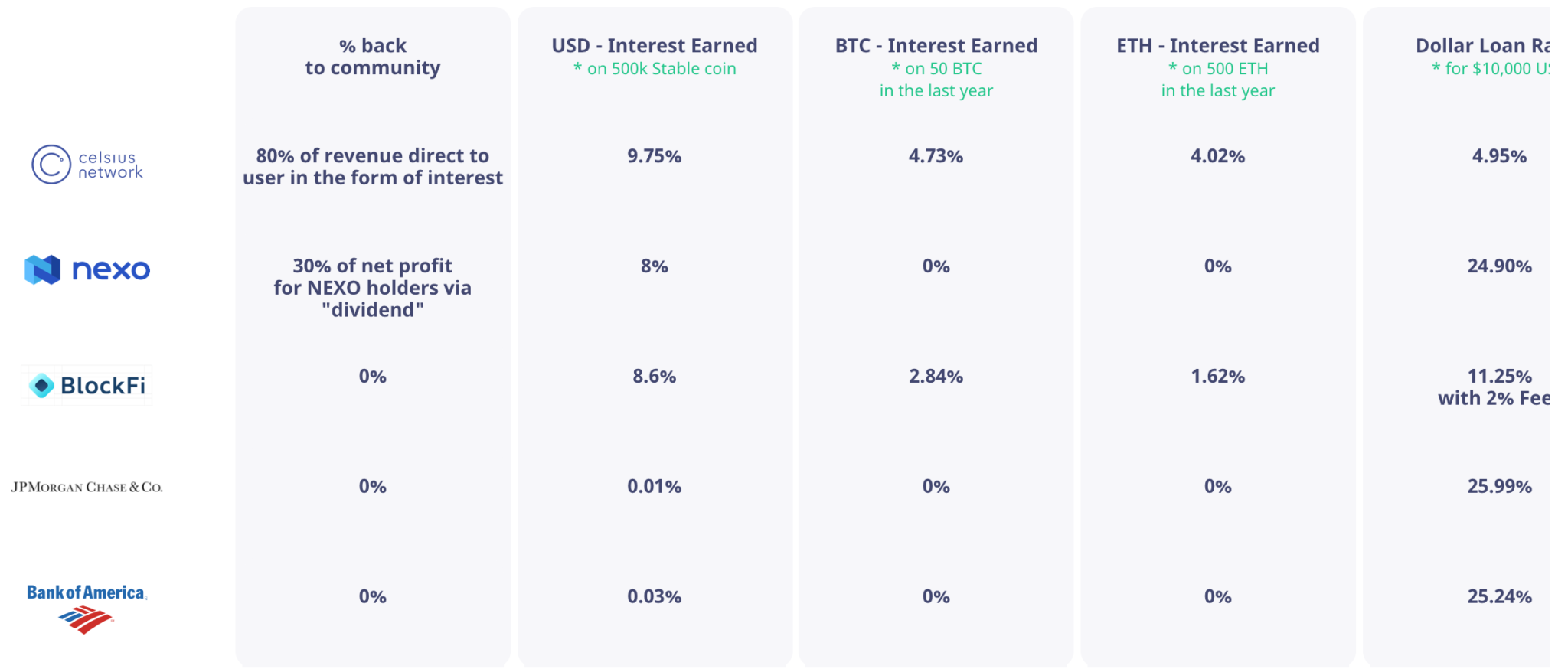

At face value, the concept is easy to understand: Users deposit any amount of a variety of digital assets and earn an annual interest rate upwards of 11%– a stark comparison to traditional bank savings accounts, which offer anywhere between .01% to 2%.

“What most people are missing is what the banks are telling their investors how they earn 15-18% on their depositors’ money every quarter,” Alex starts. “If they cared about their customers, the banks could also be paying 9% as we do. They’re focused on returning profits to shareholders, not interest to depositors, the two directly conflict. CoinCentral’s Steven Buchko first interviewed Alex back in 2018, when Celsius was in the middle of launching its app

Challenging the Status Queue with Blockchain: Investment Bank Edition

Rarely does one visit appealing financial opportunities without a healthy dose of incredulity or skepticism. The expression If it’s too good to be true, it probably is… is built on multi-generation experiences of disappointments, trickery, and usually a guy with a bleached smile, an expensive suit, and a $100 haircut.

However, too good to be true may carry less weight in a paradigm that is already significantly skewed against your best interests. At least, that’s what the Celsius ethos argues.

“Back when I made VoIP in the ‘90s, we were able to offer the service for a fifth of the price,” says Mashinsky. “People said it was impossible to offer cheaper services than AT&T. Today, people assume that just because a bank pays them 1% in interest, no one can beat the bank.”

“But, Mr. Mashinsky, how does the bank even pay people 1%?” a curious reader may ask.

When we think of big banks, we usually think of gigantic buildings sitting on the most expensive streets of downtown and highly paid executives. Banks just know how to make money, even in their darker days. In the 2008 aftermath, $1.6 billion of the federal bank bailout money went to executives. Lloyd Blankfein, the then-president and chief executive officer of Goldman Sachs, left with $54 million in compensation that year, and the top five executives received $242 million. The house never loses.

To understand how banks make their money, Mashinsky implores us to study up on something few Americans outside of the finance world are aware of called securities lending.

Securities lending, or sec lending, is the practice of “loaning” a stock, security, or derivative to an investor or firm. It’s generally done between brokers and dealers and not individual investors. As a critical component of creating market liquidity (specifically for re-hypothecation, or basically the process to facilitate shorts and other options trading), sec lending can be incredibly lucrative.

Mashinsky walks us through a simple example.

“Let’s say you buy a TSLA stock from Charles Schwab. You take on the risk of TSLA going up or down, but on the back-end, Charles Schwab is loaning your TSLA to other brokers and dealers and making something between 12% to 17% per year.”

How much do you, the investor, and owner of TSLA make on Schwab’s interest revenue? A big fat zero.

Similarly, most bank savings accounts have historically offered depositors a sliver of a percentage (now upwards of 2%) on their assets, but are loaning depositor out to receive hearty returns. JP Morgan, a financial behemoth entrenched in American history, banks for over 100 million Americans who have Chase cards, bank accounts, and other accounts.

“JP Morgan’s cost of capital is less than 1%,” says Mashinsky. “Their return is close to 17%. That’s how they make $36B a year, which they mostly use to buy back their stocks, pay dividends to shareholders, and compensate executives. How is that a good deal for the depositor? What does the depositor get out of this? They take the money you give them for free and lend it back to you and charge you 24% on your credit card.”

Mashinsky brings us to the punchline, of which he has many.

“If a bank has 10:1 leverage on your money, if you withdraw your money, they lose 10x. The only one who has the power to let the bank do what it does is you. You just don’t know you don’t have the power.”

Celsius is looking to flip the script.

“Show me a fintech company that puts a scratch on any bank,” says Mashinsky. “JP Morgan just had their best year. No fintech company has been able to unseat or dethrone these institutions. They just get stronger and institute it. Institutions can’t win in my game. We took the juiciest part of Wall Street and brought it to the crypto community. People hate me for spilling the beans. Give the bulk of the fees to the depositors. We give 80% of revenue to the depositors.”

Celsius: Blockchain Verified Interest and Cryptocurrency Interest Accounts

Historically, monopolies build a fortress around their business interests by the high barriers to entry created by existing infrastructure they’ve built or purchased. However, advances in technology can often antiquate the existing infrastructure, as we’ve seen the impact of automobiles and planes on the railroad industry.

Mashinsky wants to use blockchain as the impetus to topple Wall Street’s dominance and bring financial empowerment to the people.

“Let’s start with the bank,” leads Mashinsky. “Imagine a public audit function. You make a deposit in a bank and ask where your money is going, where it’s stored, who they’re lending it to, how much the bank is charging them, how much of that money is coming back to you, and how they plan on distributing it back to you.”

“If you’re not a high net worth individual, any bank would kick you out and shut down your account for having the audacity to ask these questions,” Mashinsky half-jokes. “They assume the marble pillars outside every bank speak for themselves: they know how to make money. They don’t have to prove anything.”

“Not only that, but the accumulating re-flating activities the government is doing is also going to get us in trouble. We have over $100T in deficits and $120T in liabilities. If banks fail and get bought out or bailed out, it’s only prolonging it. You can rearrange the seats in the titanic at any time, but the ship is still sinking. This ship is going down no matter what, the question is how much water is it taking on.”

Celsius cuts out banks and governments by using blockchain to give all parties visibility into its business workings. It had to start with re-inventing the interest-bearing account from scratch.

“The reason Celsius focuses on transparency and using the ledger is its amazing mechanism to deliver the interest. I can’t use a credit card to deliver the fees to you because their fees are too high. Bitfnix recently moved almost $1B for $6 using blockchain. That’s not possible with any other infrastructure”

“We use blockchain as an interest-delivering vehicle on the front-end, and we’re using transparency and open ledgers on the back end. Celsians.com, for example, is a third-party site that uses blockchain data to audit Celsius. They take all of the wallets we publish since transactions are public, you can verify everything we’re saying. Who they’re giving these loans to? Payments coming in. We can see the interest, who’s paying the interest, and who is Celsius paying this interest to. We publish all wallets on the website, you don’t have to be a member of Celsius, you can verify it just by knowing the blockchain works.”

Mashinsky sees Celsius as the future of the financial institutions, even if only as a foundation.

“We hope we set the skeleton of the foundation of the future institution. This isn’t about Celsius, it’s about creating a whole new infrastructure to replace Wall Street.”

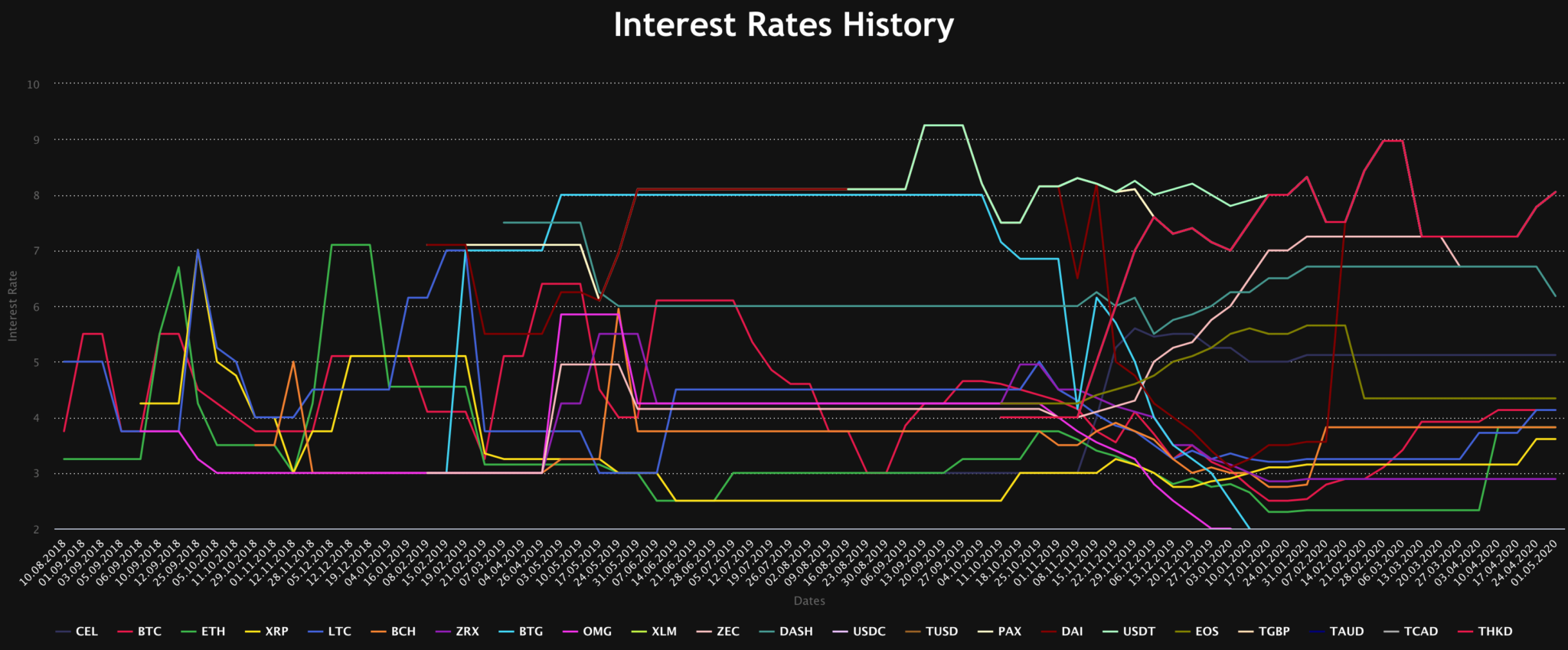

“Celsius has shared how much we charge customers, how much we earn, how much we payout for the past 114 weeks since our launch,” Mashinsky says proudly. “ We are probably the most transparent company in cryptocurrency. Our community routinely runs audits on our numbers via the blockchain as well.”

Leading the Crypto Interest Account Market

With more earnings in BTC and ETH than all of its competition within the cryptocurrency space combined, Celsius has earned a significant stride.

Mashinsky credits Celsius’s market leadership with community effort and operational execution. Mashinsky, who served in the Israeli military for three years, isn’t one to shy away from going for the jugular.

“Celsius did more than anyone else because our competitors just don’t pay users enough. Celsius distributes 80% of its revenues to its community, whereas our competitors just published 30% of NET profits which is much less.”

“None of these companies will show you how they earn the interest or share any details about their business,” says Mashinsky. “Many of them won’t even give you a physical address of where their offices are. I would not trust such companies.”

“Many of them are simply just trying to compete with us directly. They aren’t earning the rate, they’re subsidizing payouts with VC money they raised from Wall-street type guys,” Mashinsky points to competitors BlockFi and Cred. Celsius is a community effort looking to provide as much effort to the community as possible.”

If you’re planning to beat Celsius, Mashinsky claims, you’d better be prepared to cut your profit margins.

“If you want to offer higher rates than Celsius, you’d better give more than 80% of what you make to the community. We want to set the bar really high.”

2020, Growth, and Onwards

The interest-bearing cryptocurrency account niche is a comparative gnat when standing next to the traditional interest-bearing market. To Mashinsky, this only means room for growth.

“Celsius is going after all the money in the world. 7.5B people want to earn more interest, yet banks and governments keep lowering rates and are giving all the money to the corporations and to the “too big to fail” banks,” Mashinsky says, preparing a heated tangent to the current economic situation.

“All the money we’re printing now should be going to the infrastructure of this country,” Mashinsky begins. “Getting everything done locally requires tens of trillions of dollars. Instead of spending it on infrastructure, we’re giving it to airlines, hotels, and cruise companies. We’re Reflating everybody, zombie companies, the fed will bail out anybody, exactly what japan did for the last 30 years. That’s what my beef is. Taking precious dollars from the future– borrowing it from our kids, making them pay taxes on it in the future, and spending it to maintain our lifestyles today.”

“If you deliver reliable interest income, seven billion people will want to use your service,” Mashinsky writes. “That has been our plan from the beginning– delivering interest income to as many people as possible, and in the process, creating mass adoption for all the coins we support.”

One of the tokens Celsius will inevitably bring attention to is its own. CEL can be used to effectively increase interest rates on savings accounts and decrease interest rates on loans.

“CEL’s main function is to offer up to 30% more interest and provide 5% income if you HODL it,” but we have other utilities.”

However, cryptocurrency deposits aren’t FDIC insured, a bane in the user acquisition aspect for many cryptocurrency interest-bearing companies. How does a company like Celsius mitigate the risk of users losing their assets in a doomsday or hack scenario?

“We only lend coins against collateral, so all loans are asset-backed,” says Mashinsky. “Most banks are leveraged 10x via fractional reserves and lend to consumers with no collateral via credit cards, so I think we are actually safer than most banks. We had zero defaults since launch, while all major banks just took over $30B in loss reserves just in the past 60 days.”

Celsius, Opportunities, and Onward

Mashinsky brings decades of experience as an entrepreneur into cryptocurrency, a vertical he’s been following since 2013. Opportunity, according to Mashinsky, requires using blockchain for innovative business models, not just traditional replicas on a blockchain.

“The best opportunity is for startups to invent a new business model that can only be done on the blockchain as Celsius did with interest income in crypto interest accounts. Many companies in crypto just copy Wall Street business models and call themselves revolutionary. I invented VOIP in 1994, and we are now building MOIP (Money over IP) to deliver a new decentralized blockchain-based financial system to the masses.”

Mashinsky also points to the entrepreneurs’ responsibility to help cryptocurrency become commonplace.

“We’ve been waiting for years for mass adoption. While any Bitcoin trader will say that BTC has done well compared to other asset classes, it gets maybe a C- grade for inclusion, scale, adoption. There are maybe 30-35 million active unique wallets worldwide for all the coins. From an adoption standpoint, we’re very early days. Celsius partially came about by asking myself how we can get to mass adoption.”

“We have almost 100,000 users who did KYC: that’s a huge number for cryptocurrency but still a small number for fintech. I think it is hard for people to believe we can pay 9% on something based on USD (stablecoins) when the bank tells them they can not even pay them 1%.”

Mashinsky advises people to get educated but to be wary.

“Trust, but verify,” Mashinsky says of blockchain echoing Reagan’s approach towards the Russians in the Cold War. His approach to news is similar. Where does an entrepreneur like Mashinsky get his day-to-day information?

“I watch a lot of news via YouTube and read WSJ and other financial news sources. Also, specific pubs like CoinCentral :),” Mashinsky notes flatteringly.

In closing, Mashinsky pushes people to take action to change things themselves by taking action.

“If you don’t like the game, invent a new one. The choice is on most of us.”