- Let's Put Things Into Perspective

- Underlying Need

- Prices

- Future of The Cryptocurrency Industry

- Conclusion

You hear it wherever you go:

“Bitcoin is dead”

“Cryptocurrency is a fad”

Don’t listen to the haters and naysayers. Cryptocurrency is alive and well. It isn’t going anywhere. Every market has bull and bear periods. It is only natural and extremely healthy for the market to correct itself after a massive bull run. Welcome to the current state of crypto circa August 2018.

Let’s Put Things Into Perspective

Bitcoin is down is 65% from all-time highs! The cryptocurrency industry is in a death spiral.

Not so fast.

We just need to consider the behavioral aspect of investors and also have the patience and foresight to take advantage of the underlying impact it will eventually have worldwide. The cryptocurrency industry is still poised for massive growth.

Underlying Need

Most importantly the underlying need for cryptocurrency has remained unchanged. I’ll save you the grief of listening to a history lesson on poor monetary policy caused the collapse of the Roman empire or how media censorship has plagued nations for centuries.

Financially, the need for a decentralized store of value outside the control of the government and central banks has proved itself financial crisis after financial crisis. Billions of people throughout the world remain unbanked due to lack of access to traditional banks.

Cryptocurrency has the power to address and fix the failures of the world’s current financial system.

Socially, cryptocurrency and blockchain technology offers novel solutions to many of the world problems. From immutable records that can be used for elections to decentralized applications that cannot be blocked by any third party, crypto has the ability to improve and connect the world in a similar way the internet initially did.

Prices

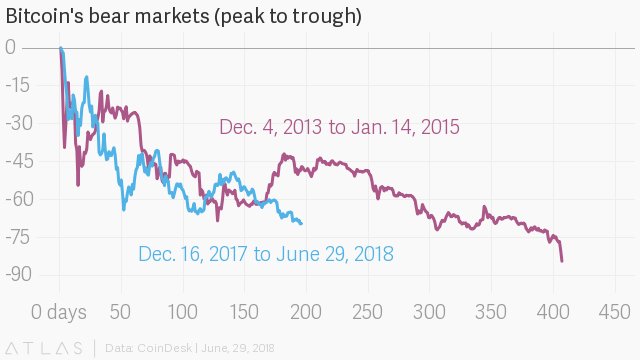

For those not in cryptocurrency for the technology, this is not the first time the cryptocurrency market has gone through a gruesome bear market. Bitcoin went through a similar down market for all of 2014.

Let’s put prices into perspective. If you invested in Bitcoin a year ago at $2500, today you would of still have more than doubled your investment. That is an unbelievable return that cannot really be matched by any other asset class.

Although it is impossible to pinpoint the exact moment Bitcoin’s bear market will conclude, current price levels are extremely attractive for new long-term investments in cryptocurrency.

Future of The Cryptocurrency Industry

The future of the cryptocurrency depends mainly on two components: institutional influence and mass adoption.

Institutional Players

New money from institutional investors will likely be the springboard that ignites a new bull market in the cryptocurrency space.

Experts such as Michael Strutton have predicted that additional $100 to $400 billion would enter the market if the SEC were to eventually approve a Bitcoin ETF. This increased money flow would easily put the price of Bitcoin above all-time highs.

Regardless, if the SEC approves a Bitcoin or cryptocurrency ETF, there are numerous, major institutional players are circling the crypto market like sharks waiting for the opportune moment to wisely get involved in such fast-growing profitable asset class.

It’s not a question of if institutional investors will eventually get involved in the cryptomarket, but when?

Widespread Adoption

Arguably most important to the long-term success of cryptocurrency industry is its widespread adoption by masses. Then one of the big problems with crypto is it’s usage in the real world, so spending it in shops etc, but now there is a debit card called CryptoPay that allows you to spend cryptocurrencies anywhere so this is a huge leap forward in that regard.

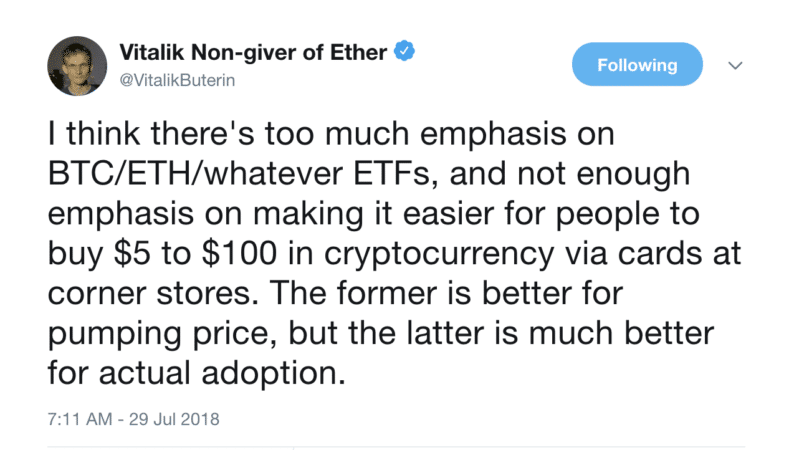

Vitalik Buterin recently highlighted the need for crypto to be more usable by the average consumer on his twitter:

Current State of Adoption

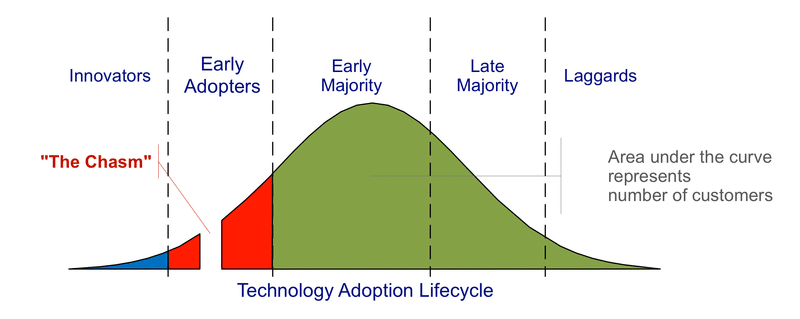

Below is the Technology Lifecycle Adoption Model which is often used in marketing to express the current state of acceptance for emerging technologies or products. The cryptocurrency industry is still in its infancy. As the graph shows, it has failed to cross the “the chasm” into mainstream adoption.

Currently cryptocurrency is still in the early adoption phase, as its price volatility and technical complexity continues to dissuade many major corporations and retailers from accepting crypto as payment.

Despite the business risks of accepting cryptocurrency, major corporations such as Overstock, Expedia, and Subway have stepped forward to accept it in hopes of attracting a new, growing customer base.

Over time, we should expect more large corporations as well as smaller stores to begin to accept cryptocurrency as a way to get an edge over their competition.

Conclusion

Although it is impossible to determine the exact moment cryptocurrency’s current bear market will end, the market is currently positioned for long-term growth as institutional investors enter the industry, and large retailers begin to accept it as a form of payment.

Don’t panic. Cryptocurrency’s bull market will eventually return.

Editor’s note: Maybe. This isn’t financial advice.

[thrive_leads id=’5219′]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.