- Is Crypto Pot's Banking and Supply Solution?

- The Case for Pot on the Blockchain

- For Payments

- For Supply Chain

- The Cryptocurrencies Providing Solutions

- Wrapping Up

Is Crypto Pot’s Banking and Supply Solution?

Young and speculative markets are often ridden with specious investment opportunities, and no, crypto isn’t any different. With a proliferation of meme-tier currencies and shitcoins, there are more worthless than worthwhile projects to choose from.

Indeed, there are 1,400+ coins and more coming out by the day. It seems like entrepreneurs around the world are slapping “blockchain,” “crypto,” and “decentralized” onto ICO projects, heralding a use case for their industry as they ride a wave of profits on a sea of opportunity.

Some industries have a clear need and use for blockchain, but for those that don’t, the voice of healthy skepticism in the back of our minds often questions: “Do we really need blockchain for that?”

If you had this reaction when coming across PotCoin, HempCoin, and the like, you’re probably not alone. But there’s actually a strong case to be made that North America’s budding marijuana industry, especially in the United States, is in dire need of standards, transparency, quality maintenance, and payment solutions, and wouldn’t you know, blockchain offers the panacea to many of pot’s problems

The Case for Pot on the Blockchain

The two seem to complement each other nicely, don’t they? Both emerging industries, both attractive to millennials, both technically legal but still sketchy and stigmatized enough that you might not disclose your interest in them at family gatherings.

Pot and crypto have definitely been hot on the tongue of pop culture recently, and what’s more, they’re starting to be used in the same sentence. With good reason, too; cryptocurrencies and blockchain technology have the potential to solve two problems plaguing the infant industry: payment obstruction and supply tracking.

For Payments

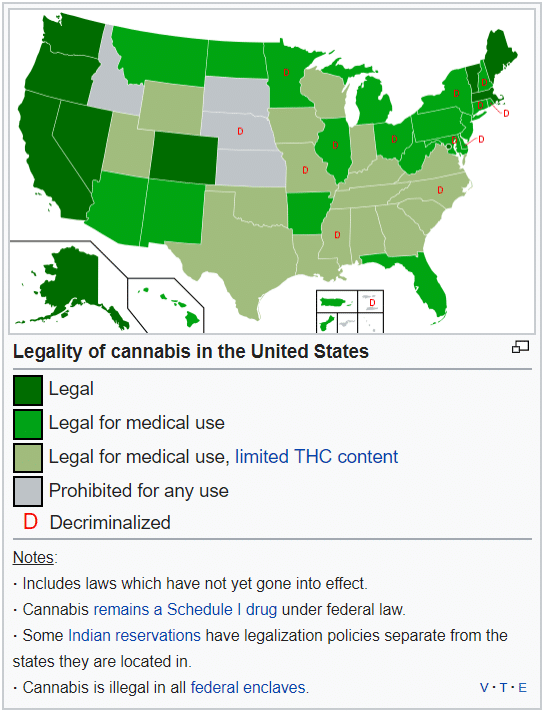

Reason being, banks refuse to open up accounts with marijuana businesses, so many have to run on a cash-only business model. Seeing as marijuana is still pegged as a schedule 1 narcotic under federal US law (the same schedule as cocaine, meth, and heroin), most banks are wary to accommodate dispensaries and growers.

In fact, only 300 out of 11,000 US banks are willing to offer their services to the marijuana industry. But even if a cannabis entrepreneur gets a bank on board, payment processors such as PayPal, Stripe, or Square may refuse to do business with them for fear of money laundering charges or federal backlash.

You probably see where this is headed. In the realm of banking for the unbanked, blockchain could provide a permissionless banking solution for the pot industry with cryptocurrencies as the source of capital and liquidation. Cryptocurrencies could serve as the cashless purchasing intermediary pot shops currently don’t have. Using either the currency directly or purchasing it with crypto ATMs within the dispensaries themselves, customers can enjoy an alternative payment method that won’t leave shopkeepers fist-full with Lincolns, Jacksons, and Benjamins.

For Supply Chain

Payments aside, blockchain technology itself could also lubricate the entire marijuana supply chain. Moreover, it could introduce an added layer of transparency that would leave every step of the process more compliant with state regulations and federal tolerance.

After Washington and Colorado legalized recreational marijuana in 2012, the US Department of Justice released a memorandum entitled “Guidance Regarding Marijuana Enforcement,” aka the Cole Memo. The memo essentially reads that the federal government will tolerate state-regulated marijuana industries so long as they comply with eight guidelines. One of these guidelines prevents cross-state sales of legal marijuana to states where it’s still illegal.

If growers, shippers, and sellers were connected through a blockchain network, the risk of illegal sales could be practically neutralized. Orders, shipments, and products could be entered into and traced on the blockchain, leaving no doubt as to how much product a dispensary has purchased and how much it has in stock. There are obvious supply chain management benefits here. But from a regulatory standpoint, if a government wanted to audit a store’s inventory and selling history for any abnormalities, a quick scan through a distributed ledger’s database could clear the air–unless a store is actually engaging in illegal sales, that is.

With this system, the entire ecosystem’s circulation could be tracked and verified. This transparency would benefit industry professionals and governments alike, as it would make it that much easier to make sure that growers, dispensers, and shippers are operating within their legal limits.

The Cryptocurrencies Providing Solutions

The few and the proud, there are a handful of projects in the blockchain realm looking for a fix. The majority of these cryptos are specifically coins, with no other function than to allow people to buy some green without greenbacks.

The two most popular, PotCoin and HempCoin, are actually some of the oldest coins on the market (both were created in 2014). Newcomer Budbo, whose token distribution went underway as this was written, looks towards being both a coin and supply tracking platform for consumers, producers, and sellers all.

PotCoin (POT)

“PotCoin is the first digital currency created to facilitate transactions within the legalized cannabis industry,” the coin’s website proudly proclaims. Touted as “a community based effort,” the coin operates using Proof of Stake and claims to provide instant, low-fee transactions.

As it currently stands, PotCoin is used primarily for its cannabis purchasing power. According to a blog post from October 2017, PotCoin is accommodated by or purchasable at roughly 800 locations in 35 countries thanks to General Bytes, one of the world’s leading Bitcoin ATM providers.

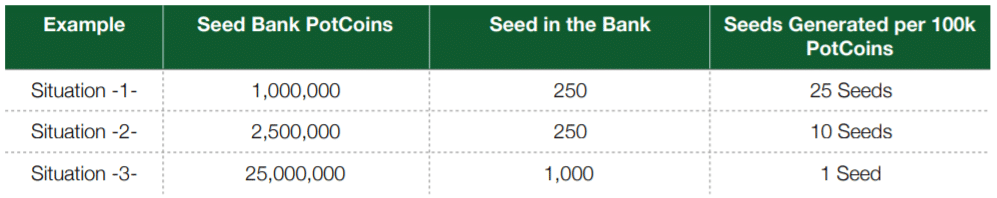

In addition to its intrinsic nature as a currency, PotCoin allows its holders to stake their POT in a seed bank. As per usual currency staking, the seed bank awards users actual marijuana plant seeds proportional to the number of POT coins they have staked. So long as you live in a location where growing marijuana is legal, you can “withdraw” your seeds and have them shipped to you at any point. This way, if you have POT staked in a PoS wallet and the seed bank, you can watch your investment grow, both literally and figuratively.

In the future, the team hopes to migrate PotCoin to the Ethereum or the Bitcoin blockchain to establish the PotCoin Decentralized Autonomous Organization. Using either Ethereum or Counterparty, the team wants to implement a governance structure for the coin complete with smart contracts. As more merchants begin to accept PotCoin, they foresee a rewards program for sellers and consumers, as well.

HempCoin (THC)

Similar market, different approach, HempCoin is working towards the same goal as PotCoin, though its method and pace of adoption set it apart. The coin has been around for about as long as PotCoin, but it’s not accepted nearly as much around the world or in North America.

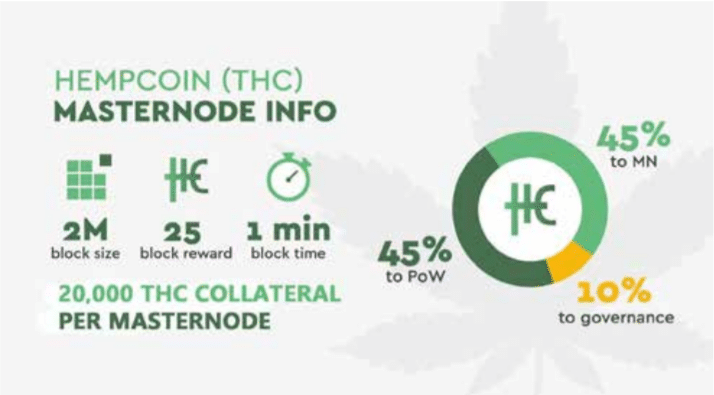

Currently, it’s undergoing a substantial rebranding. For the first two quarters of 2018, the team has a hardfork planned to move the currency to a masternode consensus model à la Dash. Like the coin that pioneered this model, HempCoin will use a hybrid Proof of Stake/Proof of Work model that will accommodate instant send and anonymous transactions along with network governance.

In addition, the HempCoin team is working on a variety of payment vectors to help their product crossover from theoretical to actual use. These include “HempPAY™ Mobile, HempPAY™ Card and HempPAY™Online.” As with PotCoin, HempCoin plans to roll out an incentives program to encourage both dispensaries and consumers to adopt their payment method.

Budbo (BUBO)

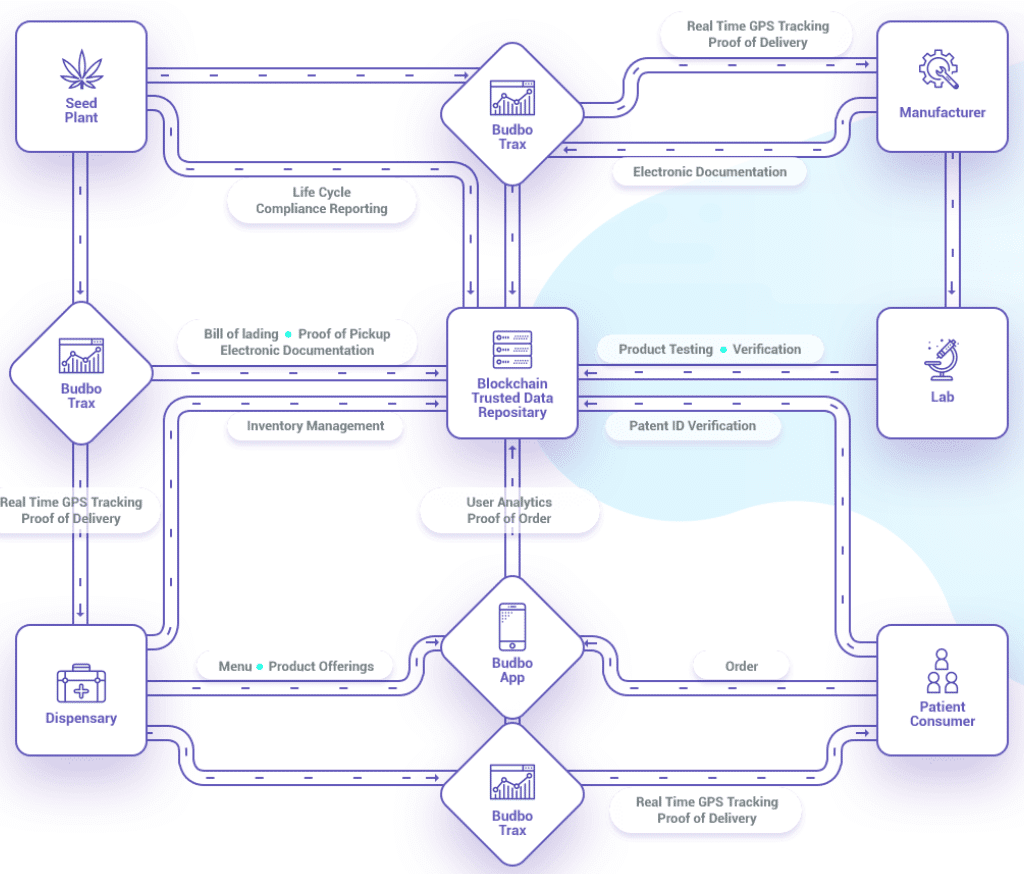

Budbo wants to be the all-in-one blockchain solution for the marijuana industry. Beyond the limitations of an alternative currency, Budbo looks to connect growers, dispensers, and customers through its blockchain, the blockchain itself providing an industry-tailored tool to manage all steps of pot production.

With Budbo, all aspects of a product’s lifecycle could be recorded and traced on the blockchain. This means that growers and labs can confirm THC/CBD content and other specifications, sellers can put tabs on inventory, and consumers can track their purchase back to the very seed it came from.

This level of quality control provides industry professionals and governments alike with a wealth of logistics, including proof of orders, proof of pickup, and proof of delivery. Moreover, growers and dispensers will be able to use Budbo to place orders for supplies and products. For example, growers can use their application to buy more seeds or harvesting tools, and sellers can fill in their inventory gaps by placing orders with growers or producers.

The Budbo application is looking to cultivate a social and business landscape for the young industry. Its inaugural version, Budbo v1.0, already provides a service for users to find products that best suit their tastes. The “Tinder-like” application allows users to swipe through a series of dispensaries and product offerings that match their individual likings, all with the hope of weeding out what they don’t want for what they do. This is just a single example of the potential to connect cannabis users from all walks of the industry into a single, all-inclusive application that will (hopefully) enhance and simplify everyone’s user experience.

Wrapping Up

Stepping away from pot-specific cryptocurrencies, there are a couple of other developments in the space attempting to solve marijuana’s money problem.

In October of last year, Dash partnered with Alt Thirty Six, a point of sale payment platform, to be the sole cryptocurrency offered by the system for cannabis-related transactions. Alt Thirty Six chose Dash for its Private Send and Instant Send functions.

We briefly mentioned ATM provider General Bytes in our discussion on PotCoin. Additionally, POSaBIT and SinglePoint Inc. use crypto ATMs to serve as an intermediary for cannabis transactions. Basically, consumers use an in-store ATM to purchase cryptocurrency with their debit/credit cards, and they can redeem this currency at the counter for any of the dispensary’s available products.

While startups and crypto projects develop working solutions, some dissenting voices are unconvinced that such a budding and uncertain industry as crypto can help another like it. The marijuana industry, they argue, will never want to adopt such a volatile payment method, mainly because banks will likely begin to accept marijuana merchants more readily as legalization continues to ink its way into state and federal legislation.

Most of these arguments, however, fail to factor in the blockchain’s supply chain and logistics benefits. Maybe crypto will grow too slowly to beat banks to the financial punch, but that still leaves the blockchain’s distributed ledger and decentralized structure to provide security, transparency, and reliability to an industry still learning to walk. Perhaps crypto will be there to hold its hand along the way, as the coming years will no doubt elucidate what role (if any) it will play in legal marijuana’s growth in North America and elsewhere.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.