Update: Cryptopia was shut down in December 2019 after hackers stole funds of about$16 million. The below article is preserved for archival purposes.

Cryptopia often lists projects when they’re still too small to be listed on a major exchange like Binance. Investing in these small coins can be highly risky, but finding the right one could mean striking gold.

In this Cryptopia review, we’ll cover:

- Key Information

- How It Works

- Trading Fees

- Available Cryptocurrencies

- Transfer Limits

- Company Trust

- Fund Security

- Customer Support

- Conclusion

Cryptopia Key Information

| Key Information |  |

|---|---|

| Site Type | Cryptocurrency Exchange |

| Beginner Friendly | |

| Mobile App | |

| Company Location | New Zealand |

| Company Launch | 2014 |

| Deposit Methods | Cryptocurrency |

| Withdrawal Methods | Cryptocurrency |

| Available Cryptocurrencies | Bitcoin, Ethereum, Litecoin, 200+ altcoins |

| Community Trust | Average |

| Security | Average |

| Fees | Extremely Low |

| Customer Support | Average |

| Site | Visit Cryptopia |

How It Works

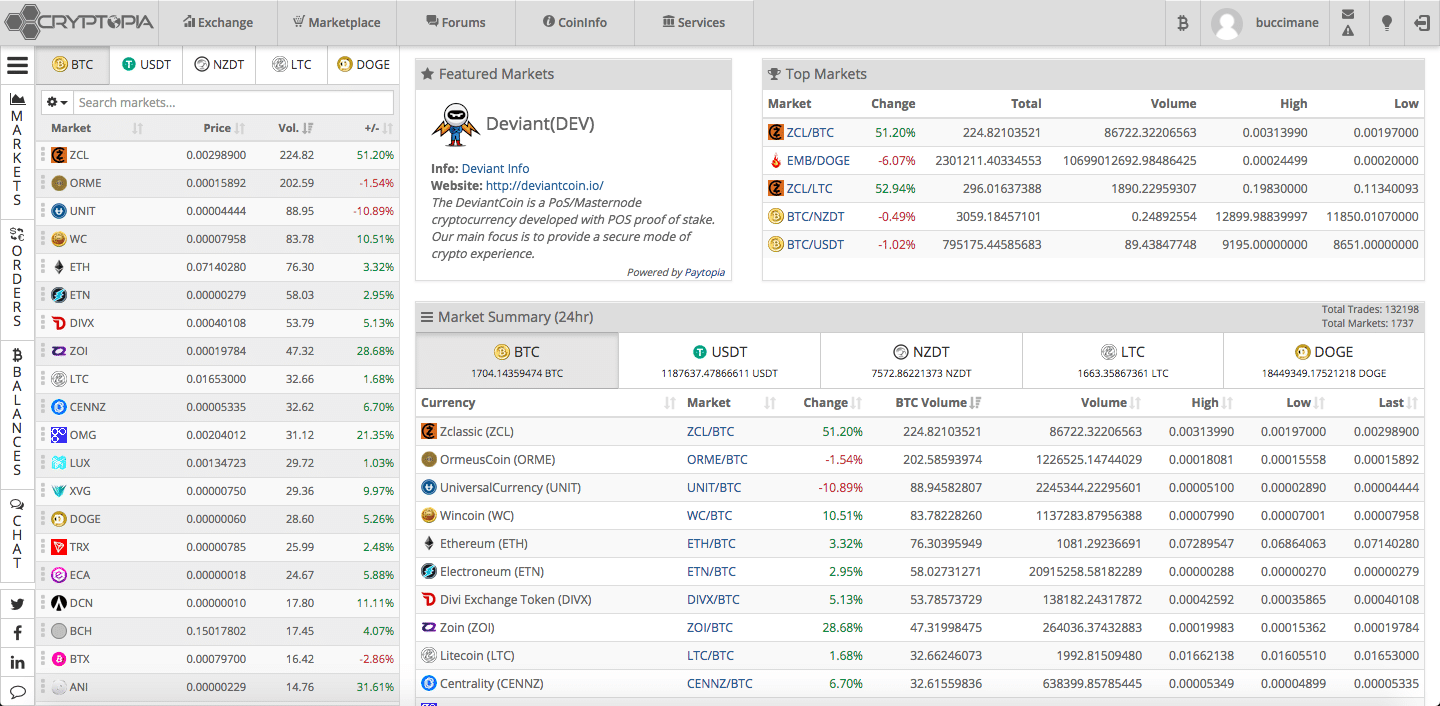

Cryptopia is purely a crypto-to-crypto exchange. This means that you’re unable to use it to buy coins with fiat currencies like the USD. Instead, you’ll need to acquire either BTC, USDT, NZDT, LTC, or DOGE and transfer it to your Cryptopia account to begin trading.

The exchange dashboard is a little cluttered. It shows a searchable list of all the markets as well as the 24-hour market summary for each market. Additionally, it displays the top market by trading volume for each currency.

To start trading, click the appropriate trading pair tab on the top left side and search for the coin you want to trade.

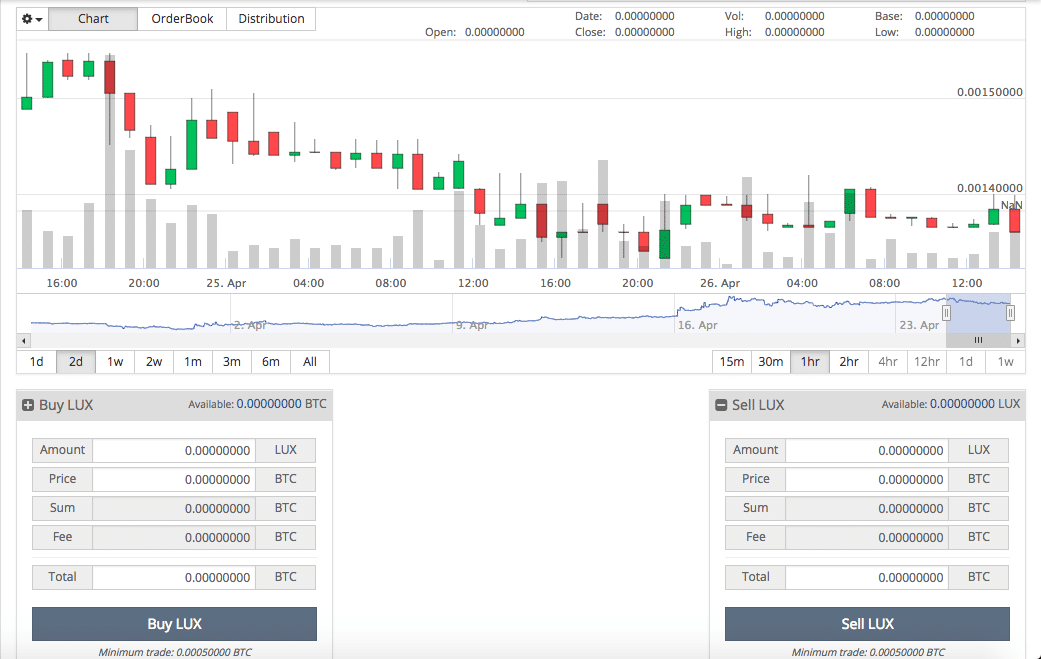

Cryptopia has a standard exchange interface. It features a graph that allows you to easily switch between candlesticks for price and volume, an order book/depth chart, and a distribution chart.

The buy/sell functions aren’t as intuitive as on other exchanges, but they still aren’t too difficult to use. Although the buy/sell panels don’t include options for market or limit orders, you’re able to click on an existing order on the books to auto-populate your order. Advanced options like margin and leverage trading aren’t included.

Trading Fees

The Cryptopia fee structure is straightforward. The exchange charges a 0.2% fee on every trade. This is on the lower end of exchange trading fees.

For withdrawals, Cryptopia’s fees vary by coin. You can view the withdrawal fee for each coin on the CoinInfo page under “Settings.”

There are no deposit fees.

Available Cryptocurrencies

One of Cryptopia’s major draws is the sheer number of coins it has available for trading. The exchange supports hundreds of cryptocurrencies in trading pairs with BTC, USDT, NZDT, LTC, and DOGE.

No matter what coin you’re looking to trade, you’ll probably find it on Cryptopia.

Transfer Limits

There’s no restriction on the amount you can deposit.

However, Cryptopia limits the amount you’re able to withdrawal based on your verification tier. The tiers and required information are as follows:

- Tier 1: Email

- Daily Withdrawal Limit: $5,000 NZD

- Tier 2: Full name, birthday, address, a photo of ID, and photo of yourself holding ID

- Daily Withdrawal Limit: $50,000 NZD

- Tier 3: Contact customer support

- Daily Withdrawal Limit: >$50,000 NZD

[thrive_leads id=’5219′]

Company Trust

Cryptopia used to be a preferred exchange for investors looking to purchase relatively unknown coins. However, this seems to have changed recently.

Numerous users have begun reporting issues with deposits as well as withdrawals. Apparently, transfers either freeze or never show up, and customer support is slow to respond to any issues.

If you value company trust over other factors, Cryptopia may not be for you.

Fund Security

The Cryptopia website is lacking any meaningful security information. It’s unclear how they are storing funds and what percentage are in online (hot) storage versus offline (cold) storage. On a positive note, the platform does include two-factor authentication when you log in and trade.

Once again, if security is a priority of yours, you may want to look elsewhere.

Customer Support

As discussed earlier, several traders have reported slow to no responses from the Cryptopia customer support team.

If you don’t need any interaction with customer support, you could still have a positive experience, though. The platform has an in-depth help section that includes a solid list of frequently asked questions and step-by-step instructions on how to perform many of the tasks on the exchange.

Conclusion

Cryptopia’s purpose is clear: an exchange to trade small market cap and lesser-known cryptocurrencies. Its security is relatively unknown, customer support lacking, but its coin selection is top of the class.

If you only want to invest in some of the top cryptocurrencies, you should avoid this exchange. However, if you’re looking for diamonds in the rough, Cryptopia may be a good choice.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.