Elastos is a blockchain-powered Internet in which you have complete control of your digital assets. As a creator, this includes your books, movies, games, etc. Or even as an average user, your data.

The project’s team believes that Ethereum and other DApp platforms face limitations at scale. They argue that they’re great for smart contracts but are slow, inflexible, and inconvenient for full applications. On a fundamental level, Elastos is a platform for decentralized apps (DApps) that solves these issues.

In this guide, we’ll dig into everything you need to know about the project including:

- How does Elastos work?

- Elastos Token (ELA)

- Team & progress

- Trading

- Where to buy ELA

- Where to store ELA

- Conclusion

- Additional resources

How does Elastos work?

Besides giving you full ownership of your digital assets, Elastos ensures that you don’t have to (or can’t) access the Internet when running DApps. Instead, all DApps run on the Smart Web. This separation protects you from malware and other digital attacks that expose you to data and/or content theft.

Additionally, the platform is mobile-friendly. And you can run network DApps on nearly every operating system (Android, iOS, PC, etc.). Let’s go over the infrastructure making this happen.

The Four Pillars

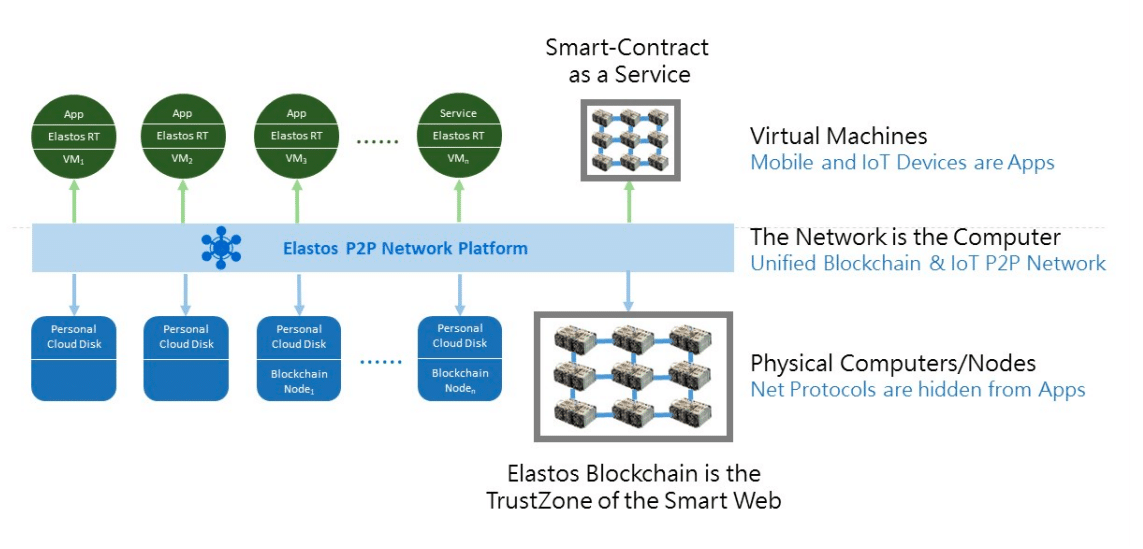

Elastos consists of four pillars that enable network separation and platform flexibility. Those pillars are the Blockchain, Runtime, Carrier, and Software Development Kit (SDK).

Blockchain

The Elastos Blockchain separates app functionality between the main chain and sidechains for each application. The main chain takes care of basic transactions and transfer payments while each sidechain executes the DApps’ smart contracts.

The sidechains have a few other advantages as well. As a client, you can customize your consensus mechanism on each sidechain and also distribute sidechain tokens. On top of that, users can transfer those tokens across sidechains and across to the main chain.

Runtime

Typical DApp platforms execute smart contracts and run associated applications directly on the blockchain. This strategy is problematic when you try to use a DApp on a mobile device. Elastos, on the other hand, runs DApps with runtime environments while still using the blockchain to enable smart contracts.

Elastos Runtime gives you the flexibility to run DApps outside of the Elastos operating system. The network includes runtime environments for Android, iOS, Windows, and Ubuntu Linux. Even though the DApps run on these operating systems, they don’t have access to your digital assets, preserving your ownership.

Carrier

The Elastos Carrier is the project’s decentralized peer-to-peer Internet service. Similar to other decentralized Internet projects, you’re able to rent out your computational power and storage capabilities to other users.

This pillar is the foundation of the network’s DApps.

Software Development Kit (SDK)

The Elastos SDK connects applications to the Smart Web, which is especially beneficial for non-Elastos apps. Using the SDK, these applications can receive their ID and access the Smart Web without having to use the Elastos virtual machine.

Elastos Token (ELA)

ELA is the currency of the Elastos network. You can use them for any activity on the system such as investing in digital assets, trading, or paying fees – to name a few.

The token economics and distribution for this token are complex. The team minted 33 million ELA in the Genesis block, and a large chunk of them was locked up by investors for interest rewards. Those rewards vary from 4 to 6 percent depending on the lock-up duration. The team has also reserved half of the token supply to reward people who contribute to the ecosystem.

Additionally, the network creates ELA at a 4% yearly inflation rate through a process called merged mining.

Merged Mining

In merged mining, both the Bitcoin and Elastos blockchains reach block consensus at the same time. And Bitcoin acts as a parent chain to Elastos. This type of mining is advantageous for miners who can now submit Proof-of-Work to both chains without having to use additional computing power.

Merged mining also brings significant benefits to Elastos. As more Bitcoin miners switch to merge-mine BTC and ELA, the hashing power on Elastos’ network increases, making it less susceptible to a 51 percent attack. An increase in hashing power is especially important for newer projects which may not have a significant number of miners on the network yet.

[thrive_leads id=’5219′]

Team & progress

Elastos began as the brainchild of co-founder Chen Rong all the way back in 2000 when he left Microsoft USA to return to China. Although the platform initially had no blockchain ties, Rong still envisioned a platform in which its apps and services didn’t directly connect to the Internet.

It wasn’t until June 2017, that Jihan Wu, Bitmain CEO, became an angel investor, and the project began to really take the shape of the blockchain-powered platform it is today.

Since then, the over 50-person team has formed numerous partnerships and built out portions of the Elastos Carrier. They also launched their mainnet in December 2017, but it’s not yet available to the public.

The team has been working closely with NEO and Bitmain as well, forming the “G3 of China.” The goal of which is to work together to create a completely decentralized economy and smart web.

Looking at Elastos strictly as a DApp platform, it most directly competes with EOS and Ethereum. Elastos and EOS both include SDKs to integrate traditional apps with the blockchain. But EOS doesn’t have its own runtime environment. For the second comparison, Ethereum has a single chain in which it executes all smart contracts while Elastos has the main chain/sidechain structure outlined above.

Aelf is a smaller project that shares many of the same characteristics as Elastos. Trying to be the “Linux of Blockchains,” Aelf also uses sidechains for each platform DApp. It does, however, use a different consensus algorithm – Delegated Proof-of-Stake (DPoS).

Trading

ELA trading only began earlier this year. For a cryptocurrency, the price has remained relatively stable over the last four months. Shortly after the ICO, the price saw typical short-term volatility before rising to an all-time high of $91.56 (~0.00879 BTC) at the end of February. The February 22 lock-up deadline for interest rewards most likely caused this increase. After that cut-off, a significant amount of coins left the circulating supply, forcing upward pressure on the price.

Following that, the price steadily fell through March. From April through today, though, ELA has steadily risen to the current $41.43 (~0.00555 BTC) level.

As with most cryptocurrencies, successful development milestones and partnership announcements could have a positive price effect. Be wary, though. Even though the lock-up periods are 1-3 years long, those tokens entering circulation again will put some downward pressure on the price. The 4% inflation rate will do the same.

Where to buy ELA

Right now, your ELA purchasing options are limited. You can buy it with USDT, BTC, or ETH on Huobi. But that’s about it.

If you’re confused on how to go about getting those coins, you should first check out our guides on buying Bitcoin and buying Ethereum.

Where to store ELA

The Elastos team has created an official wallet that you should keep your ELA in. It’s currently only available via the web, but it’s mobile responsive, so you can still use it on your phone.

Conclusion

Elastos is a decentralized Internet and DApp platform that gives you control of your digital assets. The team probably describes it best:

Elastos = Trustworthy Ledger + Smart Contracts + Monetizable DApps and Digital Assets

Working to improve on the scalability and flexibility issues of other networks, the network is explicitly built for DApp performance. To accomplish this, it mainly uses sidechains and runtime environments for mobile optimization.

There’s still some time before we’ll see the complete Elastos vision come to fruition. But the partnerships with NEO and Bitmain seem to foreshadow positive news and much more extensive plans for the future.

Additional resources

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.