Melanie Plaza, Elix Co-founder

Melanie Plaza, co-founder of Elix, is a biologist turned computer programmer on a mission to improve blockchain technology’s accessibility. Elix is a decentralized lending and crowdfunding platform with a focus on usability for the non-technical. If you’re interested in learning more about the platform, be sure to check out our beginner’s guide here.

In the following interview, Coin Central’s Steven Buchko talks with Melanie about her introduction to cryptocurrency and some of the unique architectural decisions the Elix team has made. They also touch on blockchain technology’s biggest roadblocks to adoption as well as the best chicken tenders around the United States.

The Interview

SB: Tell me the story of how you got to where you are today, working on Elix.

MP: I originally started out thinking that I was going to do biology research. I went to Bronx Science, a very sciencey school, and then I became a biology major at Yale. But I was frustrated by the way that academia works. You spend a lot of time writing grant proposals and there are limitations that exist in research.

So, I started doing programming instead. I thought it was cool because technology was (and still is) the future. I liked that I could do a lot of different things with programming, working across different sectors.

Then, I started working more on blockchain projects and began working with David [Elix co-founder] as a contractor at a development shop. Before that, I had been involved in crypto-related things but wasn’t actually working on any projects. I was just trading and working on a little trading bot.

I saw that Elixir had the potential to solve a lot of the problems that I had previously seen in the industry. I love the nature of decentralized crowdfunding and lending and the opportunity it gives people to have more financial freedom. It also limits existing funding biases.

A few months after working as a contractor, I joined Elixir full-time as a co-founder.

What was your first introduction to cryptocurrency? What made you want to start trading and build that trading bot?

My friends started talking about cryptocurrency a little over a year ago. Before that, I had heard about it, but I wasn’t really aware of its disruptive potential. Back when it was ‘Bitcoin Pizza,’ I didn’t know if it was a good thing or not. I started looking into it more, though, and thought it was a cool technology.

I was also taking a class on how to build self-driving cars with AI which led me to start working on the trading bot. I wanted to apply some of my machine learning education to cryptocurrency. I wasn’t serious about making a lot of money on it or anything like that. I just thought both were cool technologies, and it was an opportunity to work on both at the same time.

In your own words, what does Elix do and what problem are you solving?

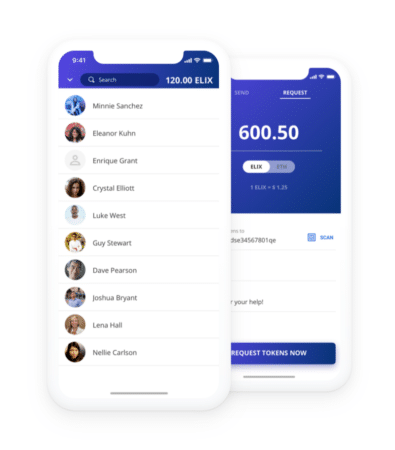

In the beginning, we’re focusing on a blockchain-based crowdfunding platform. We’re also doing an MVP [Minimum Viable Product] with lending. People can send and request tokens and pay each other back. We’ll eventually build out both of these ecosystems, adding features like collateralized lending and reporting tools for crowdfunding. Right now, though, it’s just a simple interaction.

We’re seeing people want to have a lot more control over their own data and how they interact with other people on the web instead of having these things controlled by some type of central authority. The decentralized smart contracts allow people to do this. They can see clearly where their tokens are going, what rules affect where they go next, and because of this, the whole system’s more transparent.

We’re cutting out this centralized middleman that people are increasingly uncomfortable with these days.

Also, for crowdfunding, we can immediately be more globalized. We don’t have foreign transaction fees, and there are no payment processors. We’re trying to make it available to everyone in the beginning.

The crypto space has exploded recently, but there’s still not many ways for people to easily use their tokens. Through the crowdfunding and lending, we’re focusing on building a product that’s really easy to use.

Even if you’re not a techie person, you can still easily interact with the app. You don’t need to understand the complexities involved with it. You can just have an app where you can utilize your tokens.

We’re allowing people to fund projects that they care about with their tokens or easily send them to other people. We see that people have cryptocurrency and that’s cool, but people now want a way to do something with it.

You didn’t do an ICO [Initial Coin Offering]. You did an airdrop instead. What was the reasoning behind that?

First of all, we wanted to be able to include people in the community, allow them to participate in the project, and have them on the same page as us from the beginning. We wanted to grow it together instead of just having a presale where we receive capital first and then work on raising the value of those tokens and finding utility for them after.

I think our community is more supportive of us because we did the airdrop instead. Now, with the ongoing security regulations and ambiguity in the space, not doing an ICO has probably benefited us in some way. With increasing regulations for ICOs, it’s most likely helped us knowing that we weren’t involved in that.

Another unique thing that you’re doing is the Proof-of-Time mining. Why that mechanism over Proof-of-Stake, Proof-of-Work, or even other consensus protocols?

We wanted to create a new, interesting mining model for people. A novel strategy for people to do that in a way that still made sense and would also incentivize them to hold these tokens longer.

How Proof-of-Time mining works: You’ve got more tokens the longer you hold them. In that way, we’re minimizing the circulating supply and encouraging people to think long term.

With Proof-of-Work, we’re seeing a little bit of a pushback because of the energy inefficiency involved with mining. Proof-of-Time is an interesting alternative that doesn’t require huge warehouses in China.

Were there any other consensus algorithms that you were considering?

We also have this other potential token that we’re working on which we’ve been thinking of different mining algorithms for. There are a few other ones that we might use for this new token. But no, the concept of Proof-of-Time was decided early on.

Is Token P the new token you just mentioned?

Yes, that’s the incentive token. We decided that we’re going to wait to release it until the ecosystem is a little more evolved. We don’t want to release a token that doesn’t have utility right away.

We think there are a lot of potential uses for it as the lending and crowdfunding ecosystems develop. We’ll structure it as a reward for participating in these ecosystems later on. And, we’ll allow people to start mining it when it has a real use case.

Could you talk more about the rewards program?

From a practical perspective, we thought it would be good to incentivize people to adopt the platform, but we also wanted to incentivize people to actually pay back their loans and to participate in lending.

One of the problems in lending is, “How do you make sure people are going to pay people back. How do you make the risk of lending worth it?”

How it works: If you lend someone funds and that person successfully pays you back, then you’re both eligible to mine another token. The reward is split between the lender and the borrower, giving the lender a little bit more, because they had the greater risk. The borrower also gets rewarded for paying back the loan in full. It’s a way to further incentivize people to participate in the lending process and also makes sure that the loans are fulfilled to completion.

Is there a penalty if a borrower doesn’t pay back the lender?

In our MVP there isn’t a penalty, but these are things that we’re thinking about. We might have to implement some type of rating system or work with blockchain credit scoring systems.

We’re also thinking about doing a collateralized lending system. That would mitigate a little bit of the risk there.

That’s one of the challenges with doing lending in this decentralized way. There aren’t the traditional avenues of credit scores or debt collections. We’re thinking of other ways that are going to solve that.

So, you’re just starting with basic peer-to-peer lending and expanding out from there?

Yes, exactly. We wanted to create a really simple system to begin with so people could easily use it and adopt it. We think it’s good to get our app out there in the beginning so that we can see how people are using it and respond to what our users actually want to see in the product. We can develop the ecosystem from there based on usage patterns and user feedback.

You already have this beta out and have smart contracts open for testing, yet you were just two co-founders for a while, recently adding two more people to the team. Do you want to keep the team small or is there a point where you want to start expanding? Many other blockchain project teams out there have gotten pretty gigantic.

We did just add another job – we have a new advisor. We also have a designer that we work with.

We’ve been able to move fast with a lean team. That’s been good for us up to this point. But yes, we’re going to start expanding the team. I don’t think it’s going to balloon to 30 people right away like a lot of the other projects I’ve seen, though.

As we launch a public app, we’re going to want to accelerate development and bring on more people. We’re going to start adding more to the team as we get closer to launch.

[thrive_leads id=’5219′]

What sets Elix apart from other peer-to-peer lending and crowdfunding platforms in the space? The one that comes to mind for me is ETHLend.

One thing about ETHLend is that they charge 0.01 ETH to fund a loan request, and more for the GAS fee. We’re not charging any fee ourselves. Right now, you just pay the GAS fee.

We also don’t have a membership token like SALT has, so we’re more of a decentralized peer-to-peer platform.

We also have that extra incentive with the reward token. I think people will want to participate in loans where they have a reward for the loan being completed. And hopefully, that also increases the number of loans that are successfully completed on our platform.

We also don’t need MetaMask, Status, or any type of extension. We’re trying to create an easier mobile experience where you don’t need to use any of those things. People don’t need to understand how to install these other extensions, making it easier for the average person.

We also didn’t do an ICO. And we control a lower portion of the token supply compared to other projects.

I saw that you’ve dubbed yourself a chicken tender connoisseur. Can you speak a little more to that?

One of the first startups that worked on back when I was at Yale was Crunchbutton, a food delivery platform. You could, with one button, order a buffalo chicken sandwich called a Wenzel. The Wenzel was the premiere sandwich.

Even though our main thing was the Wenzel, I always preferred the chicken tenders you could get from the same restaurant. So, I started sampling all the fried chicken tenders in various restaurants around town trying to find the premiere chicken tender as well.

I don’t know if everyone appreciates chicken tenders as much as I do, but I still enjoy trying out them out whenever I go to someplace new.

So, which place has the best chicken tenders?

There’s this place in Marina del Ray that has a full chicken breast that’s been made into a tender. It used to be called Marla’s, but now I think it’s Munch Late Night or something like that.

I consider them to be a fancy chicken tender because they’re much more expensive than the pizza place tenders, but they’re very good.

What’s next on the agenda for Elix in 2018?

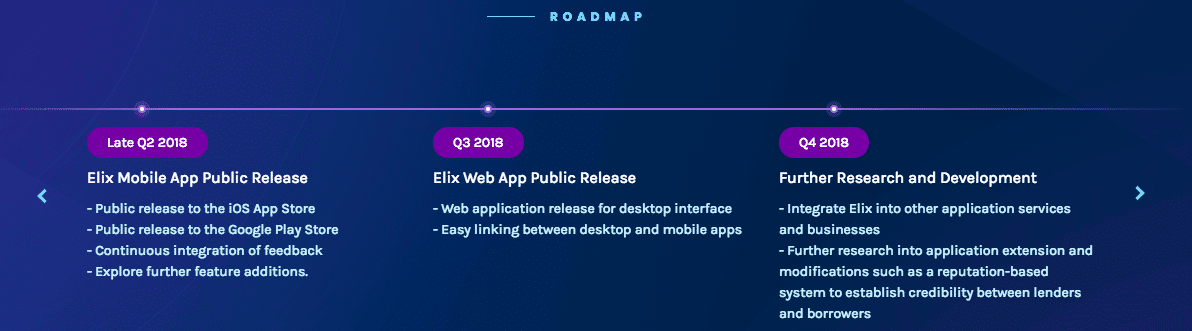

We’re planning to submit the app to the app store towards the end of June. Hopefully, we’ll have the public release shortly after that.

Then, we’re going to build out some of our web features. We’re not planning to have total feature parity in the beginning but we’ll incorporate some of the mobile features.

Depending on how users are using the app, we have some ideas for how to expand the crowdfunding ecosystem – like incorporating reporting tools. There’s all these cool things you can do with blockchain technology other than just transactions. For example, allowing people to submit immutable reports as they complete their projects or submit data they’re collecting for an experiment.

We also want projects to be able to disperse tokens as certain milestones are met instead of having everything disperse at once after hitting their funding goal. We also want to give you the ability to publish your findings if you funded some type of research or include a report at the end.

Those are things that we may incorporate if people are using the crowdfunding platform and running into some of these problems.

Also, we might eventually make a fully decentralized web version. Right now, we’re only showing projects on the app that we’ve verified as being legitimate projects. Eventually, we want to make a fully decentralized version, so you can see all of the potential projects (even the crazy ones). A fully decentralized version for people.

What’s involved with the vetting process right now? How do you know what’s legitimate versus not legitimate?

This is one thing that I’ve been thinking about a lot because I don’t want us to be a centralized system. In the beginning, especially because we’re trying to be focused on everyone being able to use it, we do need to do some vetting.

We’ve been contacting all the people that apply to us. If they’re doing a product, we ask them if they have a prototype, some code to show, or if they have a detailed plan on how they’re going to build it. Basically, just getting more information about how they plan to actually pull off their project.

In your opinion, what is the biggest roadblock to widespread mass adoption of cryptocurrency and blockchain technology?

It’s difficult right now to get started. To convert from fiat to cryptocurrency in the beginning, you usually have to wait awhile to get approved by one of the exchanges. And some of them are even kind of sketchy.

It’s not as easy for people to get comfortable when you have to do all these transfers to different wallets as well.

For us, that’s going to be one of the biggest problems in adoption. That’s why we’ve worked so hard in trying to make it really easy to use once you’re on the platform. But you still have to get your initial tokens and Ether somewhere.

Understanding how to get started, how to get your first cryptocurrency, and the different methods of transfer–those are the biggest roadblocks.

Do you have a favorite project outside of Elix?

Yes, I have a lot. I really like Litecoin as one of the bigger ones. Looking at transaction volume, Litecoin is heavily used. Some people say it’s just used to transfer between exchanges and as a means to get different tokens. But that still means that people are using it because it’s cheaper and faster than Bitcoin.

For a smaller one, UTrust is cool if they can pull off the whole Paypal-esque token usage. And I like Elix obviously.

We’re starting to see a culling of projects before the end. A lot of the shadier ones will die, but we’ll also see more winners emerge.

People compare crypto to the .com bubble. There will be a lot of pets.com type projects where people thought it was a cool idea, but it dies. However, there will also be a lot of winners in this space as well.

Thank You

Thank you, Melanie, for taking time out of your day to talk with us. We wish you and the Elix team the best of luck as you publicly launch your project. We’re looking forward to trying out Marla’s next time we’re in Marina del Ray!

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.