- eToro’s Company Information

- Key Feature #1: What is the eToro Copytrader feature?

- Key Feature #2: CopyPortfolios

- Key Feature #3: Virtual Portfolio

- eToro USA and eToro International

- What are eToro’s Fees

- eToro Fund Security

- Final Thoughts: Is eToro Worth Using?

eToro is often referred to as the “Robinhood of Europe,” drawing comparisons to the U.S. Fin-tech unicorn for its user-friend trading experience. For U.S-based eToro users, the platform offers 15 cryptocurrencies for trade, such as Bitcoin and Ethereum. For international eToro users, the offerings expand to stocks and forex.

A few unique features give eToro separate eToro from the cryptocurrency exchange pack: social trading, CopyPortfolio, and CopyTrader– the latter feature allows you to simply “copy” the live portfolio of top cryptocurrency traders on the platform. Whereas traditional fund managers are formally accredited and can invest your money for a fee, eToro’s copyable traders are ordinary people who have had success or experience trading cryptocurrency.

While the hands-off cryptocurrency investing approach can be fairly attractive, we urge our readers to be cautious when investing in anything. Cryptocurrency is a very risky asset class, and just because your trades are on autopilot doesn’t mean you can’t get rocked all the same (set your stop losses!)

The following eToro review will teach you everything you need to know about the trading platform:

- eToro’s company history

- How to make an account on eToro

- eToro wallets and accounts

- What are eToro fees

- How does trading work on eToro

- What is the eToro Copytrader feature?

Key points:

✅ eToro is a user-friendly social trading platform that allows United States traders to trade various cryptocurrencies, and European traders to trade a wider variety of financial instruments like stocks, crypto, commodities, and currencies. eToro USA LLC does not offer CFDs, only real Crypto assets available.

✅eToro is a very beginner-friendly exchange that allows for a direct fiat-to-cryptocurrency exchange.

✅ CopyTrader and CopyPortfolio are unique.

❌Trading fees are relatively higher than the industry standard for most other exchanges. We call this the “UI Tax”

❌Users can’t actually access their assets, they can only trade them for fiat. Although eToro is a great trading platform, we’re not too big a fan of the lack of custodial ownership over your cryptocurrency.

eToro’s Company Information

A quick walk down the history lane of the rising fin-tech star leads us through a user-first approach to design and a pivot to embrace the growing cryptocurrency market.

When was eToro founded? Founded in 2007 by entrepreneurs David Ring, Ronen Assia, and Yoni Assia in Israel, eToro has since grown to over 500 employees, operations in 140 countries, and over 13 million users internationally.

How much has eToro raised? eToro is fairly well-capitalized and has raised a total of $222.7M in funding in over 10 rounds, with the latest Series E round coming in April 2018.

Which companies has eToro acquired: eToro has acquired two organizations–Belgium-based cryptocurrency portfolio tracker app Delta in September 2019, and Danish smart contract infrastructure provider Firmo in March 2019.

The holding company eToro (UK) Ltd. is based in London, and eToro has additional registered offices in Cyprus, Tel Aviv, New Jersey, Sydney, and Shanghai.

eToro started with a primary focus on trading fiat currencies and commodities, introducing stocks in July 2013 and a broader array of cryptocurrencies in 2017. eToro offered Bitcoin trading in 2013 with CFDs and was one of the few FinTech platforms of the time providing access to the then-nascent Bitcoin.

In February 2017, eToro expanded its cryptocurrency offerings to Ethereum, XRP, Litecoin, and a handful of other cryptocurrencies. With the ensuing mid-2017 cryptocurrency market boom, eToro doubled down on its international customer acquisition to cement itself as a premier exchange in the cryptocurrency community.

eToro launched its eToro U.S. operations in March 2019, starting with a handful of cryptocurrencies available for trading and eventually growing to over 15.

The platform is unique in the cryptocurrency industry because of features like CopyTrader and social trading, allowing traders to share live trading information, copy the portfolios of the best-performing traders, and approach cryptocurrency investing from a relatively “hands-off” approach* we’ll get into it below..

*Let’s reiterate this important caveat:: don’t invest anything you cannot afford to lose, no platform can offer truly 100% guaranteed gains, all investing (particularly cryptocurrency investing) tend to come with a high degree of risk.*

Key Feature #1: What is the eToro Copytrader feature?

In 2010, eToro leaned into the title of being the world’s first social trading platform with the launch of OpenBook, a feature that allowed anyone in the world to copy successful traders using CopyTrader. OpenBook was regarded as a fairly revolutionary concept in FinTech at the time, winning the Finovate Europe Best of Show for 2011.

CopyTrader, in our humble opinion, stands as one of the best features in FinTech.

Why? Being able to see how and what top traders are trading is something that some companies try to charge thousands of dollars for, or a percentage of assets under management. eToro takes it a step further by making it possible to “copy” their portfolios with one click.

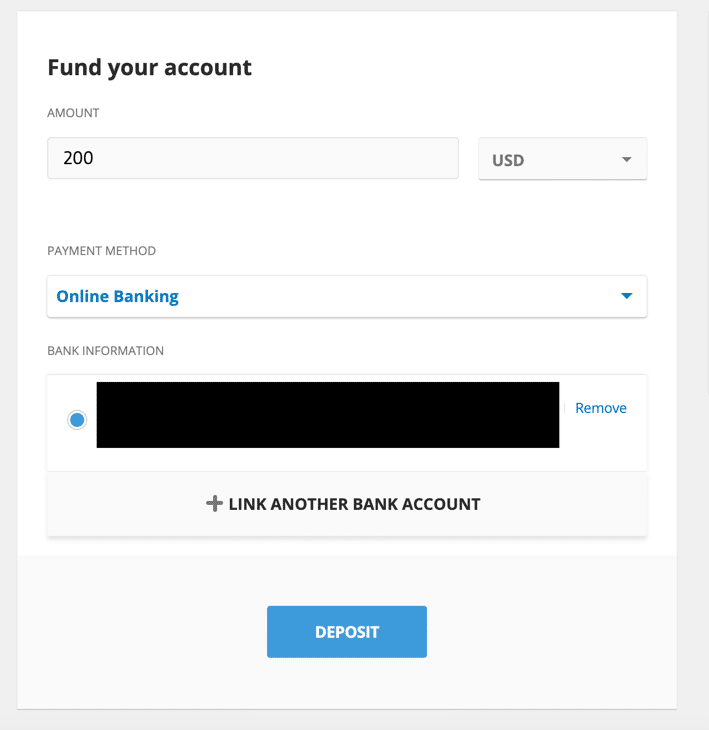

The minimum amount to copy a trader is $200, and the max is $500,000. You can copy up to a limit of 100 traders at the same time.

Here’s our run-through of CopyTrader

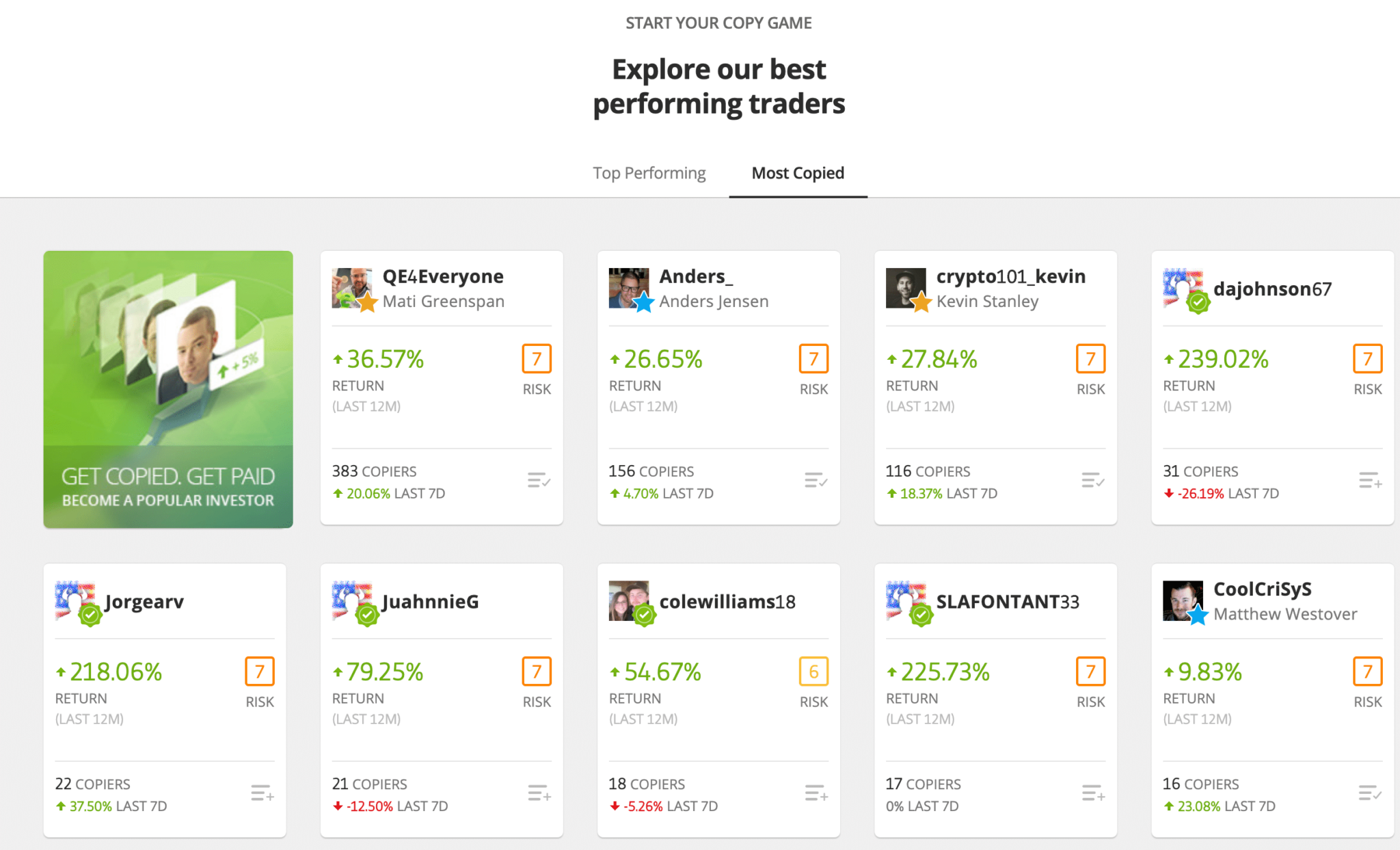

Below, there are two sections: “Top Performing” and “Most Copied”

On the Most Copied section, we see the platform’s most popular traders, seemingly sorted in some sort of weighted popularity average rather than percentage gain.

Let’s check out what makes this QE4Everyone (Mati Greenspan) trader so popular.

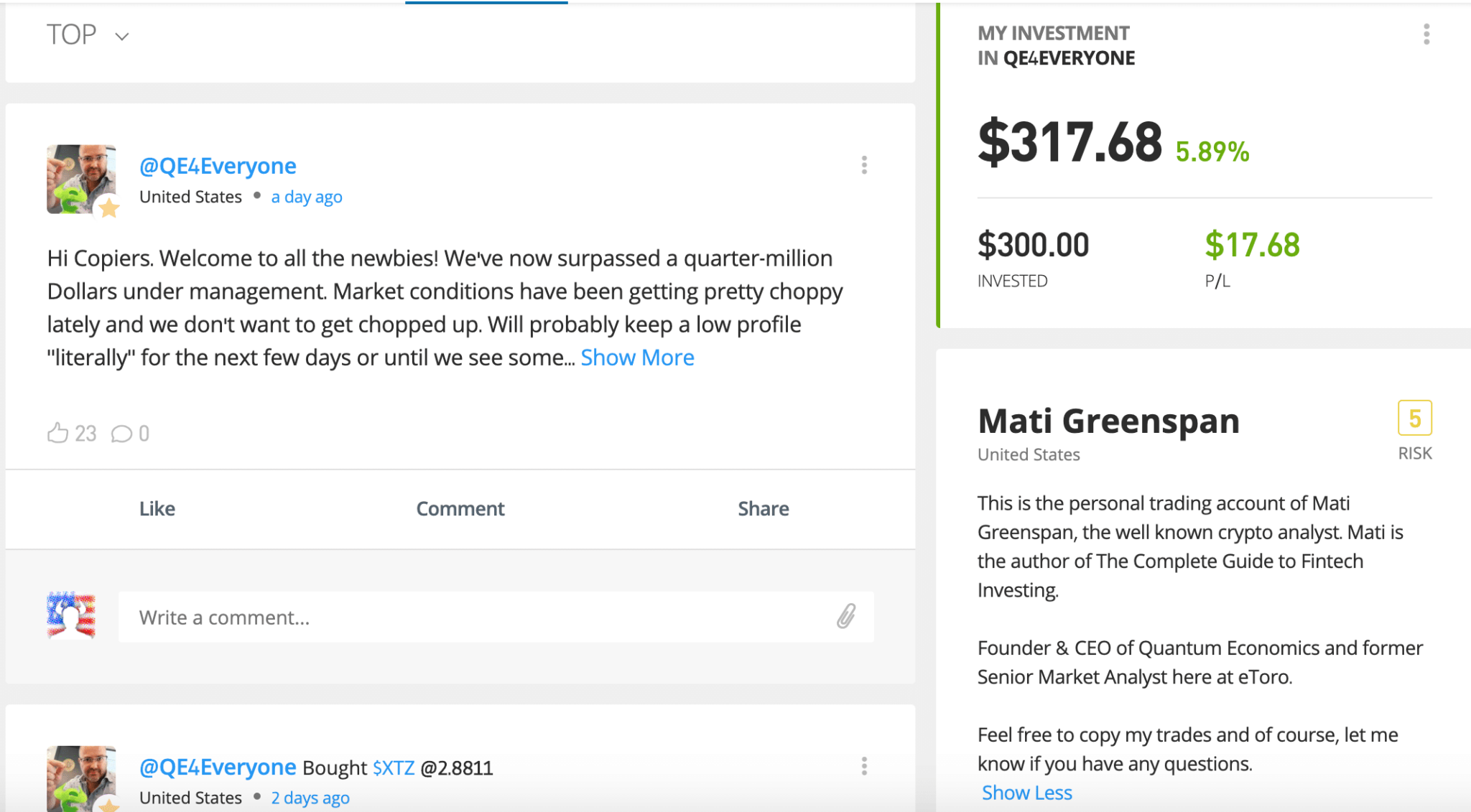

After clicking on Greenspan’s profile, we see his social posts directed towards the eToro trading community, our current investment (we deposited $300 to test this feature) in his copy portfolio and it’s overall performance– thanks for the $17 bucks, Mr. Greenspan. We also see Greenspan’s bio– a published author, Founder & CEO of a company called Quantum Economics, and a former Senior Market Analyst at eToro.

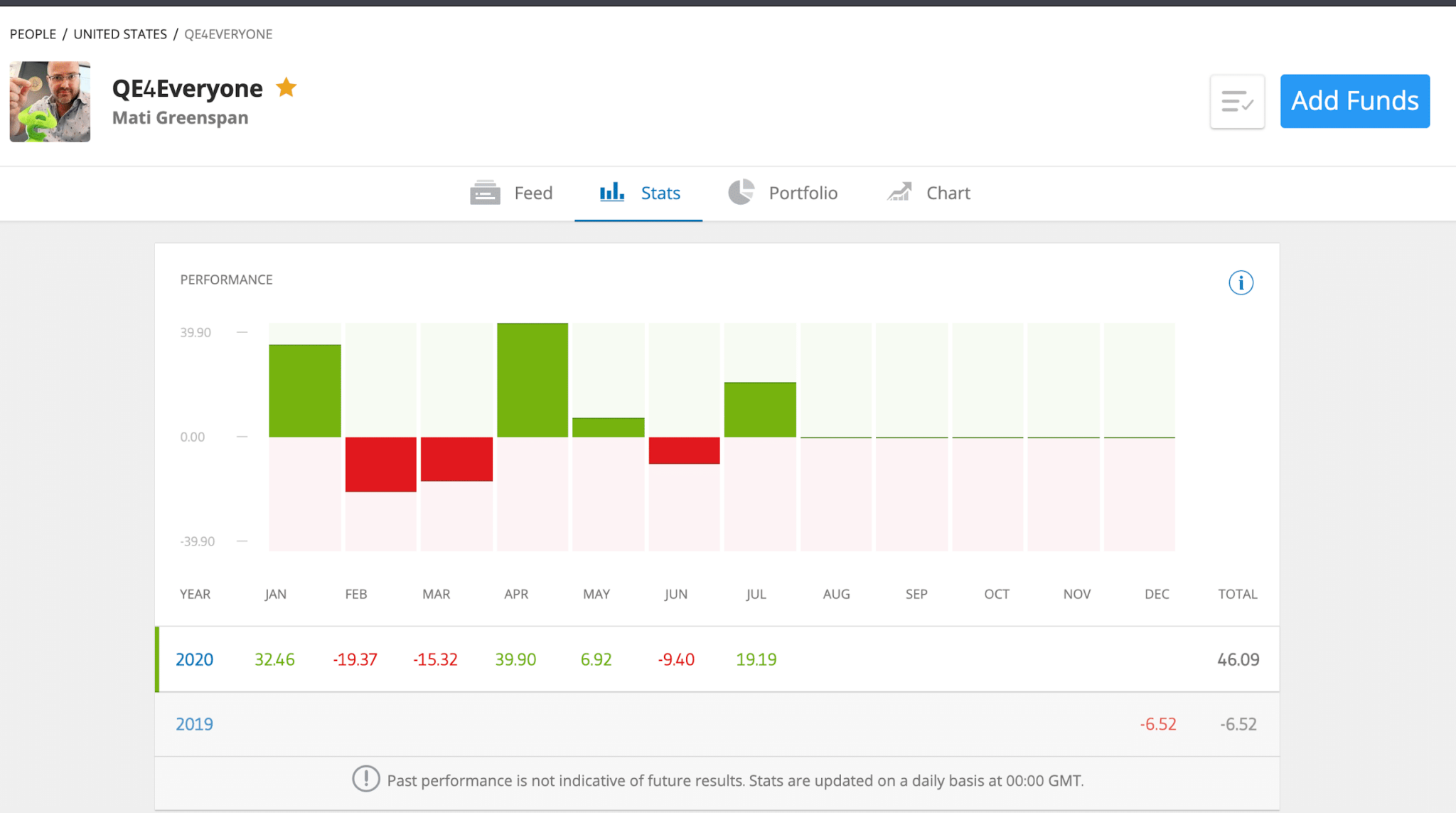

Clicking on his profile stats, we see his cryptocurrency trading performance per month. While the cryptocurrency market itself experienced some volatility these months, Greenspan seems to have handled it pretty well.

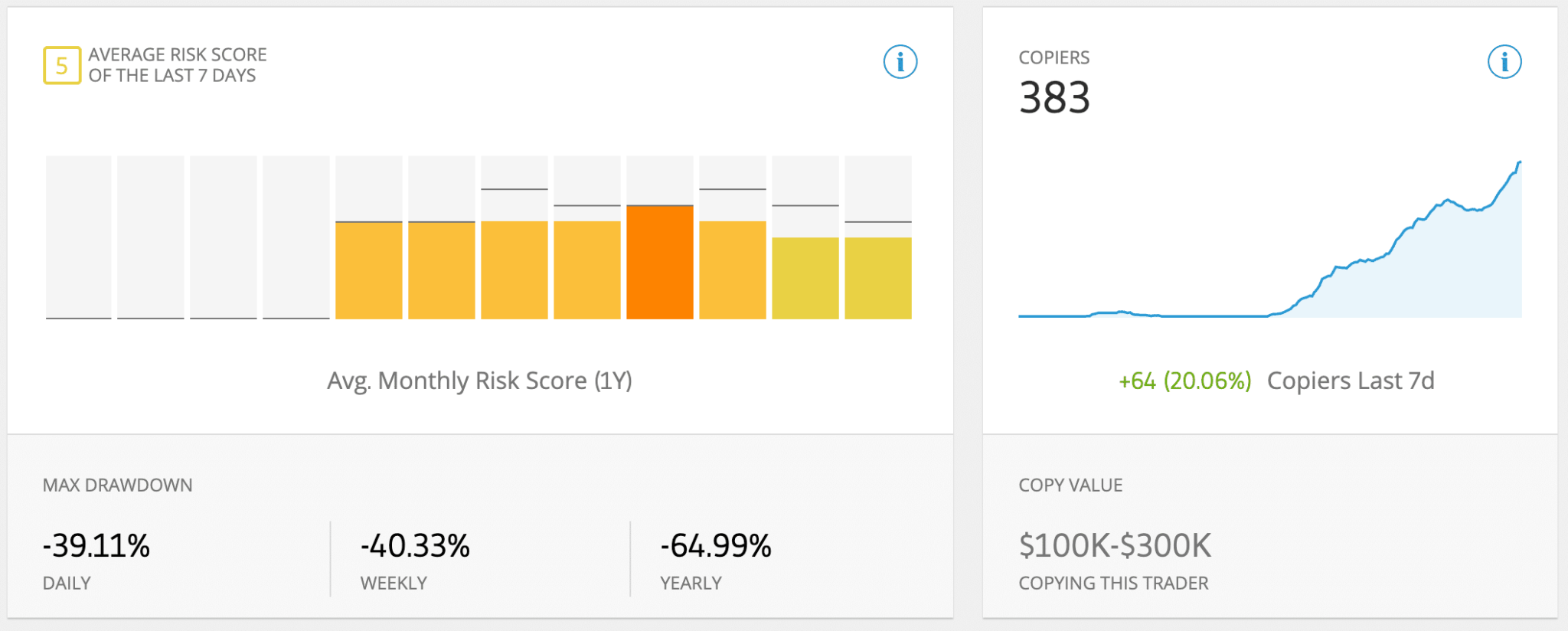

Further, we see how “risky” this trader is with a risk score assigned by eToro, as well as the number of recent trade copiers (of between $100k to $300k in copy value.)

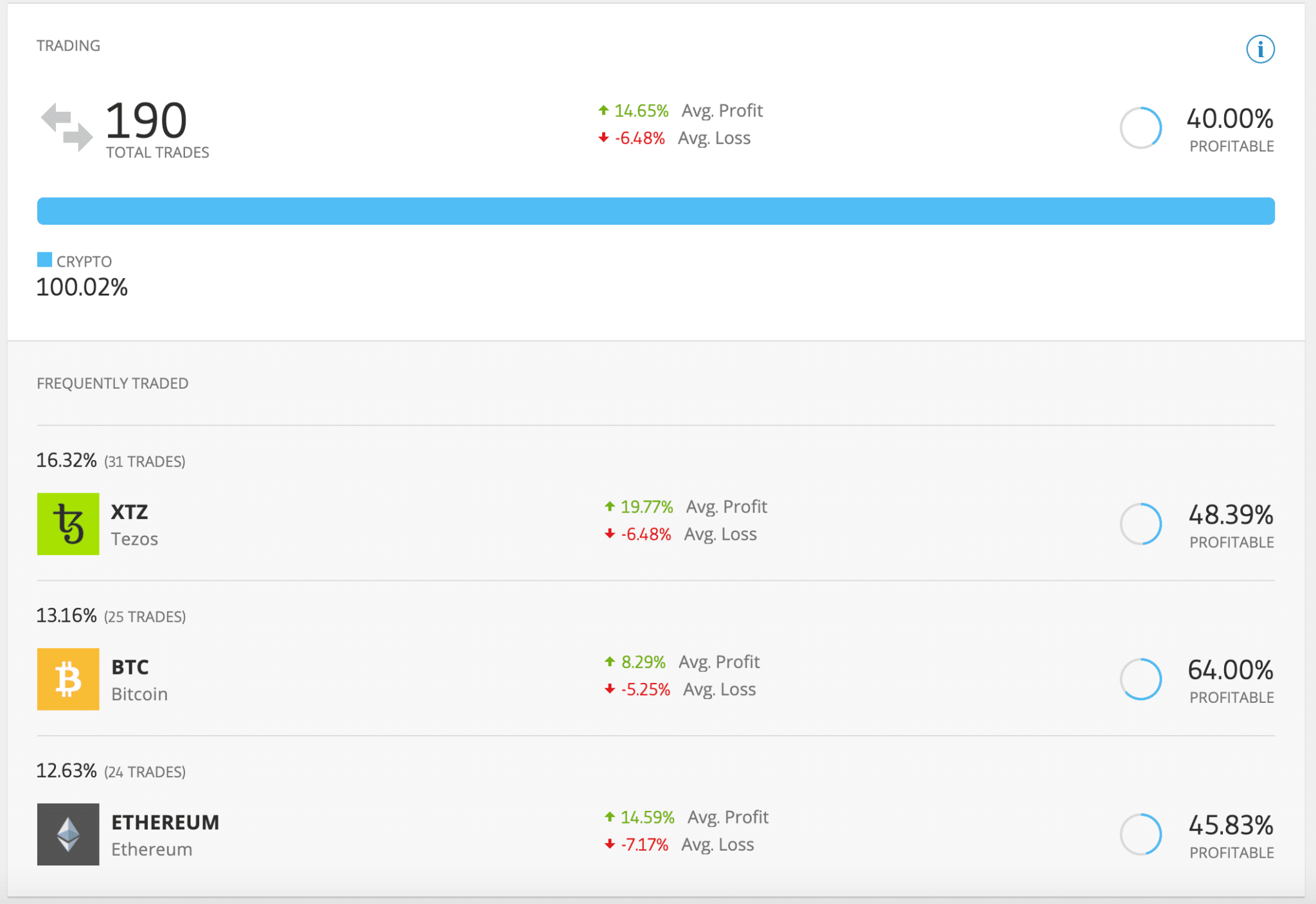

We can get a bit more detail into Greenspan’s trades: we see the total amount of trades in the past year and his most frequently traded assets.

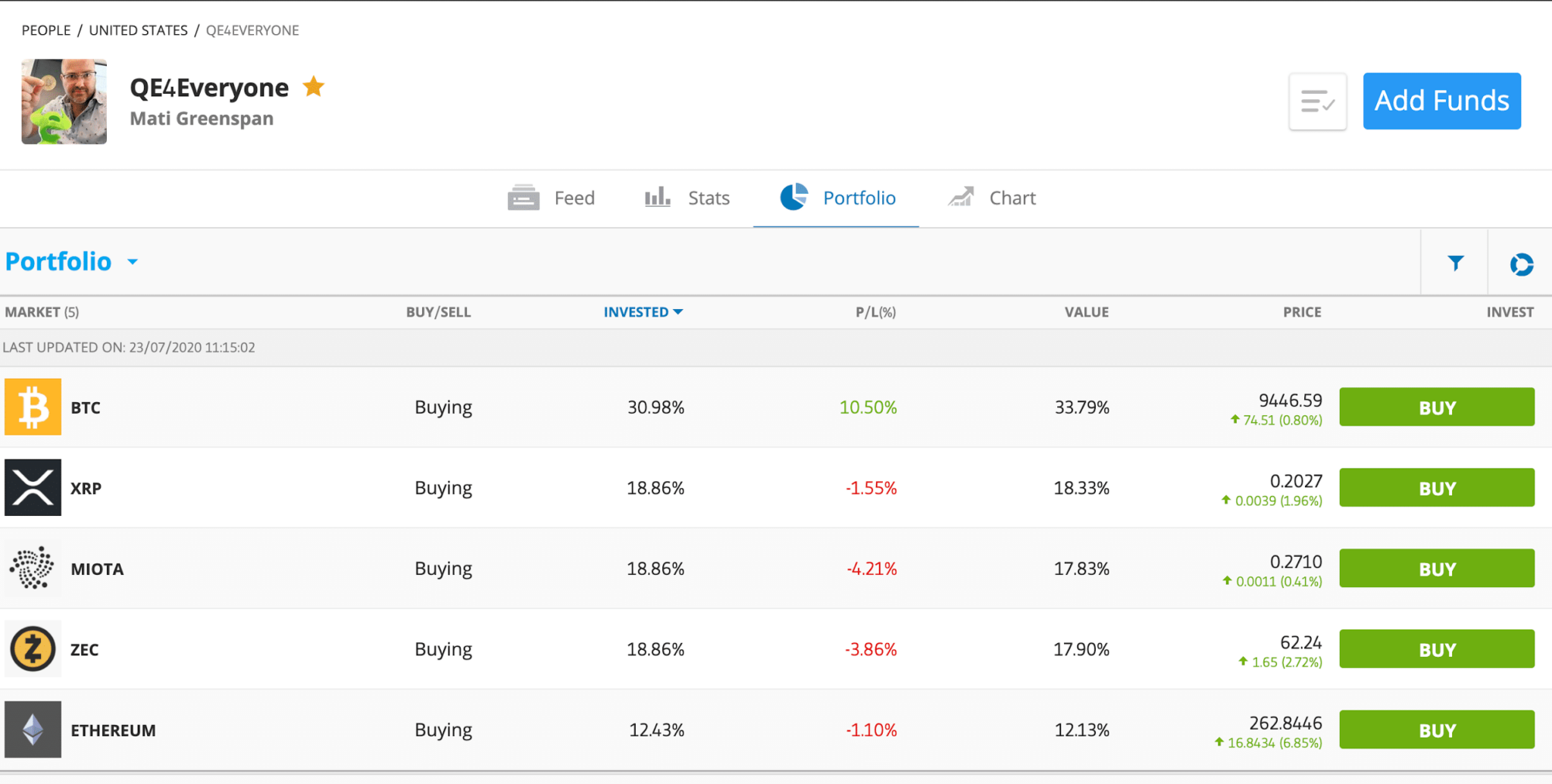

On the portfolio tab, we see exactly what his trades are at the current moment. From here, we can either buy those same assets manually, or once we add some funds, we can copy Greenspan’s portfolio, and eToro will automatically mirror his trades until you tell it to stop, or until the copy stop loss hits.

While the Top Performing profiles look very appealing, we urge our readers to do the appropriate amount of research on eToro’s platform to understand how they’ve been able to achieve such results.

For example, many of these traders have simply bought one asset months ago that mooned and haven’t launched a trade since. So, by copying their portfolio, you’d basically just be “buying” the asset at its current price.

How to Use eToro’s CopyTrader:

Go to CopyTrader section, select a trader to copy, and add the funds required.

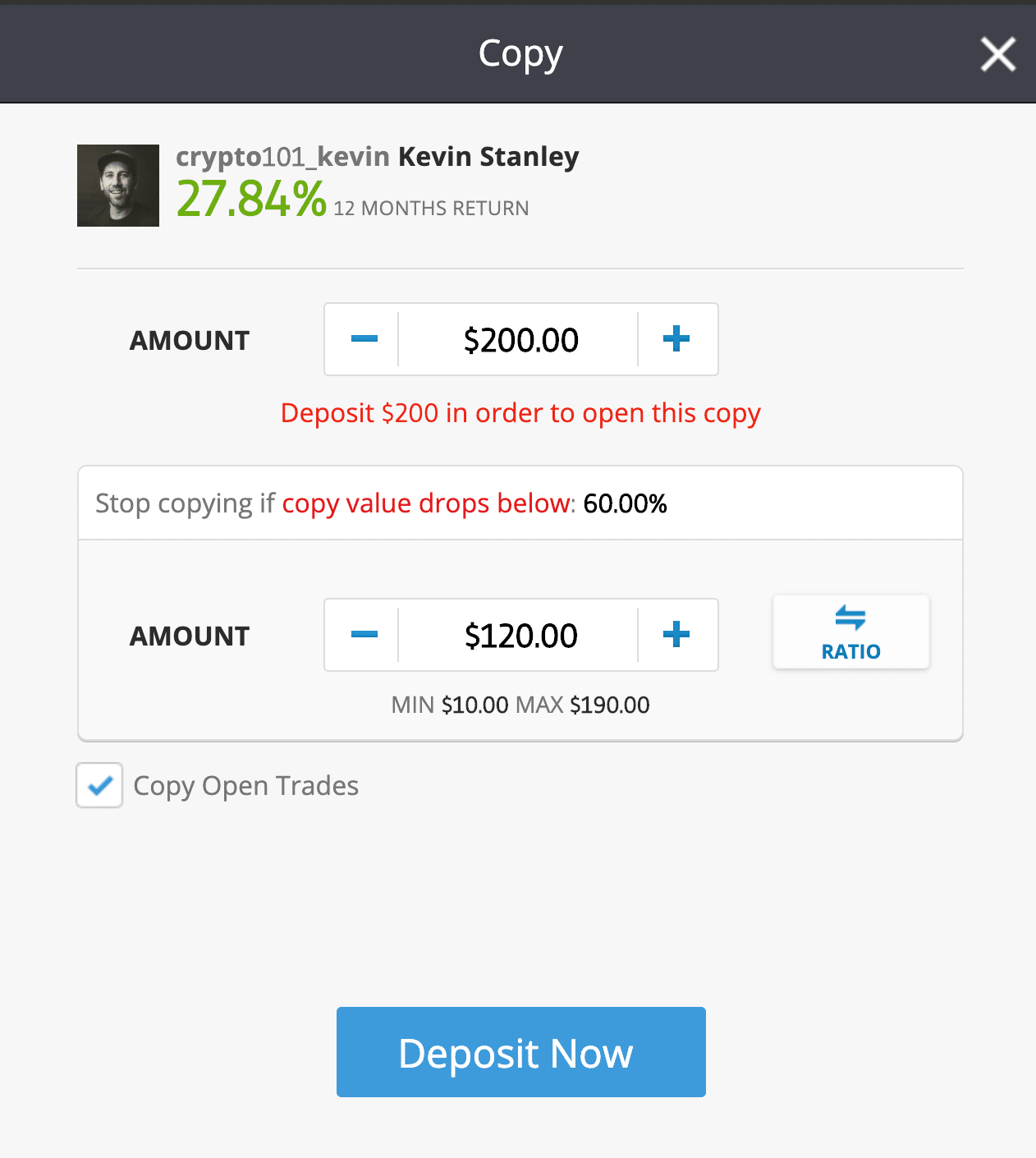

For example, let’s say we want to copy crypto101_kevin (Kevin Stanley). He has a decent amount of other copiers and a 27% gain for this year so far.

An important risk-management feature here is the ability to immediately stop copying a trader’s profile if the value drops below a certain amount. Let’s assume we’ve decided we can stomach a 60% worst-case-scenario loss on an investment of $200– we would set the amount accordingly and deposit the funds.

We deposit the USD, and boom– we’re copying a trader.

Key Feature #2: CopyPortfolios

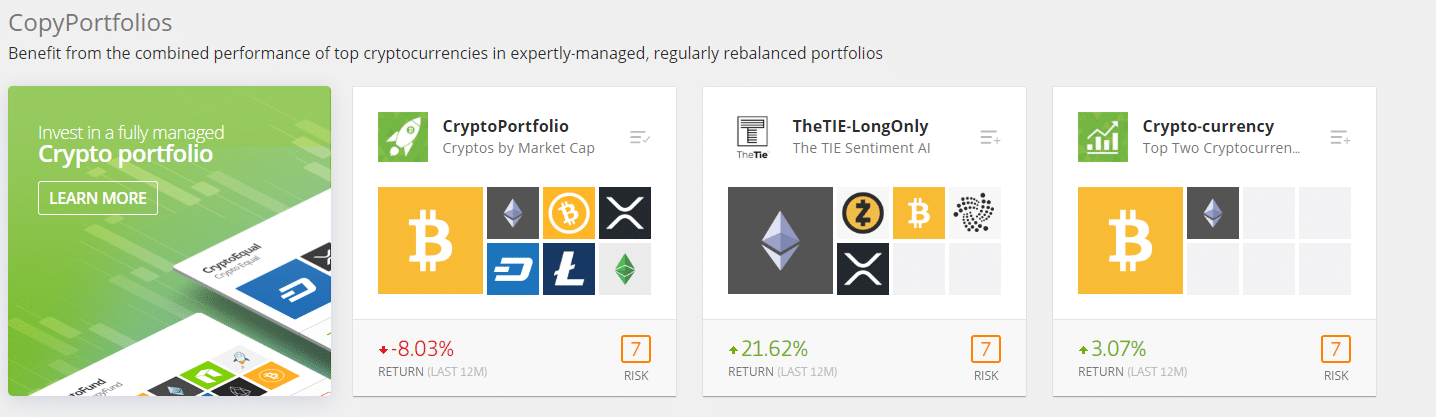

In 2016, eToro furthered its social trading offerings with the release of CopyPortfolios, a long-term thematic investment product of managed portfolios with bundled Top Traders or specific assets using a predetermined market strategy. The majority of eToro’s CopyPortfolios utilize machine learning to seek maximum returns.

There are three CopyPortfolios available in the United States. TheTIE, for example, builds its investment strategy on sentiment analysis, gauging the positive and negative tone of tweets on Twitter.

Key Feature #3: Virtual Portfolio

The eToro virtual portfolio is basically a sandbox, where users receive $100k in fake money to test-drive the platform.

This feature doesn’t seem to be available in the USA just yet.

eToro USA and eToro International

An important distinction to make for our wonderful readers spread all over the world: eToro has two different platforms due to regulatory compliance: one for eToro U.S. and one for eToro International users.

Is eToro available in the US? Yes, but only the cryptocurrency trading aspects. If you’re in the United States, you’ll have access to the same cryptocurrency investment trading platform as everyone else, as well as the CopyTrader and CopyPortfolio features, but you can’t trade stocks or forex (yet).

eToro USA LLC; Investments are subject to market risk, including the possible loss of principal. Archived, “Virtual currencies are highly volatile. Your capital is at risk.”

Disclaimer: 78% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What are eToro’s Fees

eToro’s pricing is much higher than the industry standard of cryptocurrency exchanges like Coinbase Pro or Binance, but eToro bills itself as more than an exchange.

eToro Spread Fees: Spread fees are basically how “no commission” brokers and exchanges like Robinhood and eToro make money– it’s a cost built into the buy and sell price of the cryptocurrency pair you want to trade. The difference between what the asset is on the market (ie. ETH = $200.23) and what it costs to buy it on a certain platform (ie. Buy ETH = $200.45)– the fee would be an additional $0.22 cents.

These fees are fairly reasonable for most cryptocurrency assets, currently ranging between 1% for BTC to upwards of 5% for Tezos, the latter of which is really high.

eToro Withdrawal Fees: There are no ($0) withdrawal fees on eToro in the US ($5 withdrawal fee for all other regions), but there is a minimum of withdrawing $30.

eToro Wallet fees: eToro doesn’t charge fees for sending or receiving transactions, although blockchain fees are still applicable. eToro does charge a .1% conversion fee set to eToro market rates.

To learn more about eToro’s fees, visit their fee page.

eToro Fund Security

eToro’s wallets are secured by multisignature and analytic behavior machine learning, which aims to help the platform’s security team identify and prevent potential threats from malicious third parties.

According to eToro, depositing fiat money into your account is safe, private, secure, and for US users, FDIC insured. Cryptocurrency, however, is not covered by FDIC insurance. Transactions are communicated through Secure Socket Layer (SSL), which helps keep personal information safe.

Final Thoughts: Is eToro Worth Using?

eToro’s reputation has been building since before the Bitcoin whitepaper was released– it was initially launched as RetailFX in 2007. It has since launched features like CopyTrader that are appealing to some users.

However, beginners interested in trading will get a better bang for their buck using something like Coinbase and other automated trading platforms. The eToro fees quickly add up.

It’s also worth noting that eToro is a custodial platform and it doesn’t even let users access their cryptocurrency directly. If you wanted to withdraw, for example, 1 BTC, you’d have to sell it for USD, transfer that USD back to your bank, then deposit the USD into something like Coinbase, re-purchase the BTC, and then you can at least access your crypto– and even then, Coinbase is a custodial platform.

Disclaimer:

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.