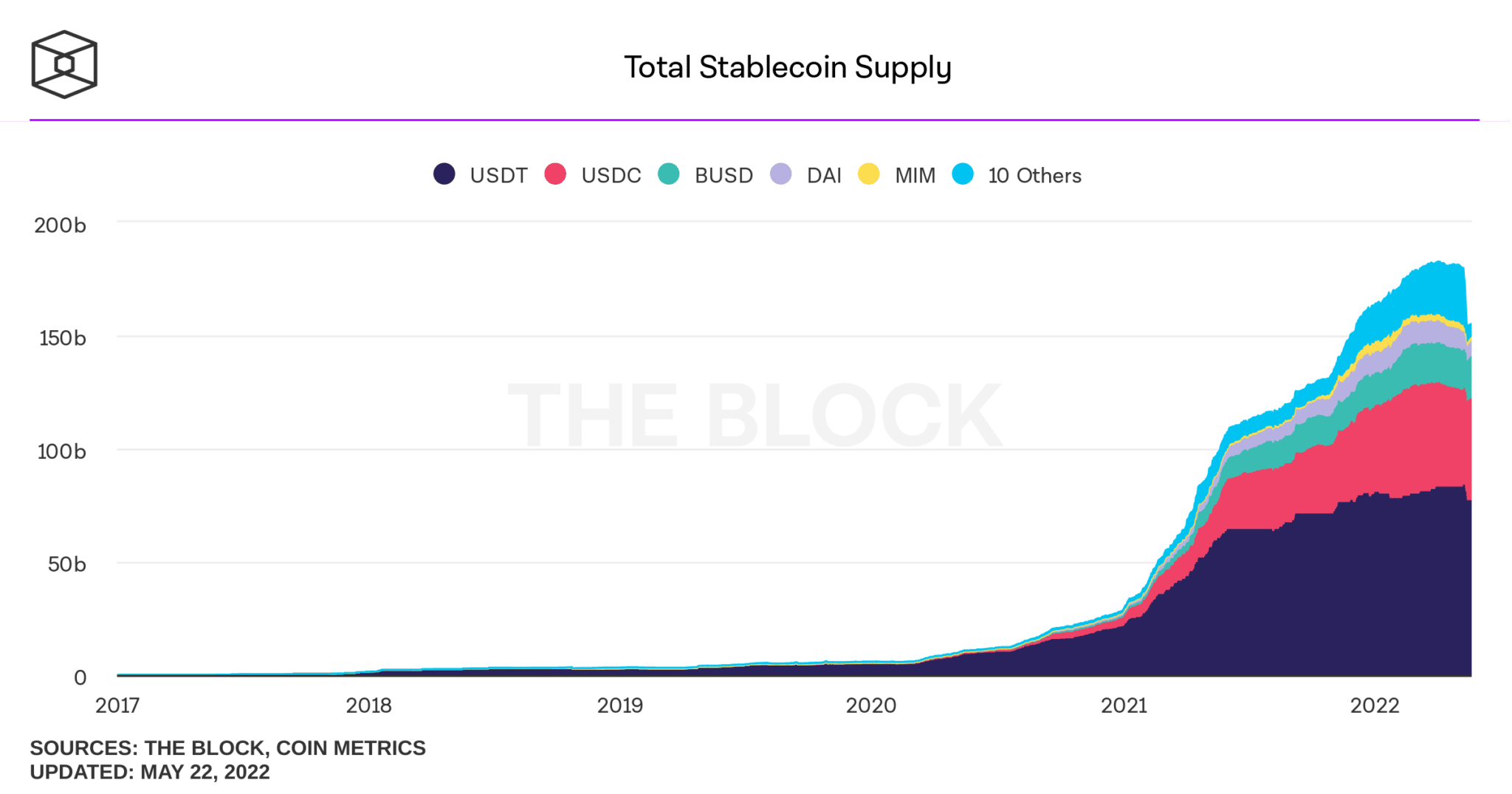

The stablecoin market has witnessed one of the most unstable moments in its history this month as TerraUSD (UST) lost its peg and momentarily threatened the perceived stability of its competing stablecoins.

However, prior to UST’s creation, a competition between USDC and USDT was already in full swing.

USDT vs. USDC

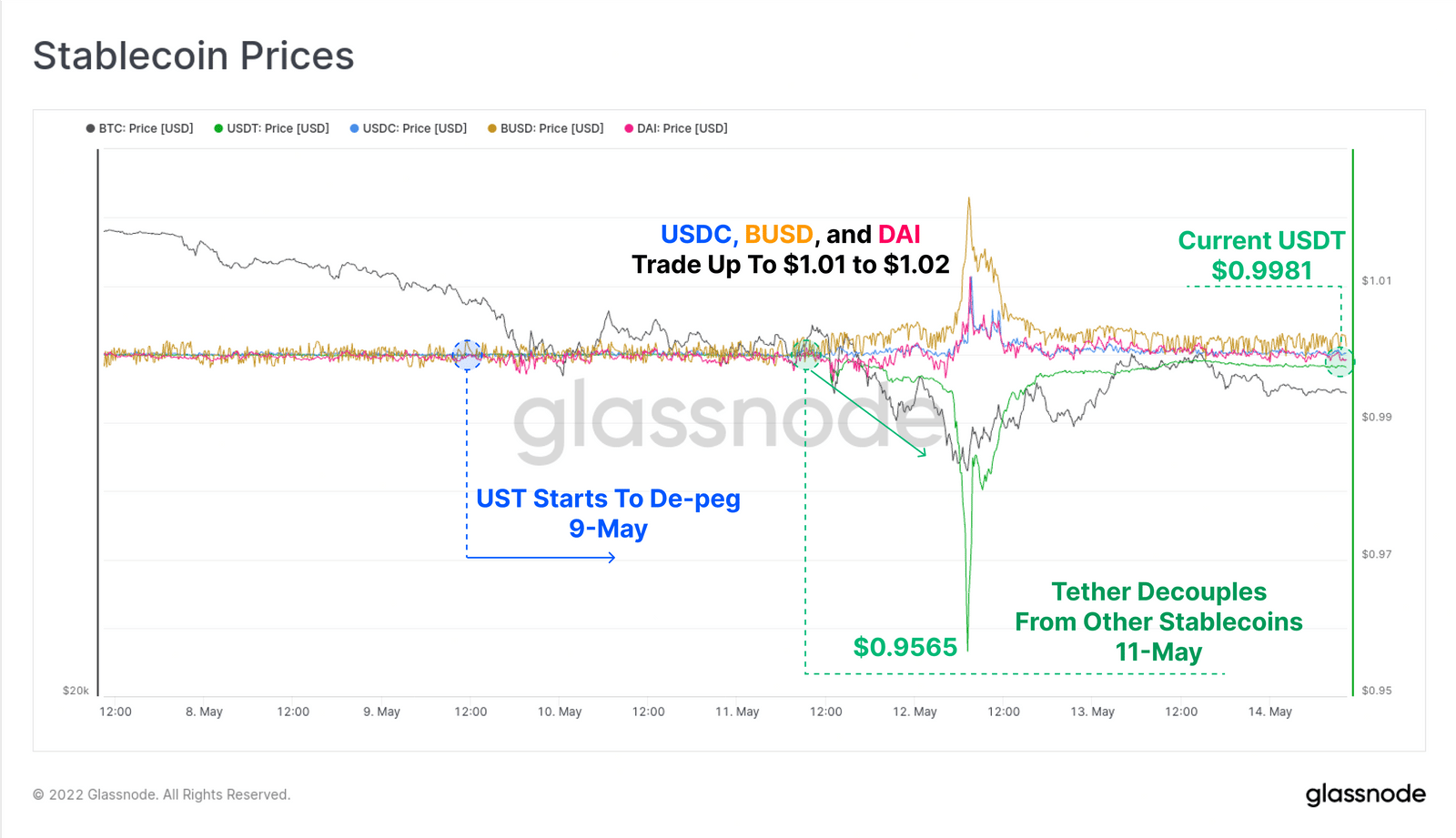

At the time of writing, UST, a stablecoin meant to trade at $1, is worth approximately $0.068 or 6 cents. The day it lost its peg (the crash of May 9), Tether (USDT) and USD Coin (USDC) were also impacted.

The former lost its peg and fell to as low as $0.95, whereas the latter, along with the likes of Binance USD (BUSD) and DAI, was trading at a premium of $0.01 to $0.02.

However, it’s worth noting that USDT didn’t actually lose it’s peg– its market value momentarily slipped under $1.00. This may sound like mental gymnastics, but the difference is a key reason USDT is still around and UST isn’t. If someone bought USDT for $0.95, they could redeem it for a full $1.00 from Tether, since the assets are collateralized by U.S. dollar reserves. UST, however, was a different story, as there was no fiat reserve available to redeem the rapidly devaluaing UST.

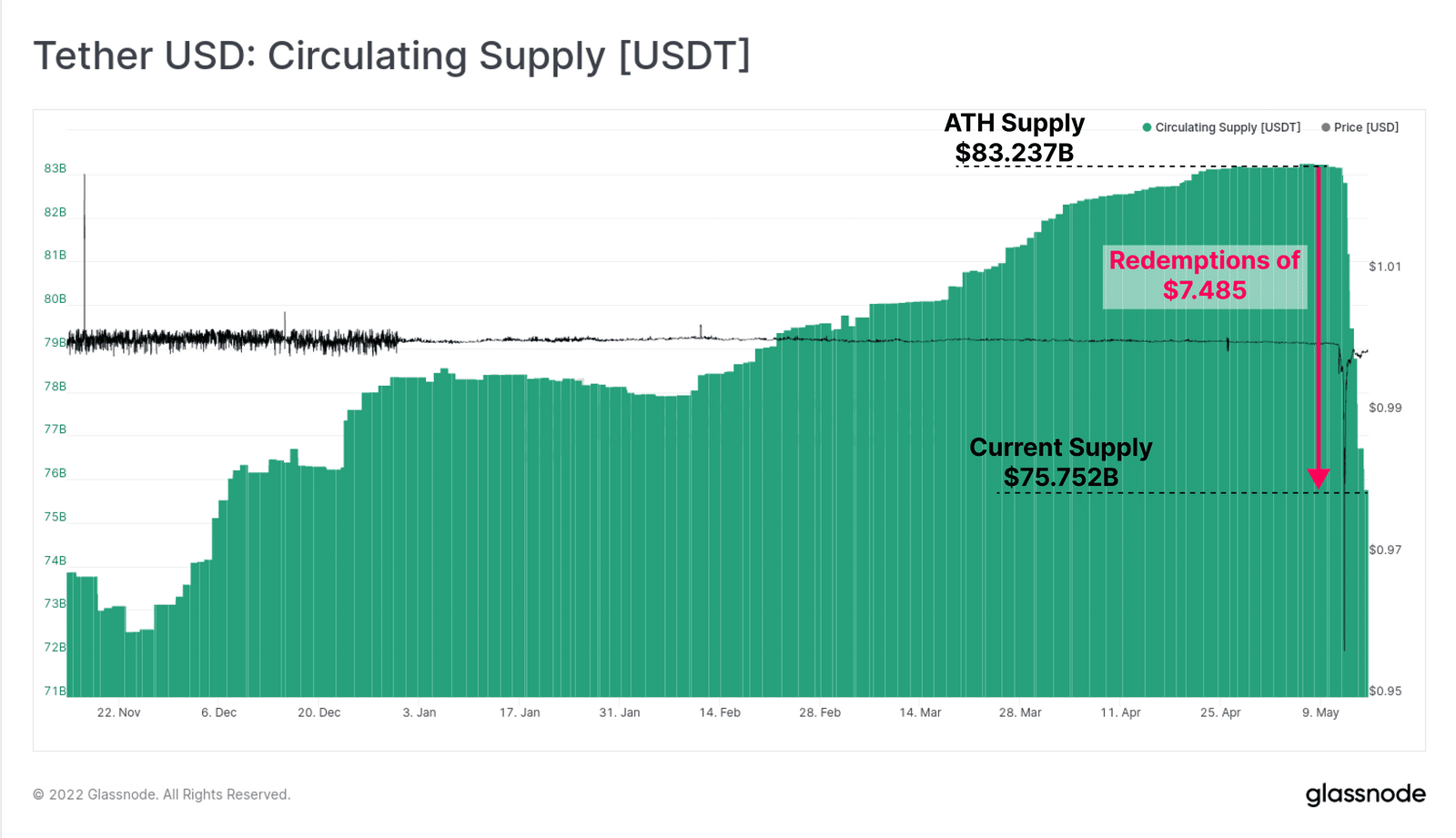

This alerted the stablecoin community since Tether is the biggest stablecoin with a market capitalization of $73.1 Billion. Consequently, Tether holders began moving their USDT supply, with many opting to redeem and sell their USDT before it followed the UST path.

As confirmed by Tether themselves, within 24 hours of May 11, about $300 million worth of USDT was redeemed, and it processed another $2 Billion USDT redemptions the following day.

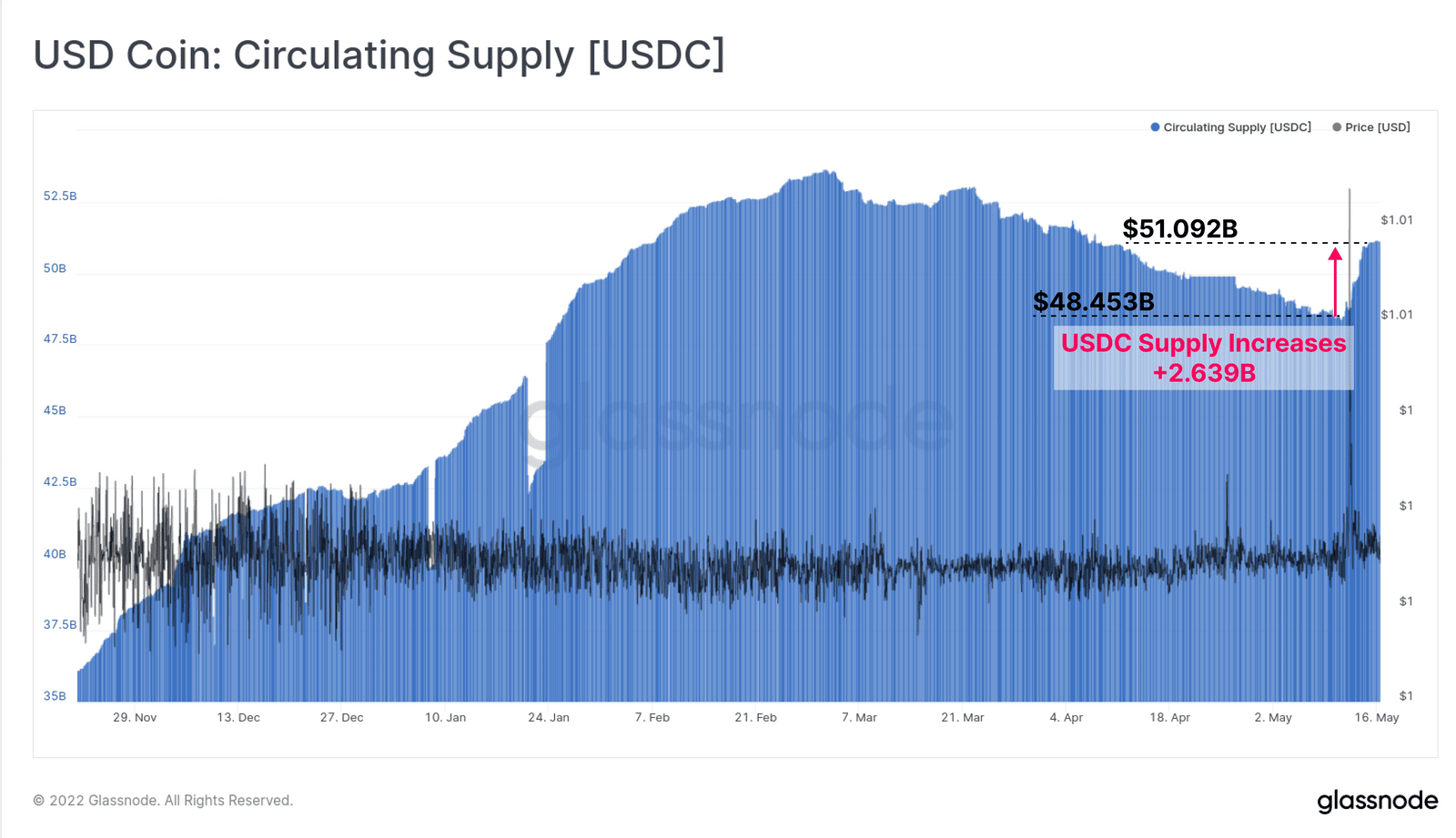

The same was not the case with USDC however, as contradictory to Tether, the USD Coin noted higher demand in the market. Tether’s circulating supply which at its peak towards the beginning of May 2022 was at $83.23 billion, slipped to $75.75 billion in the span of 4 days as $7.4 billion worth of USDT was redeemed.

However, USDC’s circulating supply shot up from $48.45 billion to $51.09 billion in the same duration. Today the stablecoin’s circulating supply is at $53 billion and is on the verge of flipping the Binance Coin (BNB), which shares a similar market cap.

Furthermore, looking at the growth chart for both the stablecoins (USDT and USDC), one can observe that in the duration of one year, i.e., since May 2021, USDC has noted a much highest growth than USDT.

At this time last year, the total circulating supply of Tether was sitting at 62.48 billion, while the same for USDC was at 20.24 Billion.

However, within the span of 12 months, as Tether’s supply grew by 23.5% to reach $73.1 billion, USDC’s supply increased by 163.3% touching $53.5 Billion.

Even in the expanding crypto market, USDC is noting higher demand.

The most recent evidence of the same is the launch of crypto exchange FTX’s services of equity trading which, as per the announcement, can be conducted by using USDC as a means of payment for buying the stocks and shares of a company such as Apple, Tesla, Disney, etc.

Faith in Stablecoins’ Reserves

Knowing that Terra’s Luna Foundation Guard’s $3 billion reserve failed to protect the peg of TerraUSD, the concern surrounding the reserve for other stablecoins rose as well.

While in consequence of UST’s depegging, other algorithm-backed stablecoins were not affected, Tether’s reserves were undoubtedly at the community’s crosshair.

In the past, too, Tether has been reluctant to be transparent about its reserves. The company did state to have an external audit conducted, but it failed to produce any report of the same audit.

The doubts rose to the extent where the financial research firm Hindenburg even offered a reward of $1 Million to anyone who produced information about Tether’s reserves and peg in October 2021.

To further raise concerns, around May 20, Tether, in its attestation report, stated that the reserve’s commercial paper was reduced by 17%, from $24.2 billion to just $20.1 billion in the first quarter of 2022.

The same was further slashed by 20% since the second quarter of 2022 began.

Instead, the reserves backing the stablecoin observed a 13% increase in the U.S. Treasury bills rising from $34.5 billion in Q4 2021 to $39.2 billion in Q1 2022. These bills now represent almost half of Tether’s $73 billion reserves.

Going forward, whether or not Tether reveals more details about its reserves is unknown, but stablecoins may face difficulty firmly gaining investor trust due to a ripple effect from UST.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.