Recently, a few of us at Coin Central got the opportunity to talk with Kilian Rausch, the Product Director at Exchange Union. Although still in its infancy, Exchange Union has many people in the blockchain industry interested and has the support of some big players like Brendan Eich, creator of Javascript and Founder of Brave (BAT).

We spoke to Rausch at the Blockchain Connect conference in San Francisco where we could luckily pull him away from his busy booth for a few minutes.

If you’d like to learn more about Exchange Union, you should check out our guide here or its website here.

The Interview

Steven: Tell us about Exchange Union.

Kilian: We are connecting digital asset exchanges to enable cross-exchange trading. So, for example, let’s say you’re a user on Binance and I’m a user on Bittrex – our technology connects those two exchanges with each other so we as users can now directly trade with each other. The benefit is, that if the price for one currency pair on your Binance platform is better than on my Bittrex platform, I can get this price through Exchange Union. I actually can see all orders from all Binance users right in my order book and are now able to fill these.. This means I automatically have access to the best price across all exchanges. And the best thing: As a user, I don’t even necessarily know this is happening.

Steven: So, Exchange Union isn’t a separate platform? Is it basically a plugin on the existing exchanges?

Kilian: We develop an open-source software which we call the “XU Node”. This software is operated by the exchange. The exchange does the hard work and integrates it for its users. User experience-wise, you can stick with your current exchange, and you don’t even have to worry about where the orders are coming from. The orders will just appear in your order book. Also, you’ll have access to new trading pairs, which the exchange might not have been able to offer locally because of low liquidity. Imagine a rather restrictive exchange that only has three or four trading pairs. Now, this exchange, if they want to, can give their users access to all other trading pairs which are traded on Exchange Union, which hopefully will be all at some point.

This means we are solving one of the main pain points for new and smaller exchanges: liquidity. When a new exchange is starting, there’s always the question of how to get up and running and how to attract new users…without having notable liquidity yet. When you connect your exchange to Exchange Union, you basically don’t have to worry about liquidity anymore – you instantly have access to the liquidity of all other exchanges in Exchange Union, combined. In the future, we believe the competition of exchanges will be about UI, user experience, and it will be about Fiat on- and off-ramps. That will be the main competition in the future, but it will be less about what trading pairs I offer and how much liquidity I have because it will all be combined together and everyone will have access to it.

Steven: Say I’m Bittrex and I want to include the Binance pairings, does Binance have to be on board with that?

Kilian: Definitely. All of them have to run the XU Node software to share trading pairs and liquidity. Some more words on our decentralized network: It means there is no “us” in the middle running, for example, a server. XU Nodes are operated by each participating exchange themselves and directly connects them to other exchanges. This has the benefit of making the system incredibly robust and censorship-resistant. No single point of failure can lead to the shutdown of Exchange Union – just like with Bitcoin.

Steven: Are there any exchanges currently using Exchange Union?

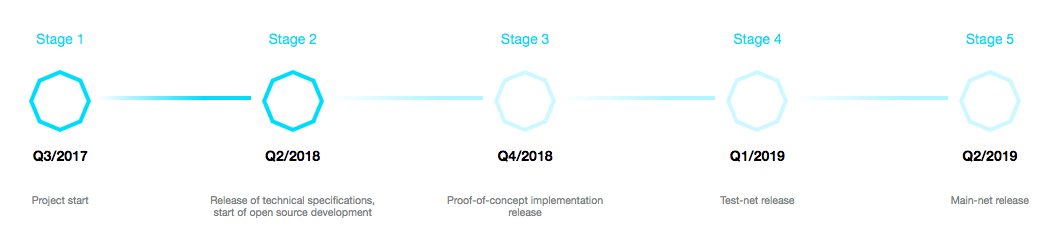

Kilian: We are currently testing it. It’s still quite far from being able to release it or test it with real money on the main net. The main net release should be in about a year from now. By the end of the year, we hope to have a proof of concept implementation out, which means this would be something that works and does what it’s supposed to do, but it’s not that stable and doesn’t look that nice yet.

For example, we have to think of different sets of APIs since exchanges have different requirements for the XU Node’s API set. They have to be customizable and that’s the hard part. It has to be nice and sexy to integrate for exchanges. Having worked at an exchange before, I know that exchanges are busy with tons of other stuff like improving user onboarding, ever-changing KYC processes, new FIAT integrations and this is why we have to make the integration of Exchange Union as painless as possible. Exchanges are our users, we are developing for them.

[thrive_leads id=’5219′]

Steven: I understand the value-add for smaller exchanges, but what would a large exchange get out of integration?

Kilian: You would think that a large, established exchange could only lose, especially in trading revenue, since local trades are filled by other exchanges. Well, the good news is that we’ve thought about that.

This is roughly how it works: A trade always has two sides: the maker and the taker part. If a regular trade happens locally on my exchange, I’m able to charge for both: the maker and the taker fee. Sometimes I set the maker fee zero to encourage market makers, but in general, I’m able to charge for both. What we do is, allow both exchanges which take part in a trade that goes via Exchange Union, in our example Binance and Bittrex, to charge their full maker and taker fee on each side of the trade.

This means, If I’m Bittrex and I send a trade to you, Binance, I keep the full maker-taker fee before sending the funds over the wire. You receive it on your side and before you send your funds, your part of the trade back to me, you also keep the full maker-taker fee. This also means as an exchange, that on a per-trade basis I am indifferent if this particular trade happens locally on my platform or if it goes out and is filled via Exchange Union.

In the long-run, in almost all cases I will be able to increase my trading revenues when connected to Exchange Union because simply put, I will also have incoming trades from other exchanges where I earn the full trading fee. Additionally, we are currently working on an incentive program to additionally incentivize liquidity providers, which especially applies to large exchanges, using our token XUC.

Steven: Is the end user paying both fees for each trade then?

Kilian: Correct, but the user still wins because the trade only gets executed if, including all fees, the price is still cheaper. It’s a win/win because if the user wanted to get the exact price without paying another maker-taker fee, the user would have to: open another account on the other exchange, transfer funds via a public blockchain, and then execute the trade manually. Doing that could take another hour, then you have to add on-chain fees and other fees, and the price most likely doesn’t even exist anymore by the time your funds reach the other platform.

Steven: When it gets implemented in the exchanges, it seems like arbitrage will be a thing of the past. It might exist between pairings still, but between exchanges, would this disappear?

Kilian: Arbitrage will always exist; it’s the very mechanism which balances market inefficiencies. Just that with Exchange Union, they will adjust much faster and will be much smaller. That’s how I think arbitrage will look like in the future. You won’t have these crazy differences between markets anymore that take hours to close because people are transferring funds via public blockchains, like Bitcoin, to other markets. In the future, everything will happen in one interface and you’ll be filling orders automatically and doing arbitrage without even knowing about it. If you wanted to still take advantage of arbitrage, you’d have to be the guy that hops on a plane and flies out of Zimbabwe with a bag full of USD. In countries where the fiat rail is somehow limited, like in Korea and Zimbabwe, lucrative arbitrage opportunities will continue to exist. These are problems we cannot solve. For now.

Steven: How did you get started with Exchange Union?

Kilian: I started working in crypto in early 2016 at BTCC in Shanghai, formally the biggest bitcoin exchange in the world. I was a product manager, and I actually got the job completely by accident. My first project was a wallet for the “everyday Joe”, a very consumer-oriented product. The main revolution was that instead of bitcoin addresses, we used phone numbers, so you could instantly send Bitcoin to your whole address book. The user experience was pretty cool and I managed to onboard dozens of my friends to bitcoin by sending some ‘bits’ to their phone numbers, of which they got notified via SMS and then started using the app. It also came with a Visa Card, which enabled you to actually use your Bitcoin to buy things on the street. In hindsight, choosing a hosted wallet for simplicity and user experience was not the ideal choice, though, since it comes with certain risks for users and a lot of legal obligations for the company as a custodian of user funds.

Through that, I started networking with some people and ended up meeting the people that had the idea of Exchange Union. I thought the idea was pretty cool and disruptive, and I also wanted to get more involved in the technology-side of blockchain. I was really excited when I first tested the Lightning Network in the middle of last year, and I started to put the concepts together for Exchange Union.

Steven: What gets you most excited about Exchange Union? It’s solving a good amount of problems.

Kilian: To be frank, we are solving the problems of people who have a very luxury set of problems. What gets me really excited about Exchange Union is a future where individuals run their own nodes. Hopefully, we won’t call it “node” anymore by then. At that point, it will be a nice and sexy light-weight mobile app. Users can then directly exchange any token with anyone without any need for a central party anymore.

We are prepared to be a fully working decentralized exchange. Since we’re using payment channels, like the lightning network to transfer funds between exchanges, it’s just the technology that has to mature until this is really feasible in the future. Think about someone in a small store in a third world country being able to accept any coin and the transaction is settled in the coin the store owner wants, like Bitcoin.

Steven: I’m fascinated by the way you guys are going about it because it’s unique to other solutions that I’ve heard. There are other companies trying to tackle the liquidity problem, but you guys are doing it in a way where, at least starting out, you’re tieing directly into the exchanges. They have the infrastructure, they have the users there.

Kilian: And they have the liquidity. Plus, when you choose a technology stack like we do, to make our decentralized network of exchanges able to meet the requirements of the exchanges, you have to be instant. While I personally use them, I’m convinced that decentralized exchanges in their current form, like 0x or EtherDelta, will never reach mass adoption. If I have to wait for one hour or more hours for a trade to confirm, pay fees for an on-chain transaction, and handle my private keys for different wallets on different chains – that’s not something I would use as a retail trader. So yes, we chose the more complex tech stack. We chose to work with technology that was successfully tested not even two months ago, but I believe it was the right the decision and we’ll put in the time and work to make it right.

Colin: Do you have plans to integrate with hardware wallets?

Kilian: In the future – definitely. I’m using hardware wallets myself and believe they are a good choice for being in control of your private keys while maintaining a decent user experience.

Colin: One of the things that I think the problem is with some decentralized exchanges, is the fact that the smart contracts, while secure, you’re at the behest of the network. If the network is clogged up because of Crypto Kitties, then your trading order may or may not go through. Will Exchange Union be using smart contracts, or will you have your own protocols completely?

Kilian: For starters, we’re using payment channels, meaning the actual value transfer doesn’t happen on the blockchain but one layer up. We’ll be using the Lightning Network on Bitcoin, Litecoin and several others and the Raiden Network on Ethereum. All other major chains are either planning or have payment channel implementations already in the works, like Trinity on NEO for example. The technology that ensures a trade is trustless is called Atomic Swaps. We [the blockchain industry] have access to technology like Atomic Swaps which enable the exchange of two assets without the need for a central escrow service for the first time in history. They enable two parties to directly trade without trusting each other. That’s amazing. So, no, we are not much worried if the underlying blockchain is congested or not because the trades are happening on the payment channel, not on the blockchain.

Colin: Is there a utility token?

Kilian: Yes, we have a token: XUC. To sum it up, we didn’t do an ICO. We did a private placement half a year ago when the idea was out, and people were interested in investing in the idea. We spent a lot of time thinking about how to properly use the token, and we took very good care to not force the usage on the token. For example, using the token as an intermediary currency that substitutes another currency and gets transferred over the wire, like Ripple does with XRP, was not an option. It’s very unsuccessful because it’s simply not feasible to create an intermediary ‘out of thin air’.

There is a reason why USD is still the best traditional currency intermediary nowadays – because there are liquid markets against virtually any other currency. For crypto, this applies to Bitcoin. I totally understand why banks don’t want to do that because it just doesn’t make any sense and creates risks. We use the token as a fee and incentive system. For starters, we’re in a luxury position where our token is already out and being traded and already has value. We can use this token to build up Exchange Union. Now, we’re in the phase where we’re building our open-source developer community. We use our token to reward developers that contribute code, review, and test.

In a second phase, once Exchange Union is up and running, it will be used for rewarding liquidity and order relays. That’s a problem no one has solved so far. You have payment channels and you have Atomic Swaps. Now, you’re able to do instant and trustless swaps, but the problem is how do you know about the other’s order without a central party? That’s what we mean when we talk about “decentralized order books”, so we have to somehow let the others know that a certain order exists.

In short, you will earn XUC, our token, if you provide liquidity to the network and pay if you use liquidity. If you are relaying other’s orders, so providing the service to take the orders, forward them, and validate them, you take a small fee. That’s the idea for our token to make a decentralized order book incentive system work.

Thank You

Thank you again to Kilian for taking time out of his busy conference day to talk with us. We thoroughly enjoyed learning more about the Exchange Union project and look forward to hearing updates.

[thrive_leads id=’5219′]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.