Kraken and Coinbase Pro ( formerly known as GDAX) are both considered among the best platforms for intermediate-level cryptocurrency traders and investors. With ample trading options and charts for analysis, these two exchanges are also great options if you’re interested in switching from something more basic, such as the basic Coinbase to something with a bit more robust functionality.

In this “Kraken vs Coinbase Pro” review, I go over the pros and cons of the two exchanges, so that you can decide which one is best for your investing strategy.

We’ll go over:

- Funding Methods

- Interface

- Trading Fees

- Available Cryptocurrencies

- Transfer Limits

- Company Trust

- Fund Security

- Customer Support

- Conclusion

Kraken vs Coinbase Pro: Key Information

[lptw_table id=”3462″ style=”default”]

Funding Methods

You can fund your Coinbase Pro account in three primary ways – bank transfers (ACH), wire transfers, and cryptocurrency deposits. Additionally, you can transfer funds from your Coinbase account, if you’re using one, instantly and with zero fees.

Kraken restricts how you’re allowed to fund your account by your verification tier.

At Tier 1, you can only deposit and withdraw digital currency, but you’re able to trade both digital and fiat currency. To get Tier 1 status, you must submit your full name, date of birth, country, and phone number.

Bank deposits and withdrawals (via wire transfer) are available at Tier 2 or Tier 3 depending on your country of residence. Tier 2 additionally requires your address while you must upload a valid government ID and recent proof of residence to reach Tier 3. To deposit and withdraw as a U.S. resident, you must be in Tier 3.

With the smooth Coinbase transfers and less stringent verification process, I recommend Coinbase Pro for people who want to get started investing as soon as possible.

Interface

In my experience, the Coinbase Pro interface is easier for the average investor to use than Kraken.

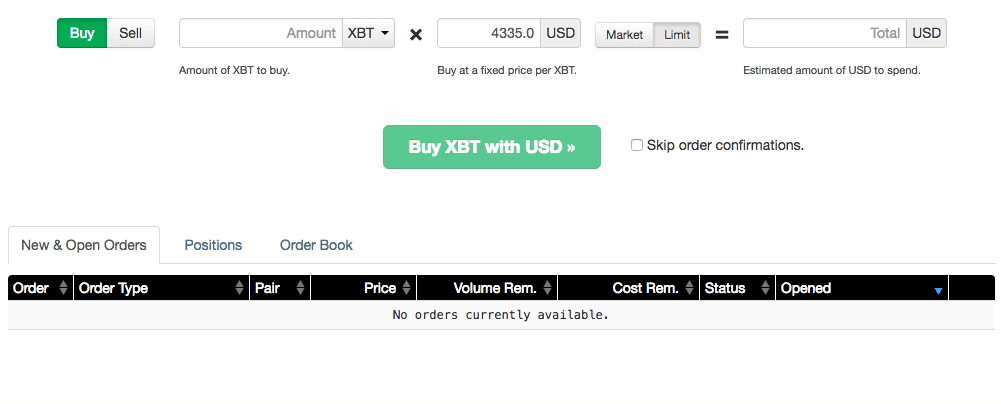

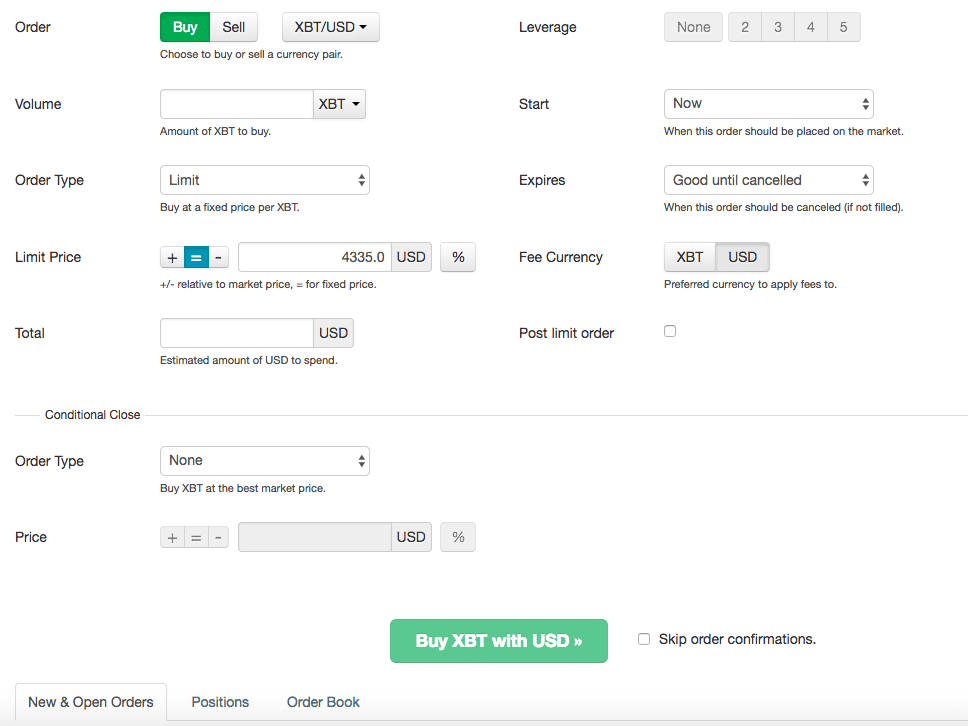

Coinbase Pro places the price chart, order book, trade history, and order form conveniently on the same screen without it feeling cluttered. Although this may take some time to get used to, it’s valuable to see all of this information when placing orders. On Coinbase Pro, you’re able to place market (filled immediately at market price), limit (bought/sold at a specific price or better), and stop-loss orders.

Kraken offers more advanced trading features than Coinbase Pro with the ability to place orders using Simple, Intermediate or Advanced options. Market and limit orders can be placed on the Simple tab. You can set stop-losses, expirations, leverage options, and conditional closes on the Intermediate and Advanced tabs.

Kraken is a better platform for investors who want to perform advanced trades.

Trading Fees

Coinbase Pro and Kraken have variable trading fees that are determined by your 30-day trading volume and whether you are a maker (putting an order on the books) or taker (filling an order from the books).

The taker fee for all coins on Coinbase Pro ranges from 0.1% to 0.25%, and Coinbase Pro has no maker fees.

On Kraken, the maker fee for Bitcoin, Ethereum, and Litecoin trades typically ranges from 0.00% to 0.16% with a taker fee between 0.10% and 0.26%. Depending on your trading strategy, Kraken may be a better choice for Ethereum and Litecoin trading because of the lower maximum trading fee (0.26% in comparison to 0.30% on Coinbase Pro).

Because these fees will from person to person, I suggest using the Coinbase Pro fee schedule and the Kraken fee schedule to estimate the fees on a few trades you may do. With those estimates, you can decide if the difference in fees is important enough for you to switch platforms.

Available Cryptocurrencies

Kraken supports several coins and trading pairings such as:

- Bitcoin

- Bitcoin Cash

- Dash

- EOS

- Ethereum Classic

- Ethereum

- Gnosis

- Iconomi

- Litecoin

- Melon

- Augur

- Tether

- Dogecoin

- Stellar Lumens

- Monero

- Ripple

- Zcash

Coinbase Pro supports dozens of cryptocurrencies.

If you’re interested in trading lesser-known alternative coins (any coin that isn’t Bitcoin), Kraken should be your choice. Because of their smaller market caps, alternative coins are inherently a more risky investment, but they can produce larger returns for this same reason.

Transfer Limits

Coinbase Pro does not have a set maximum for the amount that you can deposit in a day. Instead, they determine your ACH deposit limit from your account age, buying history, and account verification. ACH deposits are normally approved within 3-5 business days. Wire deposits on Coinbase Pro are restricted to $250,000, and there is no cap for cryptocurrency deposits.

The Coinbase Pro withdrawal limit is $10,000 per day.

Kraken’s deposit limit is the same for everyone at $25,000 per day when you provide proof of source of funds. The withdrawal limit is also restricted to $25,000 per day. Kraken deposits take 1-5 business days for approval.

Company Trust

Kraken and Coinbase Pro are both trusted exchanges operating within U.S. regulations and transacting nearly $1B worth of trades per day each.

Kraken is operated by Payward, Inc. and located in San Francisco. The exchange has received over $6 million in funding from several notable investors including Blockchain Capital. Since its launch in 2013, the trading volume on the platform has doubled about every 5 months – a remarkable growth pace. This growth demonstrates the trust that traders and community members have in the exchange.

Coinbase Pro, headquartered in Silicon Valley, was founded in 2012 as a branch of Coinbase. The platform has successfully exchanged over $20 billion of digital assets for 8 million people. Coinbase Pro has also received investments from Andreessen Horowitz, Union Square Ventures, and the New York Stock Exchange, to name a few.

Three months ago, the price of Ethereum plummeted from over $300 to 10 cents almost immediately on Coinbase Pro. This was caused by a multi-million dollar sale order that triggered several automatic sales in a domino effect down the order book. The market recovered shortly after, but several users lost a significant amount of money in the bizarre flash crash. Coinbase Pro refunded the money lost to those affected by the incident in an effort to rebuild market trust.

Fund Security

Both Coinbase Pro and Kraken use industry best practices to secure your digital funds. Additionally, Coinbase Pro keeps all U.S. dollar (USD) deposits in banks with FDIC insurance up to $250,000 per depositor.

Kraken stores all new coin deposits in encrypted wallets held offline where hackers are unable to reach them. They only keep digital coins online as a means to keep operational liquidity on the exchange. Kraken also maintains full reserves to prevent any possibility of a bank run.

Coinbase Pro keeps the majority of its digital assets in cold (offline) storage on encrypted USB drives with paper backups. Less than 2% of their digital assets are held online, and those that are, are fully insured by Coinbase Pro.

Kraken vs Coinbase Pro Customer Support

Kraken and Coinbase Pro usually provide good support to their customers – something that’s often missing from lesser known exchanges.

You can find a comprehensive FAQ section on both platforms that covers common support issues as well as beginner investor questions. Kraken also includes a thorough trading guide to help you get started.

Both companies handle support tickets through email, and Coinbase Pro has a typical response time of 2-3 business days.

Recently, Kraken has received criticism in many forums for having slow response times and ignoring customer support tickets (although I’ve never experienced this).

If you’re a new investor who may need help getting started, put your trust in Gemini and its robust support system.

Final Thoughts: Coinbase Pro or Kraken?

Coinbase Pro and Kraken are targeted to cryptocurrency investors with intermediate experience– that is, they’re comfortable with a variety of fleshed-out trading features versus simply placing an order and paying a fee.

Kraken has a larger selection of coin pairings and is suited for more experienced investors who are interested in alternative coin trading.

(See CoinCentral’s Full List of Crypto Exchange Reviews)