As the third largest market cap cryptocurrency, Ripple (XRP) is still significantly misunderstood.

Whereas many other coins experienced an eventful past few months, Ripple’s developments have been fairly under the radar.

Although it’s understandable that many people who watch the markets tend to gravitate towards high-velocity cryptocurrencies, you shouldn’t sleep on what Ripple is trying to accomplish. It’s perhaps the best-suited company to completely change the trillion dollar global payments industry, and has already made significant strides in doing so.

This article will help you better understand the fundamental features of Ripple as well as the direction it seems to be headed.

What is Ripple and How Does it Work?

Ripple is the holding company of all Ripple products, including the digital asset XRP. It has offices in San Francisco, New York, London, Sydney, India, Singapore and Luxembourg, as well as over 90 customers around the world. Ripple has also attracted investors such as Andreessen Horowitz, Google Ventures, Accenture, Seagate, and many more.

XRP is the digital token that we can buy, sell, and trade. It aims to solve a major point of friction in cross-border payments (the pre-funding of nostro/vostro accounts).

Ripple’s goal is to lower the marginal cost of international payments so money can move around much more easily without enormous fees. Ripple plans to accomplish this by enabling a global network of financial institutions to use the Ripple software to create something Brad Garlinghouse (Ripple’s CEO) calls the “Internet of Value”.

As more companies join Ripple and use its products, the demand for XRP will increase and the markets will adjust accordingly.

There are currently about 75 banks and payment providers active on Ripple’s network, with about 90 additional banks across the world including BBVA, Standard Chartered Bank, Westpac, Banco Santander, and National Australia Bank.

Ripple’s Market Growth

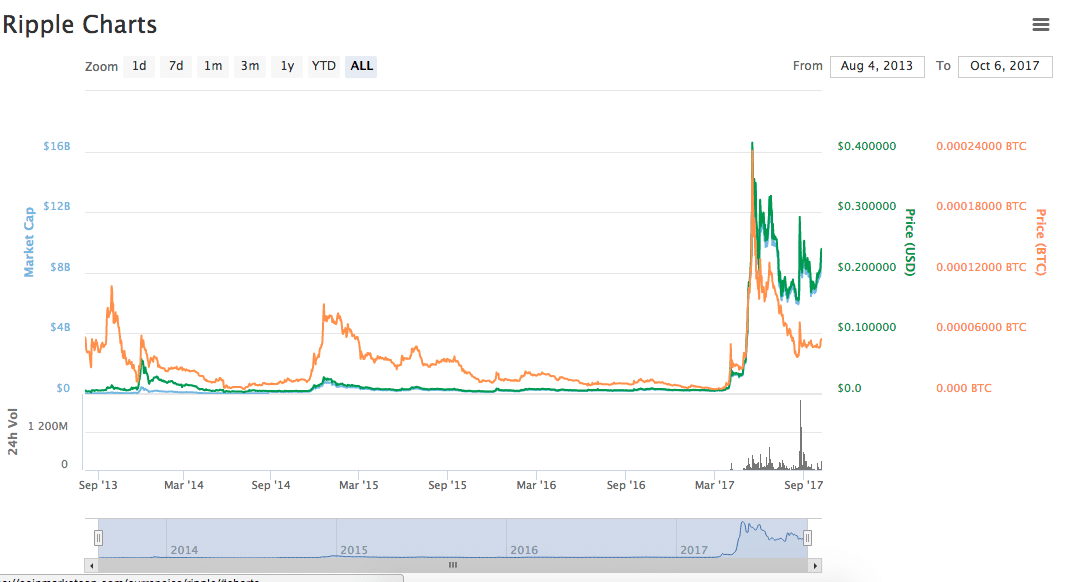

I think one of the biggest reasons Ripple is largely misunderstood is because its market growth in the past few months has been underwhelming at best.

Other than its meteoric rise of seemingly out of nowhere from March 2017 to about mid-May 2017, Ripple has generally hovered around the same price range.

Additionally, the cryptocurrency world saw some very notable events occur after Ripple hit its all-time high:

- Privacy coins such as Monero saw a 2x – 3x jump in price in August.

- Bitcoin Cash came out after a tense period where people were eagerly waiting for the Bitcoin fork in July.

- Other altcoins such as NEO kept growing every single day

- Even Litecoin started seeing some impressive growth.

Q/A with Brad Garlinghouse, the CEO of Ripple

In a Quora Session with the CEO of Ripple Brad Garlinghouse on October 3rd, some of the biggest burning questions many users had were answered. The full series of questions can be found here, and the following is my analysis of the answers.

I think the way Garlinghouse responded to this was graceful given the position of Ripple as a private company already earning a positive cash flow. He stated he doesn’t have plans to raise additional capital, which is good for investors because it won’t dilute the current price per token.

He also added a quip that reflected Ripple’s stance on raising money in general “and no offense, but if we did, we’d only raise capital from institutional investors!”

This is something that gets asked a lot.

It’s a reasonable question because here you have Ripple, this scrappy startup starting to see some momentum, and then the old-guard deep-pocket high marble column banks starting to realize that this whole crypto-thing might not be a flash in the pan.

However, to look at Ripple vs. Big Banks as a classic David vs. Goliath wouldn’t be entirely accurate. Ripple is aiming to build something that all banks can use, whereas some big banks are likely going to work on something similar for the sake of control.

Garlinghouse noted that “A bank-issued digital asset can only really efficiently settle between the banks who issued it. I strongly believe banks need an independent digital asset to enable truly efficient settlement and we believe XRP is best positioned for that role.”

In my humble opinion, the reason big banks are going to have extreme difficulty executing their own cryptocurrency spin off is that they’re cemented in being a centralized self-serving authority. They’re stuck with the paradox of having to create something inherently decentralized while maintaining complete control. It’s worth noting that Ripple itself is fairly centralized; it is a private company and owns the vast majority of the XRP (about 61 percent, or $16 billion worth).

Additionally, I get the feeling that in order to reach a consensus between hundreds of haughty and borderline imperious banks would require divine intervention. Ripple, as an independent third-party working on something every bank will want to (or eventually have to) use, has an edge.

3. How will Ripple revolutionize finance?

Boom. There’s a big one.

Garlinghouse compares the sluggish and expensive world of global payments to the ability to talk to anyone in the world instantly and for free.

It seems that modern technology hasn’t graced the world of global payments yet. Global payments are the busted up 2002 Toyota Corolla of the streets today. Things such as being able to live stream video and audio didn’t even exist in the 90s, yet global payments have been around for decades. Even the ability to throw a Snapchat filter that changes the structure of my face was the stuff of science fiction growing up, and yet payments have hardly changed.

The frustratingly fascinating part is that global payments is an almost incomprehensibly large industry. The world sends upwards of $155 trillion across borders. That’s $155,000,000,000,000 being sent through a system that charges extremely expensive fees and takes days to process.

And it’s not like banks that are making billions of dollars in payment fees are sprinting to uproot their systems.

Garlinghouse noted that Ripple aims to solve this problem through its “Internet of Value” to connect billions of people around the world to instantly transact, and it could also unlock a “myriad of opportunities”

I believe that Ripple offers a solution that will play a pivotal role in the already outdated world of global payments, a world that could have had a facelift a decade ago.

4. What will set XRP apart from other cryptocurrencies?

There are many things that set XRP apart from other cryptos, but Garlinghouse mainly highlighted the difference between XRP and Bitcoin.

“While I’m personally long BTC and a believer that it’s solving a different use case, the reality is that today the average time to complete a BTC transaction is about 4 hours. In contrast, XRP is about 4 seconds. A couple other similar comparisons important for payments and enabling an Internet of Value:

- The XRP ledger can handle more than 1500 transactions / second. BTC is currently ~15 transactions / second.

- XRP fees per transaction are measured as fractions of a penny. BTC fees per transaction are measured in dollars.”

To add to that, I think there are a few points that could have also been fleshed out.

A big reason (and a chewy one) that Ripple (XRP) is different from other cryptocurrencies is that it’s commission based and not entirely decentralized in the same way many other coins are. Ripple owns about 61 percent, or $16 billion worth, of all the XRP. There’s nothing stopping them from releasing their XRP into the market to control prices. It’s also in the best interest for the pursuit of low payment fees to keep the price of each XRP low.

There are also currently 38,343,841,883 XRP in circulation. So that means if you have 1000 XRP at $.20, the market cap would have to increase by $7,668,768,376.60 just for you to double your money. Yes, doubling your money is any situation is a pretty sweet deal, but keep in mind that $7.6 billion in market cap is nothing to scoff at.

Should I Buy Ripple (XRP)?

The best way to know whether you should invest in anything is to do it the same way the big fish, the movers of markets, the investing sages do it.

They wake up and grab their morning coffee. They take a sip, but it’s too hot so they put it down for later. Soon. They crack their knuckles and open their MacBooks. Ah, Ethereum went up 10% today. They wonder if they should buy it. They Google “Should I Buy Ethereum”. A reddit user cryptosandlambos98 says “yes if ur not buying Ethereum ur missing out!” They place an order for $10 million.

Unfortunately, it’s not that simple. While speculation has its clear impacts on price fluctuations, I’m not one to tell you that you can reliably time it.

That’s why I want to highlight the importance of knowing the fundamentals of cryptocurrencies such as Ripple (XRP), and then making a decision for yourself. Here are a few questions I ask myself:

- What are they building?

- What is their industry like?

- What’s their competitive edge?

- Who’s on their founding team?

- How many tokens have they released?

- What problems are they solving?

Once you’ve got those down, keep going. You are ultimately responsible for making the best decision regarding your investments. We just want to be here to expose you to new information and insights.

Final Thoughts

The cryptocurrency world is filled with exciting promises of industry-disrupting solutions, but there are comparably very few coins that actually have the potential to make good on them.

Ripple (XRP) is one of the rare companies in the cryptocurrency sphere already making money and working with real clients; not to forget the fact that they could potentially become the leaders in tackling a trillion dollar industry.

That being said, it’s important to become educated and stay updated on the Ripple’s fundamentals and the long-term picture before you choose whether or not to invest into it. Either way, it should be an interesting narrative to follow.

Disclaimers: I’m currently an investor in Ripple (XRP) holding for the long-term. This is by no means financial advice.