Bitcoin’s price history is a rollercoaster, fueling both bulls and bears seeking to make a profit on the price jumps.

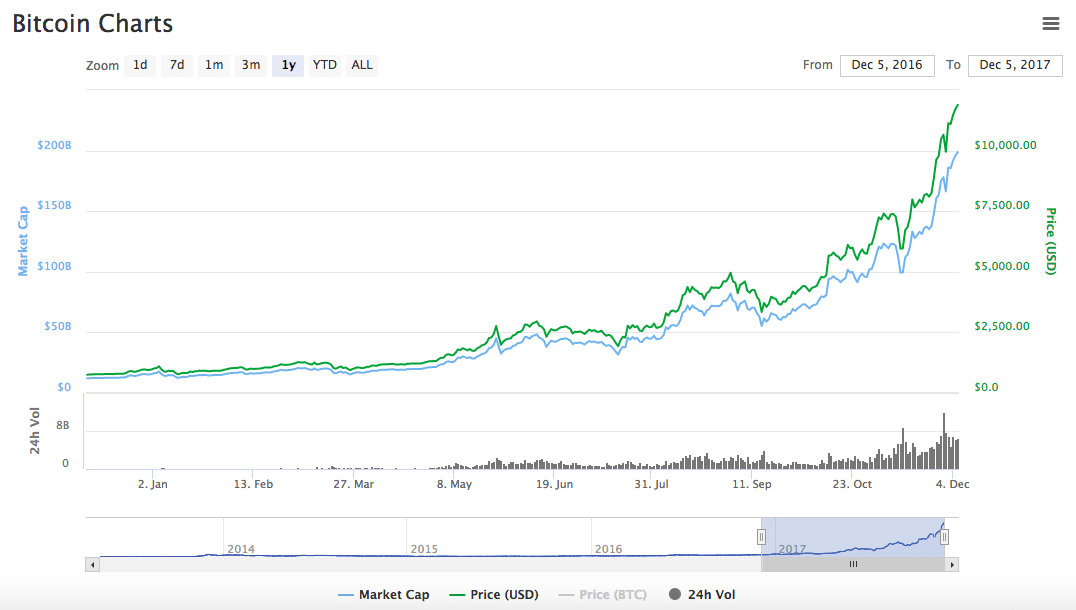

For example, we first published this article in December 2017. We’ve kept our original screenshot for melancholy’s sake below. It’s interesting to consider how people felt at this moment in time.

Bitcoin had just climbed from around $900 in January 2017 to an all-time high of over $20,000 in December 2017. Around the same time the following year, Bitcoin was hovering at around $4,000. The asset saw a 22x jump in 2017, and then an 80% fall the following year.

We received a significant number of search queries from people wondering, “can I short Bitcoin?”, eager to consider a stake in the volatile and unpredictable world of Bitcoin’s price action.

Zooming out a bit further, as evidence with the image below, Bitcoin would climb to over $64,000 in the following years, and then fall just below $15,000 in 2023.

So, let’s explore shorting Bitcoin. Please note this information is purely for educational purposes. Crypto is risky, “shorting” assets is risky, and the two combined are nuclear-level risks.

Can you short Bitcoin?

Yes. Although not as prevalent as buying, there are a few different ways you can short Bitcoin:

- Shorting Bitcoin on an exchange

- Shorting Bitcoin CFDs

- Bitcoin futures market

How to short Bitcoin on an exchange.

If you already have experience trading cryptocurrency, the most natural way for you to short Bitcoin is on a cryptocurrency exchange. Many of the major exchange such as GDAX and Kraken give you the option to short the coins on their platform.

Bitfinex and some other exchanges also have leverage trading. You can leverage your Bitcoin short (up to 5x on some exchanges) if you’re feeling particularly confident or risky.

Shorting Bitcoin CFDs

A CFD (Contract for Difference) is a contract between two parties that speculates on the price of an underlying asset – in this case, Bitcoin. These investment derivatives allow you to “bet” on the price of Bitcoin without having to actually purchase it.

Not all CFD platforms have Bitcoin shorting options.

Bitcoin futures market

Similar to a Bitcoin CFD, you can also short Bitcoin through a futures trade. To short Bitcoin with this method, you need to sell a futures contract for Bitcoin at a price that’s lower than it is currently.

Until recently, there weren’t many reputable trading platforms you could do this through. However, the Chicago Mercantile Exchange (CME), Nasdaq, and most recently CBOE all announced that they’re opening up Bitcoin futures trading early this December.

Final Thoughts: Is Shorting Bitcoin Risky?

Yes., very. When you buy “long” on an asset, the maximum amount that you can lose is what you’ve invested because an asset can’t be worth less than $0.

When you short an asset, you can lose all your money if the asset continues to rise.

With Bitcoin sometimes doubling in price before any significant pullback, shorting it could be a risky endeavor. That being said, there are plenty of people who’ve made a significant amount of money through short-selling and making investments that seem to go against the grain.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.