- Stacks (STX) NFTs: A Quick Look

- The Stacks Ecosystem

- The Top STX NFT Collections

- Final Thoughts: Stacks (STX) and BTC

Stacks (STX) is an NFT ecosystem that utilizes the best of two worlds; it’s secured by the Bitcoin network while also on Bitcoin which leverages the scalability of the Ethereum network.

Bored Ape or pixelated Punk, there’s no denying the NFT movement & market roared to life in 2021. While the mainstream has yet to warmly embrace the technology, it’s at least caught their attention. For the most part, Ethereum (ETH), alongside the popular marketplace OpenSea, has reaped the majority of the cash flow, eyeballs, and market share — followed closely by the Solana (SOL) network.

Yet over in a much smaller part of the space, another blockchain is hosting a sub-renaissance of sorts: reviving, as it’s come to be known, the “digital-rock,” Bitcoin. An L-1.5 by the name of Stacks (STX) is responsible for a recent flurry of activity that’s currently “bringing” NFTs to the most proven chain of them all.

There’s a healthy debate surrounding the exact technical implementations of the STX project. With obvious storage constraints like the block size, it’s not accurate to say Stacks allows for building on top of Bitcoin as much as Stacks is secured by Bitcoin.

Perhaps not-so-surprisingly, this debate has drawn the ire of both the majority of Ethereum-ites & the minor but loud Bitcoin Maxi crowd — most of who cast aspersions of altcoin & bitcoin-affinity marketing. Of course, it’s not without irony that the majority of the criticism leveled comes from Blockstream employees working on the Liquid Network (which, a great product on its own, also has clear trade-offs).

If the last few months are any indication, the Stacks community has very clearly shrugged these criticisms off & did what any developer-heavy project does best: build.

Stacks (STX) NFTs: A Quick Look

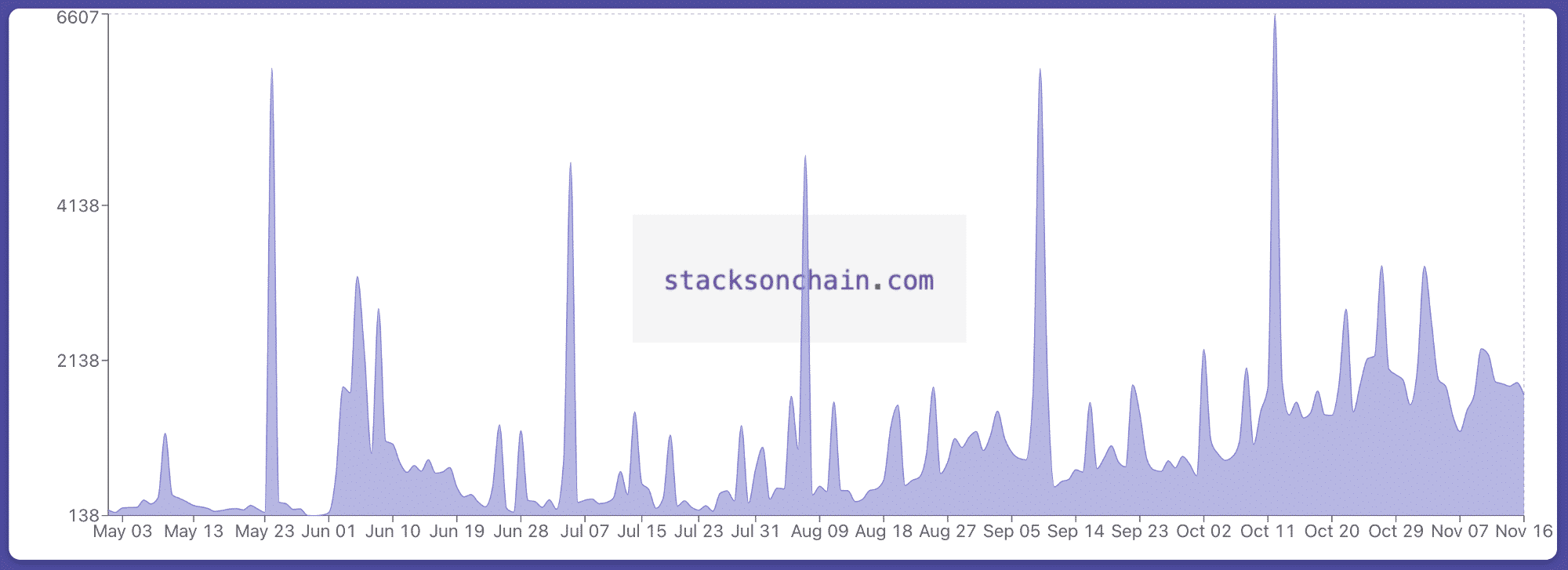

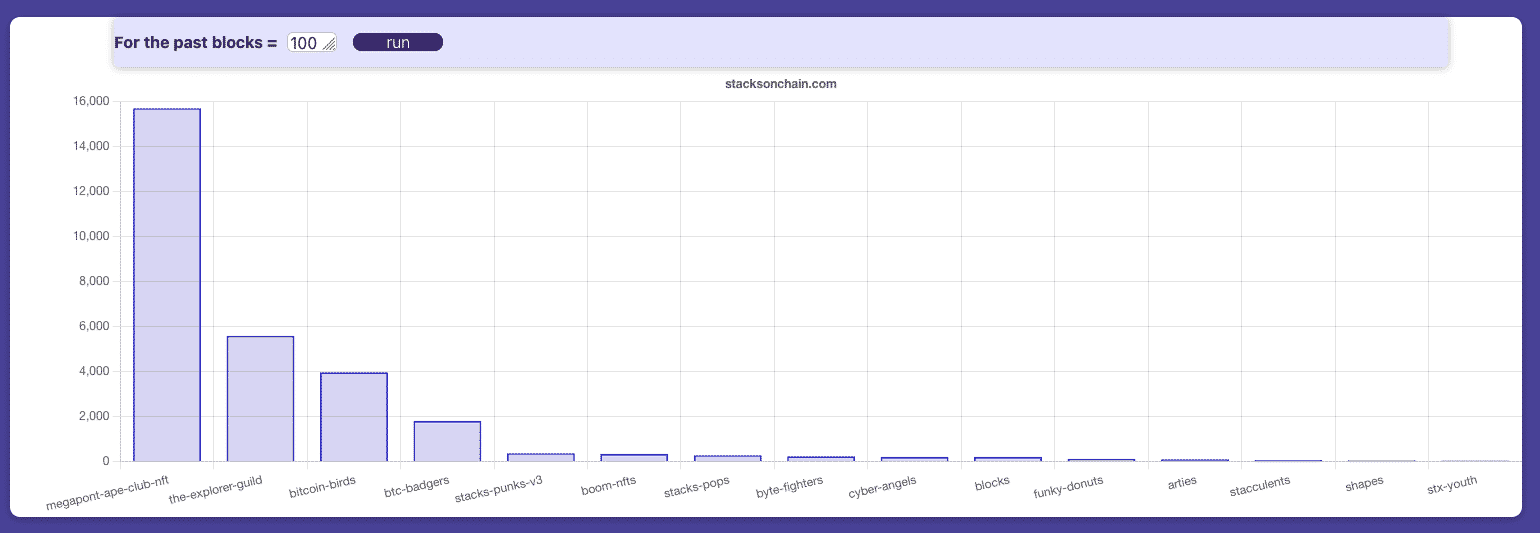

Courtesy of the StacksOnChain data analytics site, a quick overview of the last few three months paints a picture of relatively fast-paced NFT activity:

- 50+ Projects Have Launched On Over 3 Marketplaces

- 5+ Projects Have Now Raised Over $100K Through Mints

- 1 Project Has Now Crossed $2M In Secondary Sales

For a chain that only fully launched (or re-launched, depending on your perspective) in early 2021, this flurry of Q3 on-chain activity is nothing to scoff at. While Ethereum, its L2’s (Polygon, etc..) & Solana undoubtedly eclipse the NFT activity of Stacks, it’s worth looking at the momentum Stacks has had in on-boarding competing Eth/Sol power-users as well as more conservative, reluctant maxi-Bitcoiners:

The number of active Stacks addresses jumped from a weekly average of ~150 active addresses to a magnitude of growth (~1,500 weekly average) from May 2021 to November 2021. This 10x has garnered attention outside of a tight-knit Stacks community.

So, who makes up the current ecosystem?

The Stacks Ecosystem

Unlike Ethereum, which is heavily dominated by a single marketplace, the Stacks ecosystem is much more diversified. There are generally three core marketplaces in the Stacks world; the launched collections, like other chains, range in quality and community. Below we’ll quickly introduce the three marketplaces and a handful of the most buzzing collections.

Byzantion

First alphabetically is none other than the brainchild of the duo known as Obsidian.btc and Plutus.btc. While lighter on the market volume than the other two markets, Byzantion recently changed its entire front-end and has been shipping new features such as the ability to search and shop on all three markets at a rapid pace.

Stacks Arts

The current market volume crown-holder (by a large degree), Stacks Arts positions itself as the high-curation marketplace. With unclear guidelines & an anonymous founder, the selection process is somewhat of a mystery— those that do make the cut, usually end up with a mint-out followed by a heavy period of secondary market sales.

STXNFT

Incontrovertibly the most powerful SEO name brand, STXNFT is second in market volume but built the perfect mousetrap. STXNFT was the first marketplace to let users view all NFTs under one address, but even more importantly, they (actually he — solo founder Jamil.btc) allowed users to simply transfer NFTs from one address to another.

In addition to these features, STXNFT is also the very first Stacks marketplace to allow for minting NFTs in other Stacks-based tokens such as MiamiCoin & recently-launched NewYorkCityCoin.

The Top STX NFT Collections

With the marketplaces introduced, we’ll now dig into the buzziest collections that comprise the young Stacks ecosystem. While there are many more projects than the ones discussed here, we chose to highlight the ones with the highest market volume.

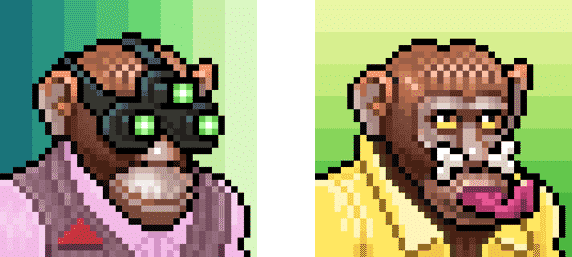

Megapont Ape Club

As seen above, Megapont Ape Club (or MAC as you might see on Twitter) is the gorilla in the room. With $2M in market sales volume in under a month & a heavy presence on all three marketplaces, they’re the most heavily traded NFT on Stacks. Showcasing some iconic pixel art & a fascinating roadmap (both shown below), it’s not surprising to see why they’re #1.

The Explorer Guild

A graduate of the Stacks Accelerator, The Explorer Guild is the NFT fundraising mechanism for the Sigle writing platform. A web3 competitor to Medium, Sigle hosts blogs & pays out writers in BTC. While MAC has a run-away amount of trading volume, The Explorer Guild holds the record for the most mint volume coming in at a total of $500K.

The Explorer Guild is also packing its NFT with utility such as a premium newsletter to custom domains to more advanced analytics, Sigle made sure to provide continuous value to their Explorer Guild owners.

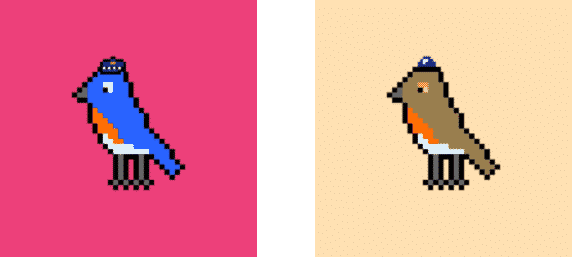

Bitcoin Birds

Bitcoin Birds is the brainchild of passionate ornithophile Abraham Finlay. A 12-year-old with a fervor for taking care of his winged friends, Bitcoin Birds aspires to be a feel-good collection.

With a very tight supply of only 400 birds (versus ~2,500 collection size of the other three), Bitcoin Birds was one of the earliest projects on Stacks to successfully mint out in a matter of hours. With real-world positive affects on their roadmap like their First Wildlife Project, Bitcoin Birds is crossing the utility threshold with a lovely charity-driven mission.

Bitcoin Badgers

Named after the eponymous Bitcoin Honey Badger meme, the very last collection in the diagram above is a collection of giffy Badgers reminiscent of Cool Cats’ art style on Ethereum.

Evident from their roadmap, Discord & Twitter activity, this team is laser-focused on the metaverse angle. Starting with 3D models & ending with an immersive virtual reality NFT gallery, Bitcoin Badgers seem like they’re making decent headway into this space — only time will tell if they head towards a Somnium Space/Decentraland competitor.

Interestingly, despite the strong secondary sales, Bitcoin Badgers is the only collection in this list with an unfinished mint (per its website, the 2nd & final half start around Dec. 3rd/4th).

Final Thoughts: Stacks (STX) and BTC

Understandably, the numbers mentioned short seem diminutive relative to the latest Beeple or Bored Ape Yacht Club sale, yet it’s worth stressing that Stacks is an ecosystem worth watching.

Stacks (STX) is far from perfect; a single search will bring up salient counter-arguments from introducing its own token (aka not Bitcoin) to having a VC pre-sale. Yet it’s in its infancy stage, smack-dab in the middle of two great principles: marked by the stable security of Bitcoin & the extended flexibility of Ethereum.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.