*Sad Trombone*

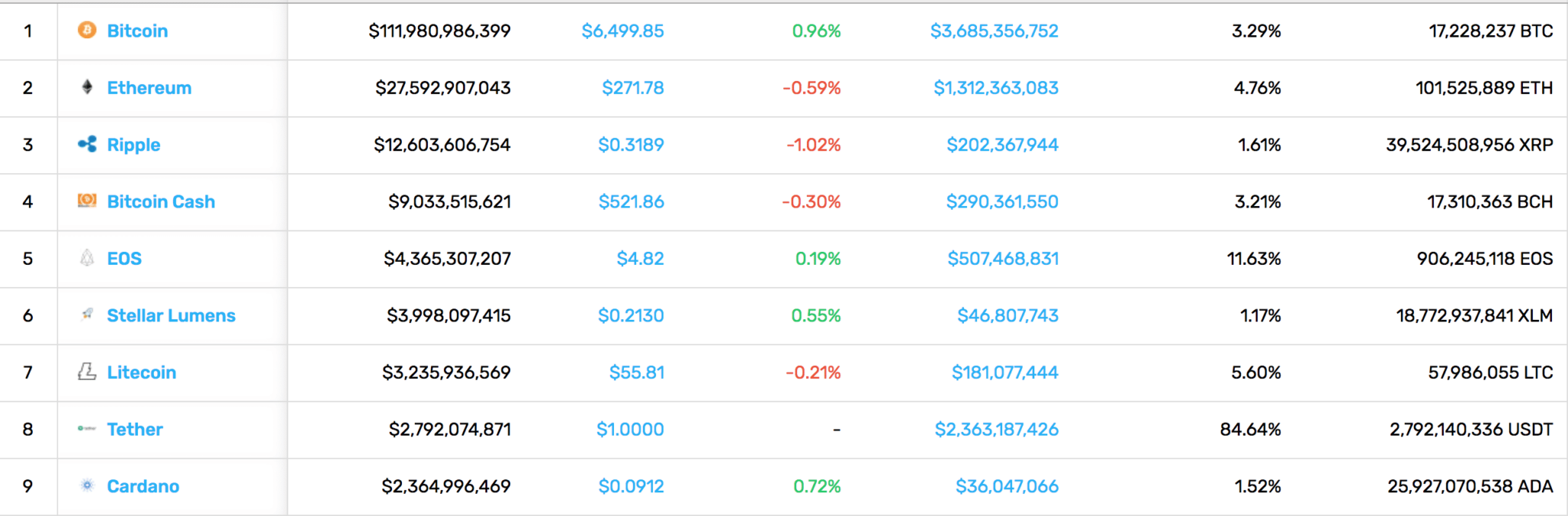

Although not a dramatic drop-off like we’ve seen in previous weeks, the market remained relatively stagnant seeing slightly lower ‘lows’ throughout the week.

This week, the entire market dipped just -0.04% on the heels of several Bitcoin ETF rejections (or were they reviews?) by the SEC. While some view anything but twenty percent gains as a negative, the lack of price movement after this negative news mean that we may have finally found a floor. Fingers crossed

Blockchain’s poster boy, Bitcoin, rose 1.29% this week – an impressive stat considering the negative press.

Ethereum continued to get hammered, down 7.35% in the last seven days.

And XRP, the coin everyone loves to hate is this week’s big winner, up 4.04%.

SEC Rejects Numerous Bitcoin ETFs (For Now): Eight more Bitcoin ETF proposals join the Winklevoss ETF in the SEC’s reject pile. The primary reason for the rejections, so far, has been the inability of the exchanges to provide enough proof that they can prevent market manipulation and fraudulent activity. Not all is lost, however. The SEC stated that their decision has no bearing on their opinion of Bitcoin and blockchain as a useful technology. And, investors seem to agree. Bitcoin’s price remained relatively stable even with the unfortunate news.

BREAKING: In a quick turnaround, the SEC now says that they will review the nine ETFs that they had previously rejected. These reviews could still lead to the same result, but they do bring a glimmer of hope for Bitcoin ETF hopefuls this week.

Steve Wozniak Announces Blockchain Involvement: At the recent ChainXchange conference in Las Vegas, Apple co-founder Steve Wozniak announced his involvement with a new blockchain company, Equi. This project is Wozniak’s first venture into the cryptocurrency space. Remaining relatively secretive, the Equi website only states that the project will “disrupt Venture Capital, Real Estate, and Luxury Asset Investing.” The platform is scheduled to launch in winter of this year.

Nvidia Calls it Quits for Crypto: Well, it looks like no one is safe in this bear market. In a somewhat surprising move, Nvidia decided to end its crypto-specific product venture. In a statement last week, CFO Colette Kress explained, “Our [Nvidia’s] revenue outlook had anticipated cryptocurrency-specific products declining to approximately $100 million, while actual crypto-specific product revenue was $18 million, and we now expect a negligible contribution going forward.”

Ripple CTO Calls Bitcoin Centralized: This week, in an article titled “The Inherently Decentralized Nature of XRP Ledger,” Ripple CTO David Schwartz flips the script on the classic “Ripple is centralized” narrative. In his post, Schwartz makes several arguments regarding validators as a better alternative to miners, the potential for the collusion of mining pools, and the final blow that “the XRP Ledger is in many ways a more transactional, functional and decentralized ledger than either Bitcoin or Ethereum.” Bold strategy, Cotton.

Bittrex Joins Hands with Rialto to Provide Digital Securities Trading: On Thursday, Bittrex informed users through its support platform that the company is teaming up with Rialto Trading to support digital securities trading. At launch, the extended platform will be available to institutional investors, accredited investors, corporations, and U.S.-registered broker-dealers.

Bitcoin Mining Juggernaut Bitmain Plans to Launch IPO: ICO, ICschmo. Bitmain is raising a gigantic round of funding. And, they’re doing it through the traditional means.

How Exchanges Are Using KYC Laws to Keep Your Crypto: KYC procedures are meant for exchanges to prevent illegal activity. However, some platforms are changing their policies without warning and freezing accounts as a result.

South Korean Cryptocurrency Market Targeted by New Rule Change: Cryptocurrency exchanges now sit alongside bars and nightclubs in South Korea. Learn why here.

9 Main Barriers to Widespread Cryptocurrency Adoption: We’re still a long way off from mainstream cryptocurrency adoption. Here are the top nine things holding us back.

Can Bitcoin Be Hacked? Get Hacked and Find Out!: Can Bitcoin really be hacked? There’s only one way to find out…

What is Tezos (XTZ)? | A Beginner’s Guide to the Controversy Coin: Check out this beginner’s guide on the smart contract platform with a controversial history.

What Is Barclays Bank Going to Do with Blockchain Tech?: Barclays Bank is joining other progressive thinking financial institutions with some new blockchain patents of their own.

The Growing World of Non-Fungible Tokens: CryptoKitties was just the start. Non-fungible tokens are becoming even more popular as groups begin to tokenize assets around the world.

Interview: Sapien Team on Web 3.0 and a New Social World: We got the chance to sit down with the Sapien team to discuss Web 3.0. Read our chat here.

A Winning Choice? Bitstarz Casino Review: Is the Bitstarz Casino a good choice for your inner gambler? We reviewed it to help you decide.

[thrive_leads id=’5219′]

Techfugees Founder on Leveraging Blockchain to Help Refugees: Techfugees’ CEO Josephine Goube is coordinating the commitment of the tech community to displaced people around the world. Learn more in our interview.

Why Switzerland Is Scrambling to Keep Its Crypto-Friendly Title: Trouble in (crypto) paradise? Switzerland is starting to look like it may not be as crypto-friendly as people have thought.

What Is Viacoin (VIA)? | Beginner’s Guide: Viacoin is a peer-to-peer cryptocurrency that works complementarily with Bitcoin and Litecoin. We break down what you need to know about it in this guide.

What is Karmacoin? (KARMA): Karmacoin was a short-lived cryptocurrency comprised of numerous projects. Read about its history in this guide.

A Closer Look at Citi’s Efforts in Blockchain and Crypto: Although blocking cryptocurrency purchases with its credit cards, Citi is creating its own blockchain solutions, Citicoin and Citi Blockchain.

The Merger of Blockchain and Higher Education: Two-way learning, customized lessons, electronic transcripts – blockchain and higher education are a match made in heaven.

What Is BitGo? Enterprise Cryptocurrency Solutions: BitGo is a company with one goal in mind–enabling institutional investment in cryptocurrency. But why should this be necessary? Doesn’t crypto provide a means of avoiding banks and financial institutions?

Fitrova Up 944% this Week – Spotting the Pump and Dump: After its meteoric rise, previously unknown Fitrova may have been on your radar this week. However, an investment in it would’ve cost ya.

Hey hey heeeeeeey BitConnect Leader Arrested in India: Divyesh Darji, the alleged mastermind behind the BitConnect Ponzi scheme, was arrested last Saturday at the Delhi airport. Immigration officers identified Darji as he was attempting to travel to Ahmedabad. Police from the Criminal Investigation Department later apprehended him at the airport. The arrest occurred roughly seven months BitConnect closed up shop due to several cease and desist letters from financial regulators. BitConnect (BCC) is somehow still trading at an over $6.5 million market cap.

Australian Citizens Now Able to Pay Bills in Crypto: A recent partnership between Cointree, a platform to buy/sell crypto, and bill payment platform Gobbill means that folks in the land down under can now pay their bills with cryptocurrency. Gobbill, acting as an intermediary, will collect funds from customers and pay bills on their behalf. This additional step allows customers to pay with cryptocurrency whether or not their utility provider accepts them.

Excited to finally announce our partnership with @gobbill , this partnership will enable automated bill payments with cryptocurrency! More via https://t.co/ZDyEhmtc1e #bills #crypto #fintech #blockchain #cryptocurrency #gobbill #cointreeau #AI pic.twitter.com/PJxdtd98ha

— Cointree (@CointreeAus) August 20, 2018

China Bans Bitcoin Again…And Again…And Again: In their most recent wave of Bitcoin-related bans, the Chinese government has now banned all commercial cryptocurrency events. Additionally, reports state that China also plans to block over 120 foreign cryptocurrency exchanges as part of a broader crackdown. All bans aside, the State Council of China has publically pushed for the acceleration of blockchain development within the country, further defining China’s love-hate relationship with the new technology.

Bitmain “Investors” Deny Association with pre-IPO: After earlier reports of several big-time firms participating in a Bitmain pre-IPO investment round, the story now seems to have changed. Tencent Holdings and SoftBank Group both came out this week denying that they’ve had any involvement. It looks like we can chalk up the falsehoods as fake news started by an IPO-focused blog on WeChat. Many analysts wonder if the $18 billion cap Bitmain has filed for is now drastically overvalued due to the downturn in the cryptocurrency market.