- Citi’s Crypto Bans

- Possible Policy Reversal?

- The Citicoin Project and Citi Blockchain: Where’s the Product?

- Regulations Influence on Corporate Adoption

- Calling Crypto Experts

- Strategic Partnerships: Nasdaq/Citi Blockchain, IBM LedgerConnect

- Conclusion

Known for being one of the four big US banks, Citigroup has accomplished a lot since its establishment in 1998. It’s served as an important player in the fiat-based economy but could become one of the biggest catalysts of crypto adoption in the near future as well. Yes, the company has been cautious regarding the possibilities of blockchain and cryptocurrency. However, we’ve begun to see some changes in recent years with the launch of Citi blockchain and Citicoin.

Let’s explore Citigroup’s movement into blockchain technology, its efforts to fight crypto-related crimes, and its establishment of strategic blockchain technology partnerships. We’ll also try to understand what this might mean for the future of the financial sector as a whole.

Citi’s Crypto Bans

In February 2018, Citibank banned all of its US customers from using credit cards to purchase cryptocurrencies. Citi wasn’t alone in this action either. Other big banks like JPMorgan Chase and Bank of America made similar announcements at that time.

In June 2018, Wells Fargo also established a ban. From a bottom line standpoint, this move does make sense. Any bank must consider that its customers might not be able to pay back in fiat when crypto prices decline.

Even though US users can still use debit cards, customers from other locations face even heavier restrictions. For example, in Q1 2018, Citibank India banned the use of credit cards and debit cards to buy cryptocurrency.

Possible Policy Reversal?

Despite large companies like Facebook lifting bans on cryptocurrency-related ads, companies in the banking sector haven’t eased restrictions. Even though the bank’s policies on crypto purchases haven’t changed, Citi has made several moves towards blockchain and cryptocurrency adoption.

So… does this mean a possible crypto policy reversal? While this could be possible in the future, it still looks unlikely for now.

The Citicoin Project and Citi Blockchain: Where’s the Product?

News about a Citi blockchain initiative and the Citicoin project was first published all the way back in July 2015. Back then, it was reported that Citi had developed 3 different blockchains and its own cryptocurrency. At the time, this seemed to be a promising sign for mainstream cryptocurrency adoption. The only issue is that there haven’t been many updates about the project since then.

Citi’s progress in releasing a Citi blockchain product has been slow. This is especially evident when considering that many (if not most) projects in this space have not only launched new digital currencies but also their own publically-available blockchains in less than one year after the completion of their ICOs.

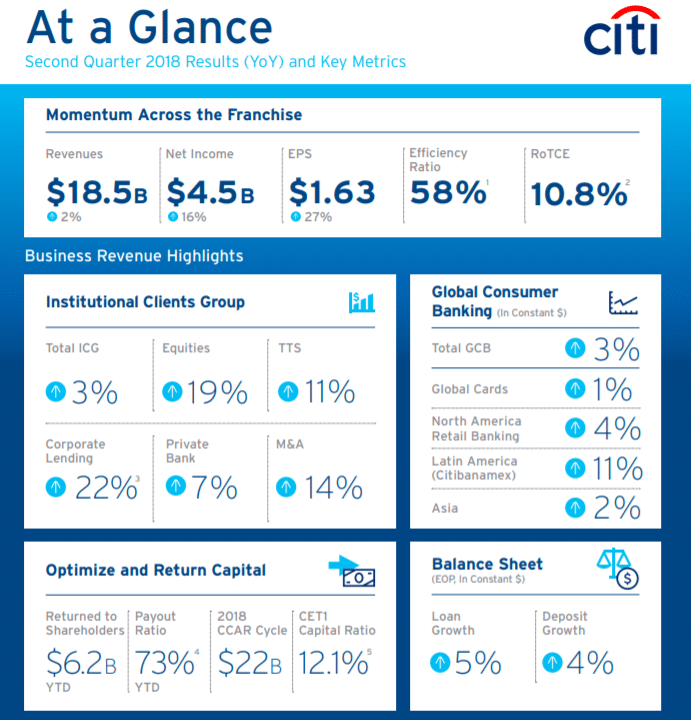

When it comes to financing, Citi has a major advantage over most new projects. It has so much capital (71.45 billion in 2017) that an ICO is far from necessary.

Flashforward to 2018, and we are finally seeing more promising signs that Citi’s efforts in this space might be moving past the early prototype stages. However, there are still a few obstacles to launching a product in this space.

Regulations Influence on Corporate Adoption

Citigroup, and all other major financial service companies, that want to be successful in this space have to make sure to thoroughly comply with existing government regulations. In the past, banks have had to pay out hundreds of millions (and sometimes even billions) in fines for breaking laws. In a lot of cases, this occurs when a bank doesn’t obstruct money laundering activities.

Yes, banks have had to pay these fines for many decades in the fiat economy. It’s hardly surprising, then, that one of the biggest fears of banks is that by allowing users to send and receive crypto, it will become more difficult to comply with AML (anti-money laundering) policies. This provides one possible explanation for why Citi and others have, for the most part, been slow to embrace crypto.

Calling Crypto Experts

Even though AML compliance presents a big issue to solve, Citigroup appears to be gearing towards the future in its hiring. For example, in April 2018, the company published a job posting on LinkedIn for two regulatory-focused positions. These included a Senior Vice President and a Senior AML Compliance Officer—Emerging Risk. Some of the qualifications included “knowledge of cryptocurrency and Bitcoin monitoring.” Additionally, the job posting lists “Bitcoin Professional Certification” (BPC) as a plus for both roles.

This could be an effort to ensure that Citigroup enforces its existing crypto bans. It could also mean that the company is trying to ensure that its own future payment technologies (currently in development) will meet government regulatory standards.

Strategic Partnerships: Nasdaq/Citi Blockchain, IBM LedgerConnect

In May 2017, Nasdaq and Citi announced a partnership to implement a “payment solution that enables straight-through payment processing and automates reconciliation by using a distributed ledger to record and transmit payment instructions”.

Yes, Citi transactions on Nasdaq’s blockchain only make up a small part of commercial transaction market volume. Still, this achievement marked a significant milestone for Citi’s real-world blockchain integration. Moreover, this move benefits both parties by making the transaction verification process faster and cheaper.

In July 2018, it was announced that Citigroup and Barclays would be participants in a trial run for LedgerConnect, a new IBM blockchain application. This app is designed to give banks one platform to deal with both AML/KYC compliance as well as loan collateral management.

Even though LedgerConnect is promising from a technological standpoint, banks like Citi must wait until at least early 2019 before using it. This is because an oversight committee that includes several central banks and the Federal Reserve Bank of New York must first approve it.

Citi’s decision to create its own blockchain solutions and collaborate with other companies that are working on similar technologies could lead to more widespread real-world implementation across a range of services.

[thrive_leads id=’5219′]

Conclusion

Citi blockchain, Citicoin, and other similar projects from established FinTech companies are important to think about. Many blockchain projects are attempting to disrupt Citi and other traditional financial institutions. As seen in several cases throughout the past, giant corporations in a variety of industries have declined due to a reluctance to embrace new business models and technological innovations.

That’s why Citi, as well as other established companies, should look to bolster innovation. Even though Citi has been slow to fully implement blockchain at scale, it has the capabilities to do so. It’s just a matter of properly utilizing its immense resources and building strategic partnerships to evolve with the market changes.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.