- Rising from the Dead

- Domestic News

- What's New at CoinCentral?

- Cryptocurrency News From Around the World

Rising from the Dead

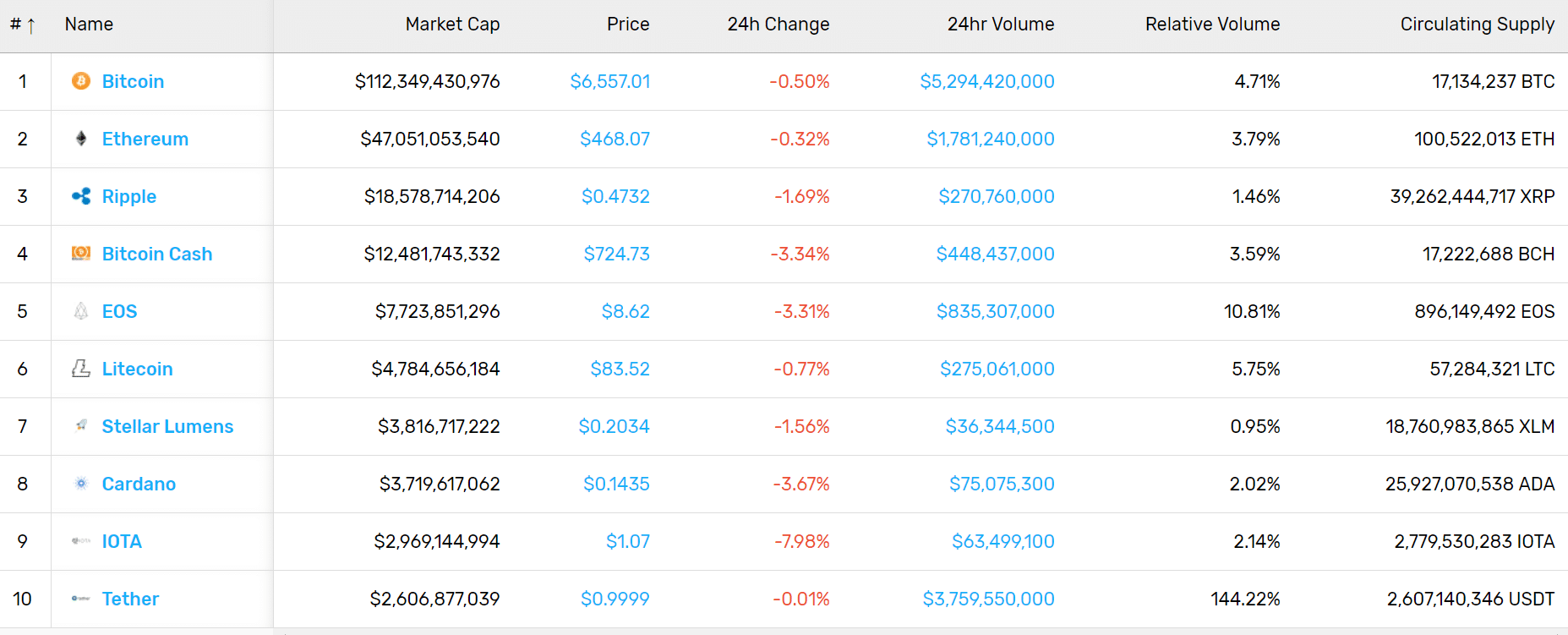

The market showed signs of recovery this week. For the first time in roughly a month, we saw positive price action, the overall market climbing 14% to a $267 bln market cap.

After breaking briefly below $6,000, Bitcoin held above a critical support level at $5,800 last Friday. Had it gone below this threshold, we would have been in for some red candles still. It held, though, and after bouncing off this point, crypto’s flagship went into a three-day upswing that took the rest of the market with it.

This is the third time this year that Bitcoin has accepted this support level, the other two junctures occurring in February and April. While there’s no guarantee that we’re out of the woods yet, this triple bottom has many convinced that we’ve found a floor around $6,000. Granted, people were saying the same thing about the double bottom that April gave us.

So nonetheless, while the positive price action is of great relief and sure to infuse some optimism into the market, trade cautiously.

Bitcoin: At $6,600, Bitcoin has gained 10% on the week.

Ethereum: At $471, Ethereum is fairing just a bit better, rising 12% this week.

Ripple: Ripple’s XRP is up 8% over the week with a current price of $0.47.

Domestic News

Coinbase Launches New Custody Service For Institutional Investors: This Monday, Coinbase Custody went live. The service offers cold storage cryptocurrency asset management for institutional investors and requires a minimum $10 million deposit and a $100,000 initiation fee to set up an account. “Today, we’re proud to announce that we’re officially open for business,” Sam McIngvale, Coinbase Custody’s product lead stated in the company’s announcement. “Over the coming weeks, we’ll continue on-boarding a set of world-class clients that includes leading crypto hedge funds, exchanges and ICO teams.” Shortly after launching, the service registered 10 clients.

IRS Joins International Coalition to Fight Crypto Tax Crimes: The United States IRS has leagued-up with tax agencies from Canada, Australia, the UK, and the Netherlands to police international tax crimes. Among other objectives, the Joint Chiefs of Global Tax Enforcement (J5) will “collaborate internationally to reduce the growing threat to tax administrations posed by cryptocurrencies and cybercrime.” Don Fort, the IRS’s Chief of Criminal Investigation, spoke to Forbes about J5’s significance: “We cannot continue to operate in the same ways we have in the past, siloing our information from the rest of the world while organized criminals and tax cheats manipulate the system and exploit vulnerabilities for their personal gain.”

SEC Examines Bitcoin ETF Proposal Amidst Plan to Lower Barrier of Entry for New ETFs: The United States SEC is mulling over changes to its Exchange Traded Fund (ETF) policies, some that could potentially make it easier for cryptocurrency ETFs to be approved. At the same time, the SEC has also reached out to the VanEck SolidX Bitcoin Trust for comment on its most recent ETF proposal. The newest proposal is VanEck’s third attempt in the last year to establish a Bitcoin-backed traditional investment asset.

SEC Charges Attorney, Law Firm Manager With Illegal Sale of Blockchain-Related Stock: Another busy week for the SEC. The agency has charged two men who it claims profited illegally from selling shares of a purportedly blockchain-related company. “According to the SEC’s complaint, attorney T.J. Jesky and his law firm’s business affairs manager, Mark F. DeStefano, made approximately $1.4 million by selling shares in UBI Blockchain Internet Ltd. over a 10-day period from Dec. 26, 2017 to Jan. 5, 2018. The sales stopped when the SEC temporarily suspended trading in UBI Blockchain stock earlier this year due to concerns about the accuracy of assertions in its SEC filings and unusual and unexplained market activity,” an official press release states. SEC Chief Robert A Cohen called the case “a prime example of why the SEC has warned retail investors to be cautious before buying stock in companies that suddenly claim to have a blockchain business.”

Blockstream Unveils Issued Assets, a Feature for Deploying Tokenized Assets: Delivering on its announcement at Consensus this year, Blockstream launched Issued Asset deployment for its Liquid platform this week. The feature is the latest in the blockchain technology company’s service offerings, and it will allow users to deploy Issued Assets (IA), blockchain-based tokens that can represent any asset, physical or digital. “Issued Assets (IA) allow Liquid users to create their own token asset on the Liquid sidechain. These assets can represent existing financial instruments like tokenized fiat, crypto assets, attested assets (e.g. gold coins), or completely new assets. Users transact privately with Confidential Assets which hide both the amount and asset type in a transaction from outside parties,” the press release states.

We are excited to introduce #IssuedAssets on Liquid! Users will be able to issue assets representing existing financial instruments such as tokenized fiat, #crypto assets, gold coins, & completely new assets all on a secure #Bitcoin-backed #sidechain. ⛓️ https://t.co/PkE1PnlGrK pic.twitter.com/lXSfJR64Mn

— Blockstream (@Blockstream) July 2, 2018

Ripple Hit With Another Class Action Lawsuit: Ripple is up to its throat in legal troubles, and this week, it only got worse. Adding to a succession of monthly lawsuits that began in May, the company is being served with its third class action of the year. Like those that came before it, the suit claims that XRP, Ripple’s currency, is an unregistered security and was sold as such. In addition, it claims that Brad Garlinghouse, Ripple’s CEO, and the rest of its team promoted and manipulated XRP’s circulation to fatten their wallets. “This is a securities class action on behalf of all California purchasers of Ripple tokens (“XRP”), brought against Ripple, XRP II, and the Chief Executive Officer (“CEO”) of the company, Bradley Garlinghouse (“Garlinghouse”), who promoted, sold and solicited the sale of XRP. Defendants raised hundreds of millions of dollars through the unregistered sales of XRP, including selling to retail investors, in violation of the law,” the suit reads.

What’s New at CoinCentral?

What Skills Are Needed for Cryptocurrency Jobs?: Think you got what it takes for a career in the blockchain industry?

Are ICOs Over-Promising and Under-Delivering?: A quick look at some of the more notorious ICO busts of the last year.

What is Delegated Proof of Stake? | Exploring the Consensus Algorithm: Want to learn more about how DPoS works? We got you.

Food Safety and Blockchain: Keeping You Safe One Bite at a Time: Blockchain technology could make grocery shopping and food services safer for consumers by providing them with transparent, verifiable origin and nutritional information.

10 Surprising Ways Companies Are Using Blockchain: Ever think of these use cases?

Margin Trading for Cryptocurrency Investors Explained: Common for legacy markets but relatively new to cryptocurrency markets, this form of trading is more complex than spot trading.

Lethal Blockchain: Militaries Look to Weaponize Blockchain Tech: So how are militaries leveraging blockchain? We’ll show you.

[thrive_leads id=’5219′]

Cryptocurrency News From Around the World

Indian Supreme Court Upholds Central Bank’s Crypto Ban: India’s Supreme Court voted to uphold the country’s Central Bank’s order that requires all domestic banks to bar their services from entities involved with trading cryptocurrencies. Decried by many as an unconstitutional edict, the order drew considerable backlash from the cryptocurrency community, sparking petitions from industry die-hards and casual adopters alike. The edict, issued on April 6, is scheduled to take effect today, July 6th, and it demands that all banks cut ties with individuals and exchanges who have established bank accounts for trading cryptocurrencies.

European Company Confirms Successful Use of IBM’s Blockchain to Settle Trades with Five Banks: The European blockchain trading platform we.trade oversaw its first live operations this week. Using IBM’s blockchain platform, which is based on Hyperledger, the company executed cross-border trades with the cooperation of 20 companies and 5 banks. In an official press release, the company states, “we.trade today confirmed that the first live trades have taken place on the platform. Over the last week several companies have executed trades, via 5 banks. These trades signify the first commercially viable open account trades harnessing blockchain technology.”

Huobi Launches Trading for Its Australian Platform: Huobi exchange, one of the world’s most popular cryptocurrency exchanges, officially launched its trading operations in Australia this Thursday. From the get-go, Australians will be able to trade Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Ethereum Classic, Power Ledger, and four other currencies directly for the Australian dollar. The exchange plans to add more pairs as the platform matures. “Crypto-traders in Australia are increasingly knowledgeable and sophisticated, matched by a receptive regulator with interest in safely developing the market,” CEO of Huobi Australia, Adrian Harrison, commented on the development. “For Huobi Group, the move to Australia is a natural fit…we are keen to partner with the growing numbers of Australian blockchain projects looking to list in a maturing market,” he continued.

#LTC/#AUD trading is now live at Huobi Australia!#huobiAU @BlockchainCTR @BlockchainAUS @BlockchainGL @Huobi_Pro @HuobiNews #cryptotrading #ltc #litecoin #crypto #cryptotrade pic.twitter.com/xp7xumgGe0

— HuobiAustralia (@HuobiAu) July 5, 2018

South Korea is Working on New Standards and Classifications for the Blockchain Industry: The South Korean government is busy at work on new classifications for the cryptocurrency sector. The National Statistical Office, the Ministry of Science and Technology, and the Ministry of Information and Communication are reportedly creating new legislative and regulatory standards for the burgeoning industry. As a bedrock for new policy, the classifications will work towards “blockchain promotion and regulatory frameworks.” With a final draft slated for the end of July, the policies will cover such industry-specific phenomena and entities as exchanges, blockchain transactions, DApp development and deployment, blockchain systems and services, etc.

Thai ICO Regulations Scheduled to Come Into Effect Mid-July: This Wednesday, Thailand’s SEC formally announced a roadmap for the implementation of its ICO regulations. The announcement indicates that the new framework will take effect starting July 16, and it includes a layered approval process that will require ICOs to be vetted by a “portal” before being sent to the SEC for final approval. In addition, ICOs will have to reveal their technical specifications and investment plans and have a minimum startup capital of 5 million baht (~$150,000) before applying.

Uzbekistan’s President Signs Blockchain Degree to Integrate Services into Government: The President of Uzbekistan, Shavkat Mirziyoyev, signed a decree this week that takes aim at the cryptocurrency and blockchain industry. Specifically, the decree lays out a three-year plan to establish a strategy to implement blockchain services into the government’s infrastructure. With the hopes of fostering a space conducive to “digital economics,” the Government Office for Project Management and the Ministry for Development of Information Technologies and Communications are tasked with forming a program that will research and develop the technology for formal integration with the government’s current infrastructure by January 1, 2021.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.