- This Week in Cryptocurrency – December 22nd, 2017

- What’s New at CoinCentral?

- More Cryptocurrency News From Around the World

This Week in Cryptocurrency – December 22nd, 2017

Bitcoin Cash Enters the Coinbase Ring. Bitcoin Takes a Hit: Coinbase spontaneously added Bitcoin Cash, the 8 MB fork & potential nemesis of Bitcoin, the news of which skyrocketed the price by over 50% and dropped Bitcoin by over $1800.

The Champ Takes a Bigger Breather: Bitcoin continued its slump from an explosive month, which was rapidly accelerated by Coinbase adding BCH. At the time of writing, Bitcoin is sitting around $13,200.00.

Ripple Continues to Go HAM: Last week, Ripple hit an ATH of $0.87 to the surprise of many holders who were used to Ripple hanging around the $0.30 range. This week, Ripple nearly touched $1.40.

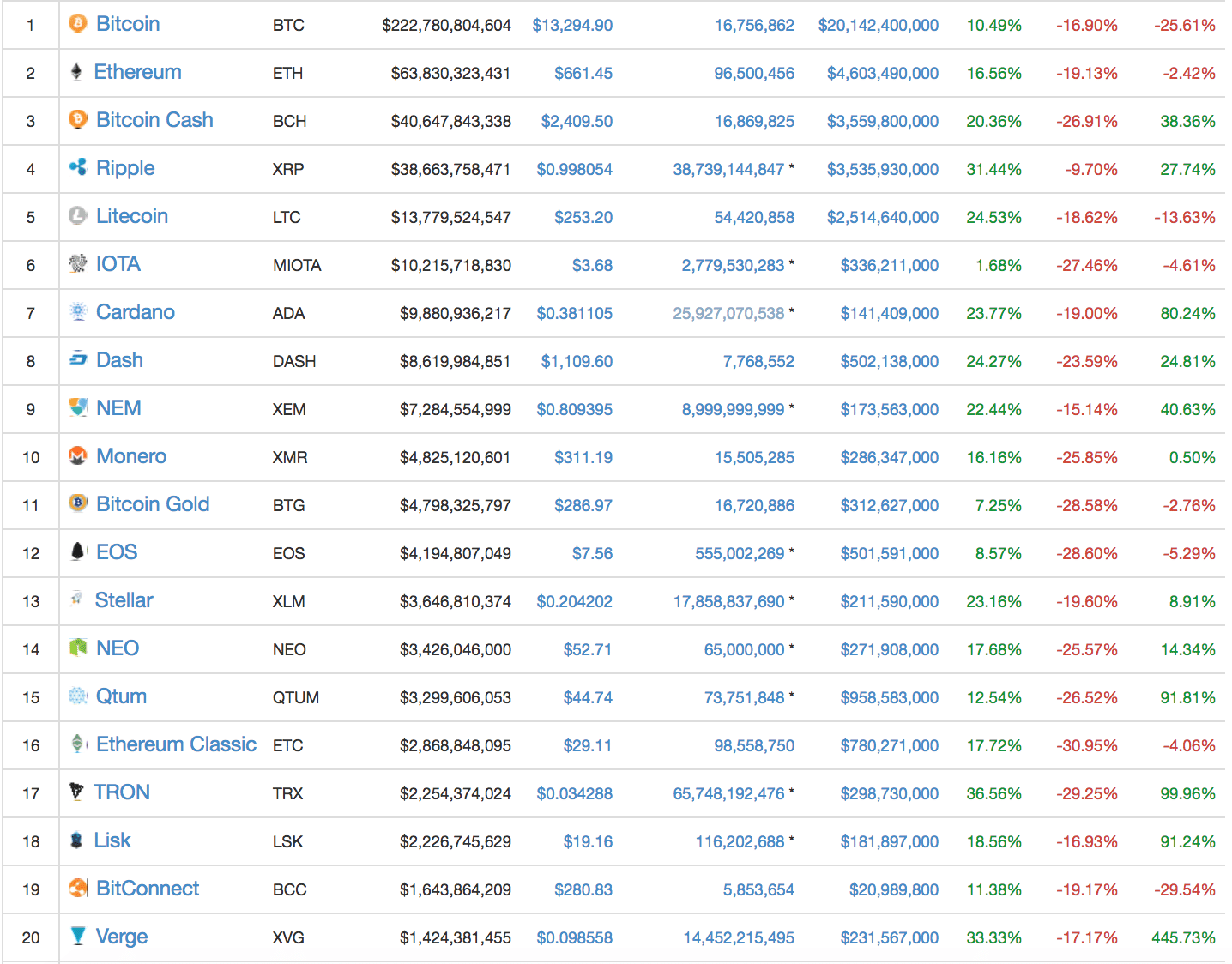

Christmas Came Early for Alts: Tokens such as Ripple (+62.30%), Cardano (+112%), NEM (+68%), QTUM (+192.74%), TRON (+150%), Lisk (+123%), Komodo (+200%), and Hshare (+90%) saw a huge spike in market cap and attention. Even Verge was able to make out with a humble +588% gain. All twenty top market cap tokens hit record highs this week. The rapid growth of the alt-coin market has started to attract more and more attention to the many blockchain-based projects being built.

….That was until Thursday when everything took a steep nose dive into the red. The much-anticipated market correction led to the majority of tokens taking a 20% – 40% hit in the span of just a few hours, with Bitcoin falling back down into the high $12,000s. Is the sky falling? Probably not. If you’ve been eyeing cryptocurrency markets for a while, you’re likely used to the occasional pullback.

Goldman Sachs to Establish Cryptocurrency Trading Desks: According to

Bloomberg, Michael DuVally of Goldman Sachs said in a statement “In response to clients interest in digital currencies, we are exploring how best to serve them”. If Goldman Sachs continues with the move, it will be the first major Wall Street Bank to create cryptocurrency markets. Let’s not forget our bi-monthly reminder JPMorgan CEO Jamie Dimon called anyone who buys Bitcoin “stupid.”

Fueled by Bitcoins Momentum, NYSE Files to List Bitcoin ETFs: The proposed rule change is under review by the U.S. Securities and Exchange Commission (SEC). If passed, the ruling would give way for investors to bet on Bitcoin’s success using a vehicle brand new to the cryptocurrency world.

Buzz Around Which Currencies Coinbase Will Add Next: Many speculators believe that any coin added to Coinbase is expected to surge in value. Seeing what happened to Bitcoin Cash, this isn’t an unfounded assumption. Rumors are leaning towards Ripple, Dash, and Iota, among others, creating hype around what the next cash cow in cryptocurrency will be.

Rumors Favor Ripple?: After a spectacular week for Ripple and passing its $1 Milestone, XRP exploded once again from around $0.65 on December 15th to an ATH of $1.22. The push was largely connected to circulating rumors that Coinbase will soon add the currency to its exchange. Many people in the cryptocurrency community have been speculating that Ripple very well might be the next coin to be added.

Coinbase Investigating Claims of Insider Trading:

Coinbase policies prohibit employees from discussing the potential addition of new currencies to the platform with anyone outside the organization. In a blog post by Coinbase CEO Brian Armstrong, “If we find evidence of any employee or contractor violating our policies — directly or indirectly — I will not hesitate to terminate the employee immediately and take appropriate legal action.” This post comes after the sharp price increase in BCH hours before the currency was added to the exchange.

What’s New at CoinCentral?

This week, we brought you a handful of new guides and resources about various new exciting projects. New cryptocurrency guides made this week:

- The Upcoming Bitcoin Forks: What You Need to Know– As more and more projects plan to fork from Bitcoin, it’s important to know what to expect.

- What is Tether– Learn more about this somewhat controversial dollar-pegged asset.

- BitConnect: Is It Legit or a Ponzi Scheme? -Is this investment platform too good to be true?

- What are Masternodes? An Introduction and Guide – Welcome to an integral component of many blockchain-based projects.

- What is Augur? – This decentralized prediction market platform could be a huge disruptor for a wide variety of industries and sectors of society.

If you’re interested in seeing some of the brightest minds in the cryptocurrency such as Tim Draper, Brad Garlinhhouse (CEO of Ripple), and Charlie Lee (Founder of Litecoin) speak, come join us at Blockchain Connect in San Francisco on January 26th, 2018. Oh, our readers can also snag 30% off with the code “coincentral”

[thrive_leads id=’3527′]

More Cryptocurrency News From Around the World

Litecoin Founder Sells All His Litecoin: Due to a “conflict of interest”, the Founder of Litecoin, Charlie Lee sold all his coins. Below is a statement he posted on Reddit to express the decision.

“Over the past year, I try to stay away from price related tweets, but it’s hard because price is such an important aspect of Litecoin growth. And whenever I tweet about Litecoin price or even just good or bads news, I get accused of doing it for personal benefit. Some people even think I short LTC! So in a sense, it is conflict of interest for me to hold LTC and tweet about it because I have so much influence. I have always refrained from buying/selling LTC before or after my major tweets, but this is something only I know. And there will always be a doubt on whether any of my actions were to further my own personal wealth above the success of Litecoin and crypto-currency in general.

For this reason, in the past days, I have sold and donated all my LTC. Litecoin has been very good for me financially, so I am well off enough that I no longer need to tie my financial success to Litecoin’s success. For the first time in 6+ years, I no longer own a single LTC that’s not stored in a physical Litecoin. (I do have a few of those as collectibles.) This is definitely a weird feeling, but also somehow refreshing. Don’t worry. I’m not quitting Litecoin. I will still spend all my time working on Litecoin. When Litecoin succeeds, I will still be rewarded in lots of different ways, just not directly via ownership of coins. I now believe this is the best way for me to continue to oversee Litecoin’s growth.

Please don’t ask me how many coins I sold or at what price. I can tell you that the amount of coins was a small percentage of GDAX’s daily volume and it did not crash the market.”

The Woeful Souls of Lost Bitcoin: Bitcoin wallets have complex passwords and security keys that prevent hackers from stealing Bitcoin. Some unfortunate early adopters of Bitcoin have forgotten their passwords and in desperation turning to hypnotists such as Jason Miller to help them remember. And then there’s James Howell, the man who would be worth $126 Million in Bitcoin today if his hardware wallet wasn’t buried in a landfill in Newport, Wales.

Nothing Like a Nice, Cold Sip of Blockchain: Formerly known as Long Island Iced Tea Corp. (LTA), the beverage company added “Blockchain” to its name. The stock nearly instantly increased up to 180%. To some, this is eerily reminiscent of the dot com era where any company could add a “.com” to its name and jump in price. While the company will remain in the drink industry, it claims it is going to build and purchase blockchain infrastructure to enter the financial services industry. Watch out world.

Estonia to Become First Country to Launch an ICO: Kaspar Korjus, managing director at e-residency, recently announced the creation of Estonia’s very own ‘estcoin’. The token will be issued to all members of its e-residency program.

EtherDelta Suspends Service Following Hack: EtherDelta users were in for a shock Wednesday when the popular cryptocurrency exchange platform was hacked. The hack tricked users into sending tokens to the hacker instead of the exchange. Roughly 308 ETH ($266,789), as well as a few hundred thousand dollars of other tokens, were stolen during the time of the digital attack.

[thrive_leads id=’3527′]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.