- This Week in Cryptocurrency – Weekly News Recap

- What’s New at CoinCentral?

- More Cryptocurrency News From Around the Web

This Week in Cryptocurrency – Weekly News Recap

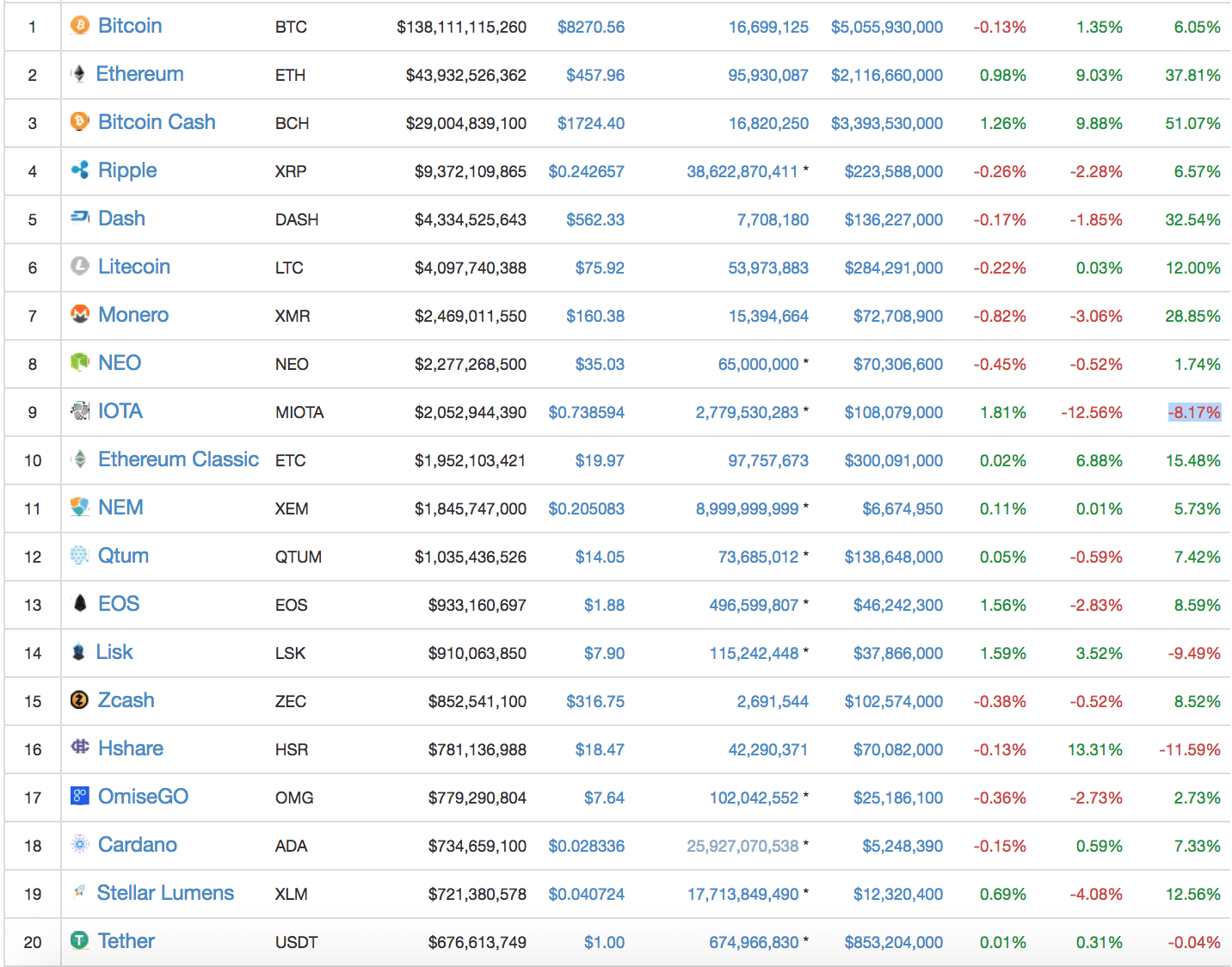

Prices Keep Climbing: A good majority of cryptocurrencies continued their price increases from the previous week.

While the previous narrative was that Bitcoin Cash was going to overtake Bitcoin, both have experienced some substantial growth this week. Bitcoin is nearing $8,300 and Bitcoin Cash experienced a 51.07% jump in price.

Ethereum also experienced quite a run near the end of the week with a 37.81% jump in price for the week.Of the top 10 coins, Bitcoin Cash (+51.07%), Ethereum (+37.81%), and Dash (+32.54%) saw the largest price jumps. IOTA (-8.17%) experienced a bit of a tumble from its huge increases in the week prior.

Trouble for Tether: Tether claimed to have been hacked for around $31 million on November 19th after $30,950,000 USDT was sent to an unauthorized digital wallet. If you’re not familiar, Tether is a startup that allows users to use digital tokens that are backed by fiat currencies such as the U.S. Dollar, Euro, and Yen. USDT is pegged to the US dollar and is supposedly fully backed by assets in Tether’s reserve account.

Predicting Trouble: The New York Times put out an article this week provided readers with words of caution when using unregulated exchanges, calling out Bitfinex as an exchange at a higher risk due to being an “opaque operation.” Coincidentally, Tether is also owned by the same people who own Bitfinex. Bitfinex claims to be the largest exchange in the world, and a similar successful attack on the exchange could wreak havoc for the crypto community.

Now You See Me, Now You Don’t: Confido, a startup that raised $374,000 USD from an ICO than ran from November 6th to 8th, suddenly disappeared with all the investment tokens. The startup pitched a solution for tracking shipments and making payments. A Confido representative posted on Reddit, “Look I have absolutely no idea what has happened here. The removal of all of our social media platforms and website has come as a complete surprise to me.” Was Confido a strategically executed scam? Is it genuinely missing and we might be seeing “Have You Seen Me?” posters on street corners? Only time will tell.

What’s New at CoinCentral?

Happy Thanksgiving everyone, we hope you had a blast explaining how Bitcoin works to your aunts, uncles, grandparents, and estranged cousins.

This week, the CoinCentral team put together some more interesting resources:

New cryptocurrency guides made this week:

- What is Ark? – Learn about what ARK is and what problems the team is looking to solve.

- What is Hshares? – A look into a token designed to allow value transfer among blockchains and between blockchains and blockless cryptocurrencies.

- What is Tangle – A beginners’ guide to what could be a revolutionary new structure (and what powers IOTA).

- A Beginner’s Guide to Ethereum Paper Wallets

[thrive_leads id=’3527′]

More Cryptocurrency News From Around the Web

New ATH for Bitcoin: Bitcoin hit another All-Time-High this week, hovering around $8,290 at the time of this update. The price has continued to nudge upwards, despite rapid growth from the seemingly antagonistic Bitcoin Cash. This has been a phenomenal year for Bitcoin, as it started 2017 at a mere $970, making the price gain year-to-date well above 700%.

JP Morgan Considers Dabbling in Bitcoin Futures: Despite its CEO’s vehemently anti-Bitcoin statements, JP Morgan Chase is considering providing access to the Chicago Mercantile Exchange’s (CME) futures trading through its own futures platform. As more and more financial institutions start to support the investment in Bitcoin and other cryptocurrencies, it seems JP Morgan will eventually be weighed down by CEO Jamie Dimon’s choice words about calling anyone who invests in Bitcoin “stupid”.

Team Long-Term HODL: Rick Falkvinge, Bitcoin Cash’s self proclaimed CEO, noted that if Bitcoin fulfils its promise (“and there’s no indication it wouldn’t”), then the equivalent of a single Bitcoin should be in the $2,000,000 to $5,000,000 range. This vision also comes with the corollary that it would no longer make sense to measure the worth of Bitcoin in USD or Euro since fiats would have collapsed under their own weight.

Team Short-Term HODL: Mike Novogratz, billionaire and long-term Bitcoin bull, predicts Bitcoin’s price will close out 2017 at around $10,000, and Ethereum’s price will be at around $500. “I think literally we end the year at $10,000 in Bitcoin. I think that is a decent move from here. I think we end the year at close to $500 in Ethereum.” Novogratz bought Bitcoin for $50 each in 2013, and scooped up Ether at the IPO for around $0.30 each. He also claims to have put 10% of his life savings in both Bitcoin and Ether.

[thrive_leads id=’3527′]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.