Turcoin, advertised as “the national cryptocurrency of Turkey” has been revealed as a multi-million-dollar Ponzi scheme as it collapsed in disgrace.

Some 12,000 individual investors are thought to have been affected. Many had sunk their life savings into the project, after Turcoin promised swift dividends and implied it had the backing of the Turkish government.

Local newspaper Posta reported that Turcoin’s parent company Hipper A.Ş. took 100 million Turkish lira ($20.6m) from investors.

The joint owners — Sadun Kaya and Muhammed Satıroğlu — ran Hipper A.Ş. out of the Turkish capital Istanbul and put the first Turcoin on sale in October 2017.

But by June 2018, the promised returns had failed to materialize and investors started to raise warning flags with the Turkish financial watchdog, the Capital Markets Board.

Investigators from the Kochaeli Public Prosecutor’s Office reportedly froze Kaya and Satıroğlu’s assets after uncovering the alleged fraud.

Both were arrested on June 19 and released on bail, but were re-arrested on July 2 and remanded in custody while awaiting trial.

Local newspaper The Hurriyet Daily News interviewed Satıroğlu, and he blamed his former business partner for the collapse of Turcoin. He said: “All the money went to Sadun Kaya’s company in Cyprus. I was only a mediator. Our company Hipper does not even have a single dollar in the bank.”

Satıroğlu then vowed to pay back investors’ money “if [the] authorities unblock my bank accounts.”

[thrive_leads id=’5219′]

How Turcoin Made Millions

Turcoin raised eyebrows across Turkey with a series of lavish promotional events, often attended by local celebrities, alongside repeat TV advertising. Early investors were promised outlandish luxury gifts, such as Mercedes and BMW cars.

The original adverts claimed that backers would make a 16 percent profit on their initial investment of 1,500 Turkish lira (TRY). When they had signed up enough other investors, they would receive a payment of 250 TRY.

It was a bold claim — and tempting — given Turkey’s severe financial woes. The average worker is paid just $455 dollars a month. Turkey’s government is also in a perpetual state of emergency after a failed military coup in June 2016.

President Recep Erdoğan was re-elected in June 2018 and immediately set about firing thousands of public sector workers. Over 160,000 people have been sacked since Erdoğan took charge.

Crypto in Turkey

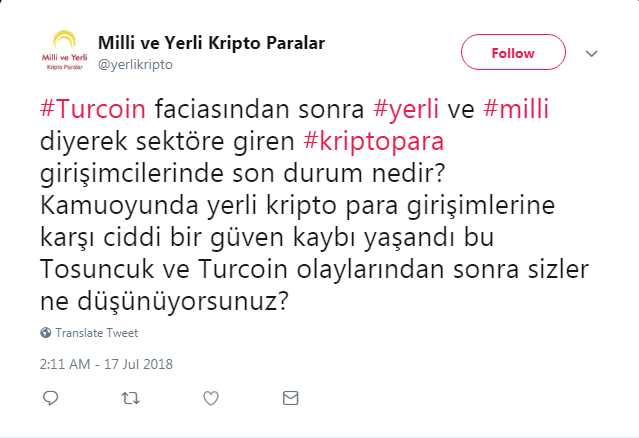

One local commenter wrote on Twitter that the experience had soured enthusiasm for cryptocurrency in the country: “In the public opinion, there is a serious loss of confidence in domestic crypto money ventures.”

The confusion in Turkey is perhaps not surprising, given that there has been repeated political interest in cryptocurrencies.

In February 2018, Turkey’s Nationalist Movement Party proposed a “national Bitcoin” in a 22-page paper on regulating cryptocurrencies.

The same month, the country’s deputy Prime Minister Mehmet Simse told CNN’s Turkish affiliate that the government was looking to release its own state-backed cryptocurrency.

Central banks and governments have repeatedly been forced to push back against rumours they have launched official cryptocurrencies.

It also happened in Hong Kong recently, when the country’s central bank, the Hong Kong Monetary Authority (HKMA) issued a strong denial that it had released a government-backed cryptocurrency “for investment by the general public.” It warned investors that “the HKMA has never launched and will not launch any such crypto product.”

And yet, muddying the water further is the fact that the same central banks and governments are investing heavily in the Blockchain technology that underpins cryptocurrencies.

The HKMA, for example, told Reuters on July 16 that it was linking up with seven banks, including Hang Seng and HSBC, to launch a Blockchain-based financial trading platform.

Of course, there is no route in to these official projects for individual investors. Institutional backers like hedge funds, pension funds and crypto-specific funds with huge amounts of capital behind them can all profit. Individuals with life savings? Not so much.

What Turcoin says

The case is ongoing, and while the company has pushed back against the mountain of cripplingly negative publicity, the Hipper A.Ş. Twitter account, @HipperIstanbul, is no longer available. Its website was replaced with a statement that reads: “Announcement: The proceedings have been suspended due to the ongoing legal process.”

A startling statement on the Turcoin website protests its innocence saying: “We have shared the data requested by the relevant authorities within the scope of the investigation and we have stopped accessing the wallet in order to prevent further processing.”

The statement goes on to accuse Turkish journalists of being corrupt or incompetent: “We remind you of the importance of not taking into account such frivolous news organizations in our country where the journalism profession is on its last legs.”

Turcoin is still claiming that it will be able to refund investors “once the investigation and subsequent judicial process is completed.”

Hipper A.Ş. is joint owned by Satıroğlu and Kaya with 49 percent and 51 percent shares respectively.

Image credit: Casal Partiu, CC BY-SA 2.0

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.