- Explaining Curve Finance

- The CRV Token & Ways to Earn Yield by Staking, Vote Locking, and Voting

- Curve’s Main Competitors

- Curve's Founding Team

- Final Thoughts: Ahead of the Curve

Curve Finance is a decentralized exchange (DEX) and liquidity protocol built on the Ethereum network. It’s often used to swap stablecoins with low fees and slippage, as well as a place to deposit cryptocurrencies into liquidity pools to earn trading fees.

Our Curve Finance guide will break down everything Curve Finance for you; we’ll walk through how Curve functions, what liquidity pools and AMMs are, how users make money with Curve, and how the platform compares to other decentralized exchanges.

However, it’s important to be clear that cryptocurrency is inherently risky, and DeFi products such as Curve are novel and experimental in nature. The technology is very interesting and can be disproportionately ruinous or lucrative– acknowledge the risks moving forward.

Explaining Curve Finance

Curve is a decentralized exchange that allows users to swap multiple stablecoins, that much we already know.

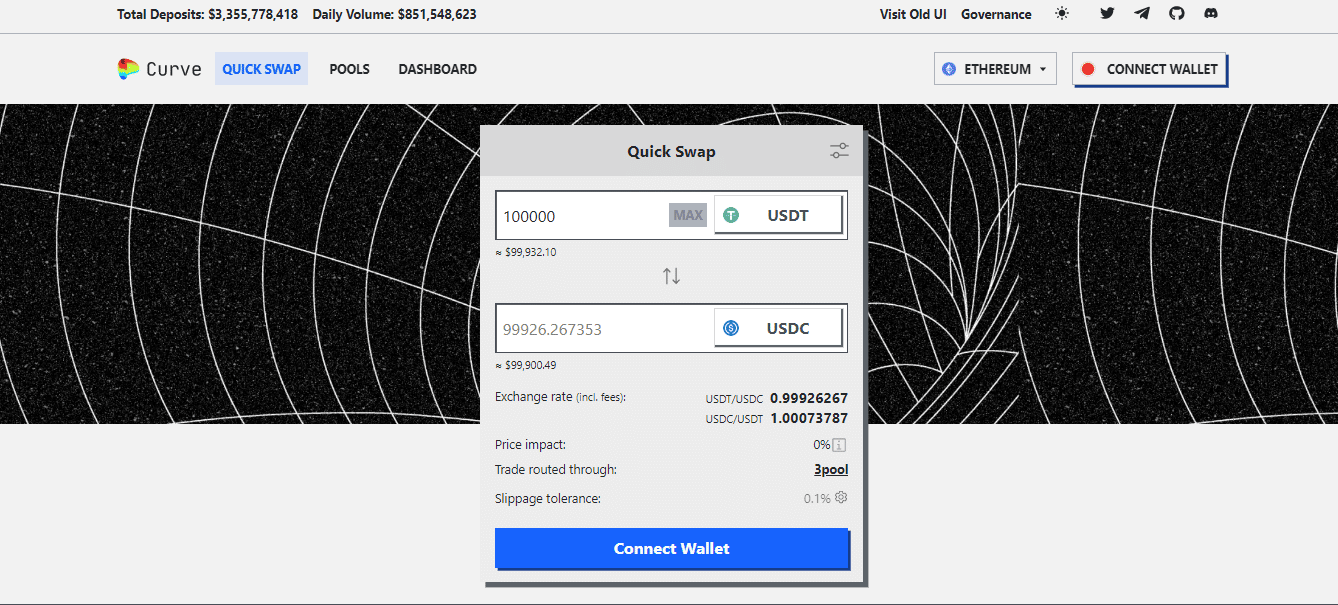

While two or more stablecoins should be in the same dollar range (1 USDC = 1 USDT), there’s always some level of slippage when swapping between two of them. The larger the quantity, the higher the slippage.

For example, if you want to trade 100,000 USDT for 100,000 USDC, you may only end up with 99,900 USDT due to slippage.

Curve uses the Curve Constant formula, similar to that of Uniswap’s, to minimize slippage and trading fees.

The other side of Curve is the liquidity protocol, and it’s better to understand what automated market makers (AMMs) are and how they work in decentralized exchanges:

- Curve relies on an AMM, which is a software mechanism that quotes prices between two different assets using a mathematical formula. In the case of Curve, it quotes prices between two stablecoins or wrapped versions of cryptocurrencies, like wrapped Bitcoin (wBTC) and wrapped Ethereum (wETH).

- AMMs are different from order books, which are typically used by centralized exchanges (CEX), in the sense that they rely on liquidity providers, which are the users, and other DEXs. Both users and DEXs deposit cryptocurrencies into one or multiple liquidity pools to reflect a balanced price between one or various assets.

- In contrast, a centralized exchange using the “order book” methodology will have a deep pool of assets in its custody if needed to provide liquidity for various trading pairs.

Liquidity providers are the backbone of decentralized exchanges; without them, a DEX would be illiquid and unable to fulfill trades at reasonable prices. Since a DEX doesn’t hold custody of its users’ assets, it must provide incentives for them to provide liquidity.

Yield farming is the act of providing liquidity —depositing funds— into a liquidity pool so other users can make trades with multiple assets. The protocol then pays a percentage of trading fees to liquidity providers as an incentive.

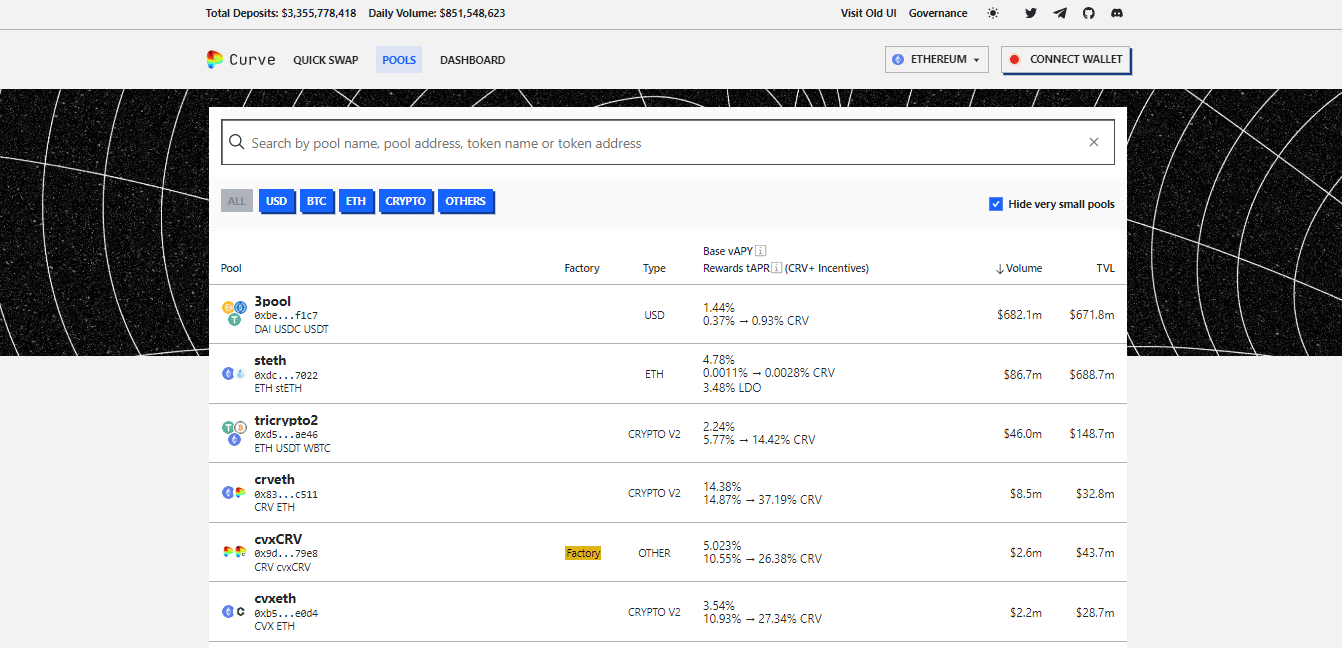

Like most liquidity protocols, the amount of fees ( the average is 0.04%) paid out to liquidity providers depends on trading volume; the higher the volume, the higher the fees, and therefore the higher the APY (Annual Percentage Yield).

Curve’s website looks like a simple Web1 interface from the late 90s, but it’s relatively easy to navigate once you get used to it.

To use Curve, you need to connect your cryptocurrency wallet, like MetaMask, Coinbase Wallet, or WalletConnect.

The first section we’ll see is Quick Swap , which allows you to swap over 100 assets including stablecoins and wrapped coins.

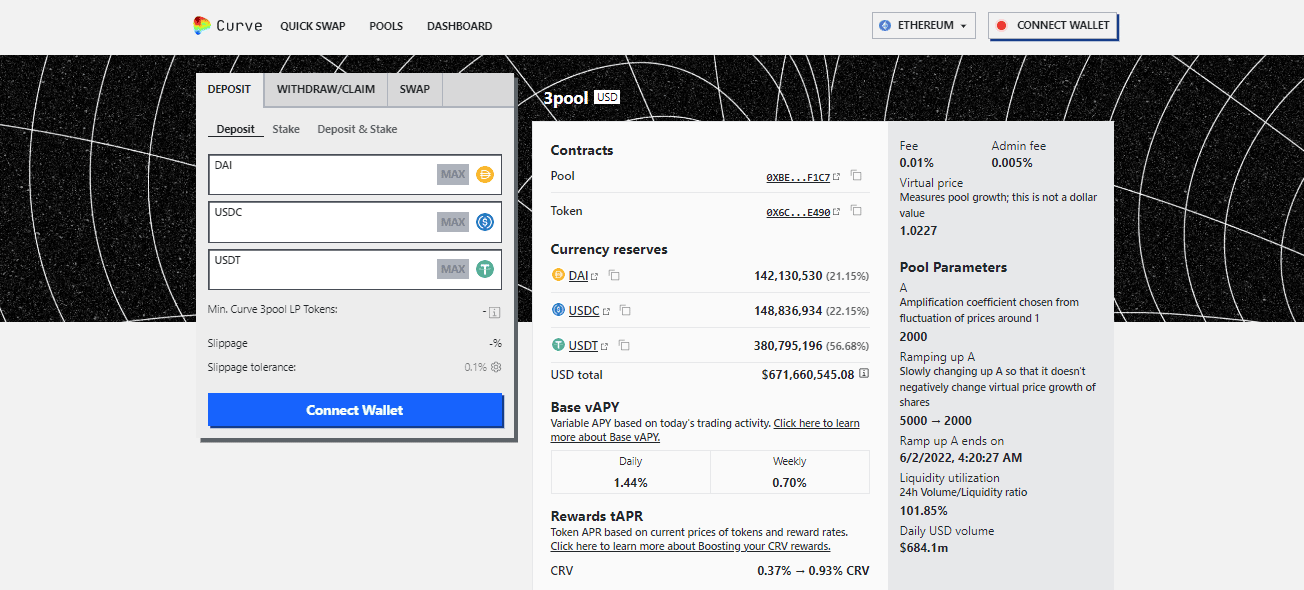

To inject liquidity to a pool, simply choose a pool from the list and click on Deposit. A deposit interface will appear with different coins to deposit. The protocol rewards you with a deposit bonus if you provide liquidity to the cryptocurrency with the lowest balance. In this example, DAI.

There are two ways of depositing: normal deposit, and stake & gauge, which stakes your tokens without lock-up periods, so you can unstake them whenever you wish to. This option allows you to earn CRV tokens as reward, but you still receive a portion of trading fees.

Curve vs. Balancer

Both Curve and Balancer work as decentralized exchanges and AMMs with rebalancing mechanisms. The main difference between the two is that Curve uses stablecoins and wrapped versions of Bitcoin and Ethereum.

When a user deposits a DAI to a USDT/DAI pool, then the pool becomes unbalanced since the DAI balance is bigger than USDT. The protocol then sells DAI at a slight discount in regards to USDT to balance the USDT to DAI ratio. In this example, volatility and impermanent loss are minimized since the protocol is working with stablecoins.

On the other hand, users deposit two or more cryptocurrencies into a Balancer liquidity pool wanting to maximize returns with the inherent risk of volatility. Balancer pools can be composed of up to eight cryptocurrencies, while Curve pools usually host three stablecoins.

The CRV Token & Ways to Earn Yield by Staking, Vote Locking, and Voting

CRV is an ERC-20 token that has three main uses:

- Staking: users lock up CRV to earn trading fees from the Curve protocol. The general APY is 4%

- Vote locking: locking up CRV for a specific period and receiving vote-escrowed CRV (veCRV), which are tokens that give users voting power and a boost of up to 2.5x on the liquidity they provide to Curve’s liquidity pools.

- Voting: The Curve DAO is where users vote on network parameter changes or submit their own proposals.

The CRV initial supply is 1.3 billion tokens, and the total supply is capped at 3.03 billion tokens.

The distribution of CRV is as follows:

- 30% to the development team and investors

- 60% to liquidity providers

- 5% to pre-CRV liquidity providers, 1-year vesting

- 5% to the community reserve

Curve’s Main Competitors

Balancer: a self-balancing asset management platform that works similarly to a traditional index fund but with decentralized features. Its pools are divided into public, private, and smart categories and can accommodate up to eight cryptocurrencies.

SushiSwap: a leading decentralized exchange built on the Ethereum network and a fork of a well-known DEX in the DeFi space, Uniswap.

PancakeSwap: a DEX built on top of the Binance Smart Chain (BSC), and supports other networks such as Ethereum and Aptos. It also integrates a marketplace where users can list, buy, sell and trade non-fungible tokens (NFTs)

Osmosis: a popular DEX and development platform built on the Cosmos blockchain, allowing users to transact cryptocurrencies through different blockchains and to build Web3 applications using SDK and other developer resources.

Curve’s Founding Team

Michael Egorov created Curve in January 2020. Before Curve, he created and led NuCypher and LoanCoin. However, details about the development team are scarce, so no one really knows in-depth who else worked on the creation of Curve.

Curve is one of the largest automated market makers (AMM) by market cap, sitting at the fourth spot with a market cap of over $510 million, according to CoinGecko.

Final Thoughts: Ahead of the Curve

Yield farming is a popular practice in the DeFi space, where liquidity providers look to put their tokens to work by depositing them into liquidity pools. But in DeFi, with great APY comes great risk, such as volatility, impermanent loss, price crashes, platform meltdown, and even hacks.

Therefore, since Curve favors stability over volatility, those who want to jump in on the crazy world of yield farming but have a lower appetite for risks can find Curve as a practical option to starting point.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.