- How Does Steem work?

- Steem Coin Supply and Sustainability

- Steem History:

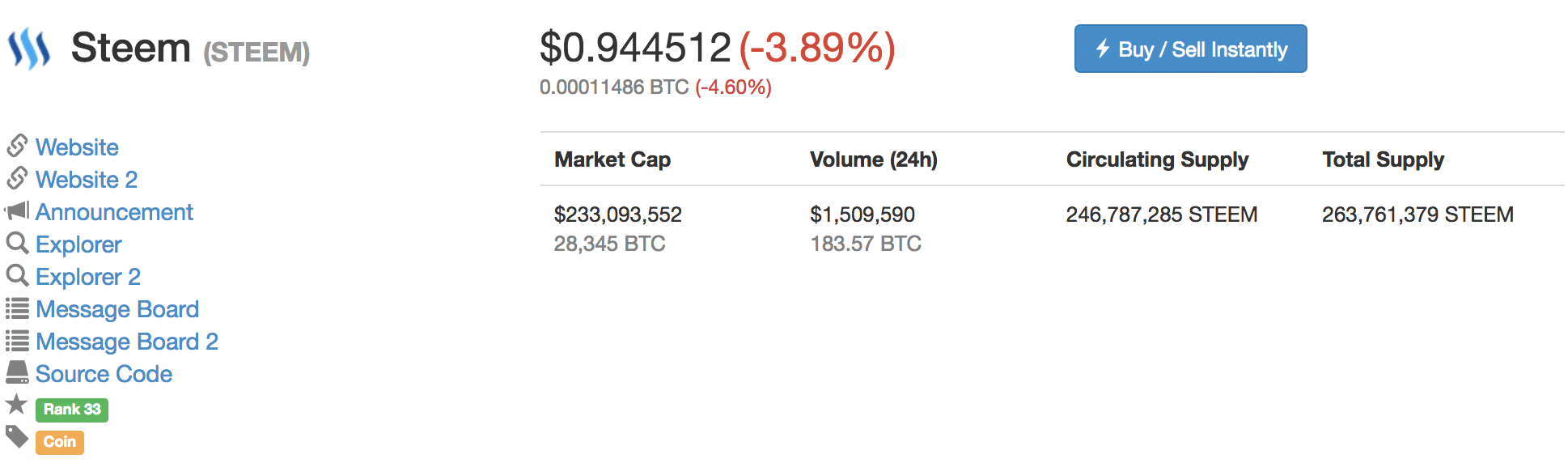

- Steem Trading History

- Where can you buy Steem?

- Steem vs. Micropayments

- Final Thoughts

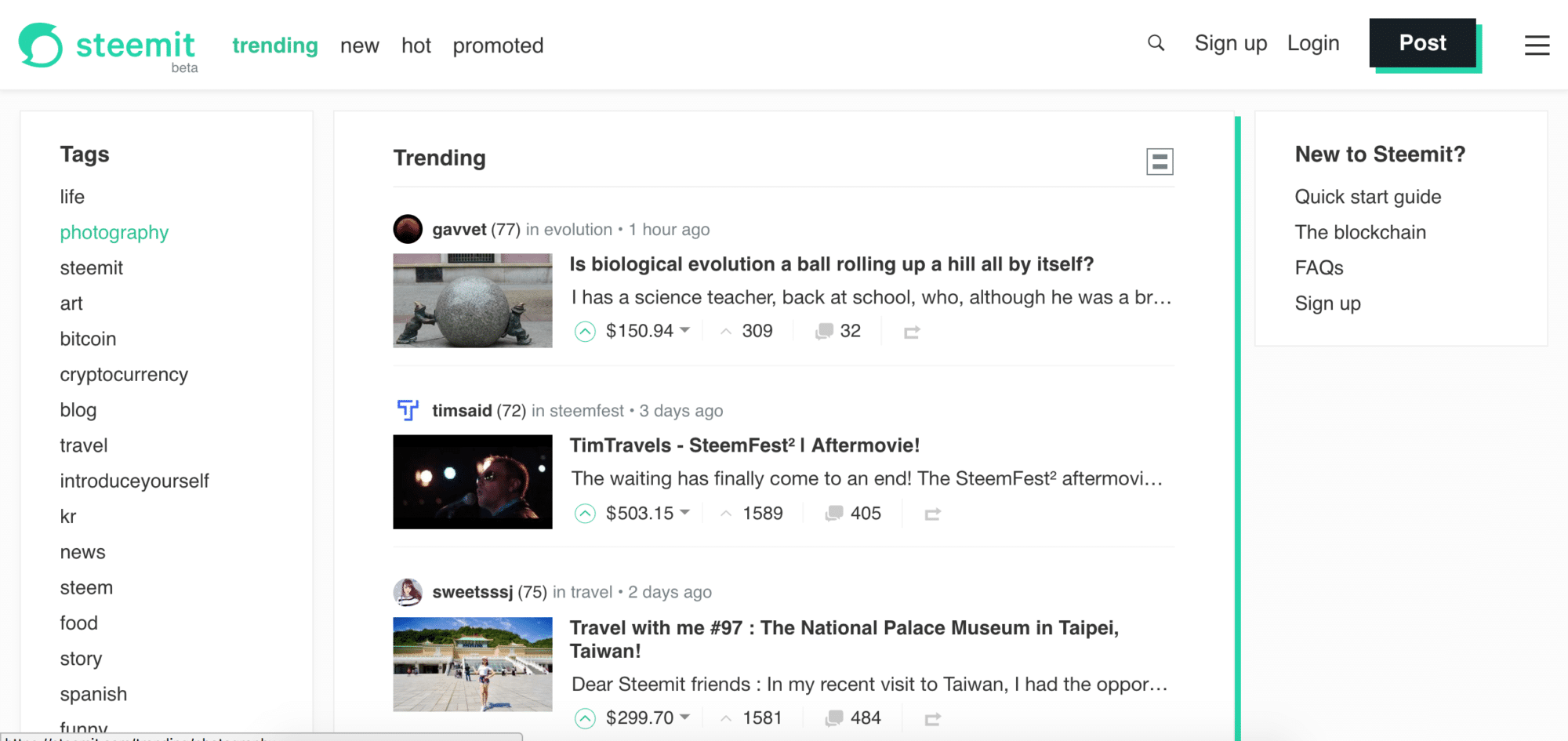

Steem is the name of the token that can be bought and sold on the open market, based on the blockchain-based platform Steemit.

Steemit is a platform that allows publishers to monetize their content that functions similarly to many other social content networks.

Think Reddit, but in a way that pays writers and content curators.

Steemit rewards writers when their content gets upvoted, and it also rewards people who help curate the best content by upvoting other people’s content.

Steem, one of the three currencies the Steem platform offers, is an integral part of this system.

How Does Steem work?

In order to really focus on Steem, we have to go over a bit about the Steemit platform.

Every day, the Steemit network creates new Steem units and distributes them to its users. The users can then exchange these units on the open market for Bitcoin, other cryptocurrencies, or fiat.

Steemit has really gathered some “steam” (excuse the bad pun) in the content and cryptocurrency community because it virtually allows anyone to write about interesting topics and start earning money.

Steemit is different from other cryptocurrencies like Bitcoin because it doesn’t solely rely on mining to generate new currency units. While you can technically mine Steem, the network creates new Steemit currency units and automatically distributes them to people who are writing on and engaging with the platform. The amount you get is correlated with the number of upvotes the content you write gets and the amount you engage with the site (upvoting and commenting).

Steemit solves a HUGE problem the content world is facing.

Outside of Steemit, the current content economy is broken.

Content creators work hard to make awesome content, but their only way to monetize is via advertising, affiliate marketing, leading readers into a funnel, or some other way of leveraging their content to get paid.

Since there’s no way to directly monetize their hard work, the best content creators often have to rely on things that could substantially impact the partisanship and direction of the content.

However, that’s just the start of it.

Not only are the current routes for monetization potentially credibility corrupting, but they’ve also become less and less effective. Content consumers have proven to show a strong distaste for paying for online content. The sheer amount of content available online mixed with a general avoidance of consuming content that requires a whitelisting or venturing past a paywall.

Digital advertising, for example, has been greatly minimized by the explosive rise of ad blocking. At the end of 2016, there were roughly $615 million devices around the world blocking ads, and the percentage of people blocking ads has been consistently growing.

This is something that affects both individual content creators, as well as large-scale media companies. Dozens of publications now ask you to “whitelist” them in order to read their content, and as you can imagine, is driving casual readers away in troops.

On the other end of the content exchange, the Steemit platform gives content consumers an incentive to naturally and organically engage with the content they read. People who upvote and help curate the best content on the site, as well as commenters who contribute to discussions, are all rewarded by the platform.

Steem Coin Supply and Sustainability

Steemit actually has three different kinds of currency units: Steem, Steem Power, and Steem Dollars.

Steem:

Steem is bought and sold on the open market the same way you would any other token. Holding Steem for long periods of time since the Steemit platform creates more every single day, and you run the risk of dilution. Steem currently erodes at a rate of 9.5% every year due to this production. Steem’s price, however, has generally gone up and some investors have been able to combat Steem’s orchestrated inflation and profit significantly.

Steem Power:

When you buy a Steem Power Unit, you can’t sell it for 13 weeks. What was originally a 2-year period, the is meant to prevent people from suddenly dumping all their units on the market and crashing the price. This is essentially a long-term investment in the platform, as holding Steem Power units entitles you to a proportionate ownership in the network. So, as the network grows (as it has been), so will the value of your piece of ownership.

Currently, around 15% of the new Steem that is generated every day is distributed to those people holding Steem Power Units as additional Steem Power Units. The remaining 85% goes to the content creators and curators.

Half of what content creators receive in their payout per post is in Steem Power Units.

The more Steem Power Units you have, the more your upvotes will count, helping users to build up more influence in the site. You will also receive a higher payout when upvoting someone else’s work, and when you upvote someone else’s content, they receive a higher payment as well.

Steem Dollars:

Steem Dollars is another type of Steemit currency and is meant to be stable. Steem dollars are pegged to the U.S. Dollar. When content creators make popular content, 50% of their pay per post is going to be in Steem Dollars (the rest being in Steem Power Units).

Steem Dollars are interesting because they give content creators three different choices:

- Convert Steem Dollars to Steem and sell it on the open market (cash out). This takes about 3.5 days.

- Hold the Steem Dollars and essentially earn 10% interest.

- Exchange Steem Dollars for Steem Power (long-term invest).

Steem Distribution and Supply:

The Steemit platform creates new tokens every single day.

- 15% of these new units are proportionately distributed to people who hold Steem Power.

- 85% of these new units are paid out to content creators, upvoters, and commenters.

Content creators that create content worthy of payment receive half their compensation in Steem Dollar Units, and the rest in Steem Power (locked up for 2 years).

Steem History:

Steemit was founded by Ned Scott and the CEO of BitShares, Dan Larimer in 2016.

The concept was introduced in a whitepaper in March 2016. It aimed to create a social content platform similar to Reddit, but where the text content and metadata was preserved in blockchain. The use of blockchain would also facilitate the creation of a system that rewards comments and posts.

Steemit also introduced a reputation system where accounts can receive notes that impact their reputation in an attempt to incentivize good online behavior (bye bye, trolls.)

Steemit was made to run on a decentralized network called Steem, where tokens could flow without friction between the platform and users. Steem accounts are made to be able to interact with the Steem database using simple user-chosen alphanumeric names (which are much easier than cryptographic hashes.)

Steem uses “proof-of-stake” to reach a consensus where accounts (called witnesses) are chosen by Steem stakeholders. According to the Steem whitepaper:

“75% of the new tokens that are generated go to fund the reward pool, which is split between authors and curators. 15% of the new tokens are awarded to holders of [Steem Power]. The remaining 10% pays for the witnesses to power the blockchain.”

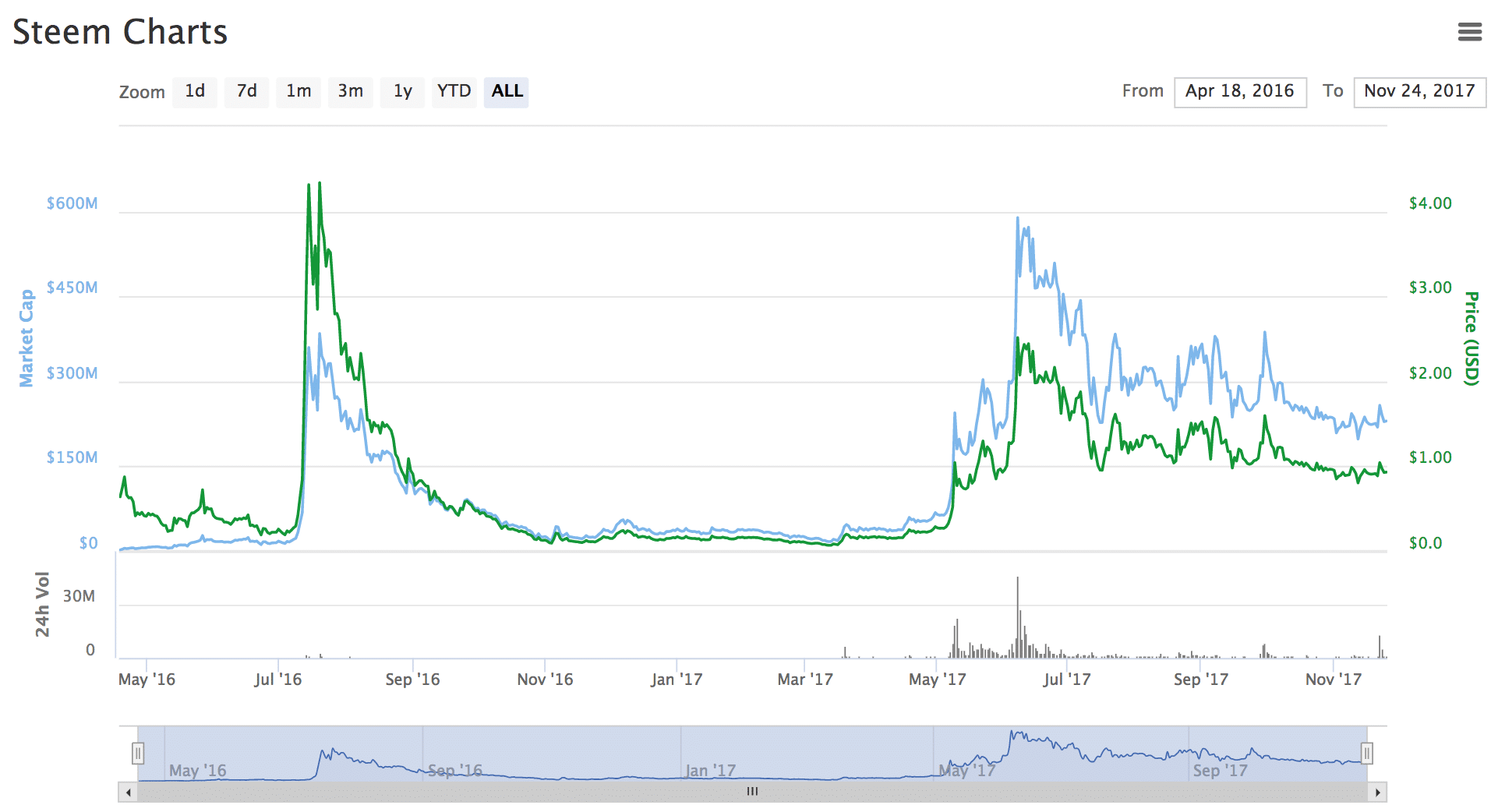

Steem Trading History

Steem is unlike the majority of other tokens on the market.

It’s amazingly functional for what it’s intended, and it is by no means intended for value storage.

The price of Steem will generally always go down. It’s intended to allow content creators and curators to cash out, and the Steemit platform creates new tokens every single day.

Granted, it doesn’t have to go down. If the Steemit platform keeps growing considerably, the price should go up. However, it’s worth noting the natural downward pressure from the increase in supply and “cash out” use case.

This is why Steemit has three different currency types (Steem, Steem Power, Steem Dollars).

Each is intended for a different purpose.

Where can you buy Steem?

If you’re interested in buying Steem, you can do so from one of many different outlets.

Perhaps the easiest way to buy some Steem is to utilize an exchange you already might be using. Bittrex seems to be the most popular way of buying and sell Steem, with roughly 73% of the total Steem/BTC volume. Poloniex is probably your next best bet. Using one of these exchanges will you to buy and sell Steem on the open marketplace, as well as store it in the respective wallet associated with that exchange.

You could also use a service such as Shapeshift.io to exchange different pairings for Steem, however, you would have to have a destination wallet to hold your purchase.

Steem vs. Micropayments

The use of micropayments is often brought up in any discussion about monetizing any type of content at scale.

Many people also erroneously refer to the Steemit platform as using micropayments to keep things running smoothly.

Steemit actually explicitly states in its whitepaper that it believes micropayments don’t work, referencing Clay Shirky’s article on micropayments (from December 19th, 2000, mind you):

“A transaction can’t be worth so much as to require a decision but worth so little that that decision is automatic. There is a certain amount of anxiety involved in any decision to buy, no matter how small, and it derives not from the interface used or the time required, but from the very act of deciding.

Micropayments, like all payments, require a comparison: “Is this much of X worth that much of Y?” There is a minimum mental transaction cost created by this fact that cannot be optimized away because the only transaction a user will be willing to approve with no thought will be one that costs them nothing, which is no transaction at all.”

– Clay Shirky

It’s interesting to note how Steemit went the route of eliminating the onus of compensation from the consumer and built it into the network.

So, where does the money come from?

The Steemit network runs by creating new currency units that are awarded to people who secure and participate in the network. These tokens can be sold on the market for fiat or other tokens.

This can also be viewed as a public company issuing new stock to raise money for working capital.

Another way to look at this is by viewing the issuance of new currency as a tax on people who use the network. The depreciation caused by the issuance of new Steem causes the currency to drop a little bit, while rewarding people who are active on the platform.

Ultimately, the price of Steem is largely dependent on supply and demand forces of an open market.

Final Thoughts

Steemit seems like an awesome self-sufficient ecosystem for content creators, curators, and people who secure the network.

It’s positioned in an industry that’s overly-ripe for change and presents a value proposition that is hard to compete against.

However, one of the main questions I wrestled with when dissecting the Steem currency was, “Why would anyone buy Steem if it’s constantly and consistently going to go down?”

There’s an almost guaranteed downward pressure of about 10% every year. Steem also just seems like the Steemit currency users use to “cash out” of the platform.

I found a couple of points against my original assumption.

For the downward pressure to substantially cripple the Steemit platform, we’d have to assume a state of significant stagnation. Steem has generally seen some pretty sizeable growth in 2017 alone, and it’s only been around for a little over a year and a half since its whitepaper introduction.

Steemit hasn’t even yet gotten to reap the benefits of any significant network effect from creators, curators, and influencers. Many articles on Steemit also haven’t had the chance to rank sufficiently high in search engines, limiting their total potential traffic.

Steemit has hardly skimmed the surface of its potential. The latest figure I found for the number of Steemit users put the average monthly users at 26,000. In comparison, Reddit has about 542 million monthly users.

Additionally, Steem Power Units are locked in for two years and provide users with some pretty incentivizing benefits. Not only do holders of Steem Power Units get compensated in dividends, but they also get a say in the future of a potentially rapidly growing site.

It’s important to note that this isn’t investment advice, and is merely meant to introduce you to a few points to help develop your understanding of where this token and platform could be headed in the future.

If you’re a writer or are simply looking for some new forums to peruse, check out the Steem community and platform. You’ll encounter some interesting personalities, some valuable ideas, and you might even earn some money on the way.

This article also serves as a good introduction, but there is much more to the technical aspects of Steem and Steemit than meets the eye.

I highly recommend checking out the whitepaper for more information (it’s one of the better ones out there).

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.