What is WAX? Virtual Goods Galore:

WAX, short for Worldwide Asset eXchange, is a global decentralized marketplace for video game virtual assets.

At first glance, the idea of a token-backed marketplace for the exchange of items and skins for your video game characters might seem lacking. However, the 400m+ gamers spending over $50B on virtual items worldwide is nothing to scoff at.

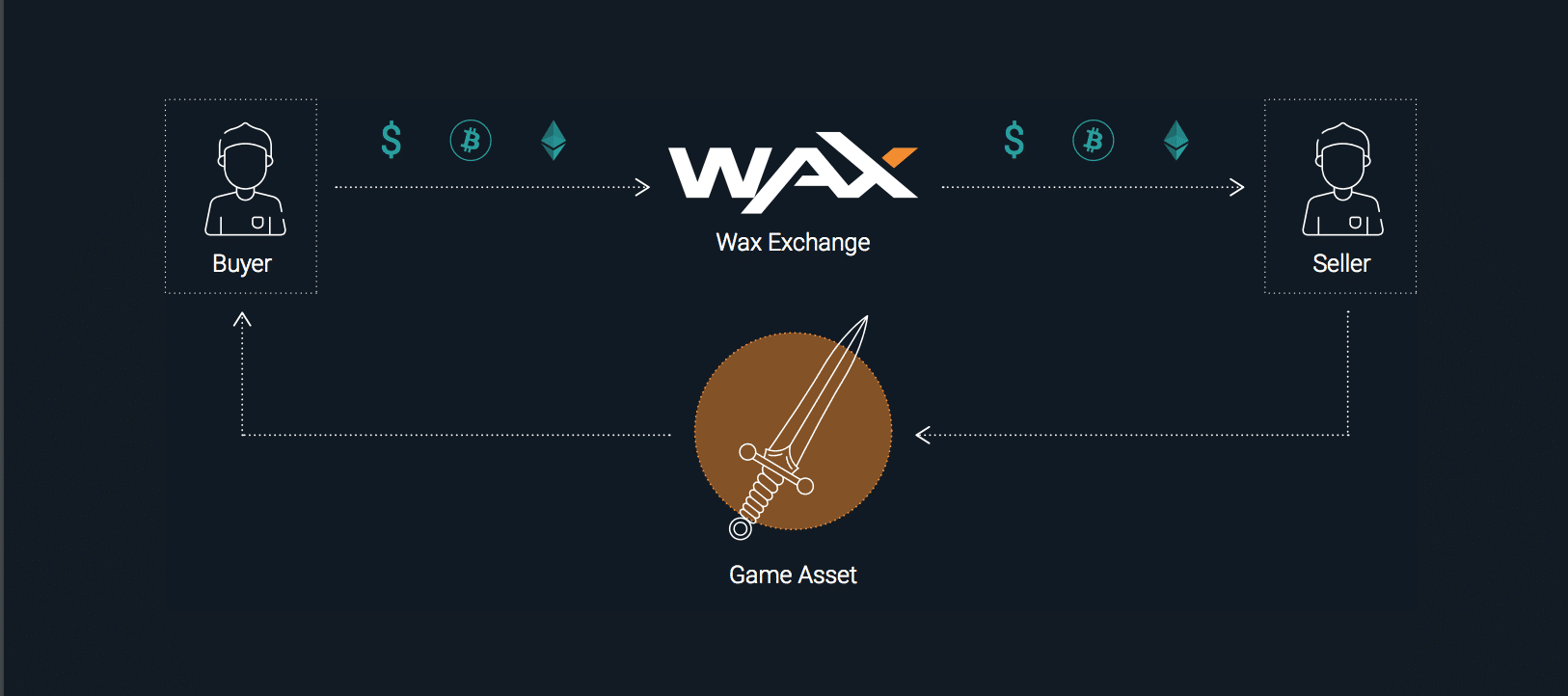

The Worldwide Asset eXchange aims to connect this loose global marketplace that is originally based on a high degree of trust and scattered user-forum communications by offering a smart contract-based peer-to-peer marketplace.

How Does WAX Token Work?

Essentially, 400 million gamers can access a global supply of virtual goods while avoiding the consignment-based marketplace model used today.

An exchange that either requires a high degree of trust between two users or within a “reputable” third party can now be done via the WAX platform in a simple smart contract.

WAX integrates the concept of a decentralized exchange with multi-party agents and settlement agents and is also asset agnostic.

WAX, the token native to the platform, is governed by a Delegated Proof of Stake (DPOS), the same one originally created by BitShares. The token generally serves as a platform utility medium. This means every item listed on the site has its value based in WAX.

WAX is also used to determine the number of vote allocations users get. Users are also charged small amounts of WAX for transactions and messages as a fee for using the network, similar to ETH Gas.

The WAX token is divisible to 17 decimal places and can be used for micro-settlements.

The DPOS consensus algorithm allows for high transaction throughputs. The main difference between DPOS and POS is that in DPOS, confirming nodes are elected by token holders who pledge votes to proposed delegates. These confirming nodes, called “Guilds” on the Wax platform, exist to ensure the platform and exchange of tokens is running smoothly. The WAX platform supports 64 Guilds, which are ranked by the number of votes they receive.

The WAX Platform also makes use of “Transfer Agents”, which are trusted users to accept and transfer virtual goods between users. What adds a degree to these Transfer agents over the traditional third-party escrow party is that the Transfer Agents have to put up a bond of WAX tokens. These Transfer Agents are rewarded a percentage of the fee in WAX tokens.

These Transfer Agents can also signal to the Guild that they want more additional settlement execution contracts when they are online. Transfer Agent roles include:

- Communicating with the buyers and sellers to arrange the pick-up and delivery of the items.

- Take control and verify the authenticity of the virtual asset.

- Digitally sign the Settlement Execution Contract that they have received the virtual asset, and sign again once it has been delivered.

- Deliver the assets.

The WAX Token Team

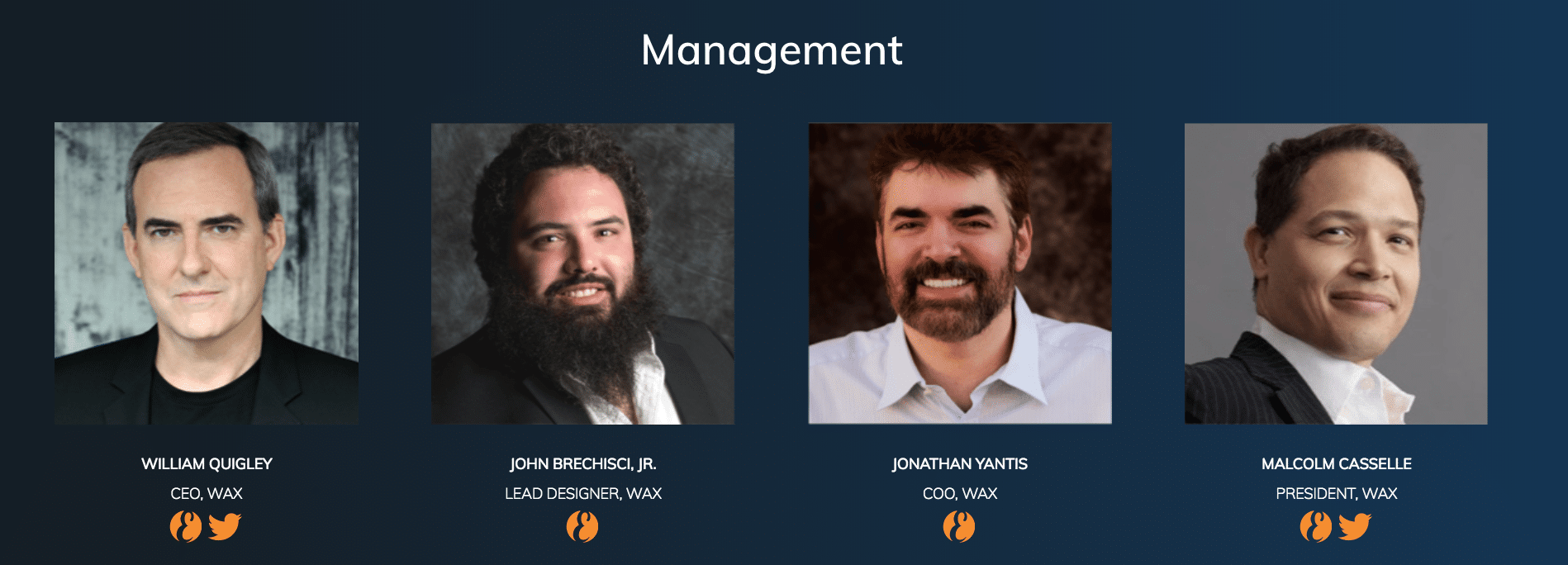

WAX was developed by the same team behind OPSkins, the largest virtual asset marketplace, which has been growing at around 200,000 new users every month.

WAX Token History

WAX carried out their ICO at the end of 2017 and sold 64,750,000 WAX. All contributors received 10x the amount of tokens they purchased, a move by the WAX team to make micropayments easier in the future.

WAX started trading at $4.60 when it hit markets on December 21st, 2017 and almost immediately hit a nosedive down to below $1.00.

Where to Buy WAX

WAX token trading popularity is fairly evenly distributed between Houbi, Bibox, Bittrex, and Upbit.

Final Thoughts

While the WAX token does serve a much-needed utility to a fairly large and active niche, its trading drop off after hitting exchanges is something that can be seen as concerning some.

WAX’s application of DPOS into Guilds and the use of Transfer Agents will be an interesting case study in how a smart contract-based utility token functions in correspondence with human escrow parties.

To learn more, check out the WAX whitepaper.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.