- How The Winkdex Works

- The Winkdex

- Winkdex App

- Winkdex Widget

- Ethereum Support

- The Winklevoss Twins

- SEC Rejections

- Winklevoss Twins Get Green Light

- The Winkdex Continues to Expand

Tyler and Cameron Winklevoss are known for their many crypto exploits. In 2014, Winklevoss Capital, the investment firm created by these twins, launched Winkdex. The goal was to create a Bitcoin price monitoring tool that was more accurate than the options available at that time. Today, the Winkdex price monitoring platform sees use by numerous financial institutions, including Bloomberg, when determining the real price of Bitcoin.

How The Winkdex Works

The Winkdex price index tool pulls data from multiple exchanges, including Bitfinex, BTCE, CampBX, and LocalBTC. The data collected is then put into proprietary mathematical formulas. These formulas take into account a wide range of factors to determine the true weighted value of Bitcoin.

The Winkdex employs a five-step process to ensure the prices provided are of the highest accuracy. The first step is to gather trade data from all the participating exchanges. The information is then timestamped and placed into a grid. The grid includes the source, time, price, quantity, and quantity as a percentage of total trade volume. Additionally, the mathematical protocol looks for erroneous data points and rejects them from the equation.

Process Data

The next step in the Winkdex equation is to sort the trades based on price from lowest to highest. This step is a critical component in the equation because it allows the platform to disregard the most unstable data. Both low and high percentile trades can create irregularities in the mathematical formula used.

Identify Trades

The third step in the Winkdex blended Bitcoin price index is to identify trades with prices within the cutoff threshold. This action requires eliminating exchange data prices collected under the top 95 percent in the equation. In this step, the top and bottom five percent of all trades get excluded from the calculations. By eliminating the top and bottom volume trades, Winkdex can create a more stable price calculation.

The fourth step of the Winkdex blended Bitcoin price index formula involves the removed top and bottom percentiles. When these removed data points don’t add up to exactly 5 percent, the Winkdex will split the data to achieve the desired fifth percentile required by the protocol.

The data collected by the Winkdex is then re-sorted and placed into a table that shows the weights of the trades. The weight of a trade is a calculation that takes into account the proportional relevance of a trade. This data will include any split trade information in the previous steps. The data gets calculated by taking the sum of volumes and dividing them by the sum of quantities.

The Winkdex

The New York-based Winkdex entered the market in October 2014 under a wave of media coverage. Since its inception, the Winkdex platform has emerged as one of the most accurate Bitcoin price indexes available to crypto investors.

Winkdex App

The crypto duo decided it was a wise decision to expand their platform into the mobile sector after recognizing the need for a more user-friendly approach. This desire prompted the launch of the Winkdex iOS and Android apps. You can utilize the platform directly from your iPhone or Android smart device.

The crypto community is uniquely mobile in their investment monitoring strategy. Many in the crypto space see mobile integration as a crucial step towards large-scale cryptocurrency adoption. By catering to these individuals, the Winkdex has been able to capture a significant portion of the market share.

Winkdex Widget

In 2015, the Winkdex platform became available in widget form as well. Widgets allow you to quickly monitor the price index without the added step of opening an app. Installing widgets is easy and the widget is a popular alternative to downloading the entire Winkdex app.

Ethereum Support

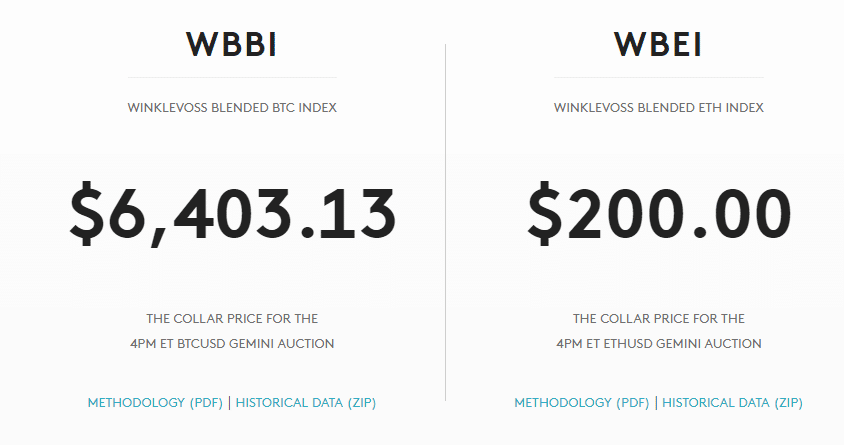

The Winkdex also supports similar functionality for Ethereum (ETH). Ethereum has long been one of the top cryptocurrencies in terms of market capitalization globally. The mathematical equation used to calculate Bitcoin’s price is the same when determining Ethereum.

[thrive_leads id=’5219′]

The Winklevoss Twins

The Winklevoss twins are no strangers to the crypto spotlight. The dynamic duo has been a significant voice in the crypto space for years. The pair initially received massive media coverage after suing Facebook. The brothers alleged Facebook had stolen their concept from the brother’s ConnectU platform. After a lengthy trial, the twins received $65 million in damages.

It was this $65 million dollar lawsuit victory which ultimately gave the twins the funding to invest in Bitcoin. The brothers used $11 million of these funds to purchase Bitcoin in April 2007, when the price of Bitcoin was around $120 per Bitcoin.

Tyler and Cameron have also made a name for themselves within the crypto community as venture capitalists. One of the twins’ most publicized investments was BitInstant. This NY-based crypto exchange entered the market in 2011 and operated until 2014. The project’s developers included Charlie Shrem and Gareth Nelson.

The Winklevoss twins made headlines again in 2008 when they competed in the Beijing Olympics. In 2017, reports surfaced that the twins were among the first Bitcoin billionaires. At the time the brothers boasted that they owned over one percent of the total bitcoins in circulation.

SEC Rejections

The Winklevoss twins have had their share of run-ins with the SEC along their crypto journey. In July of this year, the brothers received their second SEC rejection regarding the launch of an ETF Bitcoin fund. The brothers named it the Gemini Fund after their highly successful crypto exchange. The SEC stated in their rejection that a “substantial majority of Bitcoin trading occurs on unregulated venues.”

Winklevoss Twins Get Green Light

This month, the Gemini crypto exchange received approval to add Litecoin to the platform. The platform boasts full SEC compliance, and coincidentally, utilizes the Winkdex pricing.

The Winkdex Continues to Expand

The Winklevoss twins are significant players in the crypto community. Their influence and ingenuity remain felt throughout the crypto space. These brothers continue to push for increased Bitcoin adoption, and many in the space see their participation as critical in getting Bitcoin ETFs licensed.

Hopefully, in the coming months, these two creative minds will be able to convince the SEC of the benefits of allowing Bitcoin ETFs to operate. For now, the crypto community is watching their moves closely to determine what’s next.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.