Charlie Shrem founded BitInstant in early 2011, a now-defunct platform for exchanging dollars into bitcoin. BitInstant operated until 2013 and amassed over 700,000 locations, attracting investments from prominent cryptocurrency figures like Roger Ver ($125,000) and a group of investors led by Winklevoss Capital Management ($1.5 million). Prior to its shut-down, BitInstant was processing nearly 30% of all bitcoin transactions.

In December 2014, Shrem was sentenced to two years in prison for indirectly sending $1 million in bitcoin the Internet black-market platform Silk Road. Shrem is largely considered a Bitcoin pioneer for his role in bringing Bitcoin to the mainstream. In an era rampant with unqualified blockchain “consultants”, Shrem is the real deal and is widely regarded for his insights in the space.

Shrem is also the Founder of the Bitcoin Foundation and the Chief Visionary Officer at Crypto.IQ.

We got a chance to connect with Shrem and tap into his wisdom into the cryptocurrency world of 2018, stablecoin mania, and the difficult challenge of true decentralization.

Could you give us a two-minute movie trailer of your life? How did you end up involved in Bitcoin?

I got involved in Bitcoin in early 2011. It was just the right place at the right time reading about bitcoin in an IRC chat room and that’s how I got involved. There was no real way to buy or sell bitcoin back in those days. There was almost no way at all until I started a company, BitInstant, and we became one of the largest companies in the space. One of the first ones to make it easier for people to buy and sell bitcoin.

How involved are you with the Morpheus network?

I’m pretty involved with them, actually. It’s one of the projects that I’ve been spending a lot of time and resources on and talking to the team. I’ve talked to the team at least once every few days. I spoke to them yesterday, keeping them on top of the project, helping them out, giving them advice, things like that. I like to project a lot.

What’s your stance on Ethereum Classic versus Ethereum? The whole debate after the DAO hack?

It’s really simple. Ethereum has a lot more market share, so, therefore, it’s a stronger chain. It’s more immutable than it was when the DAO happened. Ethereum is still in its nascent early days when the DAO happened, so a lot of the miners were able to remove its immutability and to roll back the chain and that’s where Ethereum Classic came from. I’m a big fan of immutability and the fact that Ethereum is not anymore is one thing, but on the other side, Ethereum is a stronger and more secure chain than Ethereum Classic is because it has a lot more market share. It’s kind of like a give and take.

No crypto is fully decentralized. A lot of cryptos are on the path to decentralization, Bitcoin being the farthest down that path. Some cryptos like Ripples’ say, “Fuck the path. We don’t even want to be decentralized” without actually saying that. It’s like achieving enlightenment in Buddhism. You never actually achieve it. You just always are on the path to achieving it, the journey.

Did you hear about the decentralized exchange that is now starting to block New York IP addresses?

IDAX and IDEX and Forkdelta, they’re all forks of EtherDelta essentially, just nicer looking. I understand why, and I don’t blame them. It’s hard.

It’s tough because when you market yourself as decentralized, you try and capture this allure of “no one can shut us down”, but then if you’re able to bend to the whim of whoever, it chips away at that core value proposition of being decentralized. Which cryptocurrencies do you believe are furthest on the scale towards decentralization or have the best projection to get there?

Bitcoin, obviously. There’s Litecoin, which was the original fork of Bitcoin. Monero is definitely on that list. Other than that, Cardano is definitely on that list I have, I make fun of and have my problems with EOS, but they’re in their early days and are figuring out what it is. That delegated proof of state model, if it has good distribution from the start, it’s definitely on the path to decentralization. Stellar is definitely on that path.

The rest of them either build on top of Ethereum or are doing these wacky different governance experimental ideas that won’t really work in the long term. Some of them are outright not, like OMG and NEO. I have a very hot and cold relationship with DASH. One day, I like it. One day, I don’t, so I’m not really sure. I like Steem a lot. I’m just going through the list of and naming the ones I like.

A lot of these projects, it’s tough for them to get exposure out of the couple thousand different tokens that exist now.

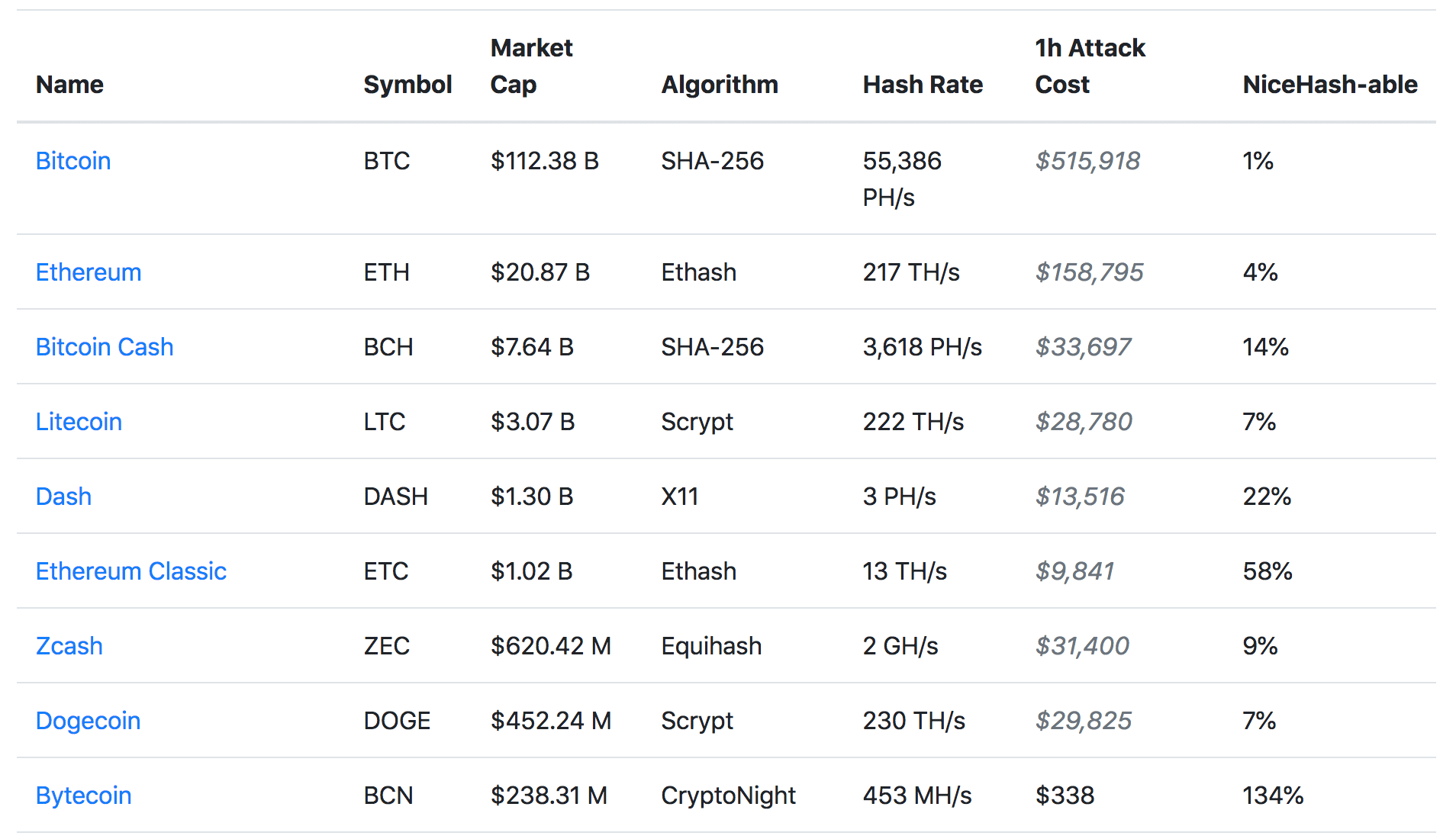

There’s a great website that shows how much it will cost to take over a chain, and most of these chains, it’s really cheap. It’s crypto51.app.

Let’s do a thought experiment. How do you think the world would react to a $1,000,000 bitcoin and how will they react to a $100 bitcoin if the price would hit that mark in let’s say a year?

A $100 bitcoin? A lot of people who say that they’re going to buy it won’t actually buy it. It will be an interesting world. Bitcoin and cryptocurrency still are very much an experiment. People forget that it’s an experiment. An experiment is anything where we’re learning as we go. Something that’s not been done before, we’re the first ones to do it.

If you look at the definition of “experiment”: experiment is a scientific procedure undertaken to make a discovery, test the hypothesis, or demonstrate a known fact. That’s what Bitcoin is. We’re undertaking a procedure to make a discovery or test a hypothesis. Experiments fail, they go away, and we have to be very careful with that stuff. The other side of the experiment continues to succeed and does really well, then you’ll see a million-dollar bitcoin, and everyone will be really happy.

A common Bitcoin maximalists’ sentiment is that if Lightning Network and other scalability attempts proved to be effective, the vast majority of altcoin use cases would be wiped out. Is this a realistic possibility?

Absolutely not because that implies that cryptocurrency is just science and technology-based. That’s maybe like 50% of it, but the other 50% of it is socioeconomics. It’s human behavior, how we act and react towards various things in the crypto community. That’s how it works. There’s a reason people still use Litecoin. There’s a reason people still use all these other things because a lot of people have appeal to these other cryptos. People like them.

We feel certain connections to certain cryptos, the people, the developers. There are so many facts that go into place. Lightning is a monopoly. Lightning comes in and will definitely take a huge market share and further a lot of developments going forward. So, I can’t wait for that to really get to get there.

What do you think about cryptocurrencies that are getting promoted as decentralized when they’re actually closer to being completely centralized, either in the form of the founding team has the majority of the tokens…

That’s a big problem. A lot of cryptos are getting more centralized. This whole stablecoin thing is just centralization wrapped up in a nice present. You have to be careful with that stuff. Stablecoins, the only stable coin that’s really decentralized is Bitcoin. and then you’re looking at like Maker DAI. Other than that, Coinbase, Paxos, Circle, Gemini Dollar. All their stablecoins, it’s all just centralized money that’s dressed up on an Ethereum blockchain.

You recently posted a video on Twitter about stablecoins where you talked about how every cryptocurrency is somewhere on a scale between full decentralized to centralized. Could you elaborate a little bit further on the stablecoin aspect of it that you just went over?

Every stablecoin, except for Maker DAI that I know of, they all rely on the legal system to maintain the crypto token peg. That inserts an unreliable middleman into the blockchain. You’re relying on the legal system, you’re relying on that counterparty. I’m a good example. I can’t pass compliance at Coinbase or Circle or Gemini, for that matter. Tether means nothing to me. Circle, you can give me all these Circle dollars, it doesn’t mean shit. I can’t use it. I can’t redeem it, I can’t spend it, I can’t do anything. It’s not fungible because I can’t pass compliance.

That’s a really good point and it’s difficult. How do you see the stablecoin landscape evolving? I think it would be Tether that owns the majority of the market share, at least in people’s minds that are trading. How do you think the future will look like when there are 10 to 15 stablecoins that are considered about equal?

They’re definitely taking market share from Tether. We’ll see how they work out. I think people are working on more decentralized stablecoins now, which are better, that are pegged with other assets. They are backed by collateralized assets that don’t rely on like a middleman.

What about if there’s a decentralized stablecoin that stays true to its value based on whatever asset that is always relatively stable, would that make a better use case for digital money then, let’s say, Bitcoin?

No. What you could do is create a stablecoin that’s backed by a certain amount of bitcoin. That will be really cool. That’s what Maker DAI is. The DAI is worth $1 because each DAI has its own smart contract and in that smart contract is enough Ether to be worth 150% of whatever the asset is. If you have $100 worth of DAI, it’s $150 worth of Ether in there.

How does this bear market compare to bear markets of the past? Specifically, the one starting in 2014. What are some differences then between 2014 and 2018?

In 2014 or 2015, the question was will Bitcoin survive? I don’t think that’s really a question anymore. Back then, that was a fear that this whole thing won’t survive. Otherwise, it’s pretty much the same.

How do you think cryptocurrency will become more mainstream? What are some obstacles that the entire industry needs to overcome before everybody’s using bitcoin for transactions or is that even a reality that we can look forward to?

These things are going to progress and get better and learn. It’s an experiment that learns from itself over time.

Which projects have you most excited right now?

I’m excited for World Crypto Con the most right now. I’m excited for the conference in Vegas next week.

Speaking of which, you’re going to be giving a keynote at World Crypto Con next week. Could you give us a sneak peek at what you’ll be talking about?

I don’t really know yet. I kind of wing it. I’ll just get on stage and start talking and see what comes out of my mouth. I’m also excited for the poker tournament.

Sounds good, see you there Charlie! To connect with Charlie, follow him on Twitter.

To see Charlie Shrem and other industry leaders such as Charlie Lee and Brock Pierce, as well as a bunch of other fun events like a crypto celebrity poker tournament and a show with Steve Aoki, come to World Crypto Con on Las Vegas on October 31st to November 2nd. Use code COINCENTRAL for 50% off tickets here.

*Editor’s note: The above article is a sponsored article. CoinCentral is sponsoring World Crypto Con 2018.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.