If you want to mine cryptocurrencies in 2018, then the chances are you will need to consider investing in some mining hardware. A Scrypt ASIC or a SHA-256 ASIC will provide a range of options for mining different coins. Here, we look at some of the options for hardware and coin mining using either SHA-256 or Scrypt ASICs in 2018.

Why Mine with ASICs?

In 2018, mining of many major cryptocurrencies is carried out predominantly using ASICs. This is true for Bitcoin, Litecoin, Bitcoin Cash, and now Ethereum too. Therefore, anyone mining these coins today using a GPU or CPU is trying to compete against colossal mining pools. These pools all use ASIC hardware that is specifically customized to solve the cryptographic puzzles generated by mining algorithms. So, going up against them using a GPU is like turning up at a gunfight at the O.K. Corral armed with a water pistol.

It is true that there are some exceptions here. Monero is one example of a coin that switches its mining algorithm on a regular basis in an attempt to remain resistant to ASICs. But if you want to mine Bitcoin, Litecoin or many other altcoins in 2018, then you are dependent on hardware such as a SHA-256 or Scrypt ASIC to get the job done.

What Is the Difference Between Mining with a Scrypt ASIC vs. SHA-256?

Bitcoin uses the SHA-256 algorithm to create hashes that represent the data held in blocks on the blockchain. SHA-256 is complex to run, which means it is highly accurate and secure but also slow. This is the reason that it takes ten minutes to generate each block on the Bitcoin blockchain.

Mining using SHA-256 requires a very high hash rate, within the gigahashes per second (gH/s) range. Because of the high hash rate, miners quickly realized that dedicated hardware offered a better solution for mining Bitcoin than a GPU, as it can mine at a far higher hash rate. By 2011, miners had started to switch to customizable hardware, called Field Programmable Gate Arrays (FPGAs), as a way of channeling more computing power into mining.

Once the first ASIC made its debut in 2013, mining became an industrial effort, and by 2014, it was clear that ASIC use would dominate the future of Bitcoin mining.

Resistance Is Futile

The Litecoin team initially introduced the Scrypt algorithm when it launched in 2011. At that time, it was thought to be resistant to the newer mining hardware being deployed for Bitcoin mining. Scrypt is a less complex algorithm and does not require such a high hash rate as SHA-256. The block time for Litecoin is only two and a half minutes.

However, Scrypt is more memory intensive than SHA-256. The hardware available at the time of Litecoin’s inception couldn’t mine Scrypt. Even once ASICs made an appearance in 2013, they were customized for SHA-256. So for a short while, GPU mining of Litecoin reigned supreme.

It was only a matter of time though. In 2014, ZeusMiner launched its first Scrypt ASIC. These days, the markets for SHA256 and Scrypt ASIC hardware alike are dominated by mining monolith Bitmain.

Mining Hardware

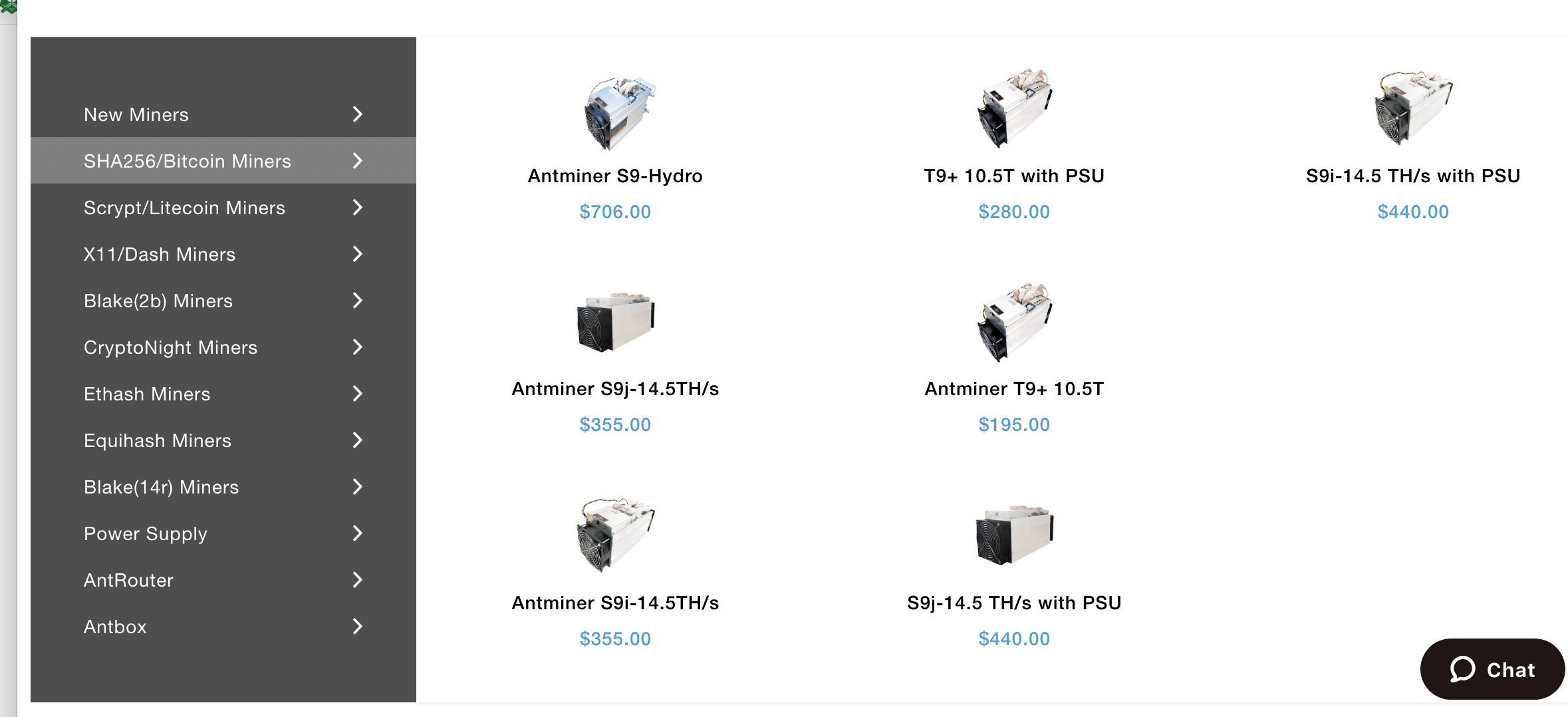

The Bitmain Antminer hardware has quickly risen to become some of the best on the market today. While there are other options, Bitmain is currently dominating the market, and smaller ASIC manufacturers are struggling to compete.

Bitmain manufactures both SHA-256 and Scrypt ASIC hardware. Which model you want will depend on a number of factors, including your budget for the initial hardware investment, desired hash rate, and power consumption. To get an idea of the profitability and trade-offs, use a calculator.

Mining Coins Using a SHA-256 ASIC

Some options for mining coins with a SHA-256 ASIC are:

- Bitcoin

- Bitcoin Cash

- Peercoin

- Namecoin

- Litecoin Cash

- Unobtanium

[thrive_leads id=’5219′]

Mining Coins Using a Scrypt ASIC

Some possibilities for mining coins with a Scrypt ASIC are:

- Litecoin

- Dogecoin

- Monacoin

- Syscoin

- Viacoin

At the time of writing, all of the above coins are currently still very much alive. There are other coins to mine using both SHA-256 and Scrypt ASIC, however, they are among the more obscure altcoins. While mining is always a potentially risky endeavor, mining unknown altcoins, which could disappear tomorrow, creates a far higher risk level.

When choosing which coins you want to mine, you’ll have to consider many variables. Profitability is one, which you can determine using a calculator. However, different coins will need different software to run on, some of which may be more complex to operate than others.

You’ll need to decide whether to join a mining pool or if you want to mine the coin solo (which may only be a viable option for the very minor altcoins). Finally, you’ll also need to ensure you have a wallet set up for any of the coins you want to mine.

Finally

Anyone considering venturing into mining for the first time in 2018 should do serious research before investing in any hardware such as a SHA-256 or Scrypt ASIC. Especially with the current market values, the profitability of mining is down, and it could be a long time before you see any return on investment.

It is also worth mentioning that manufacturers like Bitmain are always going to release upgraded versions of ASIC hardware. This means that mining will likely require continual investment to remain competitive. If you are thinking of going into mining, make sure you’ve done all your homework and have your eyes wide open to the risks.