Saga Monetary Technologies announced its plans to launch its Saga token (SGA) on December 10th, and it currently has an open onboarding process on its website.

Saga was created by Israeli VC Ido Sadeh Man and investor Moshe Hogeg and first started gaining significant attention in 2018.

The Saga team and group of advisors is stacked with economics heavyweights and finance experts such as Economics Nobel Laureate Myron Scholes (Scholes created the Black-Scholes formula, which is the most well-known model for pricing derivatives and options) and JPMorgan Chase International Chairman and former Governor of the Bank of Israel Jacob Frenkel. The advisory board also includes Dan Galai, a co-developer of the leading measure of financial market volatility called VIX, and Leo Melamed, a financial futures pioneer and the chairmen emeritus of CME Group.

The project raised a $30 million seed funding round in 2018 from Lightspeed Venture Partners, Mangrove Capital Partners, Vertex Ventures, and others.

According to a press release, Saga’s goal is to create a stabilized currency for global usage. It aims to accomplish this without the friction and volatility of other digital assets. Saga aims to achieve four main characteristics that will help SGA become a viable form of global currency:

-

- Modeled: Saga’s monetary model is the culmination of a multidisciplinary team consisting of renowned economists, historians, and technologists.

- Tamed: Saga utilizes a fiat reserve as a stabilizing mechanism to support the consistent growth of the currency while also minimizing the volatility.

- Transparent: Saga uses an online regulated KYC and AML process on all its participants. Its banking partners also provide daily confirmation about the reserve status.

- Governed: Saga is working on a delegate-based governance structure to make and execute decisions. The project is governed by delegates of SGA holders benefiting from the expertise and efficiency of having a centralized governor while also allowing to SGA holders to maintain the integrity of their votes.

The SGA token, fully compliant with the ERC-20 token standards as well as global regulatory frameworks, is backed by a basket of national currencies, which will ideally reduce price volatility. The reserve ratio is anticipated to gradually decrease as user adoption increases and the price becomes more stable.

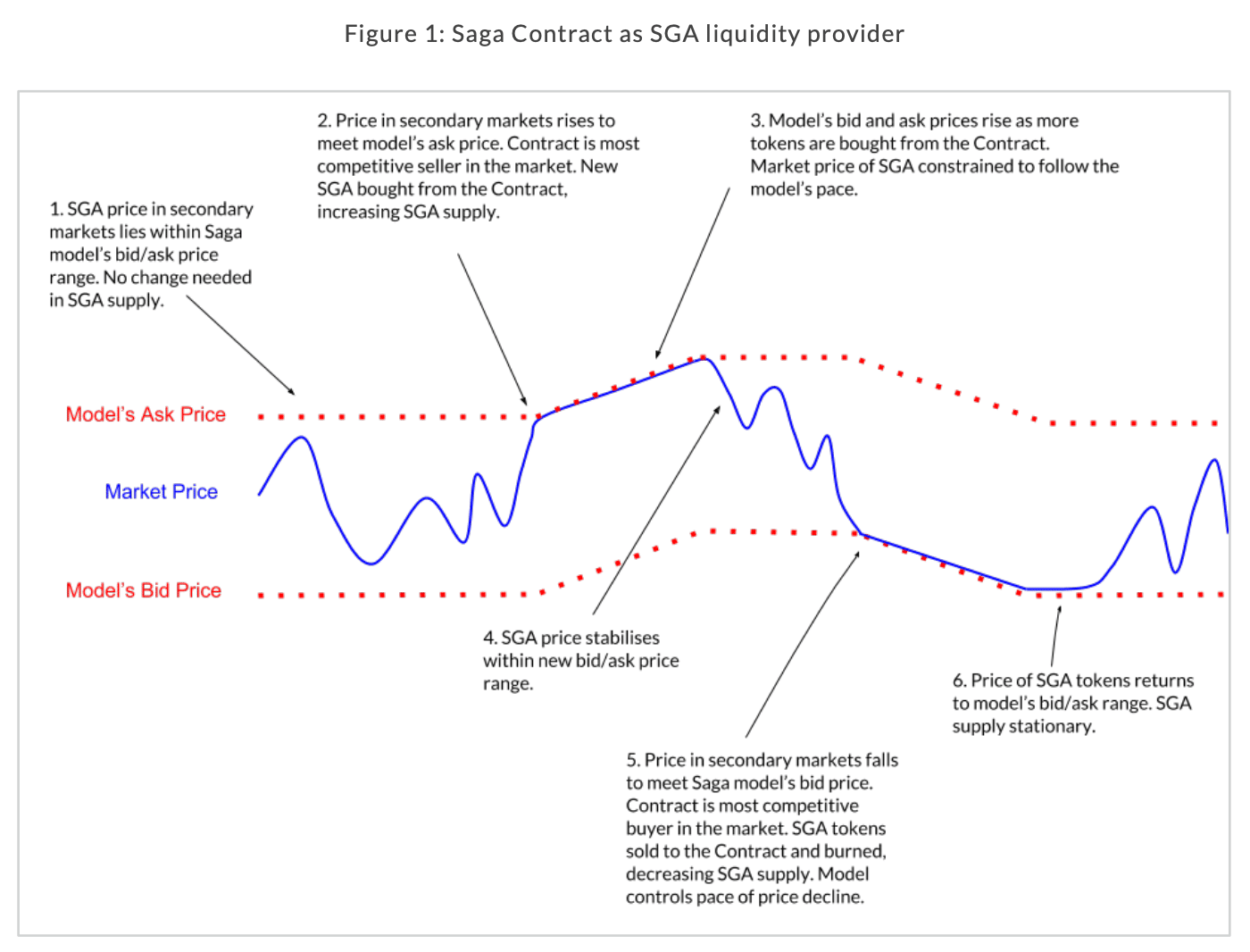

The way Saga is built, Saga Contracts act as SGA liquidity providers and ensure that the token’s value stays within the pricing model’s range.

“Some of the current players in the cryptocurrency ecosystem seek to reject the established financial system; to sit separately from, and replace fiat currencies,” comments Founder & Chairman of the Board Ido Sadeh Man. “Saga’s goal is to be the bridge between the crypto ecosystem and the establishment – harnessing blockchain technology to complement fiat currencies by creating a new truly global currency. Saga is partnering with financial services institutions new and old, building on the successes of central bank currencies and evolving them for the digital age.”

SGA can then be bought from the Saga contracts until the model’s ask price matches the secondary market price, allowing for a self-regulating money supply without drastic swings in either direction. If you’d like to learn more about Saga and the SGA token, feel free to reference Saga’s Monetary Model.