Even though many people view cryptocurrencies as a speculative investment, it’s still worth adding it as a payment option if you run an e-commerce store. Several reputable stores already include cryptocurrency payment options, and the number is growing each week. In this article, we’ll analyze the pros and cons of including it as a check-out option and provide you with the resources to add it to your store.

The Pros

Reduced Fraud. Chargeback fraud is a common occurrence on e-commerce platforms. Here’s how it works:

- A customer orders your product using a debit or credit card.

- You deliver the product to the customer.

- Once the customer receives the product, he/she initiates a chargeback. They claim that the package never arrived, their card was stolen, or some similar excuse.

- You’re stuck wasting resources to fight the claim. You have to prove that the product arrived successfully while the card company locks the funds in the meantime. This is especially troublesome for e-commerce businesses with an already limited cash flow.

Cryptocurrency payments are irreversible. Once a customer pays you, there’s no way they can reverse the transaction. You would have to initiate a payment back to the customer. Because of this, chargeback fraud is virtually impossible when using cryptocurrency payments.

Lower Transaction Fees. Most payment processors charge around 3.0% per transaction. On top of that, some also have markup and monthly fees. Although 3.0% may not seem like much, it adds up over time.

Cryptocurrency transaction fees are significantly less. Current Bitcoin fees are ~$1.00 per transaction and are estimated to decrease with further SegWit adoption and Lightning Network implementation. Additionally, you have significant control over the fees that you pay. The higher your transaction fee, the quicker you’ll receive your payment. If you’re in no rush, just set a lower fee payment.

Other cryptocurrency projects, like Nano, are working on an instantaneous payment solution with absolutely no transaction fees. Some e-commerce stores have even begun to successfully implement Nano on their platform, and now people are starting to shop more than ever, especially now that they also have the option of using coupon codes. Beyond the transactional advantages of accepting cryptocurrency, you also reach more customers by doing so. In a world where governments and large corporations seem to be tracking your every move, customers are becoming more privacy-focused. More and more people are beginning to use cryptocurrencies, like Bitcoin, for online purchases in order to keep some form of anonymity. Having cryptocurrency payments as an option at checkout helps to target this customer base.

The Cons

Price Volatility. As you probably know, the price of Bitcoin and most other digital assets can vary widely on a day-to-day basis. As an e-commerce store owner, you want to ensure that the $50 you receive for your product is still worth $50 a week later.

The simple solution to this problem is to cash out your cryptocurrency to fiat immediately when you receive it. Several cryptocurrency payment processors support this as an option. As cryptocurrency sees more real-world adoption, the prices will begin to level out as well.

Additional Set-up. As with adding any new feature to your e-commerce platform, there’s additional work involved. You need to configure the back-end to actually accept the cryptocurrency payments as well as design a new user interface so your customers can make the payments.

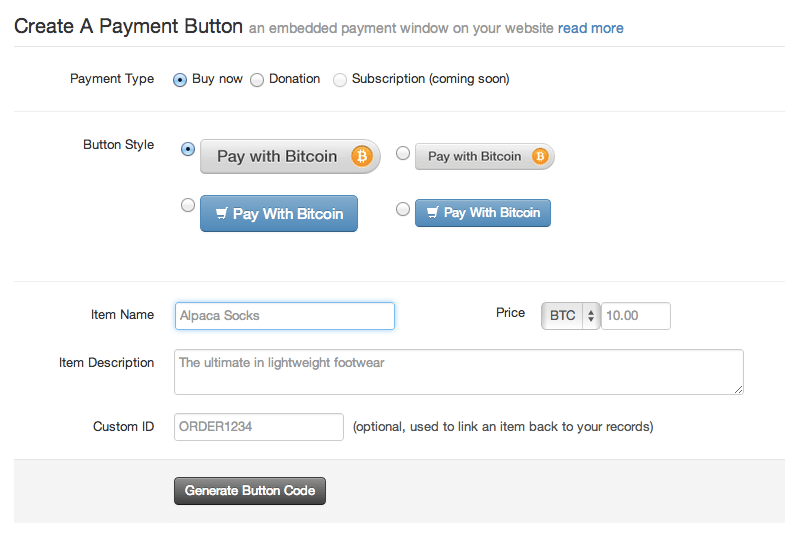

Well, there’s good news. The top cryptocurrency payment processors have out-of-the-box solutions that provide everything you need to easily integrate crypto onto your platform. They include everything from the wallet capabilities to “Pay with Bitcoin” buttons to add to your checkout screen.

Customer Confusion. Customers may be confused by the additional option(s) at checkout. Even though Bitcoin is becoming more popular, we’re still in the early days of adoption. Be prepared to field questions from curious customers on how it works.

[thrive_leads id=’5219′]

How to Start Accepting Cryptocurrency Payments

There’s no shortage of options to begin accepting cryptocurrency on your e-commerce platform. Some methods are easier than others, but they don’t give you as much flexibility when customizing the solution.

The Hard Way

If you want to avoid using third-party processors, you can manually set-up wallets and exchange accounts to receive payments directly.

First, you need to choose a wallet in which to receive payments. Be aware that different wallets support different coins, so the one (or ones) you choose will determine which currencies you accept in your store. Although they both cost around $100, the Ledger Nano S and Trezor hardware wallets are more secure than their online counterparts. They also support a wider variety of coins than most other wallets.

If you’re interested in converting your crypto funds to fiat, you should also create an account on an exchange. Once again, different exchanges support different currencies, so take the time to research which exchange is best for your needs. Gemini and GDAX are both great options if you’re fine with only supporting the most popular coins. At this time, GDAX supports Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, while Gemini only supports Bitcoin and Ethereum. Check out Kraken if a greater coin selection is important to you.

Once you create your wallet and accounts, you’ll need to know some web development to actually implement the payments on your site in a secure way. The list of work includes:

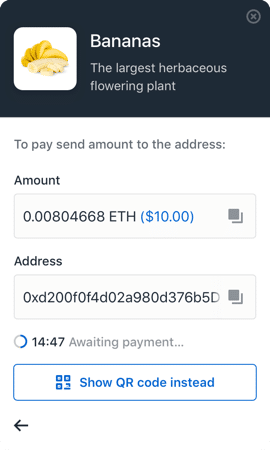

- Creating an interface for the user to make the cryptocurrency payment

- Generating new addresses to receive coins

- Safely securing customer information

- Transferring funds from your wallet to the exchange

- Exchanging your coins for fiat on the exchange

If you aren’t comfortable programming these tasks yourself, you can hire a freelance developer to do the work for you.

The Easy Way

A slightly more expensive option, you can integrate one of the many cryptocurrency payment providers into your store. These providers do the majority of the heavy lifting when setting up, processing crypto payments, and converting to fiat currency.

These processors usually include UI components to use as well as a robust suite of API calls. This is great for all skill levels as you can start with their standard solution then work to customize it and make it your own over time.

BitPay and Coinbase are two popular payment solutions. BitPay only charges 1% on each transaction while Coinbase is free. However, Coinbase does charge a 1% fee when cashing out your bitcoin to a bank – but only after your first $1 million.

The Easiest Way

If your e-commerce store is on WordPress, Shopify, or something similar, you can use a plug-in to accept cryptocurrency. Not all plug-ins are created equal, though. When choosing a plug-in, make sure it’s up-to-date, receives good ratings, and has a significant user base.

Final Thoughts

Integrating cryptocurrency payments into your e-commerce store may take some additional work, but it’s well worth the time and effort to do so. Accepting cryptocurrency lowers your chargeback risks, decreases your fees, and expands your customer base.

It’ll only be a short time before cryptocurrencies are the go-to payment for online purchases. Be one of the first to catch the trend.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.