What is AST?

AST, or the AirSwap Token, is the membership token of the AirSwap decentralized exchange. The folks at AirSwap call the present iteration of their decentralized exchange (or DEX) the AirSwap Token Trader. Eventually, you’ll be able to trade your favorite ERC20 tokens for free on their AirSwap DEX. The AirSwap Token provides the right to signal your intention to trade one cryptocurrency (or asset) for another. If there is someone out there that agrees to your terms, the transaction may safely proceed without you having to take the risk of giving custody of your asset to a third-party. Transactions are executed in a peer-to-peer fashion using either MetaMask or Ledger wallets.

Token Summary

Symbol: AST

Specification: ERC20

Network: Ethereum

Circulating Supply: 150,000,000 AST

Total Supply: 500,000,000 AST

https://youtu.be/LTTUzICnazU

Introduction

Transaction-fee free trading is possible thanks to the Swap Protocol. The protocol settles orders on the blockchain (or on-chain) through an Ethereum smart contract. Everything else is handled independently of the blockchain (or off-chain). Connecting traders off-chain should make the AirSwap decentralized exchange faster than other decentralized exchanges like EtherDelta and even the Plasma-based OmiseGO decentralized exchange, that depend on the blockchain for information propagation and order fulfillment.

Connecting traders on-chain is not ideal because the nodes in the network, like the Ethereum network, must reach consensus on the transactions in each block. On the Ethereum network, the time to reach consensus is typically 15 seconds. In comparison to traditional exchanges that transmit order information in microseconds, this is simply too slow.

Apart from the latency introduced by propagating order information on-chain, the ability for unethical parties to manipulate that public information is also possible. This phenomenon is called front-running. Front-running is not unique to cryptocurrency exchanges. However, it’s a particular problem for decentralized exchanges that publish order information on the blockchain.

Thankfully, the Swap Protocol eliminates front-running by miners and exchange operators. This happens because the protocol doesn’t publish order information on the public blockchain. Miners are not privy to sensitive information that they could exploit for financial gain.

Furthermore, the protocol dispenses with the use of a centralized order book. It’s able to do this thanks to implementing:

- An Indexer

- An Oracle (Optional)

The AirSwap Indexer is like a search engine. It disseminates counterparty information publicly. Traders may then communicate price information privately with the counterparties provided by the AirSwap Indexer. Should the trader not know what price to use in negotiations with the counterparty, the trader may consult with the AirSwap Oracle.

The AirSwap Oracle provides pricing suggestions. By using the AirSwap Oracle, the AirSwap decentralized exchange enables price discovery without requiring the levels of liquidity found in large, successful centralized exchanges.

How does AST work?

The AirSwap Token is essentially a token for professional market makers, or simply makers, on the AirSwap DEX. Makers have a cryptocurrency that they want to exchange for another cryptocurrency at a specific rate during a specified period. This is called providing liquidity. Consequently, makers are also referred to as liquidity providers.

The price the maker offers to pay for an asset is called the bid price. The price that the maker wants to sell that same asset for is called the ask price. Traditionally, liquidity providers hold large amounts of a specific asset and they make their money on the spread, or the difference between the ask and bid prices.

Anyone can be a liquidity provider on the AirSwap decentralized exchange. You simply need to signal your intention to provide liquidity. In order to signal your intention to trade, you need to possess 100 AST. That amount of AST is then staked, or locked, for seven days.

This amount and the lock duration are determined by the governance mechanism built into the AirSwap Token. Holders of AST can collectively decide on the threshold and lock period at any time. For the time being, locking 100 AST entitles the maker to signal 10 trades.

Liquidity takers, or takers, accept a maker’s ask or bid price. They trade for free on the AirSwap decentralized exchange. Even if they don’t own AST, takers pay nothing to discover makers via the AirSwap Indexer, receive pricing information from the AirSwap Oracle, and/or settle the order via the Ethereum smart contract.

Who came up with AST?

Michael Oved and Don Mosites co-founded AirSwap in Hong Kong in 2017. The two first met at Carnegie Mellon University as students. They parted after graduating, however, cryptocurrencies brought them back together. Deepa Sathaye was the first engineer on the team.

AirSwap launched with several strategic partners. Joseph Lubin, Bill Tai, Brock Pierce, and Michael Novogratz are some of the high profile individuals to throw support behind the project.

Initially, a silent liquidity partner provided a market for AST-ETH trading. However, the number of liquidity providers has been steadily increasing. On March 1st, 2018, Michael Oved announced an additional three liquidity partners for the upcoming AirSwap Token Marketplace. Market makers interface with the AirSwap Token Marketplace via a private API. The Marketplace builds on the AirSwap Token Trader to enable the trading of 24 new cryptocurrencies.

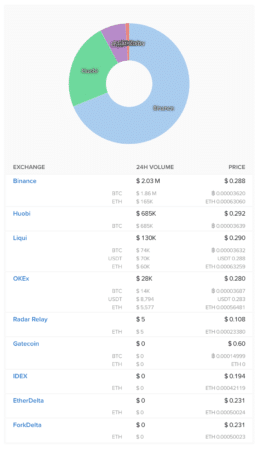

Where can you buy AST?

According to CoinLib.io, AST is available on Binance, Huobi, Liqui, OKEx, Radar Relay, Gatecoin, IDEX, EtherDelta, and ForkDelta. It’s most certainly available at AirSwap.

Where can you store AST?

AST is supported by MetaMask and Parity wallets. Additionally, MyEtherWallet supports it, so you can also store it on the Ledger Nano S and Ledger Blue hardware wallets.

Conclusion

The AirSwap Token is most valuable to market makers on the AirSwap decentralized exchange. If the platform grows, demand for AST will increase as liquidity providers become more active on the AirSwap decentralized exchange. Makers must lock more AST the more active they become. Since the supply of AST is fixed, the price of AST is certain to increase with the success of the exchange. The AirSwap team, holding 350 million AST, will be handsomely rewarded by this appreciation.

This potential to appreciate also appeals to speculators. Thanks to the power of network effects, the forthcoming AirSwap Token Marketplace, the AirSwap Partner Network, and the fact that the AirSwap DEX competes with rivals unencumbered by transaction fees, AST is well positioned to make a big impact on how everyone buys and sells cryptocurrencies.

[thrive_leads id=’5219′]