How to cancel an unconfirmed Bitcoin transaction

When sending Bitcoin, it can be easy to make a small mistake causing you to want to cancel your Bitcoin transaction. Oftentimes, funds can become stuck if the miner fee you enter isn’t high enough for any miner to confirm your transaction.

Unfortunately, the steps to cancel a Bitcoin transaction are a little more complicated than just pressing an “Undo” button. In this brief guide, I’ll walk you through the process to cancel an unconfirmed Bitcoin transaction.

Has your transaction been confirmed?

The first step in canceling your Bitcoin transaction is to check whether or not it has any confirmations.

When you made your transaction, you should have gotten a transaction ID that looks something like this:

240615b6ab59a5adb19ba52cb969aeb16ff82d2082b7a72cb2912c5d38c297cf

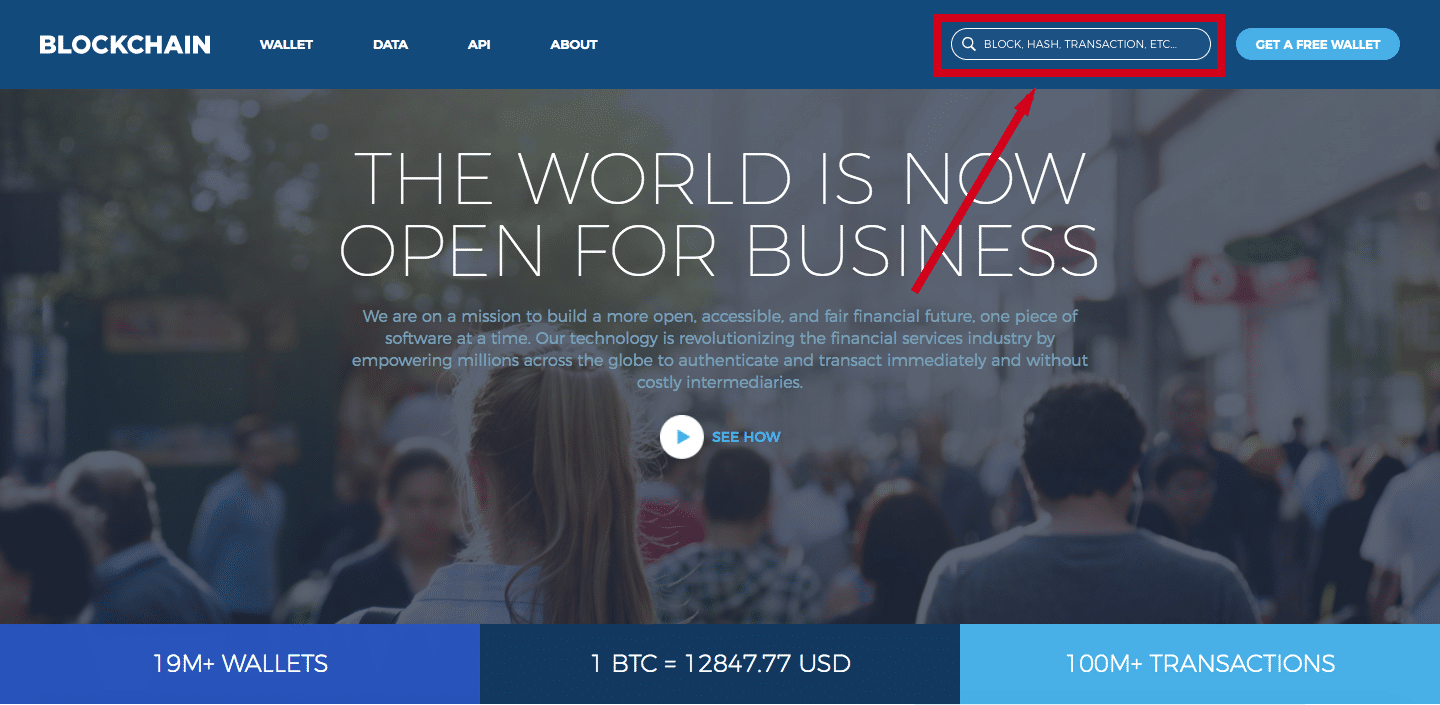

Take your transaction ID and enter it into a block explorer. Blockchain.info is a great option.

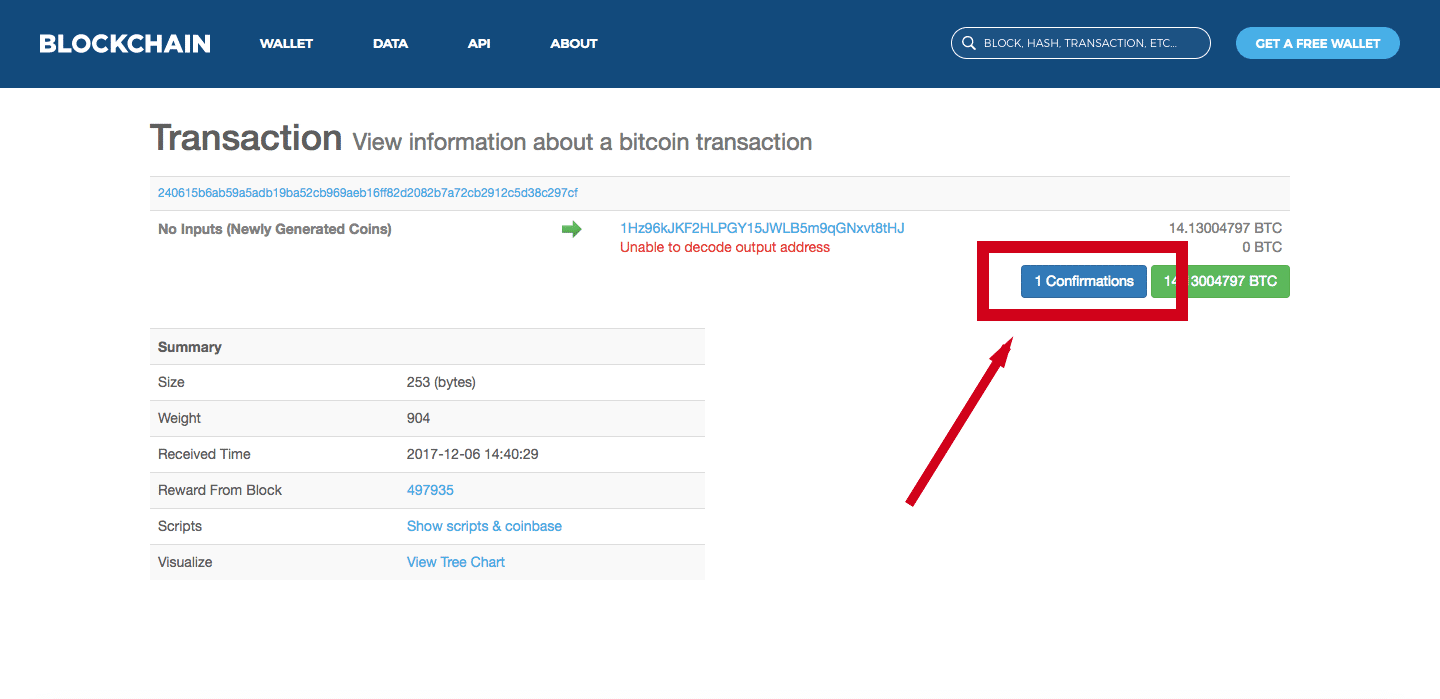

On the next page, you can see information about your transaction including the number of its confirmations.

If the number of confirmations is greater than 0, you won’t be able to cancel your transaction. Confirmed transactions on the blockchain are permanent and irreversible. Just wait and your transaction will finish going through soon.

If the transaction has no confirmations yet, there’s still a chance that you can cancel it.

How to cancel an unconfirmed Bitcoin transaction

There are two primary strategies you can use to try to cancel your unconfirmed Bitcoin transaction:

- Replace by Fee (RBF)

- Double spend using a higher fee

Some wallets support the RBF protocol allowing you to replace your original transaction with a new one that includes a higher transaction fee. This would effectively unstick your transaction.

To use this feature, though, you would’ve needed to make the original transaction replaceable (usually via an opt-in checkbox); here, you can see the actual structure of a mined RBF transaction.

To use this feature, though, you would’ve needed to make the original transaction replaceable (usually via an opt-in checkbox).

If you’re unable to use RBF, you still may be able to cancel the Bitcoin transaction by double spending with a higher fee.

To do this, make a new transaction equal to the amount of the original one and send it to yourself. Make sure the transaction fee on this is significantly higher than the original one you paid.

You may need to use another wallet or specialized software that allows double spending for the transaction to be broadcast to the network.

If all goes well, miners will pick up the new transaction, and your Bitcoin will be back in your wallet.

Most miners and wallets have safeguards against double spending, though, so there’s still a large chance that this method may not work.

Hopefully, one of these two methods works for you. If not, treat this as an important lesson taught to you by the wild world of Bitcoin.

This educationally-focused technical article is proudly sponsored by BitScript.app, a Bitcoin educational platform & development environment.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.