The Downward Trend Continues

Another week, another round of losses.

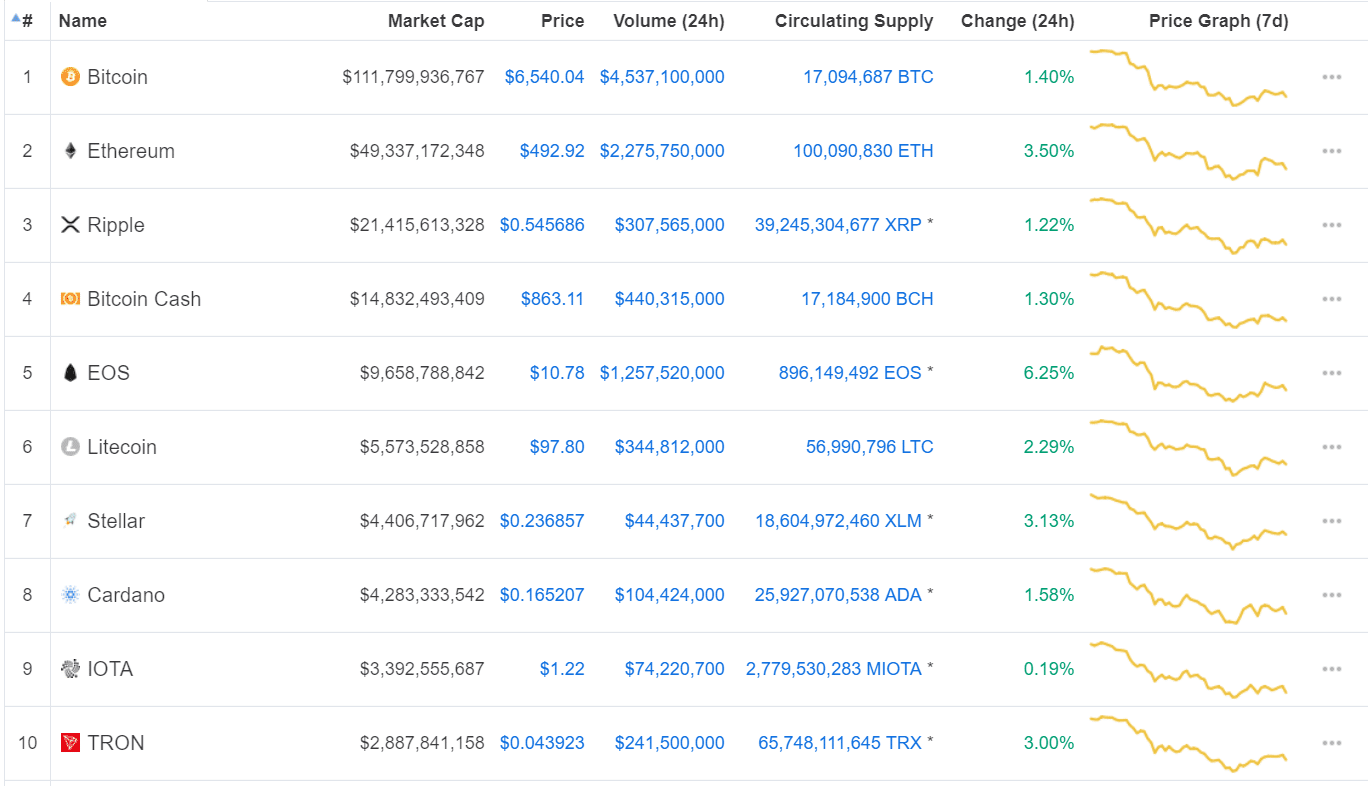

The cryptocurrency market shed a collective 17% over the course of this week, its market cap decreasing from $339 bln to $280 bln. News that the SEC doesn’t see Ether as a security gave the market some brief reprieve on Thursday, but the charts today seem to point to prices retreating back downward.

Times are rough, friends, and they could be rougher still. If we don’t bounce upward and find support in the coming days and week, we could be in for a dip that bottoms-out below our previous lows from this year.

Bitcoin: With an asking price of $6,540, king crypto has lost 13% of its value over the week.

Ethereum: Even with positive news from US regulators, Ethereum is down 17% on the week at $492.

Ripple: Coming off a logo re-branding, Ripple’s $0.54 price has it losing 18% since last week.

Domestic News

Ether is Not a Security, SEC Director Indicates in Speech: In a speech delivered at the Yahoo Finance All Market Summit: Crypto, William Hinman, Director of Corporate Finance for the SEC, clarified the agency’s stance on Ether this Thursday. “[Based] on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions. And, as with Bitcoin, applying the disclosure regime of the federal securities laws to current transactions in Ether would seem to add little value,” he said in his speech.

https://twitter.com/msantoriESQ/status/1007374817484566534

Coinbase Index Fund Opens its Doors to Accredited, American Investors: The cryptocurrency wallet and vendor geared up its index fund this week, opening it for the first round of investments. Announced earlier this year, the Coinbase Index Fund is the first accredited fund of its kind for the industry, and it’s only open to investments of $250,000 to $2 mln. “Coinbase Index Fund gives investors exposure to all assets listed on our exchange, weighted by market capitalization. As we announced yesterday, the fund will be rebalanced to include Ethereum Classic, and more assets when they are listed by Coinbase in the future,” the official blog post reads.

Congress Introduces Bill That Looks to Scrutinize Crypto’s Use in Sex Trafficking: Money laundering and terrorism funding are old news. Now, Congress wants numbers on how cryptocurrencies are changing how sex traffickers do business. According to the bill, “the ‘Fight Illicit Networks and Detect Trafficking’ or the ‘FIND Trafficking Act’ would require the Comptroller General of the United States to carry out a study on how virtual currencies and online marketplaces are used to buy, sell, or facilitate the financing of goods or services associated with sex trafficking or drug trafficking, and for other purposes.” If the bill were to take effect, the Comptroller General would issues a comprehensive report to Congress regarding the study’s findings in a year’s time.

LA Area Woman Gets Tagged With Operating an Illegal Monetary Exchange: In what’s being branded as an unprecedented case, a Los Angeles resident is facing federal prosecution for running an illegal Bitcoin trading operation. Going by the pen name Black Maven, Theresa Tetley grossed some $300,000 annually from 2014-2017 by operating a Bitcoin and cash transmission service via a listing on localbitcoin.com. The court prosecutor holds that Tetley “fueled a black-market financial system in the Central District of California that purposely and deliberately existed outside of the regulated bank industry.” She’s facing the threat of 30 months in federal prison for her alleged crimes, as well as asset seizures for 40 Bitcoins, nearly $300,000 in cash, and 25 gold bars.

Wells Fargo Bans Crypto Purchases With its Credit Cards: In a move that is unsurprisingly in line with other big banks and credit card companies, Wells Fargo will shutter its credit card services to cryptocurrency purchases. This puts America’s third largest bank in the company of J.P. Morgan & Chase, Citibank, and American Express. “Customers can no longer use their Wells Fargo credit cards to purchase cryptocurrency. We’re doing this in order to be consistent across the Wells Fargo enterprise due to the multiple risks associated with this volatile investment. This decision is in line with the overall industry,” a spokesperson said in a statement for the company.

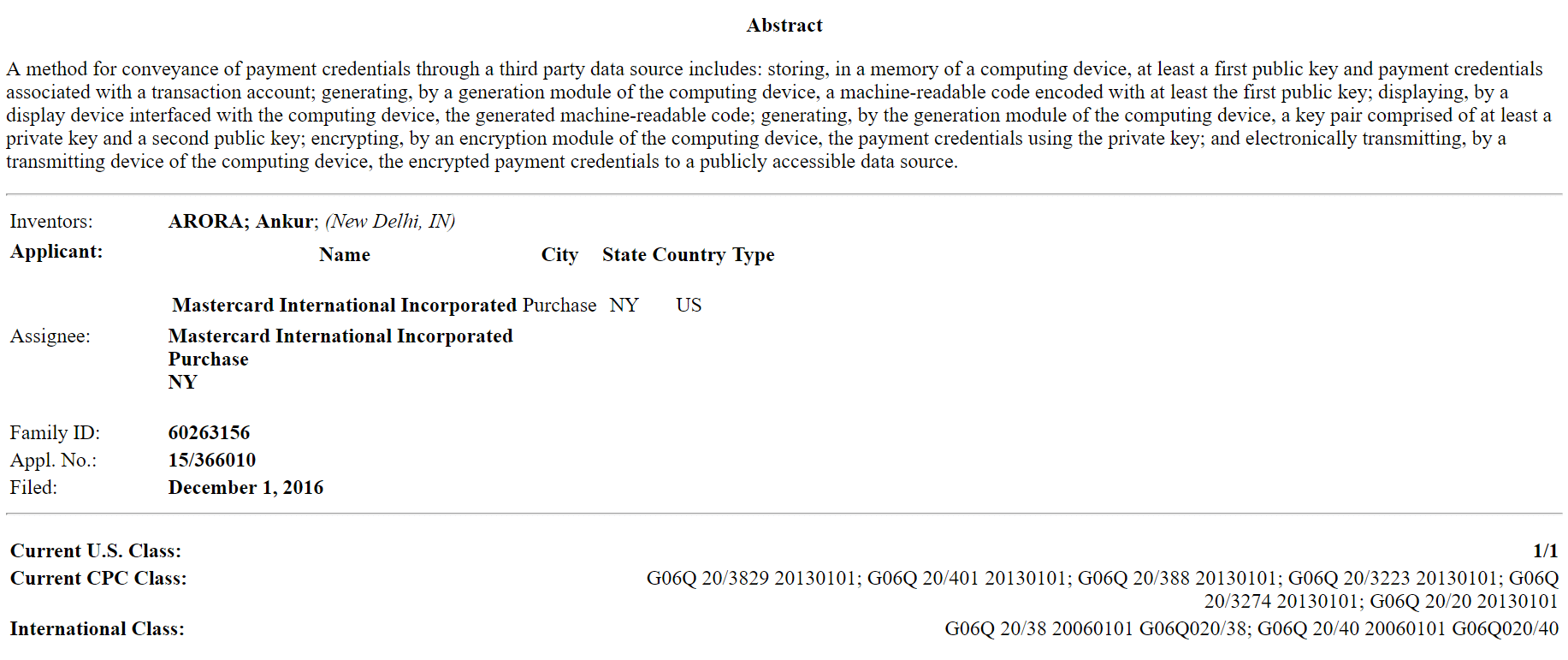

Meanwhile, Mastercard Has its Cake and Eats it Too, Applies for Blockchain Payment Patent: Credit card companies may want nothing to do with cryptocurrencies, but in the realm of picking and choosing, they have no qualms over seizing its technology, blockchain, for their own benefit. Mastercard at the very least seems to indicate as much, as the credit card company filed a patent on June 7 with the US Patent & Trademark Office for a “method and system for payment card verification via blockchain.” The patent seeks rights over “the verification of payment credentials via the use of blockchains or other publicly accessible data sources, specifically the use of encryption and the transmission of data between a computing device and a point of sale to accommodate the retrieval and usage of verified payment credentials without the use of a traditional payment instrument.”

Connecticut Governor Signs Bill That Proposes a Blockchain Working Group Into Law: Connecticut’s Governor, Dannel P. Malloy, signed a bill on June 6 that formally establishes the Connecticut Blockchain Working Group. The bill, which passed both in Connecticut’s lower and upper houses to unanimous votes, calls for the state “to develop a master plan for fostering the expansion of the blockchain industry in the state and recommend policies and state investments to make Connecticut a leader in blockchain technology.”

What’s New at CoinCentral?

What is Elastos (ELA)? | Beginner’s Guide: Elastos is a blockchain-powered Internet in which you have complete control of your digital assets.

Huobi Announces Plans for a Decentralized Autonomous Organization: Through the Huobi Chain Project, the company will build a public blockchain. This will allow them to move from a centralized corporation to a decentralized one run by communities.

A Primer on Cryptocurrency Charting in Trading View: TradingViews offers charts for a handful of coins, and it’s a good thing to get to know if you plan on trading.

The State of Sharding: How Can this Technology Make Blockchain More Scalable?: Sharding is a type of database partitioning that separates larger databases into smaller, faster, more easily managed parts called data shards.

The DAICO Is Here–Does the New ICO Model Offer Better Security?: Vitalik’s idea for a DAO ICO has become a reality, but will it solve current token sale problems?

Do We Really Need Cryptocurrency? A Modern Exploration of Money: Is cryptocurrency really necessary? Looking at the traditional system, we certainly think so.

There’s a Bright Future for the Binance Ecosystem Fund: The Binance Ecosystem Fund is Binance Lab’s latest project: an initiative to foster development and drive adoption.

Beyond CryptoKitties: The future of ERC-721 and Ownership of Unique Assets: Cryptokitties are the most well-known ERC-721 tokens, but in the future of tokenization, these can be tied to more assets than glorified digital beanie babies.

The Best Bitcoin Mining Software of 2018: Looking to start mining (or just need a refresher)? We got you, fam.

What Are Walmart’s Plans for Blockchain Tech?: You know the world’s largest retailer has plans for the tech, but what do they entail?

The Past and Present of Bitcoin Mining Fraud: Botnets, mining malware, power theft–oh my!

The Differences Between Shares and Cryptocurrency: An article for when you need to explain to your old man why/how coins are different than traditional stocks.

Xeeda’s Kevin Maloney on Cryptocurrency Hardware Wallets: Kevin Maloney is the Founder and CEO of Xeeda, a cryptocurrency hardware wallet specifically designed for smartphones.

The Move Away From ICOs–Five Things You Should Know: ICOs are becoming less common, while airdrops and VC funding are coming more into the fold.

The First Business Model Blockchain is Upending: Payments: Seems obvious given that Bitcoin was created as an alternative currency, but nonetheless, it’s worth looking at how blockchain will change payment processing.

Binance Announces That It Will Offer Euro Trading By End of Year: The world’s largest exchange has a bank account in Malta, and with this liquidity, it’s opening up euro trading pairs.

Siglo’s Isaac Phillips on Blockchain’s Role in Emerging Markets: Isaac Phillips is one of the Founders of Siglo, a Gibraltar-based blockchain protocol for decentralized apps to sponsor connectivity in emerging markets.

What is the Environmental Impact of Bitcoin Mining?: Some might say it’s catastrophic, others are much less doom and gloom. Is the truth somewhere in between?

What is Merged Mining? A Potential Solution to 51% Attacks: Simply put, merged mining (also known as Auxiliary Proof-of-Work) is the process of mining two different cryptocurrencies at the same time.

Blockchain in Automotive–Fragmented Sector to Focus on New Technologies: Blockchain and cars? You bet, and the industry is already researching the technology.

[thrive_leads id=’5219′]

What is Web 3.0?: It’s more than just a buzzword; it’s actively being built around us.

Top 10 Most Active Politicians–Global Edition: These are the faces of the movement’s most engaged political actors.

Coinbase to Add Support for Ethereum Classic: Coinbase announced this week that it would be adding Ethereum Classic to its offerings in the coming months.

Gnosis’ Stefan George on Barriers to Adoption for Decentralized Exchanges: Stefan George is the Founder and CTO of Gnosis, a Gibraltar-based prediction market platform built on Ethereum. Gnosis is the second largest prediction market platform by market cap behind only Augur.

What is Casper: The Friendly Haunting of Ethereum: Casper is closer to materializing with each day of development, and the PoS upgrade is nearly ready.

Elix Co-founder Melanie Plaza Talks Crowdfunding, Blockchain Usability, and Chicken Tenders: Melanie Plaza, co-founder of Elix, is a biologist turned computer programmer on a mission to improve blockchain technology’s accessibility.

IDEX CEO Alex Wearn on Aurora Advancements: Alex Wearn is CEO and co-founder of Aurora, the company behind IDEX. He is presently working on many different initiatives, including a re-branding for the famous decentralized exchange and financial platform.

Cryptography: A Brief History from Symmetry to Bitcoin: A dive into the technology that laid the roots for a revolution.

Blockchain Connect to Host Conference in San Jose Convention Center: Blockchain Connect (Silicon Valley) is hosting its second conference in the United States on June 26th and June 27th at the San Jose Convention Center in California. Oh, and our readers get 40% off with this code: CoinCentral40.

What is Cobinhood Coin (COB)? A Beginner’s Guide: Say hello to Cobinhood, a cryptocurrency exchange that charges zero fees for trading. Yes, you heard that right, zero! With a cheeky take on the Robinhood theme, Cobinhood has decided to move in on the zero-fee crypto exchange game.

Blockchain Affiliate Marketing: Boosting Profits for Publishers: Blockchain affiliate marketing platforms are some of the latest to exploit new technology to solve old problems.

Ether Is Not a Security, SEC Director of Corporate Finance at Crypto Summit: William Hinman made one of the industry’s most noteworthy comments of the year at Yahoo Finance’s Crypto Summit this week: Ether is not a security.

Indiegogo’s Slava Rubin on Crowdfunding and ICOs: When it comes to crowdfunding, few people have keen insights rooted in deep experience as the Founder of Indiegogo, Slava Rubin.

Improving Defense Industry Technology with Blockchain: So, what are some of the biggest blockchain research projects for the defense industry so far? And how can blockchain reshape the future of military technology?

Cryptocurrency News From Around the World

Binance Sets its Sights on Offering Euro Trading Pairs By Year’s End: Binance consistently ranks as the top exchange in the world by daily trading volume, and it’s looking to take its success a step further by integrating euro trading pairs into its services. The exchange’s CEO announced this week that it would see to adding euro trading pairs by the end of the year, teasing that more fiat pairs would be in the works down the road. For now, though, the euro will trade with to-this-point unspecified cryptocurrencies, an outcome no doubt made possible by Binance opening a bank account in Malta last week.

Mining Firm Agro Blockchain Poised to Be First Crypto Company on London Stock Exchange: An IPO will likely cement Agro Blockchain as the first offering on the London Stock Exchange (LSE). The mining company announced this week that it plans to hold a public offering on the stock exchange. This would follow the $2.5mln the company has already raised in a private investing round earlier this year, and the announcement came on the same day that Agro made subscriptions for mining contracts open to the public.

Coinbase Adds Ethereum Classic to its Suite of Offerings: Coinbase customers will now have two Ethereums to choose from in addition to the two Bitcoins–and one kinda-Bitcoin–the platform offers. The world’s largest cryptocurrency vendor announced this week that it would begin integrating Ethereum Classic into its services over the next few months. Once the team does all the heavy lifting on the back-end, ETC will be available on the Coinbase Pro exchange (formerly GDAX) and added to the Coinbase Index Fund, but it will not be immediately added to Coinbase, the company’s main venue for cryptocurrency purchases.

Some thoughts on why Coinbase would list $ETC.

TLDR:

History of censorship-resistance, active development, effective governance, achievable roadmaphttps://t.co/3a35E3TUMq— ETC Cooperative (@ETCCooperative) June 13, 2018

South Korean Banking Group Plans to Release Blockchain-Based ID Verification System: The Korea Federation of Banks announced this week that it would be rolling out a new blockchain-based ID verification system by July of this year. BankSign, as it’s called, will look to replace an outdated system that’s been in use for the past two decades, and the banks will apply the ID tech to their mobile and online banking platforms.

Canadian Government Release First Draft of Proposed Crypto Regulations for Exchanges and Payment Processors: Canada released a draft of proposed cryptocurrency regulations this week. The regulations take aim at KYC/AML measures, specifically assigning crypto exchanges and payment processors the classification of money service businesses under Canadian law. “The proposed amendments to the regulations would strengthen Canada’s AML/ATF Regime by updating customer due diligence requirements and beneficial ownership reporting requirements; regulating businesses dealing in virtual currency; updating the schedules to the regulations; including foreign money service businesses (MSB) in Canada’s AML/ATF Regime; clarifying a number of existing requirements; and making minor technical amendments,” the draft states.

UK Regulators Issue Letter of Advice to Banks on How to Manage Risks of Crypto Assets: Signed by Executive Directors of Supervision Jonathan Davidson and Megan Butler, the United Kingdom’s Financial Conduct Authority has sent letters to domestic banks in an effort to advise them on how to manage risks involved with cryptocurrencies. The letter touches on topics that range from crypto’s ties to black market operations to its own market’s speculative nature. “There are many non-criminal motives for using cryptoassets. These include using them as high-risk speculative investments or as a means of funding innovative technological development. However, this class of product can also be abused because it offers potential anonymity and the ability to move money between countries. You should take reasonable and proportionate measures to lessen the risk of your firm facilitating financial crimes which are enabled by cryptoassets,” the letter reads.

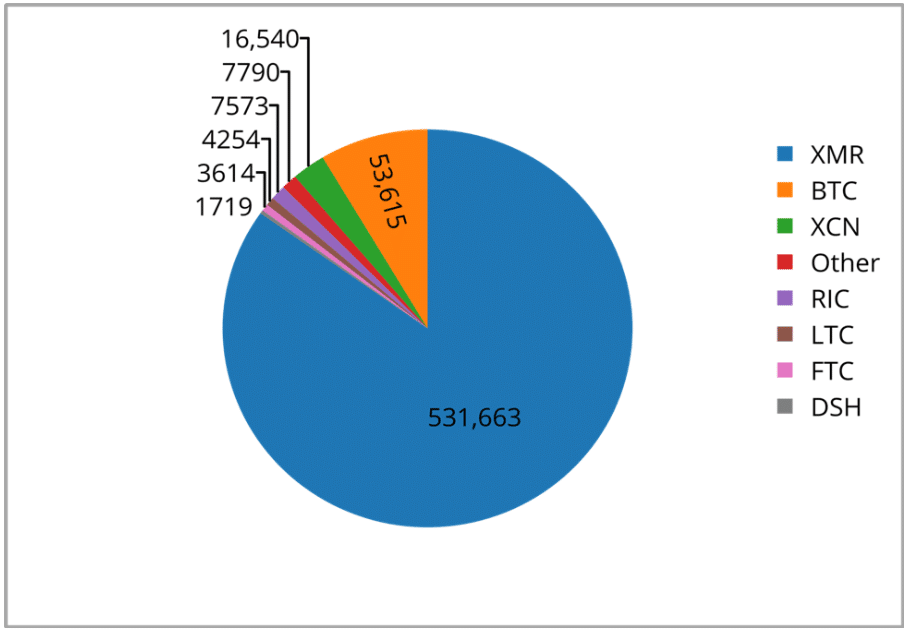

5% of All Monero Circulating Today Was Mined Using Malware, Report Claims: A report by the Palo Alto Network Research center reveals that 1/20th of all Monero in circulation was minted using mining malware. Authored by Josh Gunzweig, the report found that Monero was the overwhelming choice of hackers, comprising roughly 85% of all mining malware profits. “It is clear that such activities have been incredibly profitable for individuals or groups who have mined cryptocurrency using malicious techniques for a long period of time. A total of $175m has been found to be mined historically via the Monero currency, representing roughly 5% of all Monero currently in circulation,” Gunzweig writes in the report’s conclusion.