- DDEX: The Decentralized Digital Exchange

- What is DDEX?

- So, how does it work?

- Advantages

- Team

- Conclusion

- Additional Resources

DDEX: The Decentralized Digital Exchange

DDEX empowers wallet-to-wallet trading of cryptocurrencies. The great benefit of the DDEX exchange is that you can securely trade tokens without having to open an account and share your name, address, and other personal information. It has no lockup period or fees for deposits and withdrawals. This decentralized exchange not only helps prevent theft but also saves time and money.

DDEX Key Details

Website: https://www.ddex.io/

Exchange Classification: Hybrid Decentralized

Open Order Protocol: Hyrdo Over 0x Order Schema

Tokens Traded: ERC20 Ethereum Tokens (presently), QTUM (planned)

MetaMask Support: Yes

Ledger Support: Yes

Matching: Off-Chain

Settlement: On-Chain

Deposit Fee: None

Withdrawal Fee: None

Transaction Fee: 0.1% (+GAS)

What is DDEX?

DDEX is a decentralized application. This decentralized application, or dApp, functions as an exchange. Exchanges allow you to trade one asset for another. DDEX is different from Coinbase, Bitstamp, and other cryptocurrency exchanges you might have heard about in that it doesn’t require you to deposit tokens in order for you to fill an order. That’s why no personal information is submitted.

So, how does it work?

Technically, DDEX is a relayer. Relayers relay liquidity information. Relayers essentially craft an order book from cryptographically signed messages made by market makers. A market maker, or maker, is simply anyone signaling an intention to trade a specific quantity of one asset for another at a specific price during a specified period.

The instructions the maker issues to the relayer are called orders. Makers are also called liquidity providers. Makers provide the liquidity information that relayers relay.

Later on, a taker agrees to trade the asset at the maker’s specific price. When this happens the order is filled. A smart contract is created and the order is settled on the blockchain. This process is called order settlement.

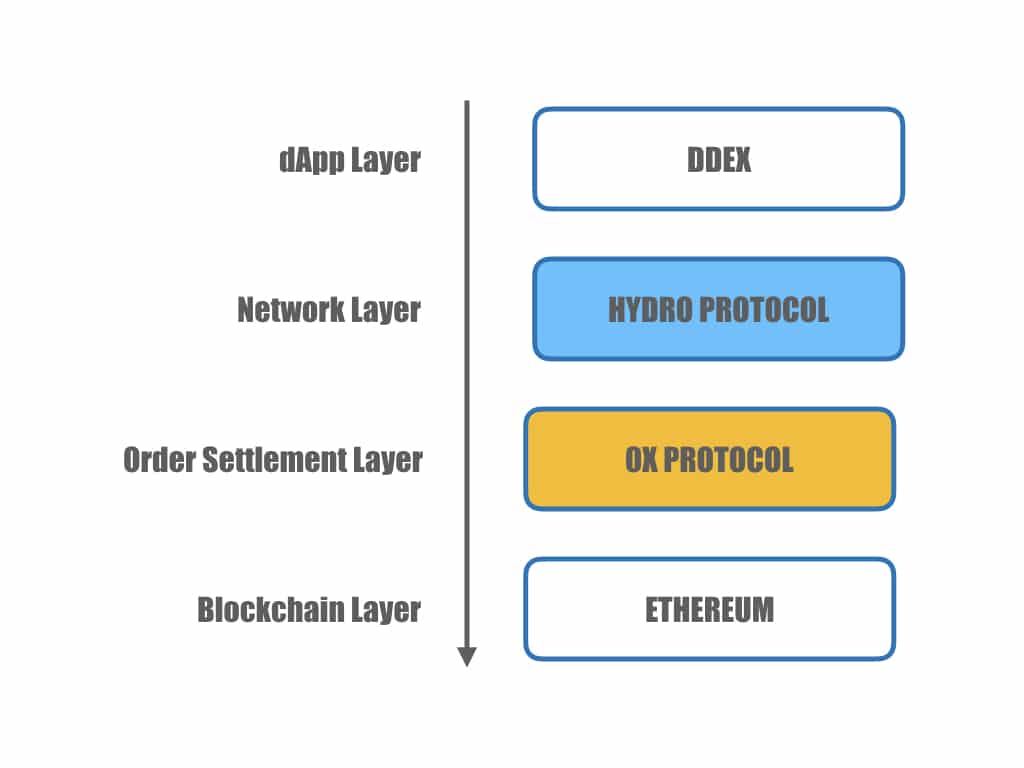

Order settlement for ERC20 tokens on the Ethereum network is handled by the 0x protocol. The exchange aspires to be blockchain agnostic eventually. In the future, it will add support for other blockchains. According to the white paper, support for QTUM blockchain is next. At that point, DDEX will support both ERC20 and QRC20 tokens.

DDEX, like other relayers, relays liquidity information off-chain and uses 0x at the order settlement layer. This allows it to do fast off-chain order relay, but immutable on-chain order settlement.

[thrive_leads id=’5219′]

Advantages

DDEX is different from other relayers and decentralized exchanges like EtherDelta. It uses economic incentives at the network layer. This incentive layer coordinates the execution of orders. The Hydro protocol “defines the rules for executing decentralized orders and provides the mechanism for order matching” at this incentive layer.

The incentive layer improves liquidity. Decentralized exchanges are dogged by poor liquidity. The DDEX incentive layer addresses the opened/closed duality of decentralized exchanges built on top of the 0x protocol.

Since everyone has the permission to match orders in an open decentralized exchange, open decentralized exchanges are more susceptible to order collisions. Order collisions are sometimes referred to as trade collisions. They occur when more than one address tries to match an open order.

Closed decentralized exchanges combat the order collision issue by only allowing the exchange to match an open order. In the closed implementation, multiple traders cannot commit to the same order.

Since orders are not shared on closed decentralized exchanges, liquidity can be an issue for nascent exchanges using 0x for settlement. The DDEX incentive layer uses a protocol that not only eliminates trade collisions but also allows more illiquid exchanges to strategically pool their liquidity.

Team

The folks that created the Hydro protocol, built the decentralized digital exchange as a proof of implementation. That team is consists of Tian Li, Kevin West, David Qin, Bowen Wang, Scott Winges, and Shanchuan Yin.

DDEX received backing from Draper Dragon, Consensus Capital, and most recently Alexis Ohanian, of Reddit fame, at Initialized Capital. Learn more about the team, advisors like Ohanian, and the hydro protocol here: https://thehydrofoundation.com/.

Conclusion

Given its unique network layer, DDEX should distinguish itself from other decentralized exchanges in terms of liquidity. So far the exchange is off to a great start. It offers the ability to trade many valuable coins.

Even though the founders hail it as an example of what can be implemented on top of the Hydro protocol in the white paper, since it charges transaction fees it is a revenue-generating project. As such, it competes with the likes of The Ocean, Paradex, Ethfinex, and other relayers charging transaction fees. Some of these competitors, like Radar Relay, which has a very slick interface and greater wallet support, offer decent liquidity, feature a substantial number of markets, and also boast impressive strategic partnerships. It will be interesting to see what alliances will form in the increasingly competitive decentralized exchange world.

Additional Resources

Website

Telegram

Medium

Twitter

Facebook

Reddit

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.