Interview: Halsey Minor on Transforming the Video World with VideoCoin [Part 1]

Halsey Minor is a serial entrepreneur with a resume that will make any startup nerd’s head spin.

The bulk of Halsey’s entrepreneurial experience comes from building, innovating, and investing in the then-nascent Internet world. Halsey is widely regarded as a pioneer of the Internet world, and has thrown his gauntlet into the rapidly-developing blockchain world. Halsey’s notable accomplishments, accolades, and experiences include:

-

- Founder of CNET, one of the first media sites to publish technology and consumer electronics reviews, news, articles, podcasts, videos, and blogs in 1994. During Minor’s eight-year leadership, CNET became one of the Internet’s first profitable companies. Halsey led the site to become a NASDAQ 100 company, and it was eventually acquired by CBS Corporation for $1.8 billion in 2008.

- Co-founder and early investor of Salesforce.com, investing $19.5 million in 1999. Halsey worked closely with John Dillon and Marc Benioff. Halsey was the second-largest shareholder when Salesforce.com IPO’d in 2004 with a 10% stake.

- Briefly collaborated with Jeff Bezos, the founder and CEO of Amazon’s, as per this 1999 relic Wired article.

- Halsey spun off CNETs technology to a web-publishing software company called Vignette in 1997 and acquired a 33% stake. Vignette would later become one of the most successful IPOs in the following tech boom and had a market cap of around $26 billion.

- Halsey provided seed funding for the music service Rhapsody in 1998.

- Halsey sold Grand Central Communications to Google in 2007.

- Founded Uphold, a digital money exchange service and early Coinbase competitor in 2014.

- Founded LivePlanet, an end-to-end capture, distribution, and monetization system for immersive video.

- In November 2017, Halsey launched VideoCoin, a blockchain-based project aimed at building video infrastructure for the blockchain-enabled Internet.

What is VideoCoin?

VideoCoin recently closed their pre-ICO fundraising round and beat their goal of $35,000,000.

In broad strokes, VideoCoin is a distributed computing project that aims at storing, encoding, and streaming video at an affordable, efficient, and sustainable rate. VideoCoin aims to utilize unused or underutilized computers in data centers to facilitate the powering of the network.

Halsey’s project will rival cloud-based video processing providers such as Amazon Web Services and provide the same services at an estimated 60% to 80% discount, while also providing video producers the ability to build their own apps within the VideoCoin ecosystem.

Editor’s note: Getting the chance to interview Halsey Minor was awesome, and we made sure to ask a variety of questions that allowed him to shed light on different aspects of the cryptocurrency world from his unique series of high-level experiences. Questions highlighted in italics and bold were shortened to save readers from our interviewer’s (my) rambling.

This is the first part of a two-part interview and primarily focuses on Halsey Minor’s new project VideoCoin, how he applied his experiences founding CNET and co-founding Salesforce.com apply to blockchain entrepreneurship, and how Halsey sees the future development of the video industry.

The second part of the interview contains dialogue around innovation and entrepreneurship with new technologies, problems with the current banking system, regulation, the global landscape, and how the cryptocurrency industry contrasts with the Internet industry in the mid to late 90s.

Alex: Could you tell me a little bit more about VideoCoin? Why did you guys start? What’s VideoCoin seeking to solve in the next year or two?

Halsey: Let me give you the history.

I’ve done a bunch of things you’re probably familiar with and a lot of them have involved launching platforms.

When I started CNET, there was no web publishing software. I created the companies and then wanted out. I kept 35% of it. They became the leading publishing company and an 11-billion-dollar company. I left CNET to help John Dylan and then Marc [Benioff] build Salesforce. Marc came to me and I was looking at buying CRM software and saw all the problems in the industry. I ended up putting $19 1/2 million dollars and leaving to basically help build the company for the next four and a half years. A lot of these things have been sort of an outgrowth of a lot of the businesses that I’ve started, maybe even all of them have been outgrowths of specific needs that I’ve had.

Just in this industry in general, just for background, I started my first company in crypto in 2013. It’s called Uphold. It’s a CoinBase competitor. It’s a great product. One of the few companies that are connected to the US banking systems so you can connect your bank account. It’s very profitable, it’s been very successful. It’s not as big as CoinBase but I ran that for two and a half years. There was so much regulatory stuff, it just drives me crazy. I brought an investor in as a CEO.

I left to build a VR video company called Live Planet. We have our own camera, we have our own cloud, we have our own software. The cloud ingests this video, which is really kind of 4K video. Then it has to process it to send it to Facebook or to YouTube or to Samsung Galaxy Gear or to Oculus.

And so, a single file that’s ingested, coming from the 4K camera, spins up hundreds of processes for encoding the video. Just as a kind of data point, if we took one of our cameras in and ran it for an entire month, 24/7, that our costs, just using our Google infrastructure, would be about $30,000.

So, the company is called Live Planet because the idea is to put these cameras everywhere. From zoos to theaters until you could essentially drop into any location around the world because these cameras are streaming live. In order to build the cloud, I’d hired Devadutta Ghat, who built Intel’s video streaming cloud, which they sold to Facebook. He built the software, he ran the data center and he did not go to Facebook with the acquisition. He’s one of the few people in the last 10 years who actually built a video streaming cloud. And by that, I mean encoding, which is all the processing part, the storage, and the streaming. We’re an interesting company in that we’ve got, in my case, very deep crypto experience going back to 2012 and a highly profitable business and very deep in experience in video.

[Editor’s note: this is really f*cking cool.]

I’ve been someone who’s always been fairly attuned to changes in the architecture of competing. I actually started CNET in 1993 as an internet company. We actually launched the website in April of 1995. So, it was very, very early. The architecture of the Internet as compared to AOL and all those other services, it seemed like the next logical step. When Marc came to me with Salesforce, the idea of getting rid of client-server software and building a centralized hub made a huge amount of sense in terms of cost.

What attracted you to Bitcoin and cryptocurrency?

It took me honestly a couple of years. I saw Bitcoin and other currencies as a way of forming a new kind of payment system. I have to admit, for a while, I really thought that the blockchain was really a technology looking for a solution. It took me probably about, really until 2016 or 2017 when I started to think about it as things like Ethereum started coming out. I started realizing that it’s actually an entirely new architecture for computing. In the simplest form, it just allows computing to be turned into a commodity in the same way that Uber has turned cars into commodities and Airbnb has turned homes into commodities.

It does that because it could do three things. It can prove that a computer has resources, it can prove that the computer has used resources, and then you have a ubiquitous payment system that doesn’t require money to be moved from border to border. I don’t have to pay our miners in China in yuan.

We started using these new payment systems. Two other parts that were sort of key catalysts was one, realizing that there’s 20% to 30% of servers that sit in data centers that are totally unused. They’re called zombies. If they were to mine bitcoin or some other currency, they would need to buy special cards, but all computers have a video encoder.

Every computer that’s sitting can do VideoCoin mining. So, you’ve got these huge resources that are out there. You have the ability now to compensate them across borders.

Video itself is going through a rapid transformation. It is itself at an inflection point. You’ve got the HD going to 4K going to HK and then you’ve got things like VR video, which we know very well. That’s really going from video being something you watch to life you experience.

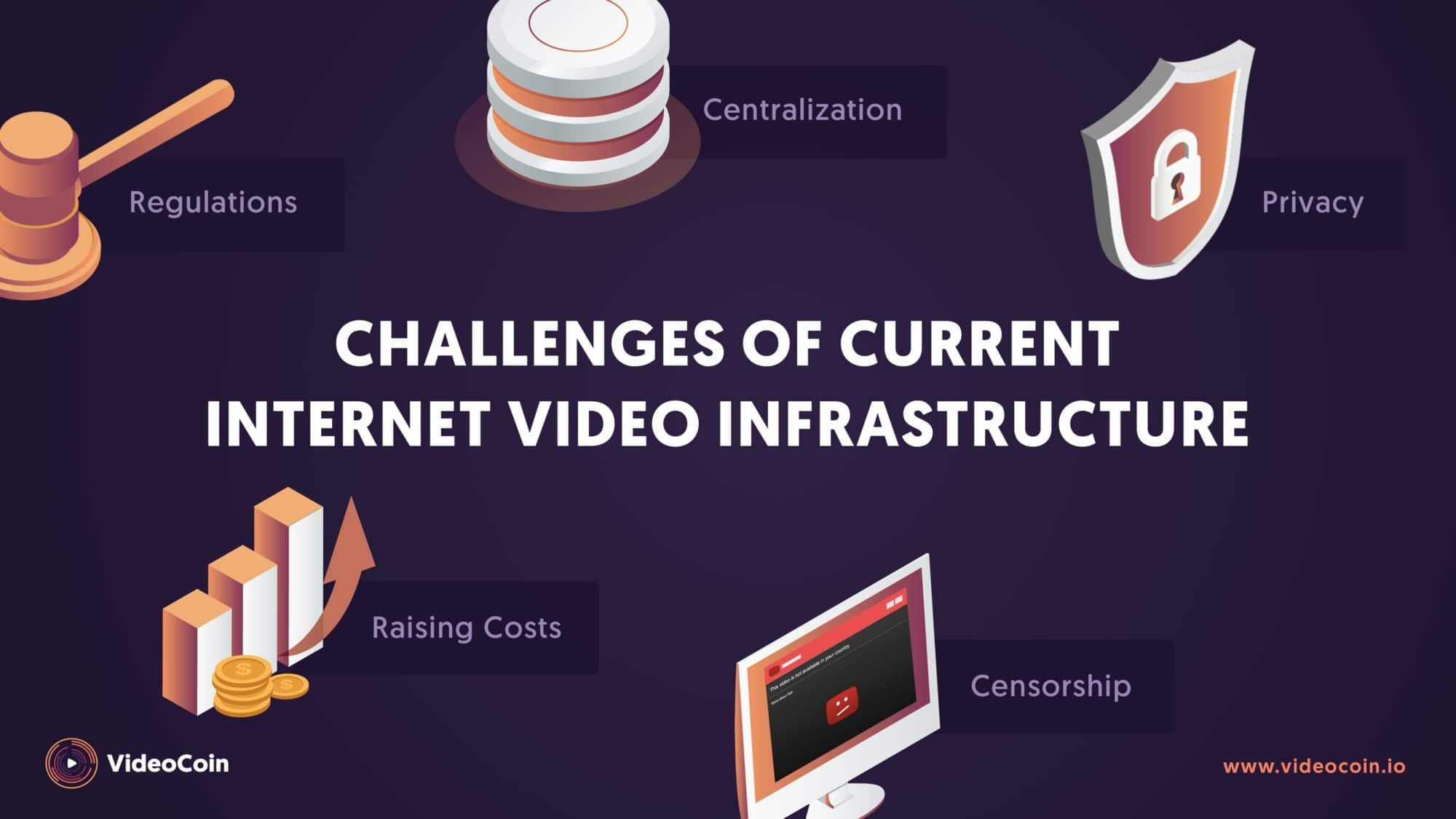

All of this has led to video now being 80% of the Internet and growing at a 25% compounded annual rate. It’s really made it very difficult for large media companies to deal with the costs of this transformation of consumption going from broadcast, which is basically costless, to being forced to connect to all of these consumers directly over the Internet and pay all these fees.

The last thing I’ll just throw in is that all of these media companies who are spending all this money on video, they’re mostly paying Amazon and Google, both of whom are their direct competitors. The only business that Amazon has that makes money is AWS and that’s the business they’re playing into.

Jeff Bezos is famous for saying that other people’s margin is his opportunity. Amazon has never actually had a profitable business. Everybody has been Amazon’s opportunity. The problem now, for the first time, Amazon has something to protect. AWS is 3/4’s or 4/5ths of the valuation of Amazon. They make a ton of money and you’ve gotten media companies who have rapidly escalating costs of video because video has gone from being delivered by satellite or cable to being delivered one to one over streaming and media companies.

You were talking about video itself as an inflection point. Do you guys have any plans to go beyond just the infrastructure of creating the VideoCoin system which is already awesome and I’m sure will have a lot of far-reaching effects on the industry? Do you guys have anything planned for onboarding more people to use video and your platform?

I’ll tell you a brief story about Salesforce. Marc Benioff started Salesforce, but he moved to Hawaii and for 13 1/2 years, John Dillon ran it. I lived in San Francisco and spent a lot of time with John. Mark was going to start something called Database.com. Database.com was going to be the cloud. I said to Marc, look, I just put $19.5 million dollars in this company for you to make Salesforce the CRM company and you go and build the cloud as another company. You should take your CRM app and just generalize it and build a cloud. This is part of a larger discussion that ultimately had him coming back and becoming CEO about three years into the life of a company.

What we’ve done is we built this app that ingests large amounts of video and is capable of taking that video and transforming the format to everything from Youtube360, Facebook360 to Oculus Rift, for instance. A huge amount of processing. The way I look at it is we’ve built our first app. That gives us a huge amount of knowledge because a lot of coins today, they’re building these theoretical solutions. They don’t actually know a specific use case that they’re solving for. We know one.

Here’s what happened at Salesforce. I built web publishing software because I knew exactly what I needed to build and that helped everybody else in the industry. One thing to point out was in the early days of Salesforce, everybody said, hey, it’s cheaper. What I did, there will be an ecosystem that will develop around Salesforce and Salesforce will end up being far more innovative than the software you’re buying for client server.

While it’s not apparent early on that it’s more innovative, there’s just a lower cost. That’s what ends up happening. So, I think that because we have an open source, we’re effectively an open source project unlike Amazon Web Services or Google.

I think you’re going to have a whole industry of people who are trying to innovate and build new applications just exactly as we’ve done. If you think about it, video is controlled by a very small number of companies and there’s been no innovation. You go past YouTube and it’s really hard to find anybody who’s done anything that is a significant innovation to video.

Now, we will change that with VR and maybe some others, but, I think in time, we will we will build other applications on top of our infrastructure. But we’ll also spend a lot of money and time trying to seduce developers to come in and build on top of our infrastructure. I think ultimately you should be able to develop video sites like you’d develop websites.

This is just a personal belief of mine because right now everybody has to live inside of the container of YouTube and their monetization system. I think one of the things that we can allow is for a lot more destination-oriented content sites to begin to flourish. Right now, people will build an app and they’ll sell it to the History Channel and it’ll collect its AWS. Let’s say an app will be bought by the Home Channel or Sci Fi. All of those apps are basically exactly the same and they just connect to AWS. They’re generally boring and don’t do anything breakthrough.

We have people like Hanno Basse, who’s one of our advisors, and he’s doing it because we as a company kind of solve two fundamental problems. How do we lower the cost that these guys are experiencing as video explodes on demand over the Internet, paying to Amazon and how do they figure out new monetization strategies with things like VR? To answer your question, I think there’s going to be a whole bunch of innovations.

What are your thoughts on innovation in the space, and how infrastructure-based projects like VideoCoin can help? For example, I’m thinking of how STEEM is building something called smart media tokens (SMTs), and many developers are using those to launch new functioning and profitable businesses. It’s really helping entrepreneurs break through current limitations.

Anytime that you can reduce the cost of something, you unleash new forms of innovation. Like FOX for instance, they want to put all of their sports content into the cloud because they’d like to then take that and start creating new products like the History of the Redskins or the history of a player, so they can basically create these sort of micro-content packages which they can monetize either by charging or with advertising.

They need to be able to put everything up in the cloud. I think there are a whole bunch of ideas emerging in crypto right now, as you point out, that are sort of next-generation video platforms. The Internet is now the Videonet. And so, I think with crypto, lower cost infrastructure de-centralization, I think you’re going to finally see a sort of reemergence of real solid video innovation.

Editor’s note: This is the end of part one. Please continue to Part Two, which contains Halsey’s thoughts on innovation and entrepreneurship with new technologies, problems with the current banking system, regulation, the global landscape, and how the cryptocurrency industry contrasts with the nascent Internet industry in the mid to late 90s.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.