- How to Buy Bitcoin with a Credit Card

- What Cards to Use

- Why Shouldn’t You Use a Credit Card to Buy Bitcoin?

- Conclusion

According to this LendEDU survey, one-fifth of crypto buyers are using credit cards. And the most popular coin, Bitcoin, is no exception. For those who don’t want to link their bank account to an exchange, buying bitcoin with a credit card can seem like a safe bet.

So how do you purchase crypto with a credit card? Are there any downsides?

How to Buy Bitcoin with a Credit Card

Here’s what to expect once you’ve drawn your credit card from your wallet: A lengthy KYC process if you’re completely new to the platform.

The process, of course, depends on the exchange. Generally, for a US citizen, your driver’s license should more than suffice. But just in case, it’s good to keep a scan of your passport ready. If the exchange can’t read your PDF or JPG file, be prepared to send it directly to their staff. If there is an issue, they’ll email you.

Of course, if your account is activated, and you’ve simply been using a bank transfer or wire before this, you should be good to go.

Once your account is confirmed, you should be able to use your credit card like you would on any e-commerce site. You select how much BTC you want to purchase, go through the steps of including your billing and card information and confirm the buy. Then in (usually) five quick minutes, you are the proud owner of more BTC, and you have the option to store or trade it on the exchange or transfer it to a hardware wallet for safekeeping.

Example: How to Buy Bitcoin with a Credit Card on Coinmama

Coinmama is one of the few exchanges that allow for credit cards, not just the debit versions. Like we’ve mentioned, signing up for Coinmama requires a KYC process. You must have either your driver’s license or passport scanned and ready before being able to buy Bitcoin. And make sure to have both sides of your driver’s license ready! You can upload yours as a common jpg file.

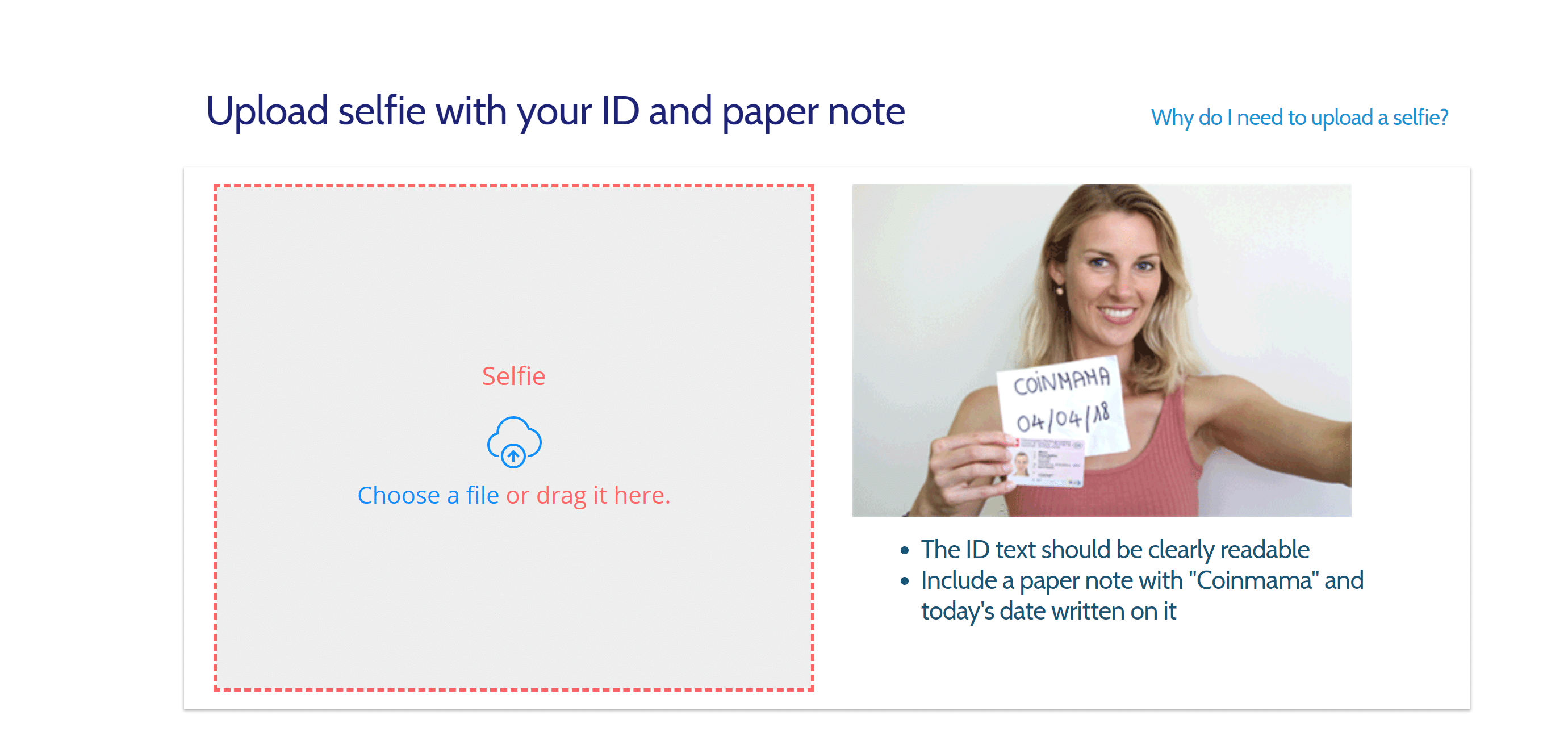

But you don’t only need your documents scanned. You’ll have to take a selfie with the document, and a piece of paper with the writing “Coinmama” and the date of the application.

It should only take a few minutes to finish the application process. You’ll immediately receive a confirmation email letting you know it could be up to a day before you can buy crypto. If your scan was high quality, there shouldn’t be any issue reviewing your documentation. And once the process is finished, you’ll get another email saying you’re good to go.

So once you are ready to buy, how can you go about it?

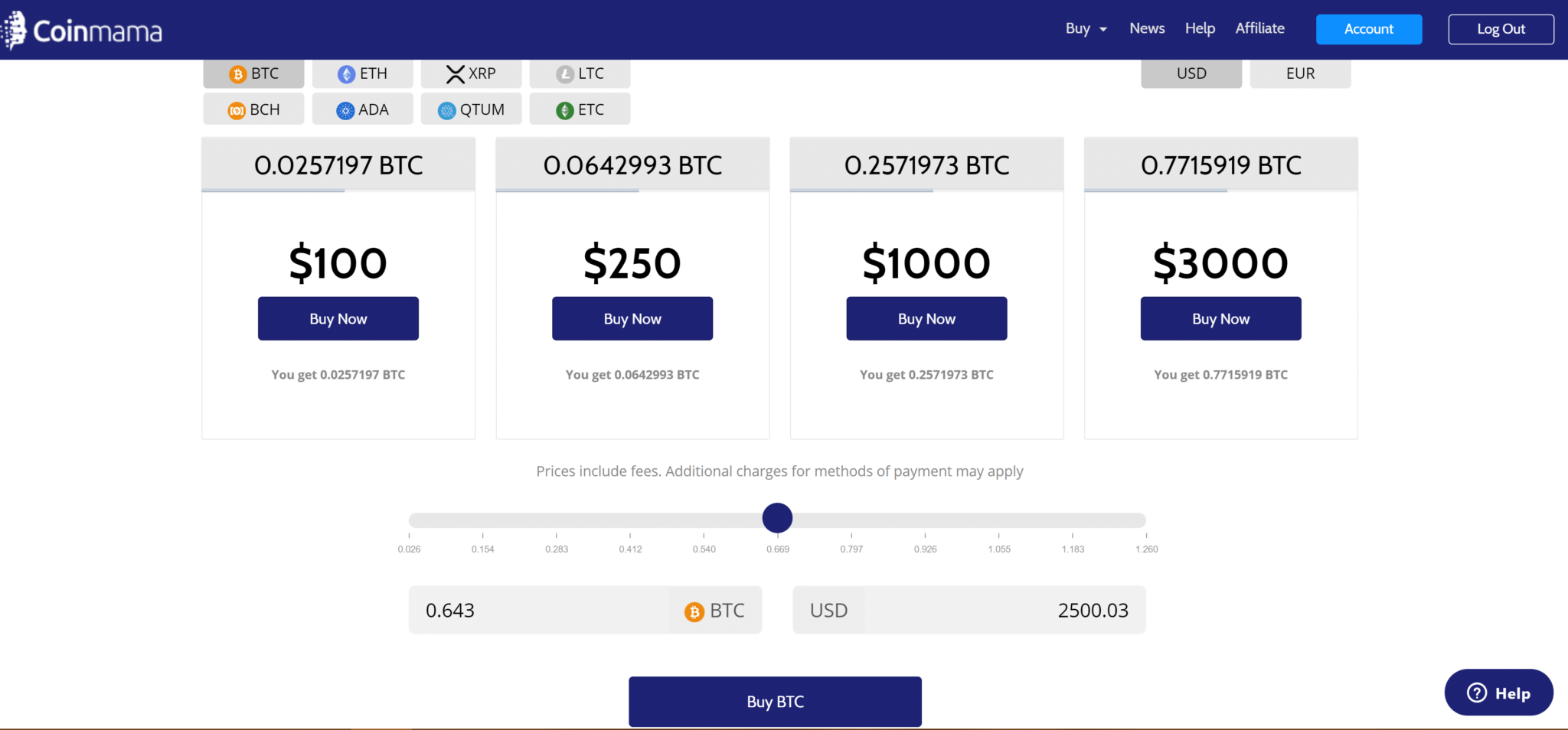

You have a few options. You can buy bitcoin for set amounts, such as $100 or $1000. Or, you can set your own price by bitcoin or the fiat equivalent.

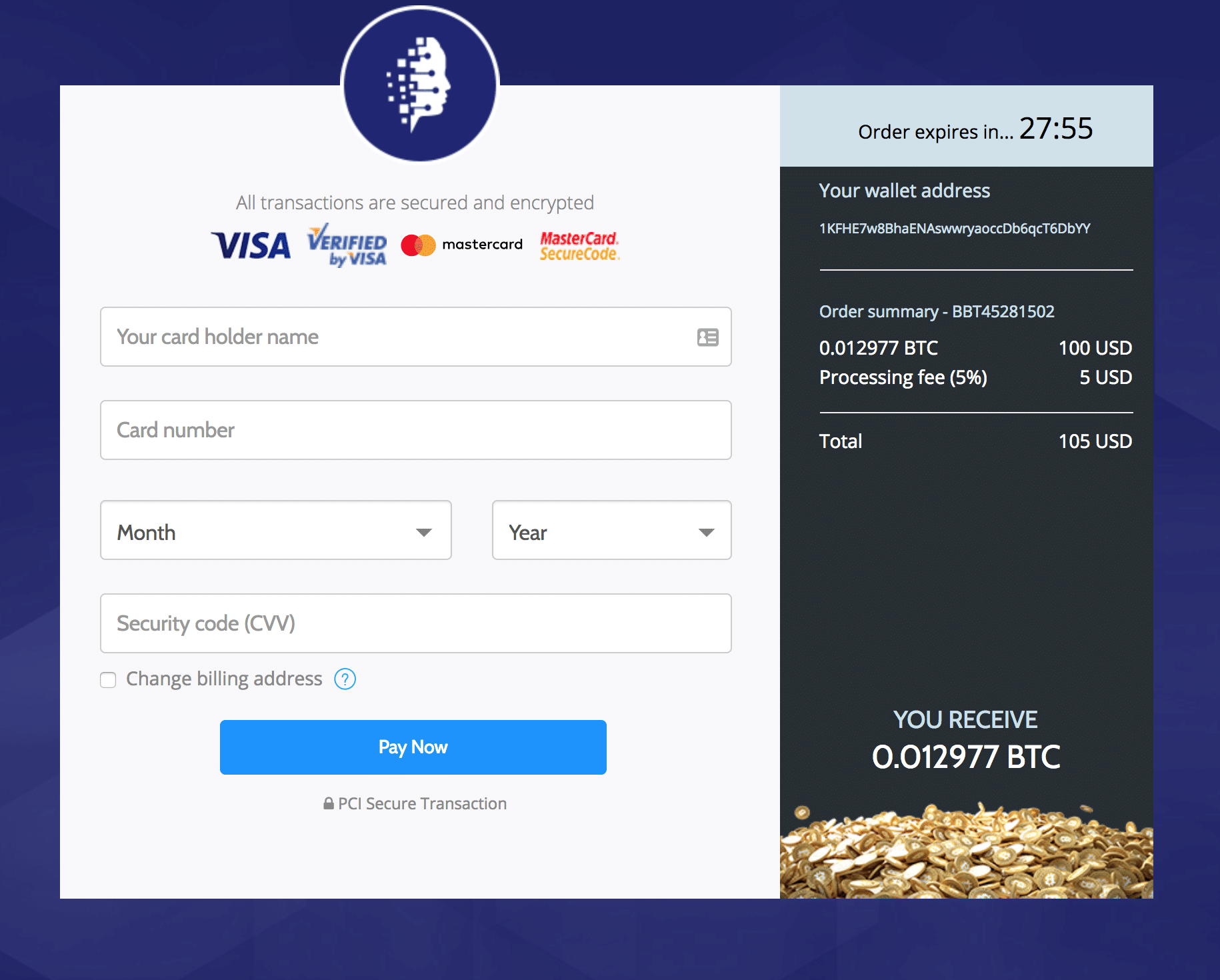

Once you click Buy BTC, the process is fairly simple.

First, enter your bitcoin (or another crypto) wallet address. Then, select your method of payment, followed by entering your card details. Depending on your card company, you may have one extra stop. Most likely, you’ll have to enter a security code sent to your phone or email from your credit card company. Once this is completed, wait for your transaction to change from In process to Approved. At this junction, it should take around 10 minutes for the BTC to be deposited into your wallet.

Yes, it’s that simple.

What Cards to Use

Most exchanges take debit cards. Even MyEtherWallet allows you to buy Ethereum if you have a Visa or Mastercard. Most popular exchanges like Coinbase will accept debit cards from both companies but not credit cards.

Those that do accept credit cards tend to stick with Visa and Mastercard as well. So, if you have American Express, you may be up a creek.

A select few exchanges accept a couple more payment options. Bitit accepts EuroCard and N26, and Bitpanda offers several online service transfers like Skrill, a PayPal alternative. If an exchange doesn’t accept your card but offers other online payment options, you can use them as a workaround. For example, use your credit card to load your Skrill or PayPal account with funds, then transfer it to the exchange.

Why Shouldn’t You Use a Credit Card to Buy Bitcoin?

You may want to avoid using a credit card for the same reason you’d want to avoid an online bank transfer: security. Exchanges aren’t as secure as wallets, and if hacked, your information could be at risk.

Keep in mind that you run that same risk every time you buy something online or use your credit card in the stores. So, if you’re using Amazon or picking up some toilet paper at Target, you are already running this security risk.

If you’re worried about security, check the exchange and look for a logo PCI DSS. This means their site is compliant with payment card security standards. While it can’t guarantee 100 percent security – after all, part of security is keeping your details safe – it is an important barrier against hackers.

[thrive_leads id=’5219′]

Conclusion

So, should you use your credit card for buying bitcoin? Right now, credit cards are one of the most convenient methods of payment, and the two most popular card options are widely accepted. In terms of security, you are not risking much more than if you had put your card in an ATM. And, if you are already verified on Coinmama or Bitpanda – you can already buy bitcoin with your credit card in just a few clicks.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.