- Verify Projects on Major Platforms

- The Best ICOs Will Have Solid Development Teams

- The Best ICO - Venture Capital Funding

- Community Support

- Examine the White Paper

- Research the Code

- Stay Determined and Don’t Cut Corners

Although highly risky, investing into a project early on can yield very fruitful results. As with any smart investment, you will need to do the proper research to protect your capital. The initial coin offering (ICO) market is unregulated, therefore, there is little recourse for you if you get scammed. That being said, ICOs are becoming more popular every day. There have already been over 3000 ICOs to date according to a study conducted by Reuters.

Choosing a winning ICO can be a difficult task. Even a psychic can’t guarantee that you will come out ahead. While no one knows the crypto future, there are still some steps you can take to find the best ICO to invest in.

Verify Projects on Major Platforms

Your search for the best ICO should start with researching what is being discussed on popular crypto forums, such as BitcoinTalk. Here you can get a wide array of advice, as well as some insight into what projects people are excited about. BitcoinTalk marks all of their ICO topics with [ANN].

[thrive_leads id=’5219′]

Both Reddit and Steamit have very active ICO forums. In addition to getting some insight into your potential investment, you can also pick up some really helpful tips from seasoned veterans. Don’t be scared to ask questions. You are going to want to steer clear if you don’t see your project mentioned on any of these platforms.

The Best ICOs Will Have Solid Development Teams

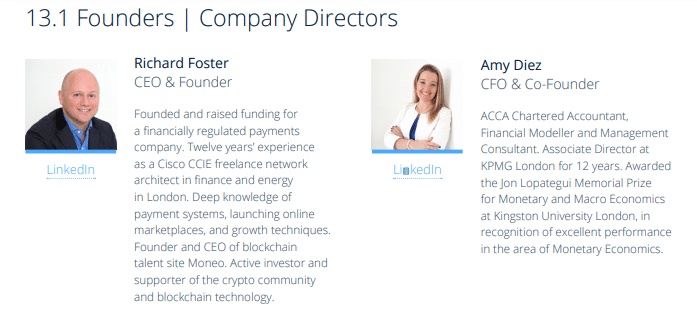

Always research the development team behind any ICO in question. These are the people who are going to be receiving your investment. Never invest in an ICO when their development team lacks the experience to accomplish the tasks required. Start with the team’s social media accounts. Social Media research can reveal a lot about a project’s team.

Do the team members interact with other professionals in the same field? This can help you determine an individual’s influence in the community. If the person in question is having technical discussions with other well-known crypto developers, this is a good sign that they are experienced in the space. Be sure to look for any red flags, such as newly created social media accounts or varying identities between platforms.

Never invest in an ICO when the development team is not public. This sounds like a no-brainer, but every month millions of dollars are lost because investors failed to investigate the development team behind the project. Ideally, you should be able to speak directly to the project’s development team via their listed contact information. You can ask for their credentials and other information that proves they are technically capable of handling the project.

The Best ICO – Venture Capital Funding

It is important that you communicate with the project’s development team. This will help you to determine the level of venture capital (VC) funding the project has already attained. VC funding is the lifeblood of many startups. VC investors are experienced professionals who won’t put their money into a project unless they are certain that the team has the ability to deliver on their promises. That being said, even the venture capitalists get it wrong sometimes.

Community Support

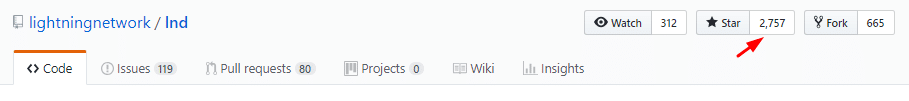

Another important factor to consider when finding the best ICO to invest in is the level of community support within the project. GitHub is a major launching ground for open-sourced projects, such as Bitcoin. The platform allows developers from around the world to work on the same project simultaneously.

A project with an active GitHub is seeing strong support from the development community. In contrast, a project with little to no activity is not. You should also investigate the platform’s Slack Channel and Telegram. Both of these platforms allow ICOs to keep potential investors in the know.

Examine the White Paper

Once you have completed your background research, you are ready to examine the white paper. You should read Satoshi Nakamoto’s Bitcoin white paper if you are unfamiliar with what a solid white paper should read like. Here is a brief rundown of common sections found in most white papers.

- Overview – This is where you find out about the market problems that the project intends to correct. This section consists of statistics, studies, and graphs supporting the reasons why the platform is essential to the market.

- Technical Specs – The technical specs section of the white paper is where you can find out exactly how the platform functions. This section should include a flowchart that explains the use of the platform.

- RoadMap – The roadmap tells you what the company’s implementation schedule looks like. You can learn a lot about the planned rate of development for your potential investment in this section. It is usually one page in length.

- Token Information – The token information section tells you what kind of token the platform utilizes. It should tell you if the token functions on a unique blockchain, or if it piggybacks off of another blockchain. ERC-20 tokens are the most common type of ICO token in existence today. These tokens function on the Ethereum blockchain.

- Team – The team section gives you the who’s who of the project. You can see who founded and who is currently developing the project in this section. Most team sections include a picture along with a small blurb explaining the team members experience and previous accolades.

Research the Code

You should never invest into an ICO that has no working code in place. Contact the developers and ask them for the coding to their project. Tell them you are interested in investing in their project, and that you want to review the coding to make sure it is sound. If they reply “no problem, it’s open source” that is a good sign that they are serious about their project. You should only invest in ICOs with open-source coding because the community is free to examine and contribute to making the code more technologically sound.

Stay Determined and Don’t Cut Corners

Now that you have a better understanding of the key factors to consider in this crypto investment process, you are ready to find the best ICO. No one can say for certain if you will profit, but you can hedge the odds in your favor by following the proper protocol when investing in ICOs.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.