Meaning “currency” in Mandarin Chinese, Huobi consistently ranks as one of the world’s top ten largest exchanges by trade volume. In this article, we look at everything you need to know as a potential Huobi user. Let’s examine fees, fund security, customer experience and more.

Huobi Exchange Key Information

[lptw_table id=”17286″ style=”default”]

User Interface and Mobile App

Available on iOS and Android, the Huobi mobile app features most of the functionalities available on the web platform. You can even complete tasks like account registration and verification directly via the app. In Google Play, the Huobi Global app has an average rating of 4.1 stars out of 3,730 reviews. However, in December 2018 and January 2019, some users have said that the Android app won’t let them login due to an error with Captcha. On the Apple App Store, Huobi boasts an average rating of 4.9 stars out of over 4,800 reviews.

Trading Options

Many centralized exchanges serve as the sole, centralized market maker. In contrast, Huobi also allows you to trade over the counter (OTC). This means that you can buy and sell cryptocurrencies peer-to-peer on Huobi. Even though this option exists on the exchange, it has yet to gain adoption from traders. Various commenters have said that there is a lack of OTC offers. Still, this is still an innovative technical feature.

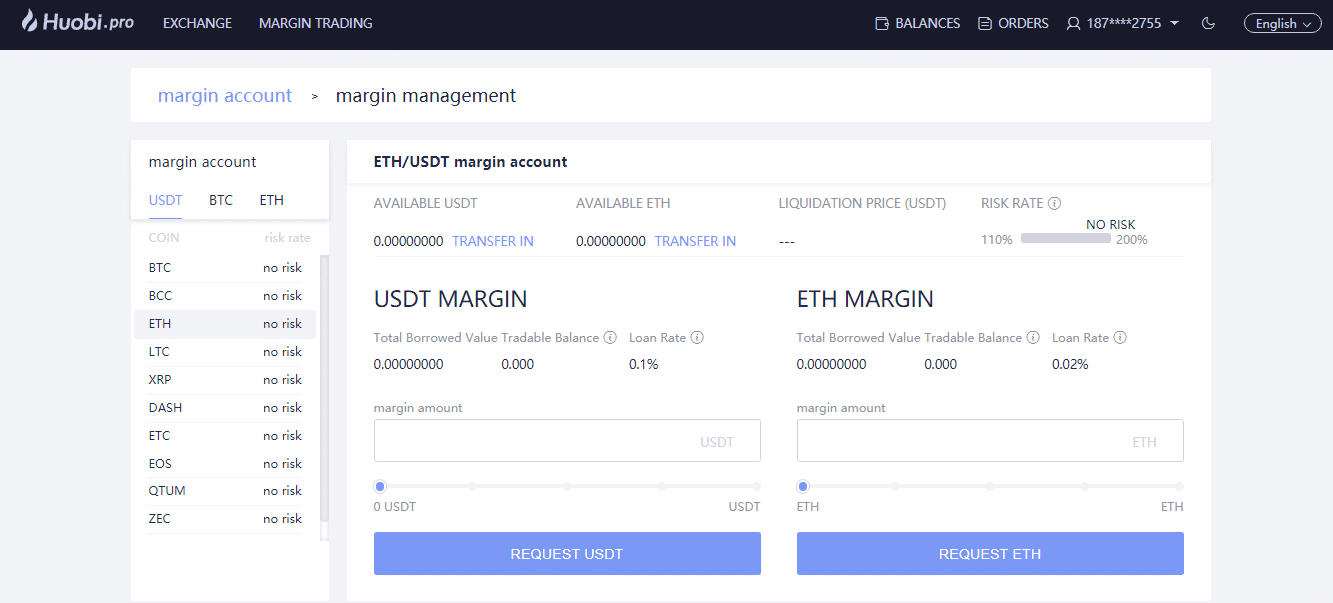

If you are a margin trader, Houbi has a separate platform specifically for this. You can access this by going to the margin tab in the header. The amount of leverage you can have varies from coin-to-coin. For example, BTC is around 3x. Compared to other margin trading platforms, this is low. Nonetheless, it is an attractive option for potential users.

In December 2018, Huobi Derivative Market issued BTC contracts and ETH contracts (including weekly, bi-weekly and quarterly, respectively), and flexible leverages, including 1x, 5x, 10x and 20x. In the future, more digital currencies will be issued to meet various investment demands.

Security: Is Huobi Safe?

Compared to other exchanges, Huobi continues to excel from a security perspective. Many top exchanges suffer from large-scale hacks, with varying results in terms of trading volume afterward. In 2015, a Bitstamp hacker withdrew 12,000 BTC from Huobi. However, this issue did not relate to the security of Huobi. Huobi reported a DDOS attack in 2015 but this did not cause a security breach. According to one review, an individual user lost USDT and EOS on Huobi. This reviewer states that the problem was caused by a technical error with Huobi’s 2FA. One comment suggests that it was the result of a phishing scam.

Huobi claims that its risk controls have been developed by the likes of Goldman Sachs. The exchange stores around 98 percent of funds in cold wallets. Moreover, Huobi now utilizes a decentralized exchange structure to prevent DDOS attacks. The exchange even has a User Protection Fund Initiative. Twenty percent of net revenue that the exchanges gains from trades will go to this fund, which it will use to buy back Huobi Token (HT). It also has a service called Huobi Security Reserve. As part of this, the exchange plans to store 20,000 BTC for insurance. This is a preventative measure that will help Huobi reimburse users in the case of any future hacks.

[thrive_leads id=’5219′]

Huobi Fees

Huobi has a 0.2 percent fee that applies to both market makers and takers for amounts between $0 and $5,000,000 over the course of a 30-day period. In comparison, other top exchanges like Binance have 0.1 percent fees. Meanwhile, GDAX has 0.3 percent fees.

In January 2019, Huobi Global launched a tiered fee structure that significantly reduces fees for higher volume traders. This is relatively competitive when compared to other exchanges. Users also have the option to reduce trading fees on Huobi by becoming a VIP member. This involves paying a monthly payment of HT, which varies depending on the membership level (1-5).

Like most exchanges Huobi has no fees on deposits. However, Huobi does have withdrawal fees and minimums that vary from coin-to-coin. For example, withdrawing Bitcoin (BTC) costs 0.001 BTC, with a minimum withdrawal amount of 0.01 BTC. For Tether (USDT), the flat fee is 5 USDT and minimum withdrawal amount is 20 USDT. Overall, this means that Huobi fees are generally higher than most exchanges for lower withdrawal amounts. A few exceptions exist. For example, TUSD has a withdrawal minimum of $20 but a withdrawal fee of only $2.

Currency Options

As of the end of January 2019, Huobi has 182 coins and 416 trading pairs. There are three major crypto markets for trading pairs (USDT, BTC and ETH) and one major fiat market (USD) for the US market. Some of the top crypto-to-crypto trading pair options (by trade volume) include BTC-USDT, ETH-USDT, TRX-USDT, EOS-USDT and EOS-ETH.

As of January 28, 2019, the only options for USD trading are BTC, USDT, and ETH. This is most likely because USD currency withdrawal and deposit services didn’t become available until January 4, 2019 for United States residents. Currently, for US residents wire transfers are the only option. Huobi also requires level 2 verification to access this feature.

For various locations throughout the world, you should check whether or not Huobi supports trading for your native currency. If you are in the US, for example, you probably won’t see the option to trade Australian Dollars (AUD) on the Huobi platform, but you will probably see an option for USD and vice versa. In other words, you probably will only see the fiat currency that is used in your current location.

Withdrawal Limitations

Similar to many exchanges on the market, Huobi has withdrawal limitations based on various levels of user verification. One thing you will notice is that withdrawal amounts vary greatly depending on your citizenship. For example, if you are a citizen of China, you can’t withdraw any funds as an unverified user or with level 1 verification. This option is only available at level 2 or above. In the United States, the exchange only requires level 1 verification. However, the amounts are relatively low: a daily limit of $2,000 and a monthly limit of $10,000.

Customer Service Experience

Compared to most exchanges, Huobi has above average customer service experience. Customer support is available 24/7, and response times only take two to three hours on average. Many consider this to be a rarity in the space.

There are two main methods that you can use to reach customer support. First, you can utilize the chat app that is available directly on the Huobi trading platform. Second, you can contact the team at support@huobi.pro. If you choose this option, Huobi asks that you use the registered email address associated with your Huobi account and include your user ID.