What’s the first thing that pops into mind when you hear “over-the-counter”?

For many, the phrase will create images of easy access to medication. OTC, however, has been around for quite some time and draws its roots from some of the first store-based exchange of goods. It refers more specifically to the easy access part than anything else.

The crypto markets are evolving, and big and small players alike are looking for the best ways to get involved. We’re going to take a deep dive into OTC as it relates to crypto and find out what opportunities the virtual currency markets are opening up for a new class of investor.

But before we do, we should probably get some pesky definitions out of the way:

Security (n): A security is any financial instrument which has a monetary value and is exchangeable/tradable on a market. Securities in most cases are used as a tool for making a profit but can also be used for technical reasons such as hedging.

Exchange (n): Most securities trade on exchanges. An exchange is a marketplace which trades securities and other complex financial instruments. They bring together brokers, dealers, and investors in a centralized way to standardize the buying and selling of these instruments. Through regulation, they also monitor markets to prevent fraud.

OTC (n): Over-the-counter is a fancy way of saying “decentralized trading”. Orders are not listed on a public order book. Clients can trade with each via broker without anyone else knowing about their transaction.

In the traditional financial world, companies that don’t have the right reputation and/or required funds to pay for exchange fees may go the OTC route to raise capital. In the crypto context, we are now seeing this phenomenon unfold as the ICO boom gathers pace.

Elsewhere, very large crypto holders (whales) would prefer to make large trades without drawing too much attention and therefore seek out specialized brokers to make this happen.

Biggest OTC Markets

It’s fairly difficult to gauge which markets and brokers are the biggest in the cryptosphere because a lot of business in this area is done privately. Vinny Lingham of the Civic project outlined some of his thoughts on the subject in a blog post and via twitter a few years back:

Overlooked fact: The OTC market for Bitcoin is bigger than the exchange market. Exchanges set the price but large trades don’t happen there.

— Vinny Lingham (@VinnyLingham) June 26, 2016

The key takeaway from his experience was that the wealthy do not use exchanges to purchase their Bitcoin. Because these whales trade in such large quantities, the orders would overwhelm exchanges and move the price dramatically. As a result, the volume of exchanges doesn’t represent the true supply and demand for Bitcoin.

Some of the well-established and respected OTC brokers in this space include:

- BitStocks

- CircleTrade

- Cumberland

- itBit

- JumpTrading

- IBC Group

- Genesis Trading

Unfortunately, these brokers only deal with high net-worth traders. Nevertheless, we’ll provide some alternatives for the so-called “little fish” in the following section.

How to Get Started

There are a number of ways to get started trading your favorite cryptocurrency over-the-counter:

ICO Investing

The trendiest OTC instrument to have arrived on the scene in recent years. In most cases the ICO model allows investors to support their favorite projects and receive tokens directly without strict oversight from authorities. Companies have raised enormous amounts of capital in only a few days creating the opportunity to drive the project goals forward. Here are some tips on how to find the best ICOs to invest in.

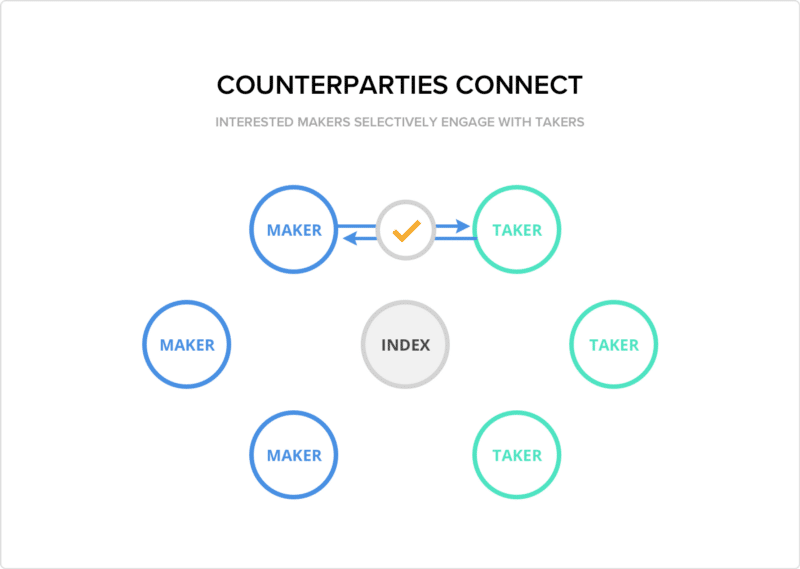

AirSwap

The AirSwap project is an innovative way to exchange cryptocurrency tokens via a global decentralized network. AirSwap is not a cryptocurrency exchange and does not list tokens or token prices. Instead, users of the network make tokens available to trade and the system with automatically match buyers and sellers according to their requirements:

To completely remove the middleman, their team has implemented exciting cryptocurrency tech called atomic swaps. Trading can be done via MetaMask or directly from your highly secure Ledger Nano S or Trezor hardware wallet. Check out our Ledger guide if you need some setup assistance.

AirSwap will only provide you a recommendation on trading prices. It’s probably a good idea to pay attention to prices listed on a cryptocurrency exchange like Binance to get a ballpark when making a trade. Furthermore, they only provide trading in Ethereum tokens at the moment but will presumably add other blockchain tokens as the platform develops.

LocalBitcoins

Based out of Helsinki Finland, bitcoin startup LocalBitcoins allows over-the-counter Bitcoin and altcoin trading in exchange for local currency. Payment methods and exchange rates are listed on the site. As you can see from below, prices vary quite a bit as a result of different supply and demand forces.

Contrast this with exchanges which list the latest trading price and give you a feel for what you should be paying for your cryptocurrency. Furthermore, LocalBitcoins provides an escrow service so you can trade with peace of mind.

Consumer to Consumer

There is nothing stopping you from buying and selling cryptocurrency directly to your neighbor. Most people do not understand or use crypto in this way because it’s not immediately necessary. But in places like Venezuela and Zimbabwe exchanging cryptocurrency over-the-counter is/was used to keep small economies going due to the Government destroying their economy with hyperinflated paper currency.

How to Make Money in OTC

Arbitrage

Arbitrage is the process of buying/selling a product or service in one location and then selling/buying it back in another location at a better price to secure a profit. In most cases, this happens virtually but it’s not uncommon for crafty arbitrage traders to carry large amounts of money to other countries to cash in on these differences.

Your first port of call would be to monitor exchange feeds to get an idea of how prices are trading. You could then pick up some crypto cheap on an exchange or one of the methods mentioned previously. Selling via AirSwap or LocalBitcoins at a better price would probably be your final step. Cryptocurrency arbitrage is fairly advanced and in volatile markets like crypto you really need to know what you’re doing.

Risks For and Against

Completely Open Marketplace

In the strictest sense of the word, OTC means you can trade in a completely open marketplace. In fact, you could sell x amount of Ethereum for y amount of Bitcoin and not be anywhere near to the current price (ETHBTC) found on any major exchange.

This can be either a good or bad thing, depending on your point of view. A completely open marketplace allows the free flow of trade between parties without middlemen interfering in the process.

The drawbacks though are a higher degree of fraud and price inconsistency. It’s much easier to get ripped off.

Regulation & Legal Concerns

Obviously, trading in any financial instrument will catch the attention of the authorities. Where there’s a profit to be made, big brother will be watching. Since OTC trading provides the possibility of avoiding official records, it’s important to know the risks associated with going this route.

Modern-day regulations tend to favor the rich (people and corporations) because only the wealthy can afford to list on some exchanges. Also, in many cases, only investors with a high net value (so-called “accredited”) are allowed to invest in other companies/projects. Cryptocurrency is a grassroots movement designed to level the playing field.

We have somewhat of a stalemate in all of this. On one hand, regulators are biased and cater for the rich and on the other, OTC traders are brokering deals recklessly without any thought to safe investing. A healthy middle ground needs to be found.

Liquidity

Liquidity refers to how easily you can buy or sell your cryptocurrency. Bitcoin is considered the most liquid cryptocurrency in the world because of high demand and therefore a high frequency of trading. Take a look at the market capitalization of Bitcoin on our crypto tracker. As you can see, the capital flows into Bitcoin have far outpaced any other cryptocurrency.

You won’t have a hard time buying or selling Bitcoin but in the current ICO boom, you will almost certainly have issues trading altcoins with low liquidity. Ethereum has fast-tracked cryptocurrency creation and it has therefore never been easier to create what is amusingly known as the “shitcoin”. Getting hold of some is usually not a problem. Getting rid of them, however, can be a real nightmare. Buying illiquid cryptocurrencies over-the-counter is risky.

Safety

A major benefit of online exchanges is a level of anonymity and fast trading. Carrying around a couple thousand dollars in cash to exchange for crypto is probably not the smartest idea. People have still been known to do this anyway. Use some common sense if you plan to trade in physical goods and/or currency.

Closing Bell

People have been negotiating since the dawn of humanity. Trying to get the best price for a product or service is possibly just the nature of the human beast. Over-the-counter could mean a decentralized international marketplace or simply making a deal with your neighbor.

In the crypto context, if it weren’t already a sort of wild west experience, OTC services are springing up to provide untested opportunities for entrepreneurial businessmen/women, brokers, traders, investors and dreamers alike. In the dusty digital towns of the new frontier, amazing bargains can be found while other deals go bad. Where will you slot in?

[thrive_leads id=’5219′]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.