The Internet of Services (IOS) is a blockchain infrastructure that’s aiming to solve maybe the biggest problem in blockchain today – scalability. The platform’s native token is the IOS token, IOST for short.

Market Problem: Current blockchain architecture has seemingly hit a plateau in which additional adoption only leads to exorbitant fees, slow transaction times, and poor throughput. Even though some second-layer scaling solutions are being implemented, they’re largely untested and may still not reach the level of scalability that an enterprise-level company like Amazon would need.

The IOS team believes that the current consensus protocols and blockchain architecture are the inherent causes of these scalability roadblocks. In this IOS beginner’s guide, we’ll look at all aspects of the blockchain infrastructure project including:

- How does the Internet of Services (IOS) work?

- IOS token (IOST) and Servi

- IOS team and progress

- Trading

- Where to buy IOST

- Where to store IOST

- Conclusion

- Additional IOS resources

How does the Internet of Services (IOS) work?

The Internet of Services (IOS) utilizes five primary innovations to traditional blockchain architecture and consensus algorithms. Let’s take a closer look at each one individually. Warning: It’s going to get a little dense.

1. Efficient Distributed Sharding (EDS)

Before getting into EDS, you need to have an understanding of how sharding works. Sharding splits the nodes on a network into groups who then verify a proportional number of transactions. The groupings enable concurrent verifications to take place, increasing the network throughput.

This poses a few questions, though. How do you select which nodes are in which shard? How can you remain resistant to malicious nodes? What’s the node leader election process? (Bitcoin does this through mining.)

To answer these questions, IOS uses the Distributed Random Protocol (DRP). Simply put, this protocol implements client-server communication with non-interactive zero-knowledge proofs (NIZK) and publicly verifiable secret sharing (PVSS) to create an unforgeable, uniformly random value. That may not have been so simple… The IOS white paper spells out the protocol in more detail.

DRP works great if there are no malicious or failing nodes on the network. But, we know that often isn’t the case. To prevent the impact of the activity caused by these nodes, IOS elects leaders using Algorand and Omniledger. These mechanisms ensure that leader nodes run the DRP protocol, and if they don’t, are then excluded from participating on the network.

2. TransEpoch

IOS switches batches of nodes in and out when transitioning between epochs. To do so, it uses TransEpoch, a node-to-shard transition assignment protocol that allows remaining nodes to continue working while having new nodes bootstrap and download history data.

The TransEpoch algorithm keeps the Byzantine Fault Tolerance (BFT) consensus on each shard. This essentially means that malicious nodes shouldn’t be able to take over the shard during the transition.

3. Atomix

With any sharding system, there’s the likelihood that you’ll need to make transactions across shards. This causes an extra layer of complexity that opens the network up to double spend hacks and inaccuracies between the transaction ledgers of different shards.

IOS’s implementation of the Byzantine Shard Atomic Commit (Atomix) protocol should make those problems a non-issue. Here’s how it works:

- Node a in shard A wants to send funds to node b in shard B.

- If the nodes in A approve the transaction, they’ll log it in A’s blockchain.

- Simultaneously, the client will lock the a funds into a transaction message and send it to B.

- A sends the transaction to B’s blockchain for validation.

- If the nodes in B approve the transaction, b receives the funds.

- If at any point in the process the nodes reject the transaction, the funds return to a.

4. Proof-of-Believability (PoB)

Proof-of-Believability separates all of the IOS nodes into two leagues: believable and normal. First, nodes from the believable league quickly process transactions. After that, the normal nodes validate samples of the transactions and provide verifiability.

The likelihood of a node being selected for the believable league is based on its believability score. This score is comprised of the token balance, reviews, and community contributions, among other things.

The purpose of the normal nodes is to ensure that the believable nodes are acting honestly. If a normal node catches a believable node acting dishonestly, that believable node will lose all of its tokens and its believability score will return to zero.

5. Micro State Block (MSB)

Having each node in a network store the entire blockchain is great for security and immutability. However, as more transactions attach to the chain, this process becomes time and resource intensive. Instead, IOS prunes blockchain storage through Micro State Blocks (MSBs).

With this strategy, each shard only stores the headers of previous blocks and the blockchain state is dispersed across multiple shards. Because of the MSB generation protocol, nodes only need to validate the last part of the blockchain as opposed to checking the entire thing.

IOS token (IOST) and Servi

IOS token (IOST)

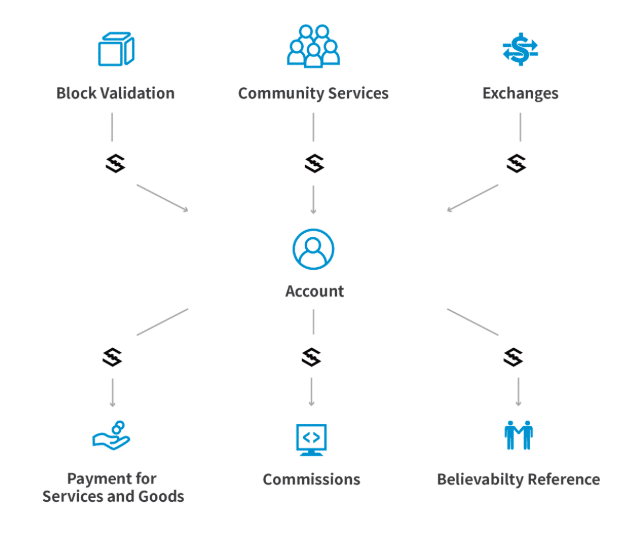

The IOS token (IOST) is the medium of exchange on the IOS network and a factor into a node’s believability score. Additionally, you receive IOST by validating transactions and contributing computing power for services such as smart contract execution.

The team minted the entire supply of IOST (21 million) during the private ICO event. They distributed the tokens accordingly:

- 40%: Token Sale

- 35%: IOS Foundation

- 12.5%: Community Building

- 10%: Team

- 2.5%: Investors and Advisors

Servi

The amount of Servi is another main factor in a node’s believability score calculation. You receive Servi when you provide services to the community, evaluate third-party services, and/or help out in other ways.

You’re unable to trade or exchange Servi, and your Servi balance resets to zero when you validate a block.

[thrive_leads id=’5219′]

IOS team & progress

The IOS team consists of over 30 members spread across Asia and North America. Resumes include CoinLang creator, EtherCap CTO, Forbes 30 under 30, National Olympiad in Informatics Gold Medalist, and numerous other roles. IOS also has an advisory board that includes names such as Yusen Dai (Jumei co-founder), Ryan Bubinski (Codecademy co-founder), and Robert Neivert (500 Startups venture partner).

An impressive amount of companies and venture capital firms have partnered with and invested in the project as well. The list includes Huobi, FBG Capital, and Sequoia Capital.

With a focus on scalability and enterprise-level usage, IOS is competing with decentralized application (DApp) platforms that have the same focuses. Obviously, IOS’s biggest competitor is Ethereum. However, EOS and NEO have come out with announcements that they also plan to solve the scaling issues that have plagued other blockchain projects.

ICON, Lisk, and VeChain also aim to provide blockchain solutions to enterprise clients. In the end, there are plenty (and will probably be plenty more) DApp platforms that IOS competes with.

Trading

The IOST price saw one sharp spike shortly after the ICO but hasn’t had much volatility since – a rarity in the cryptocurrency space. It’s unclear what may have caused that initial spike to the all-time high of ~$0.13 (~0.00001 BTC), but it could’ve just been investors simply finding out about the project.

After the end of the January pump, the IOST price immediately dropped down to almost ICO price levels. It continued to slowly drop through most of March before turning around. Starting at the end of March, the price steadily rose and is now at ~$0.05 (0.000006 BTC).

baseUrl = “https://widgets.cryptocompare.com/”; var scripts = document.getElementsByTagName(“script”); var embedder = scripts[ scripts.length – 1 ]; (function (){ var appName = encodeURIComponent(window.location.hostname); if(appName==””){appName=”local”;} var s = document.createElement(“script”); s.type = “text/javascript”; s.async = true; var theUrl = baseUrl+’serve/v3/coin/chart?fsym=IOST&tsyms=USD,EUR,CNY,GBP’; s.src = theUrl + ( theUrl.indexOf(“?”) >= 0 ? “&” : “?”) + “app=” + appName; embedder.parentNode.appendChild(s); })();

This project has a long roadmap ahead of it, so it’s difficult to say what may affect the price. Overall market conditions will most likely be the biggest influencer. Partnership announcements could lead to some positive price actions as well.

Where to buy IOST

You can purchase IOST on Huobi, Binance, or OKEx with BTC or ETH. However, the coin has the largest trading volume as a trading pair with Bitcoin on all three exchanges.

If you don’t own any cryptocurrency, you can first pick up some Bitcoin on an exchange like Gemini or GDAX.

Where to store IOST

Because IOST is currently on the Ethereum network, you can store it in any wallet with ERC20 support. MyEtherWallet is a great online choice while the Ledger Nano S is a solid hardware wallet you can use.

Once the team launches the mainnet, you’ll want to store your coins in the official wallet that they provide. This launch isn’t scheduled until Q3 2019, though, so the team hasn’t released that wallet yet.

Conclusion

IOS is attempting to build a more scalable blockchain infrastructure. Easily one of the more complex projects in the space, it’ll be at least a year before we’ll be able to measure its success.

If the team can achieve the ambitious goals they’ve set for themselves, we may see an entirely new blockchain infrastructure conquer the space. However, with the number of developers working on scaling solutions for projects that are much further along, it may be too late.

Additional IOS resources

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.