- Bitcoin & Ethereum’s Challenges

- Directed Acyclic Graph

- Change Blockchain Itself

- What Will Replace Blockchain?

Should we replace blockchain with something else? That’s a question many technologists are asking in the wake of scaling challenges for key blockchain platforms.

Blockchain is undergoing some growing pains. The core platforms that are the most well-known in the blockchain ecosystem, Bitcoin and Ethereum, have both run into challenges over the past year with scalability.

Bitcoin & Ethereum’s Challenges

For many users, Bitcoin’s transaction confirmation times have always been too long (if you wait for six blocks, as recommended). Last year, Bitcoin’s fees also soared with the popularity of the network as the 1MB block limit prevented miners from including many transactions.

Ethereum has suffered similar setbacks (though not as dramatic) with its transaction times and gas requirements. The notable and oft-cited example is how the Cryptokitties trading card dapp overwhelmed the network for a short time last year.

[thrive_leads id=’5219′]

So far, neither network has implemented a solution that fundamentally fixes these problems. Moreover, many people believe that scalability is a problem that’s inherent to blockchain as a protocol. The more people you include on a network and the more transactions you need to verify, the harder it is to reach consensus.

As a result of these setbacks, some experts are questioning whether blockchain in its current form can truly solve the enterprise and society-level problems it originally set out to address. On one hand, some argue that blockchain itself is an inadequate technology and we need to replace blockchain with a different distributed ledger technology. On the other hand, others claim that blockchain can be fixed, but it will need significant redesign.

Directed Acyclic Graph

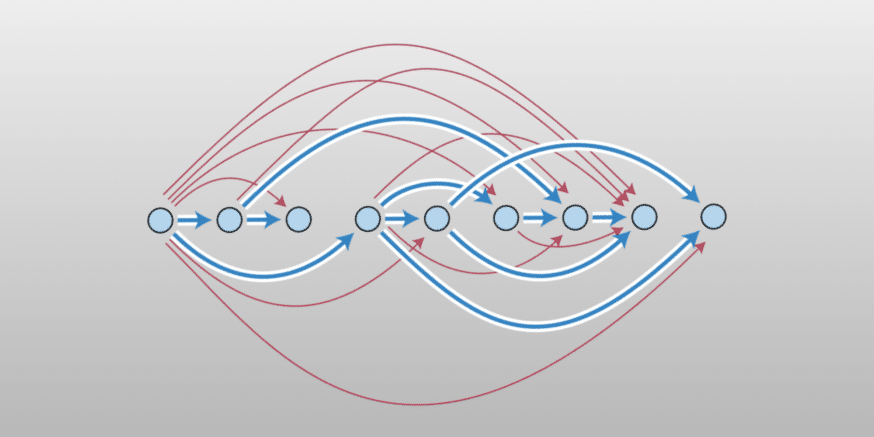

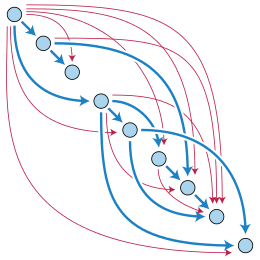

Blockchain is not the only kind of distributed ledger technology out there. There are other ways of keeping a secure record without using blockchain. One such alternative that could replace blockchain is directed acyclic graph (DAG).

What is DAG?

The result is a crisscrossing web of confirmations where each new transaction has at least two parent transactions that confirm it. In turn, those parent transactions point to earlier transactions. Over the course of cascading confirmations that grow exponentially, all new transactions end up referencing the same set of prior transactions.

The upshot of this architecture is it scales along with the number of nodes in the network. In addition, it stays cheap to operate, with little to no transaction fees. Since each node submitting a transaction must verify other transactions first, the network scales itself and there are no miners to pay rewards to.

The drawbacks of DAG are theoretical at the moment, but could soon become real. Without a lot of network traffic, DAG architectures become vulnerable to attack. For this reason, in the early days, DAG projects usually need a central coordinator to make sure there aren’t rogue chains and that all transactions get an equal amount of confirmation. DAG also is a new technology with less testing and proof behind its security than blockchain.

Projects Using DAG

- Byteball – Byteball is a cryptocurrency, like Bitcoin, but built on DAG infrastructure with the intention of massive scaling. It also includes contracts capability for conditional payments.

- IOTA – IOTA is focused on building a network for fee-free transactions between machines in the internet of things. It’s DAG architecture, known as the Tangle, enables these transactions but has also come under fire.

- Hashgraph – Hashgraph has been touted as the blockchain-killer. It’s an open project to develop DAG for widespread use, using Gossip, where each node randomly chooses another node to share all its information with. However, it hasn’t launched yet.

IOTA is a top ten cryptocurrency, giving legitimacy to DAG’s potential to replace blockchain. However, as you can see, there still aren’t many DAG projects, and the technology is fairly new and untested.

Change Blockchain Itself

The other option is to replace blockchain with a better version of itself. However, these new versions would require some fundamental changes to the way blockchain currently works. Let’s take a look at some of those options…

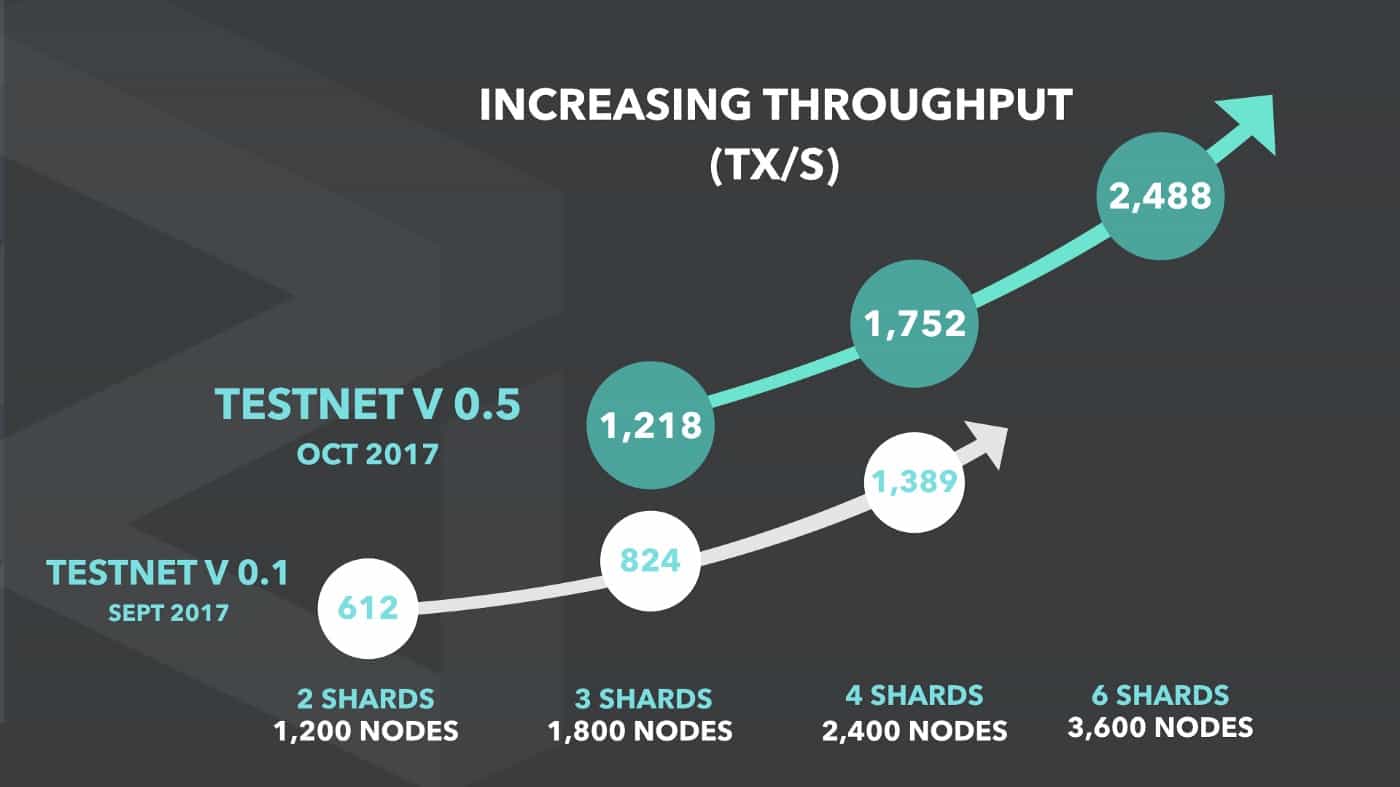

Sharding

Sharding involves splitting the network of full nodes up into smaller groups. These smaller groups would verify a proportional amount of the total transactions on the network. As the mining network grows, you shard it into more groups, meaning transaction capacity scales with the number of mining nodes.

The challenge here is sometimes ordering matters, and transactions need to see the confirmation of something in another shard before it can be confirmed. This is especially true if you try to shard smart contract or dapp transactions. As soon as you introduce too much cross-shard communication, you lose the advantages of sharding in the first place. Additionally, nobody has solved the problem of state sharding, which would allow complex contracts to operate on a sharded network. Right now, sharded networks like Zilliqa can’t support anything outside functional contracts.

Ethereum is currently working on state sharding as part of its solution to scalability.

New Consensus Mechanisms

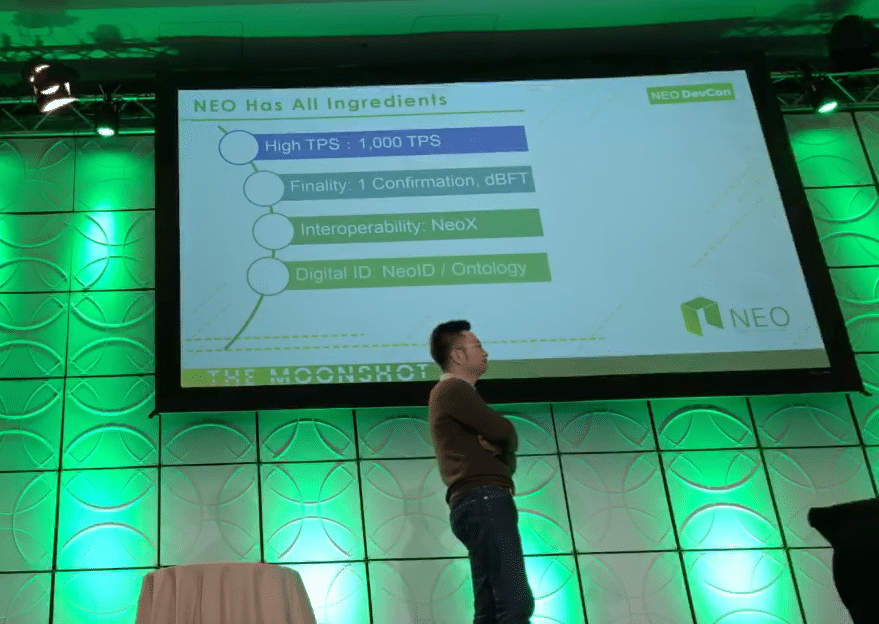

Several projects are experimenting with new consensus mechanisms to replace blockchain consensus as we currently know it (i.e. Pow and PoS). These new consensus methods generally involve reducing the need for the entire network to participate in consensus by randomly electing a smaller group of nodes to verify and confirm transactions.

Byzantine Fault Tolerant consensus has become the generally recognized standard for this approach. NEO is probably the most well-known blockchain project to implement BFT consensus (NEO uses dBFT). Recently, NEO announced their network had reached 1,000 tx/sec without sharding in testnet conditions.

Side Channels & Trusted Nodes

The launch of the Lightning Network on Bitcoin raises another potential reinvention of blockchain. The idea is to use side channels to settle transactions between parties who frequently do business. These transactions wouldn’t need to be settled on the blockchain except for when you open or close a channel.

Another option is to operate a second tier of mining nodes that serve as trusted nodes. These supernodes could verify more transactions more quickly. One example of such a system is Dash.

While these tactics do reduce overall demands on miners, they’re really stopgap measures that don’t address the underlying issue of blockchain scalability.

What Will Replace Blockchain?

Blockchain still has some development ahead of it. These are the early years of this new technology, and it’s possible the solution that will replace blockchain hasn’t even been invented yet. Still, these issues will be make or break over the coming years if blockchain is to gain wide adoption.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.