Bitcoin Wants to Pump…You Up!

The good times keep on rollin’ in. The market was fairly quiet this week. Well, quiet until late Monday when it rocketed up more than 10 percent overnight. And this pump wasn’t followed by a dump, either. The total market cap continued to climb through the remainder of the week, finishing over 22 percent higher than last Friday.

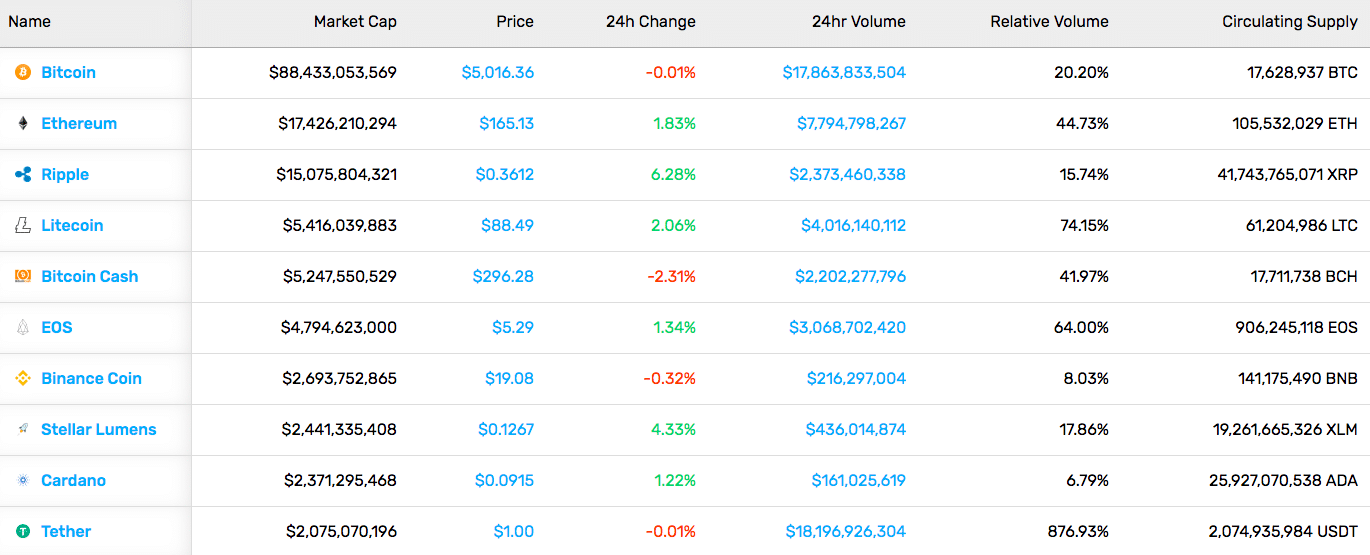

If you were an altcoin without double-digit growth this week, you were doing something wrong. Out of the top 100 coins (excluding stable coins), only three coins were in the red over the last seven days. How about our three leaders, though?

Bitcoin, most likely the catalyst for this rally, surged ahead 22.56%. It now sits above $5,000.

Ethereum was close behind with a 17.19% gain. Its price is now comfortably above $160.

XRP came in at third, jumping up 16.83%. The price is floating right around $0.35.

SEC Gives Some Guidance: On Wednesday, the SEC released a Framework for “Investment Contract” Analysis of Digital Assets, but the contents left some community members disappointed. Rather than provide any legally-binding guidance, the framework only “represents Staff views and is not a rule, regulation, or statement of the Commission.”

Additionally, the document doesn’t outline anything that the SEC hasn’t already explained. It effectively walks through the different pieces of the Howey Test and describes how they may apply to cryptocurrencies and initial coin offerings (ICOs). The framework wording implies that a good chunk of digital assets aren’t doing so well with this test.

So, in other words, your “utility” token is still probably a security in the eyes of the SEC.

SEC Gives the Go Ahead: In the second piece of SEC news this week, the organization issued its first “no-action” letter, permitting an ICO to sell tokens. The recipient, TurnKey Jet, Inc. (TKJ), wrote to the SEC on Tuesday asking if the commission would take action if they held an ICO. The 13-page letter outlined several aspects of the business including the token sale details, need for blockchain, and internal analysis of the Howey Test.

In response, the SEC wrote that they would take no action as long as the company met certain criteria. Specifically, they require that:

- “TKJ will not use any funds from Token sales to develop the TKJ Platform, Network, or App”

- “TKJ will restrict transfers of Tokens to TKJ Wallets only”

- And “…each Token will represent a TKJ obligation to supply air charter services at a value of one USD per Token”

If TKJ can follow these rules along with a few additional ones, they can hold their ICO without having to register with the SEC.

People Saying Things

Former Dogecoin CEO Elon Musk: As part of an April Fools Joke led by the Dogecoin Twitter account, Elon Musk temporarily changed his Twitter description to former Dogecoin CEO. And in true Internet troll fashion, continued to Tweet positive Doge statements and memes. He’s since removed the title, but we’re sure the trolling will continue.

Looks like you’re the CEO now @elonmusk, DM us where to email the access codes 😀 pic.twitter.com/xaftsRZ8MA

— Dogecoin (@dogecoin) April 2, 2019

8 of the Best Blockchain Development Tools for Ethereum Developers: Interested in developing some smart contracts but don’t know where to start? We’ve got you covered.

How Blockchain Is Changing the Rental Property Market: There are three things to consider when valuing a rental property – blockchain, blockchain, blockchain.

What Does a Blockchain Consulting Firm Actually Do?: It’s a lot more than just charge you an arm and a leg.

Ethereum Predictions for 2019: Will the Bulls or the Bears Win Out?: Ethereum Bears vs. Ethereum Bulls. Who will win? Only time will tell.

Gauging the Blockchain Buzz at South by Southwest: CoinCentral’s Steven Buchko hit the streets at this year’s South By to see if blockchain’s still got it in the bear market.

[thrive_leads id=’5219′]

What Is Holochain (HOT) | A Guide to the Agent-Centric Non-Blockchain: Learn about the project trying to reshape the way we think about distributed apps.

MimbleWimble | An Answer to Scalable Blockchain Privacy: Hocus. Pocus. Alakazam. MimbleWimble is working to make your transactions as private as it can.

The Potential of Cryptocurrency: How It Could Be the Best Form of Money: The ideal form of money has six fundamental characteristics. We examine how Bitcoin stacks up.

[SPONSORED] Obsidian Bot on Automated Cryptocurrency Trading and Bot Creation: We sat down with the Obsidian Bot team to learn what it’s like to run a crypto trading bot company.

Airbnb Deserves Better: Why IPOs Are Too Dated to Do the Sharing Economy Justice: This ICOBox guest post looks at how crypto could help owners in the sharing economy.

Terrorists Don’t Like Cryptocurrency: According to a recent study by the RAND Corporation, terrorists simply aren’t using cryptocurrency to fund their operations. More specifically, there are “still only a small number of publicly-documented and confirmed cases of TF [terrorist finance] involving VCs [virtual currencies].”

The reasons shouldn’t come as a shock. Many cryptocurrencies, like Bitcoin, aren’t anonymous are easily traceable. Additionally, cryptocurrency is still relatively difficult to use when you compare it to traditional mediums. And, spending cryptocurrency poses another challenge due to the current low adoption rate. Even privacy coins such as Monero are hardly utilized.

That being said, the study concludes that upcoming improvements to virtual assets will make cryptocurrency a much more likely choice for terrorists in the future.

But Apparently, Banks Do: A report published by the World Economic Forum on Wednesday outlined that at least 40 central banks around the world are researching central bank digital currency, CBDC. Beyond that, many of them are running CBDC pilots as well.

The list of banks includes the Bank of Thailand, Central Bank of Brazil, Hong Kong Monetary Authority, Bank of France, among several others. The Bank of France, for instance, replaced its process of SEPA Credit Identifier provisioning with a blockchain-based solution. And, the upgrade has been successful. The bank has seen greater time efficiency, process auditability, and disaster recovery under the system.

Sponsored Spotlight – Obsidian Bot

In this day and age, cryptocurrency traders are taking any edge they can get it. One of those edges is automation. Why tempt yourself with irrational trades when a bot can cut out the risk of human error for you?

Obsidian Bot brings you customizable bots for 24/7, hands-free trading with no long-term contracts. Trade with your bots, sell them, or purchase someone else’s – the choice is yours. Visit the Obsidian Bot website today to start your free 14-day trial.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.