- High Commission Fees

- Price Valuation

- Blockchain Rental Security Deposits

- Blockchain Rental Multiple Listing Services (MLS)

Blockchain technology is beginning to change how people buy and sell properties. It’s even gained significant adoption by governments that want to improve land registry systems. How exactly can it improve other areas of the real estate sector? Here are a few ways that blockchain is impacting rental property management, including examples of some projects that are disrupting this industry.

In 2019, quite a few blockchain projects have brought innovation to both short-term and long-term rental platforms. The following four areas present a few ways blockchain could offer a better answer to both property owners and renters. The first three topics already have real-world blockchain solutions provided by specific platforms. In contrast, the last category is an area where blockchain could theoretically be applied to change the property rental industry.

High Commission Fees

Real estate and legal fees can be costly. While this is especially true when buying and selling properties, many agents charge high fees for rental properties as well. When looking at short-term stays at properties on Airbnb, for example, the site takes up to 20 percent of profits that could have gone directly to the property owner or passed on to the customer in the form of lower costs.

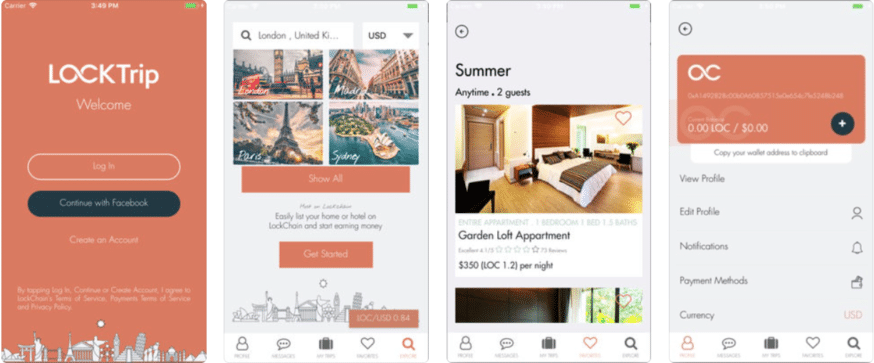

With a blockchain solution for rental and short-term stays, the transaction is truly peer-to-peer. While it is theoretically possible that fees could be set at higher prices than traditional rental sites, this isn’t the case in reality. The goal of blockchain platforms is generally to automate the rental process and lower operational costs.

In practice, there are several blockchain platforms that allow users to send and receive cryptocurrency for rental transactions at little to no fees. The decentralized and free-to-use LOC Travel Engine keeps all hotels, rates, and availability as an open-source turnkey solution for any third-party applications that wish to connect and offer retail travel services at zero percent commission. This platform states that its prices are 20 percent lower than other online hotel and rental booking sites. It even has decent adoption, with 100,000 hotels already live on its marketplace.

Price Valuation

For those that want to buy or sell a property, accurate price valuation is a must. However, this tends to be much more sophisticated when assessing how much a property is worth overall. For those wanting to put a rental property online, it can be even more difficult to know exactly how much to charge for shorter periods of time (i.e. dollar amount for one month). Yes, owners could compare with other sites available online. However, factors (i.e. city, neighborhood, number of rooms, yard space, etc.) oftentimes vary greatly. A lack of comparable options might mean that an owner is trying to rent at a price point that’s either too high or too low.

There are solutions emerging among decentralized, public blockchains. However, major banks have also developed private blockchains for a similar purpose. The Bank of China already uses a blockchain-based property valuation platform. This solution stores vital information such as property address, valuation, and hashed reports.

The general manager of the Bank of China’s IT department, Rocky Cheng Chung-ngam, has stated that 85 percent of mortgage-related real estate valuations of the bank is already being processed by this platform. HSBC also utilizes a similar solution. Theoretically, this concept could be applied to give property owners a more accurate estimate of how much to charge renters as well.

[thrive_leads id=’5219′]

Blockchain Rental Security Deposits

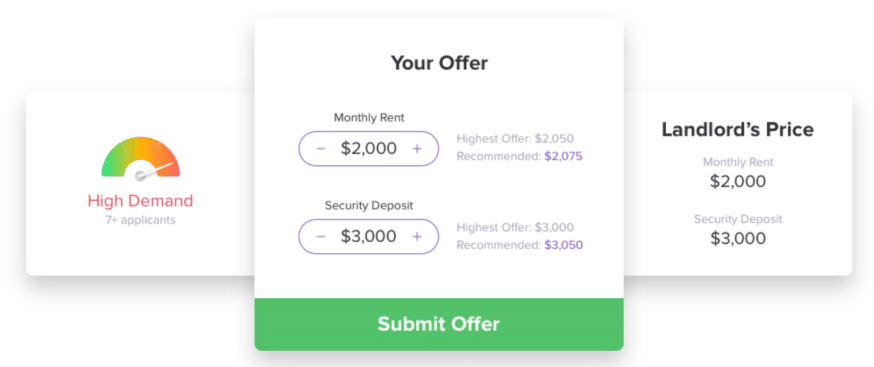

For many people, security deposits present a financial burden. In most instances, renters have to pay first and last month’s rent up front. In some cases, legal jurisdictions require renters to present proof of income and other documents. At the same time, the landlords have to set up banking and legal procedures to manage each tenant.

With a blockchain solution for rental, it’s possible for renters to crowdsource their security deposits by letting other people who have the necessary funds pay up front. These individuals have the ability to earn interest. Meanwhile, the renter can move into a new rental property without having to worry about large fees associated with the traditional lease model. Additionally, landlords can save time and money by reducing their reliance on traditional contracts and funding options.

Rentberry is one example of a project that provides such a solution. With this option, renters only have to pay ten percent as a deductible on the security deposit. Lenders can typically earn between three and four percent of the deposit annually. This works like a normal security deposit. If the landlord doesn’t note any damage at the end of the lease, the initial deductible is returned in full to the renter. The rest of the funds go back to the lenders. In addition, Rentberry provides other innovative features like a transparent rental auction to help determine price valuations.

Blockchain Rental Multiple Listing Services (MLS)

Multiple listing services (MLS) serve a vital role in modern real estate rental. These sites and apps simplify the process of helping a property owner let potential buyers know about availabilities. However, this can also complicate the communication process between owners and renters. This is especially true when properties are no longer available but still appear as available on various MLS-based sites.

With a blockchain solution, all of this information could exist in a single place. If the property is no longer available, for example, it would be possible for the owner to more easily communicate this to potential renters. Developers could even create automated notification processes based on when rental transactions on the blockchain occur.

Perhaps one of the largest obstacles to a successful blockchain competitor to current online MLS solutions is a lack of blockchain interoperability or a commonly-accepted platform. Currently, a few major blockchain rental solutions are competing against one another for a limited share of the rental market. However, if these projects are able to work together, it would be possible to keep rental information up-to-date across multiple sites or blockchains. As a result, this could potentially improve user adoption among property owners and renters.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.