Cryptocurrency Market Update

We’re off to a green start for summer. Hopefully, by, now it’s safe to put your crypto winter jackets away and slip into some swimwear as we enter the first day Summer 2019.

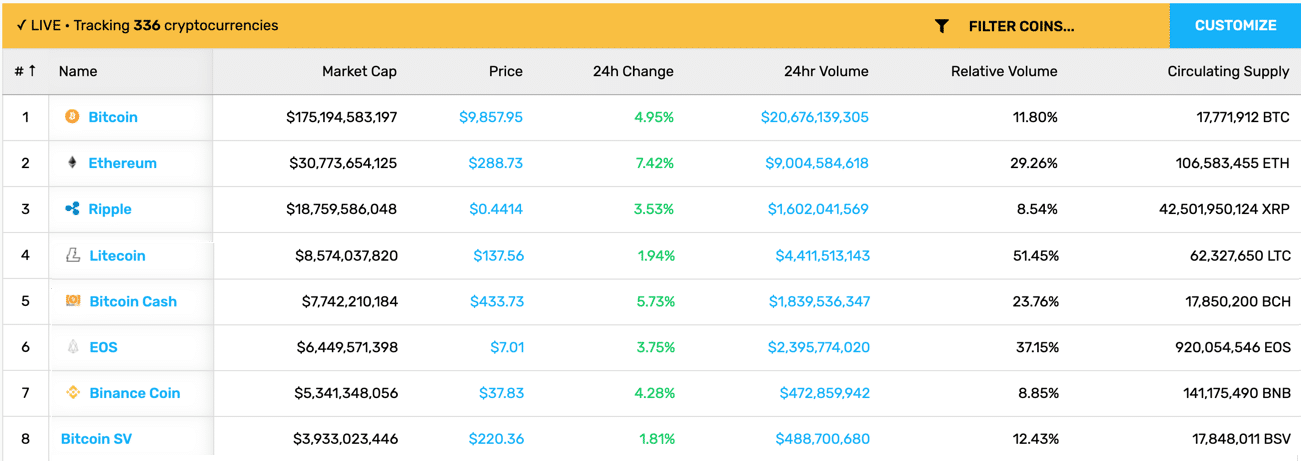

The Big Bad Bitcoin is currently nearing a $10,000 hurdle and is up 17.57% on the week. The last time BTC was near $10k, it was in freefall in the middle of the crypto winter on May 5th, 2018. $10k just feels better when it’s on the way up.

Ethereum also had a great week, up 12.31% and nearing $300 per ETH. XRP is up 11%. Binance Coin made a comeback from last week and is up 16.88%. Privacy coins Monero and ZCash are up 22.55% and 23.69% respectively, likely in connection to the news of Facebook formally announcing the launch of their stablecoin. MonaCoin, known as “the first Japanese cryptocurrency”, is up 41.35%.

However, it wasn’t all sunshine and daisies. A few projects missed the green wave and sunk in the red: Tezos down 7.11%, Nano down 8.71%, and Komodo down 10.45%, losses that dig even deeper when adding the whopping BTC gains on the week.

The Big Cryptocurrency News of the Week

Facebook Announches Libra Launch to Contentious Crowds: Facebook officially announced the test-net and launch of its much anticipated Libra stablecoin, and everybody and their grandmother had a public comment about it. With nearly 2.4 billion monthly active users, it’s no shocker the ol’ FB made some waves. One of Libra’s main goals is to create a global currency for the world’s unbanked populations. With similar fungibility to fiat currency, Libra wants to help everyone keep their funds secure and accessible.

Japan’s Largest Messaging App to Launch Another Cryptocurrency Exchange: Line, the most popular messaging app in Japan with over 80 million users is pending approval from Japan’s Financial Services Agency to launch a cryptocurrency exchange called BitMax. Line previously launched BITBOX, a cryptocurrency exchange in Singapore, and BitMax aims to use the same technology of the generally well-ran BITOX exchange. The approval is set to happen as early as June 2019.

People Saying Stuff

Bitcoin to $15k? Tyler Winklevoss Thinks So: With a $10k BTC in sight, Gemini Co-founder Tyler Winklevoss tweeted $15k as the next logical price target for the token. John McAfee also chimed in, claiming that if BTC breaks $100k, its next target will be a cool $1,000,000.

If bitcoin breaks 10k, you can bet it’s going to break 15k…????????????

— Tyler Winklevoss (@tylerwinklevoss) June 19, 2019

What’s New at CoinCentral?

What Is Libra? | A Guide to Facebook’s Upcoming Cryptocurrency: Unless you’ve been trapped on the Himalayan mountains for the past week, chances are you’ve heard about Libra.

What Is LEO? | All You Need to Know About Bitfinex’s Cryptocurrency: LEO is a utility token that you can use on all iFinex platforms, including Bitfinex and Ethfinex. The token derives its name from “Unus Sed Leo,” iFinex’s company motto. The Latin phrase describes a story in which a sow berates a lion for having only one child. The lion agrees in response but states that the one child is a lion, arguing for quality over quantity.

What Is Grin? | The First Major Blockchain to Implement MimbleWimble:Grin is a private, lightweight, MimbleWimble blockchain project. Like Monero and Zcash, the goal of Grin is to keep your identity and financial history private as you participate in the network.

Can the Facebook (FB) Coin Really Disrupt the Crypto and Remittance Markets: Facebook’s highly secretive Libra Project has been making headlines lately due to the immense potential it holds to disrupt both the international remittance market and the cryptocurrency sector.

Libra Pokes U.S. Regulators to Action: In some news about the news, Facebook’s launch of Libra has also prodded the sleepy bear that is Washington. The U.S. lawmakers and regulators have long kept a tepid and conflicted stance on cryptocurrency, and the focal point of their concerns thus far has been to protect consumers from scams and prevent the funding of illicit activities. However, with a parent company that is already sitting in hot regulatory water over user privacy concerns and potential looming monopoly charges, U.S. regulators are likely going to keep a close eye on Libra and the cryptocurrency space at large.

Upcoming FATF Guidelines Could Bring Doom to Some Crypto Businesses: Today may be a “make or break” day for numerous cryptocurrency companies, particularly exchanges and crypto custodians. On that date, the Financial Action Task Force (FATF) is releasing guidance on how countries should oversee digital assets, Bloomberg reports.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.