Theta is a decentralized video delivery network with its own blockchain, designed for incentivizing the sharing of bandwidth.

Currently, video delivery networks suffer from poor reach to less developed countries, a high-cost setup and a centralized makeup. This lends itself to abuse and cutouts to service. Furthermore, Theta sees the current infrastructure as unprepared for the accelerating demands it will face due to 4K, 8K, virtual reality and other developments, such as light field technology.

Theta is building a peer-to-peer (P2P) mesh network that aims to solve these current issues while using a blockchain to serve as an incentive layer to keep the delivery network at a continual high performance.

In this guide we will cover the following:

- How Does Theta Work?

- The Purpose of the Theta Token

- Theta Team and Roadmap

- Theta Token Trading History

- Where to Buy Theta

- How to Store Theta

- Conclusion

- Additional Theta Token Resources

How Does Theta Work?

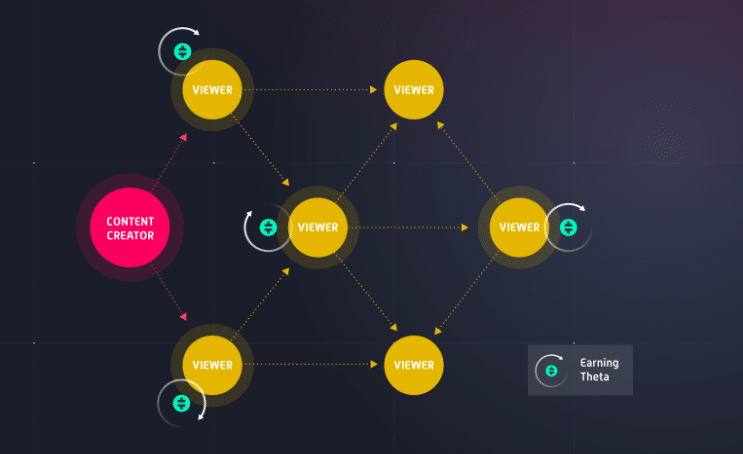

Theta is comprised of two parts. The first is its video delivery network. This is formed from nodes that join the network and contribute their bandwidth. This network is what forms the actual decentralized video delivery. The second part is the Theta blockchain. This is for incentive purposes, to give a reason for participants to join the delivery network.

Theta Network

Right now, content delivery networks (CDNs) deliver video content and streaming. These typically consist of very large centralized data centers scattered across the globe. The main problem with these is that they are not geographically close enough to many viewers, which leads to lower quality streaming. Theta’s answer to this is to create a P2P mesh network of users who share their bandwidth. The result should be a global network to either replace or supplement the existing CDN infrastructure.

Users can lend their devices as caching nodes that relay video streams to any viewer in the world. A caching node is one that stores the video data. As a result, because the Theta network will have vast amounts more of caching and relaying points than the current system, stream quality will be improved. This is because packets of video data will not have to travel as far. Caching nodes will be rewarded with Theta tokens, and are thus incentivized to offer their spare bandwidth resources, strengthening the Theta network.

Theta’s white paper claims that its solution could reduce delivery costs by 80 percent over the existing infrastructure. It seems that this is due to the savings from not having to maintain the huge data centers that currently power CDNs. While this is a big claim, we will have to wait and see if they can fulfill this.

Improved Resilience

In addition to the improved quality of streaming that this should offer, Theta also hopes it will improve the resilience of the infrastructure. Right now, the entire streaming industry is dependent on a small number of data centers. This poses a risk whereby, if several go down or are taken offline, global streaming deteriorates massively. By distributing the caching and relaying to thousands and potentially tens of thousands of nodes, Theta’s network should be far more sturdy than the current system.

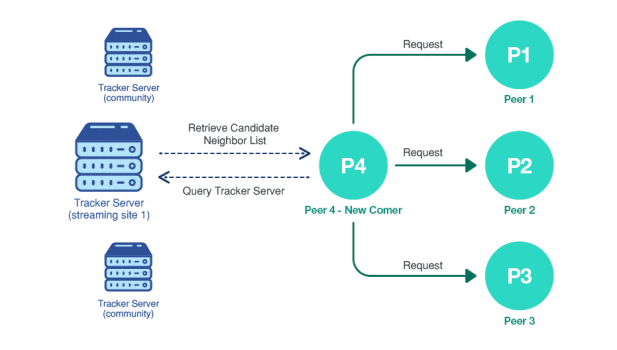

Variance in Quality

The main problem that Theta identifies is the difference in the quality of varying nodes. Additionally, there is nothing to stop nodes dropping off. To counter these issues, the team is building a server and client to help nodes identify the closest nodes to them in terms of network hops. Nodes will then be able to connect with their nearest peers, as opposed to connecting randomly with any node in the world. Theta hopes that this will allow nodes to pull streams much more consistently and so rival the consistency of current CDNs.

Theta Blockchain

The purpose of the Theta blockchain is to serve as a consensus layer for payments and rewards within the ecosystem. It is important to know that no video files are being stored in the blockchain whatsoever. This would be impossible due to the data demands it would impose.

The blockchain will be completely open-source and the team hopes that developers will build and deploy their own DAPPS on top of the blockchain.

Tackling Scaling

Since there will theoretically be tens of thousands of nodes contributing to the mesh network, there will, as a result, be a huge number of micropayments for rewards. On top of this, the blockchain needs to account for an equally large number of payments in the form of tips, purchases, and other token use cases. As a result, Theta is trying to build a proof of stake (PoS) blockchain with extremely high throughput, while not comprising decentralization and its security. This, of course, is no small problem and is something that has plagued many blockchain projects.

The team has split their blockchain into two levels. A small validator committee of just up to 20 validating nodes produce the blocks. Beneath that, an expanded pool of guardians running up into the thousands are responsible for validating the blockchain at set points and contributing to consensus. Theta believes that this will give that extremely high throughput without compromising decentralization.

On top of this, Theta is using an aggregated signature gossip scheme. This means that the guardian nodes instead of sending out their signatures to all other nodes sends them out to their neighboring nodes. This process continues, spreading the signatures much the same way as a virus would spread in a pandemic. This is designed to maximize the efficiency at which guardian nodes communicate with each other. The final part is the off-chain micropayment system that adds additional capacity to the blockchain. This is apparently double-spend resistant.

The Purpose of the Theta Token

Right now the Theta token exists as an ERC20 token and does not have any utility function. However, when Theta transitions to its native mainnet on March 15, 2019, these tokens will be swapped 1:1 for the new Theta tokens, riding on top of Theta’s new blockchain.

Once the mainnet goes live, these new tokens will primarily be used for securing the Theta blockchain. In addition, the team hopes that people will use the token as a means of paying and rewarding content creators, trading virtual products and purchasing premium content.

708,000,000 out of a total supply of 1,000,000,000 tokens are currently in circulating supply. This equates to 71 percent, which means that the token supply cannot be diluted too significantly, positive news for investors.

At the same time as the mainnet launch, Theta will issue Gamma tokens to all THETA holders. Five Gamma tokens will be issued for every one THETA token held. These tokens will have the utility value and will be used to pay for video segment transactions and cover the smart contract operations. It appears, that the Gamma token, rather than THETA token will be used as a means of paying and rewarding content creators, trading virtual products and purchasing premium content. There will be five billion Gamma tokens produced.

Of course, until 15th March, investors only need to concern themselves with the current THETA ERC-20 token.

Theta Team and Roadmap

Theta’s team, advisors and list of partners is impressive. The team consists of 14 members as well as a multitude of blockchain and media advisors. Steve Chen, the co-founder of Youtube has been an advisor to Theta along with prominent members and ex-members from Twitch, Verizon and Plays.tv among others.

During the testnet phase, Theta has been partnering with Sliver.tv, its parent company, as well as Samsung VR and MBN, a major Korean media company.

In 2019, the team is aiming first and foremost to launch their blockchain and swap the current ERC20 tokens for the new Theta tokens. Beyond this, the focus seems to be around bringing on more content partners and generally growing the Theta network.

Theta Token Trading History

After the token sale in January 2018, Theta has been actively trading since January 27, 2018. It reached its all-time high of $0.314425 on January 27th. It has been in decline ever since, along with the rest of the cryptocurrency market. THETA performed similarly to other altcoins across 2018.

We should expect THETA to start breaking away from the rest of the market once the mainnet goes live in March, and users start to join the network. At this point, the token will move from a speculative vehicle to one with a use case as an incentive mechanism for network participation.

Where to Buy Theta

Relative to its market capitalization, Theta is a very liquid token, making it easy to purchase. Trading right now for Theta is focused in Korea, with the Korean Won accounting for the majority of volume on Coinbit, Bithumb and Upbit. However, there is also a reasonable amount of volume between Binance and Huobi for Bitcoin, Tether and Ethereum pairs. Investors can be confident in buying large amounts of Theta without experiencing any slippage.

How to Store Theta

For now, the current ERC20 token can be stored easily in any wallet that supports this standard. We typically recommend MyEtherWallet in conjunction with a hardware wallet such as a Ledger or Trezor. This gives you a high level of security along with a simple user interface.

Theta has said that they will release their new wallet before the mainnet launch. Users will able to store the new tokens in this wallet.

[thrive_leads id=’5219′]

Conclusion

Theta’s answer to the current scaling problems of content delivery is certainly fascinating. Its unique approach to the P2P mesh network, which is incentivized and secured by the high throughput blockchain, if successful, could certainly be very disruptive.

Whether they can maintain the decentralization of their blockchain and keep their mesh network at a consistent quality are probably the two biggest questions right now.

The theta token itself makes a lot of sense as a utility token. More importantly though should work as a means to incentivize the sharing of bandwidth. This will in turn aid the development and growth of the mesh network.

With the mainnet set to be launched in the coming months, 2019 should be an exciting year for Theta, and we will certainly be watching them closely.

Additional Theta Token Resources

There are several other ways to keep up to date with the progress at Theta: