Will Bitcoin ever replace fiat? This question has made the rounds on more than just a few online forums, mostly cryptocurrency related, admittedly. The debate is real and the opponents are often programmers versus armchair economists.

Fiat, or government-backed currency, has been a feature of city-states, kingdoms, and countries now for over a thousand years. The battle is a truly epic showdown between the establishment and the relentless advancement of technology.

A comprehensive analysis of the pros and cons of each would probably take weeks to write. Instead, let’s take a look at a few fundamental differences between the two systems and see if any conclusions stand out.

The Inflationary Model

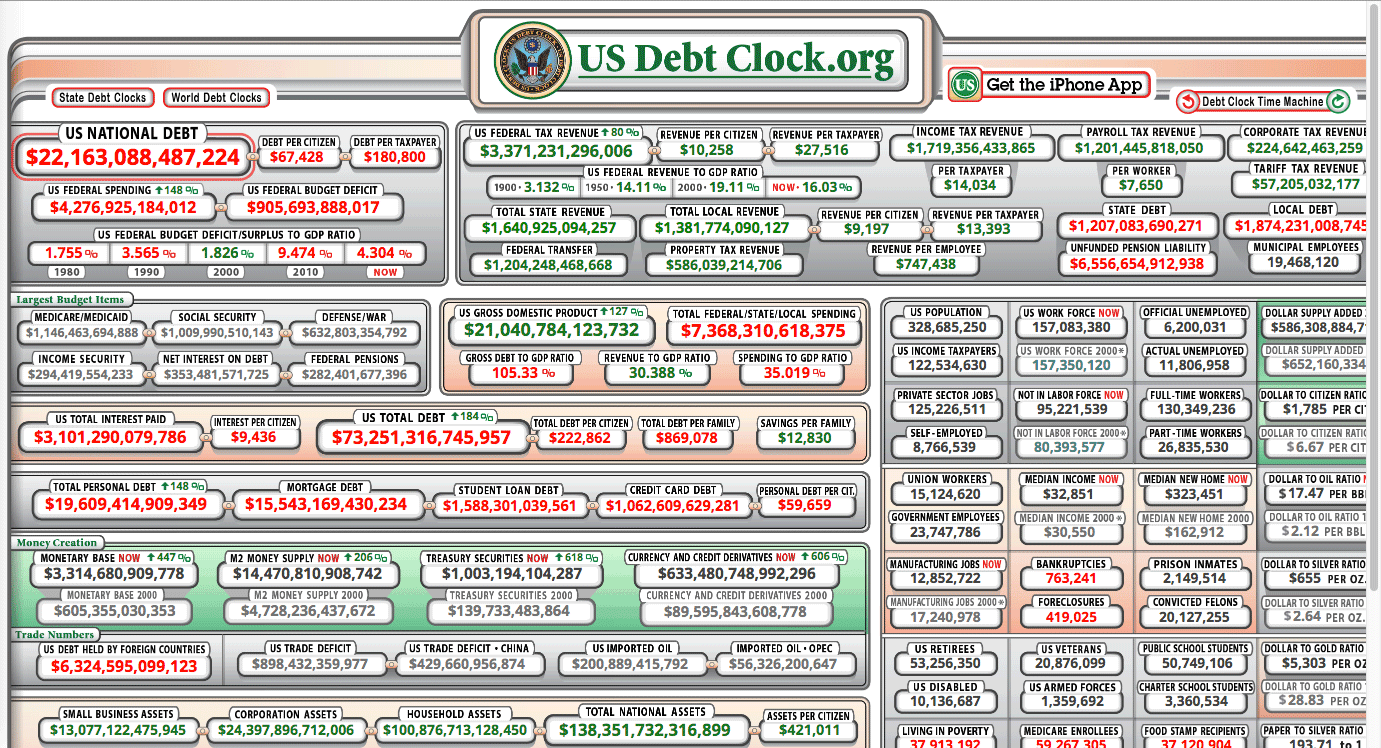

Most fiat-based systems today are built on the back of a potentially infinite money supply. Modern banks use a system known as fractional reserve banking. In this system, banks can lend actual client deposits to other clients up to a certain level. The remainder needs to be kept in the bank as reserves in case a depositor would like to withdraw their cash. The reserve requirement in the US has typically been 10 percent. Let’s illustrate this idea with a simple example.

Starting from scratch, Joe has $100,000 that he’d prefer not to keep under his mattress, so he deposits it at the bank. The bank lends $90,000 of this to Tim, who uses it to buy out Mary’s small business. Mary also deposits this in the bank for safe keeping. The bank now has $190,000 in deposits. The bank can now lend out 90 percent of Mary’s $90,000 deposit and the process continues.

Fractional reserve banking works well initially to kick-start an economy by providing more loans than could otherwise be provided. It causes a couple of problems, though. If customers lose faith in the banking system, too many may try to withdraw their cash at the same time resulting in a bank run. Then there’s the easy money policy. If too many customers default on their loans there’s the possibility of creating a serious debt crisis similar to what happened in the 2008 financial crisis.

The Deflationary Model

21 million coins. The upper cap places Bitcoin on the rare currency list along with gold. There is no built-in mechanism to create debt or inflate the currency supply in such a model. That’s why the fiat to crypto exchange rate is so high. A basic rule of wealth is this: the less of something there is that people want, the more they are willing to pay for it.

That may be good from an investment standpoint, but can a deflationary currency like Bitcoin act as a viable medium of exchange? Leading cryptocurrency exchange Bitmex recently weighed in on the debate and had some interesting things to say. Despite praising its deflationary properties in their report, it went on to state:

“Bitcoin may satisfy a useful niche, that of making both censorship resistant and digital payments, but it’s unlikely to become the main currency in the economy.”

Bitmex notes that those who argue against deflation often look back to the great depression of the 1930s. When the stock market crashed in 1929, people began accumulating gold. The situation became worse when financial institutions started to go under. Civilians hoarded the yellow metal as they lost faith in banks and ultimately the US Dollar itself. Is society seeing a similar situation play out today?

Prosperity comes through circulating a currency, not hoarding it. And this, according to some, brings into question the very philosophy of the Bitcoin HODL. Until people actually perceive there to be a fair value from crypto to fiat, they may not want to spend their Bitcoin.

So to the extent that the experiment [Bitcoin] tells us anything about monetary regimes, it reinforces the case against anything like a new gold standard – because it shows just how vulnerable such a standard would be to money-hoarding, deflation, and depression.

Obstacles to Adoption

Bitmex further notes that the irony of all of this debate is that there’s no surefire way to see the effects (either negative or positive) until Bitcoin is actually widely adopted as an alternative.

In the meantime, Bitcoin still has some other issues to worry about. For one, it’s heavily reliant on electrical and internet infrastructure that is often highly centralized. While that is changing, it still poses a threat to places like Venezuela where cryptocurrency is in high demand. Physical, tangible currency is still a lifeline in many parts of the world.

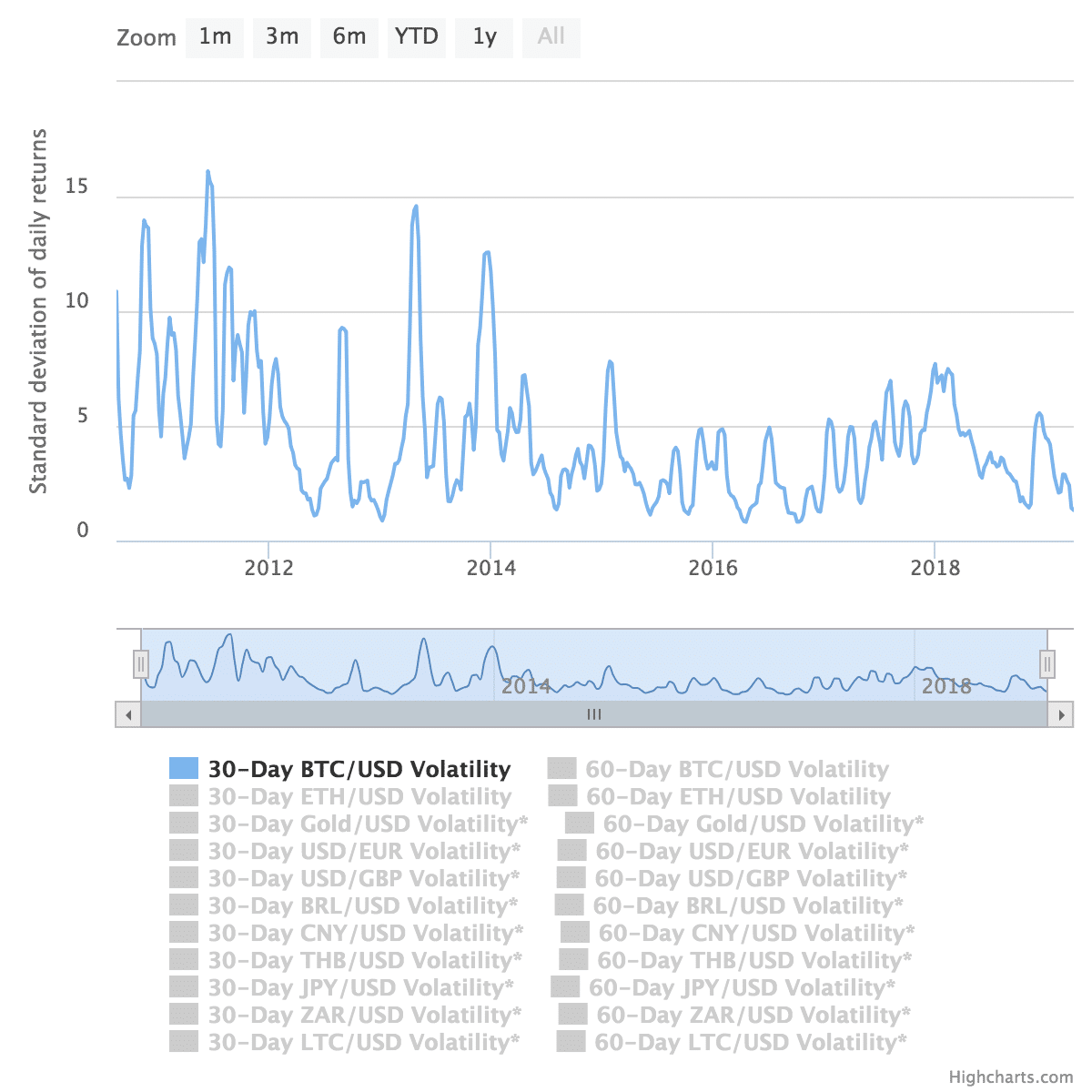

The public’s perception of Bitcoin’s volatility also remains an issue. High percentage swings against Fiat are great for speculators but they generally don’t inspire confidence for day-to-day transactions. Fiat may be flawed, but it’s a flaw that people are comfortable with. Volatility may need to stabilize first before consumers, instead of speculators, are the primary bitcoin users. Fortunately, that volatility has been falling since Bitcoin hit the markets.

These are just two examples. There are others of course. Money is used in different ways by different people across different cultures. Building a worldwide money that accommodates everyone is no easy feat.

[thrive_leads id=’5219′]

Will Bitcoin Ever Replace Fiat?

That’s kind of like asking back in the ’90s whether the internet would ever replace the fax machine. The answer is so painfully obvious to us now. Yet at the time, highly praised economist Paul Krugman got it completely wrong. If Nobel prize-winners don’t know, there’s surely no way to predict the path of money and cryptocurrency in particular.

The answer will most likely come from some kind of hybrid of the two. Both sides may want to take a chapter or two out of each other’s playbook. There’s plenty of room to learn from the past. As American fiction writer F. Scott Fitzgerald so articulately said:

“The test of a first-rate intelligence is the ability to hold two opposing ideas in mind at the same time and still retain the ability to function.”

One thing’s for sure though, the internet and technology continue to play an integral part in our every-day lives. It’s not inconceivable to think that the children of the next generation will grow up not knowing what Bitcoin or Fiat are. Instead, they may just casually use a superior worldwide monetary system we haven’t even thought of yet.