“We are tired of people asking us about target prices.”

This was Tom Lee towards the end of 2018., the co-founder of Fundstrat Global Advisors and one of the most prominent cryptocurrency price analysts. He famously predicted Bitcoin would end 2018 at $25,000. Despite Lee’s claim to fame being his ability to predict stocks and crypto prices, even he has become tired.

Unfortunate as it is, this is what the crypto industry has been reduced to. Crypto traders and enthusiasts alike have become obsessed with prices. The conversation has dramatically shifted away from the solutions that cryptos are offering. Those who care about how XRP is settling funds transfers in seconds across borders are becoming fewer. The use of Ethereum’s blockchain to automate insurance settlements is no longer the hot topic.

The Glory Days

2017 was the best year yet in the cryptocurrency industry in terms of market growth. Most will remember it as the year in which Bitcoin almost hit $20,000. However, the year was much more than price targets. It was also a year in which people devan eloped interest in the transformative power of cryptos.

One crypto project that grabbed people’s attention was Ripple. Ripple’s digital currency, XRP, was one of the best performers, buoyed primarily by the interest it received from the industry and beyond. Ripple set out to work with banks and financial services firms to settle payments quickly and cheaply. It on-boarded close to 100 banks globally. They included MUFG, the fifth largest bank globally, UBS, Standard Chartered, Bank of America and Credit Agricole.

The crypto world was buzzing with excitement about Ripple and XRP. Many sought to understand Ripple’s products including XRapid and XVia, and how they differ from each other. Crypto enthusiasts wanted to know if their banks were using Ripple to settle cross-border transactions.

EOS also interested many, and its widely-successful ICO reflected this. The project promised to improve on Ethereum’s shortcomings, such as scalability. It also promised a better network for the development of decentralized applications, better known as DApps. Even the mainstream media took note, with EOS being covered extensively by leading publications such as Bloomberg, CNBC and Forbes.

When It All Changed

Then came 2018 and everything changed. In the first two months, Bitcoin’s price had halved and didn’t show any signs of a recovery. The altcoins weren’t faring any better, and the market began to panic. Most retail traders sold their crypto stashes. For the minority who didn’t sell, predicting when Bitcoin would rise to former highs again became a priority.

Media publications, both mainstream and crypto-focused, also changed to adapt to the new consumer tastes. Articles on when the next bull run will take place grabbed all the headlines as well as the readership. The mainstream media turned to analysts who could make predictions, most of which were outrageous.

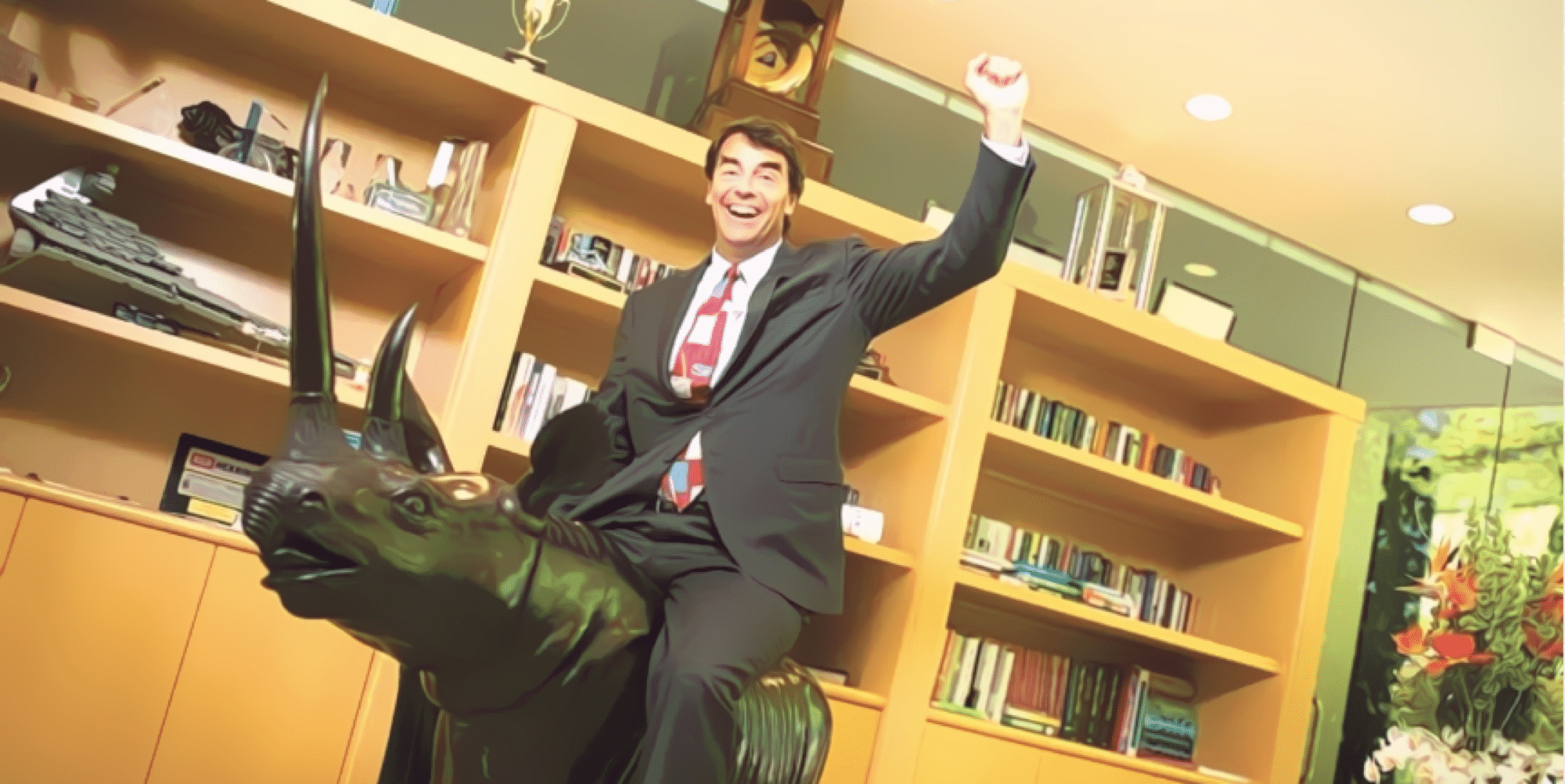

Tom Lee was a favorite for many media outlets. He first predicted that Bitcoin would close the year at $25,000, later revising the prediction down to $15,000. Other famous predictions came from Mike Novogratz, John McAfee, Tim Draper and more.

Diverting the Attention

The diversion of attention to more sensational price-related topics wasn’t too much of a surprise. Many crypto investors had lost a sizable amount of money in the 2018 bear market. They were therefore all too eager to recoup their money.

[thrive_leads id=’5219′]

The diversion has had a negative effect on the industry. For one, it has taken away from cryptos’ biggest objective: challenging the status quo and introducing the public to a new world of possibilities. Not too long ago, cryptos had caught the attention of the enthusiasts and skeptics alike for transforming millions of lives.

In the U.S, Wall Street giants had become rattled after recognizing just how much of a challenge Bitcoin was putting up against the traditional finance system. From J.P. Morgan to Goldman Sachs, the biggest banks were investing in research and development of crypto.

In Africa, remittances were becoming cheaper, faster and more convenient. Startups such as Bitpesa were turning to cryptos to settle cross-border transfers in real-time. In a region in which remittances cost three times as much as their Western counterparts, cryptos were sparking a revolution. Global giants such as Binance were also setting up shop, recognizing that Africa was the next crypto frontier.

Whether Bitcoin can hit $20,000 again has major consequences. However, we can’t risk having the speculation overshadow every other aspect of the industry. Developers who are building decentralized applications and using cryptos to change lives must be accorded the support they need. Otherwise, we risk making cryptos a price speculation asset and keep them from delivering the decentralized future that Nakamoto envisioned.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.