Waves is a blockchain platform you can use to create your own custom token. Whether you want to crowdfund a project, build out a loyalty rewards program, or create an in-app currency, the Waves platform may be worth looking into.

According to its website, you can create your own token in as little as one minute (but you may want to take some time and have a good plan on how you’re going to use it first). Waves also includes a decentralized exchange (DEX) in which you can trade your newly created coin in a trading pair with any other Waves token.

In this Waves platform guide, we’ll talk about:

- How Does the Waves Platform Work?

- Waves Token & Architecture

- Waves Platform History

- WAVES Trading

- Where to Buy WAVES

- Where to Store WAVES

- Conclusion

- Additional Waves Platform Resources

How Does the Waves Platform Work?

To put it simply, new tokens that you create and transfer using the Waves platform are done so as attachments on blockchain transactions. There’s an inherent problem with this strategy, though. Using the typical blockchain protocol, as seen in Bitcoin, the network client software needs to update with each new transaction type. This update is more commonly known as a hard fork. As we’ve seen through blockchain history, hard forks come with a significant number of risks and a large amount of work.

To prevent this, Waves implements new transaction types through plug-ins as an extension on top of the core software. That way, even if a client is missing the plug-in, it can still relay the custom transaction through the network. They can effectively still participate in the network without updating their software.

There are a handful of features included in the core Waves software:

- Custom Application Tokens (CATs)

- Decentralized exchange (DEX)

- Smart Contracts

Custom Application Tokens (CATs)

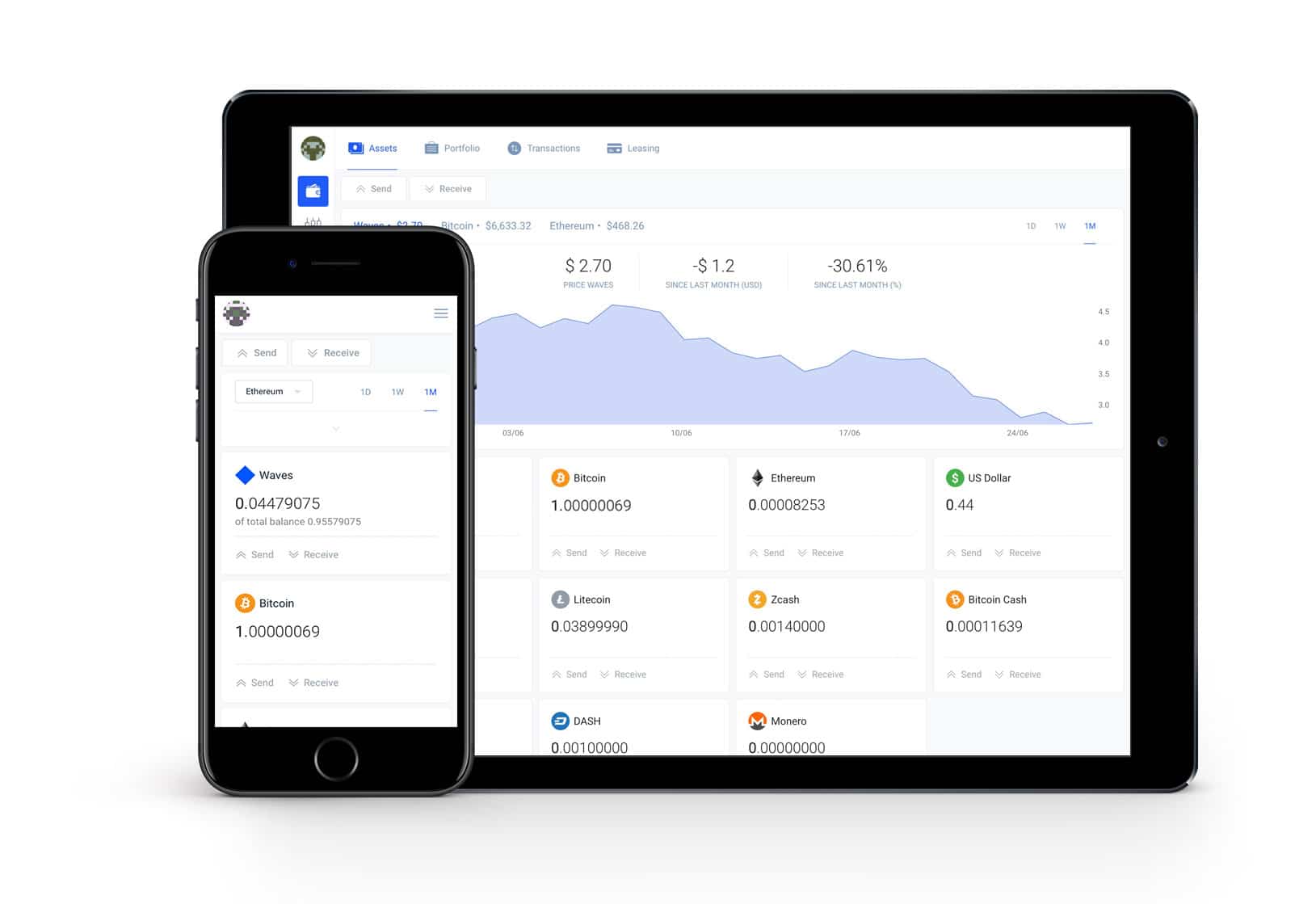

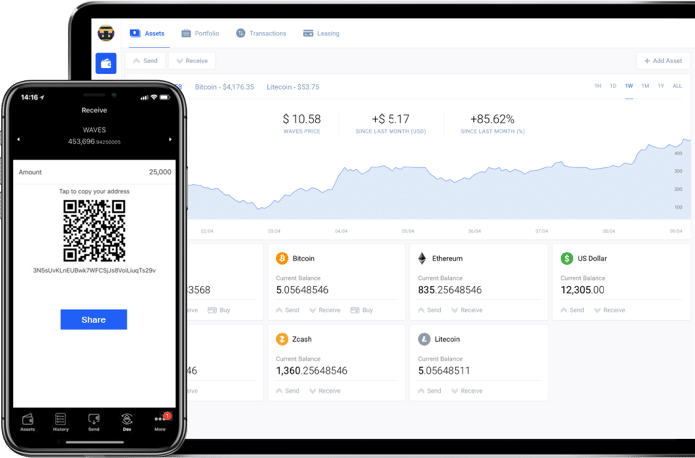

The primary focus of the Waves platform is in the creation and transfer of custom tokens. You can create a token directly through the lite client which is available on the web as well as both Android and iOS.

The tokens that you create can be bought, sold, traded, and transacted all without a middleman. Because you can customize the coin, they can represent whatever you want. Although you may not get as much token functionality as you would on another platform, like Ethereum, using Waves is infinitely easier and requires zero coding knowledge. This ease-of-use makes the Waves platform ideal for crowdfunding, simple ICOs, and loyalty programs.

It costs 1 WAVE to create a custom token – about $2.00 at the time of this writing.

The use of the platform has grown substantially since launching. Since December 2017, the number of custom tokens issued using the Waves platform has grown from 7,000 to almost 20,000 CATs.

Decentralized Exchange (DEX)

Decentralized exchanges reduce many of the risks associated with using a typical, centralized exchange.

Because your funds are stored directly in your wallet, there’s almost no chance of the DEX being hacked. Additionally, decentralization means that there’s no administrator to freeze your funds or limit your trades and withdrawals. You have complete control of your account.

The Waves DEX uses an automated matcher to pair buy/sell orders and exchange the tokens when orders are fulfilled.

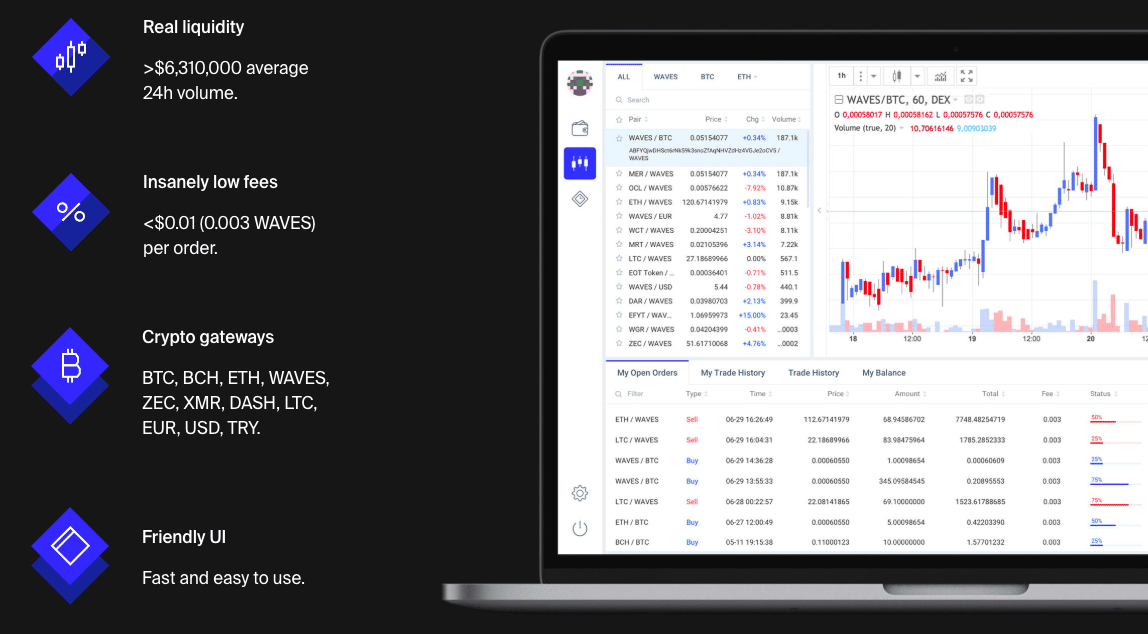

As you can see, the Waves DEX excels with low fees (<$0.01 per trade order) and numerous gateways. Other than the standard ETH, BTC, and WAVES gateways, the DEX provides on/off ramps for ZEC, XMR, and other cryptocurrencies as well as some fiat options like USD and EUR.

Although you need to provide KYC/AML information to use the fiat gateways, all crypto-to-crypto orders on the DEX are completely anonymous. To help with usability, the Waves team performed a complete update to the DEX’s interface in July 2017.

Smart Contracts

In September 2018, the Waves team implemented the first set of smart contract functionality on the platform. The new features include “multi-sig addresses, token freezing, atomic swaps, voting, and Oracles.” The smart contracts utilize a new programming language, RIDE, specifically made for the project.

Unlike Ethereum smart contracts, ones on Waves do not require Gas to execute. Instead, the network charges a minimal, flat fee.

Waves Token & Architecture

Waves differs slightly from the traditional architectural structure that other blockchain companies are using. To prevent scaling issues, the platform uses a two-tier architecture with both lightweight and full nodes maintaining the network. This is different than the strictly full node approach that Bitcoin purists favor.

Two-Tier Architecture

Waves lightweight nodes never download the blockchain. Instead, they depend on the full nodes for transaction confirmations and the interactions on the network.

The strategy is taken from the SuperNET lite client which has been successfully validated by the NXT project.

To facilitate the trust between lightweight and full nodes, Waves uses the Scorex platform. Instead of downloading the complete history of transactions, lightweight nodes use the current network state. They then use that state to establish simplified payment verification processes.

Leased Proof-of-Stake (LPoS)

There are 100,000,000 Waves tokens, WAVES, in circulation.

The platform uses a variation of the traditional Proof-of-Stake consensus algorithm to maintain network integrity. In a Leased Proof-of-Stake (LPoS) system, you can stake your tokens by “leasing” them to the full nodes that are running the network. Leasing costs 0.002 WAVES.

You need 1,000 WAVES to run a full staking node. This number has changed and is much lower than the initial 10,000 WAVES requirement. If you don’t have that many coins, you can still participate in staking by leasing your WAVES to a public mining pool. Check out the full list of Waves nodes to find the one best suited for you.

[thrive_leads id=’5219′]

Miner Reward Token (MRT)

As a full staking node, you earn Miner Reward Tokens (MRTs) alongside your WAVES rewards. You receive 60 MRT for the first 70 blocks you create in a day and earn 30 MRT per block after that. MRT is a Waves platform token, so you can trade it freely on the DEX for any other supported cryptocurrency.

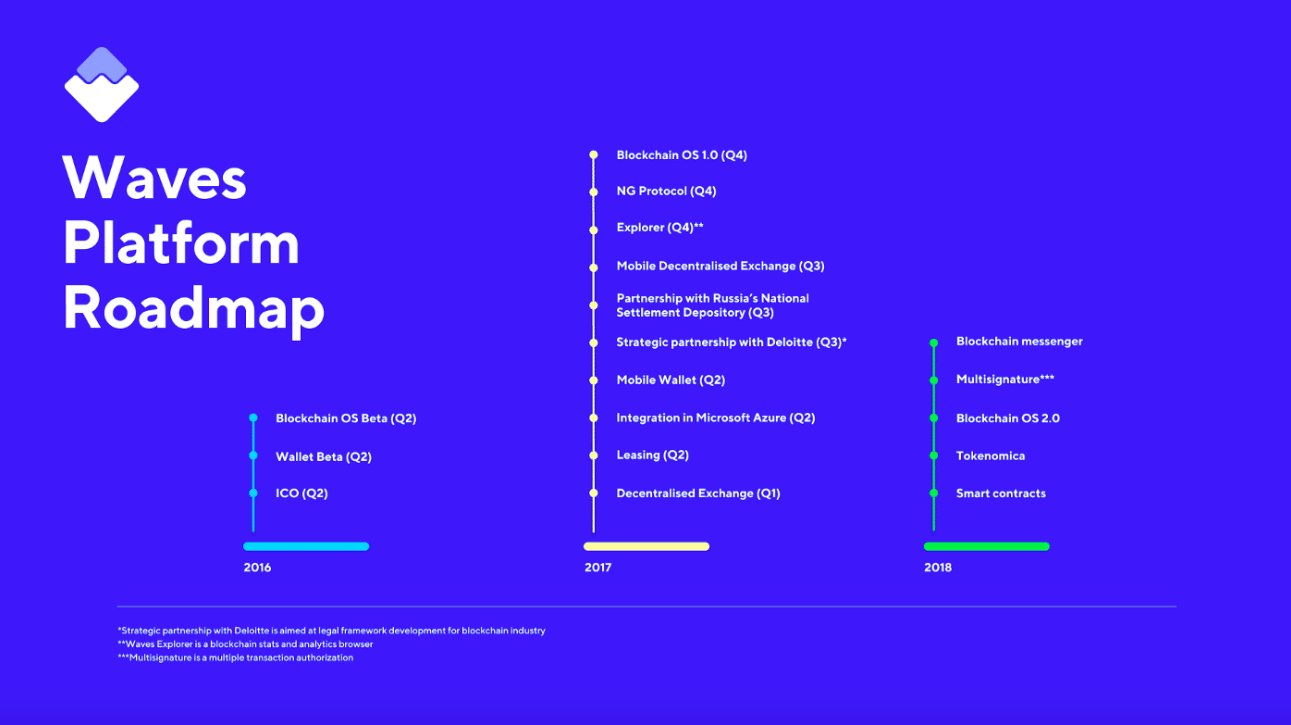

Waves Platform History

Multiple members of the founding Waves team previously worked on the NXT project together. A poor initial coin distribution, rotating development teams, and controversial development decisions were all factors in them leaving to start their own project – Waves.

Instead of forking from NXT, the team decided to start completely from scratch. A major difference between the two platforms is Waves’s emphasis on inherent fiat integration.

The company has partnered with Deloitte to provide clients with ICO services and is also working with the Russian National Settlement Depository (Moscow Stock Exchange) to potentially develop a blockchain platform to distribute digital assets.

In October 2018, the Waves platform set the record for processing the most transactions of any blockchain project in a single day. The network completed 6.1 million transactions, surpassing the previous record-holder, EOS, which had 5.4 million.

Competition

There’s no shortage of competition in the smart contract space. Ethereum is currently the big name when it comes to ICOs and dapps but there’s enough room for other projects as well. NEO, EOS, Lisk, and Stratis are also competing for smart contract clients.

Waves appears to be carving a niche by focusing on mass adoption through simplicity. The tokens you can create with Waves are missing some of the functionality seen on other platforms, but they’re ridiculously easy to make. As the team continues to add smart contract functionality, though, the feature gap will further close.

Waves also faces significant competition on the DEX front. IDEX is one of the top competitors, and protocols like 0x and the Kyber Network make it relatively easy to spin up a new DEX. The Waves team is focusing on usability and transaction speed to separate the exchange from the pack.

WAVES Trading

Waves completed their ICO in June 2016 raising over $16 million. Almost immediately after the ICO, the price of WAVES plummeted 80% and stabilized around $0.20 (0.0003 BTC).

The price remained relatively flat before rising up in July 2017. This run-up was most likely caused by the release of their roadmap as well as a partnership announcement with ICO Hub for a pre-ICO challenge.

For the rest of 2017, the price slowly fell before jumping to hit a new all-time high (in USD) this December of $17.06 (~0.000899 BTC). Among other factors, this bull-run was most likely caused by the team’s claim that Waves would soon be the fastest blockchain in the world. With Bitcoin’s scaling issues, speed is increasingly becoming a greater and greater factor when evaluating the value of a cryptocurrency.

Besides spikes in price during February and April 2018, WAVES has fallen with the rest of the market during these bear market times. it’s unclear what caused the February run-up, but we can assume that the April rise was due to the smart contract feature implementation.

The coin has been trading steadily around $2.00 for the last couple of months. Further use of the token issuance functionality, the DEX, or the new smart contract innovations should have a positive effect on the price.

Where to Buy WAVES

You have two options available to buy WAVES:

- Exchanges

- DEX

Exchanges

Numerous exchanges like Binance and Bittrex have WAVES available for trading. To exchange for WAVES on these platforms, you first need to purchase Bitcoin or Ethereum. Once purchased, transfer your funds to one of the previously mentioned exchanges and trade them for WAVES.

You can also use a service like Changelly or Shapeshift to get WAVES.

DEX

You can also use the DEX to exchange for WAVES. The token is available to trade with BTC, USD, and EUR although trades with Bitcoin have significantly more volume than the other two. Usually, the higher the volume, the easier it is to trade.

Where to Store WAVES

The best place to store your WAVES is in the lite wallet client provided by the company. Keeping your funds on an exchange exposes them to hackers and leaves them under the control of a third-party.

As mentioned earlier, the lite client is available on the web, on Android, on iOS, or as a Chrome plug-in.

Make sure to lease out your tokens when storing them so you can support the network and get those nice staking rewards.

Conclusion

Waves provides an easy way to create your own token and take advantage of simple blockchain functionality. The platform is good for people looking to run a crowdfund or create a simple loyalty coin for their business. With the additional smart contract functionality, the platform is also becoming more competitive with the likes of more popular dapp platforms (e.g. Ethereum).

The value of Waves is within its simplicity. Anyone can create a customized token with a few clicks and little knowledge of the underlying technology. Beyond straightforward token creation, Waves also operates a decentralized exchange.

If the team continues to make vast improvements on the network’s speed and usability, it’s feasible to see the platform gain significantly more popularity.

Editor’s Note: This article was updated by Steven Buchko on 10.23.18 to reflect the recent changes of the project.

Additional Waves Platform Resources

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.