This Week in Cryptocurrency – January 19th, 2018

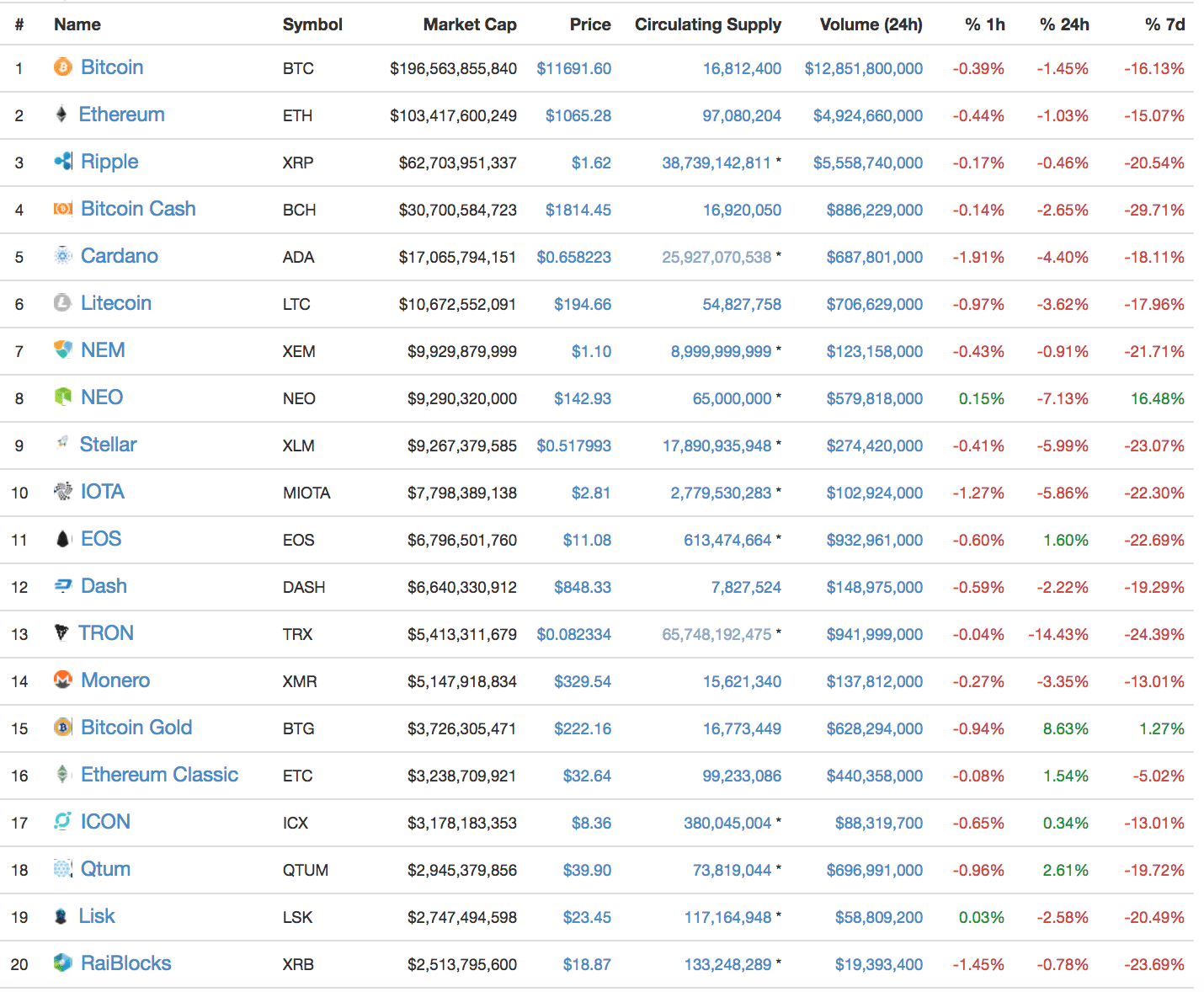

What a Dip: There’s nothing like a tumultuous dip to keep the majority of cryptocurrency investors on their toes. Although the markets started to pick back up on Wednesday, there was a period where the vast majority of cryptocurrencies were down between 25% to 45%. Yikes!

Well, fear not CoinCentral readers. We’re here to bring you some of the hottest new articles in the cryptocurrency world.

Bitcoin: Satoshi’s brainchild is down a total of about 16% for the week, momentarily dipping below $9,500 at one point, it’s lowest since November 26th, 2017 – about 7 weeks ago. Oh, the horror! Bitcoin currently sits at $11,717.00

Ethereum: Ethereum is down about 15% from its previous explosive growth week and is currently $1066.

Ripple: If there was one top-five token to really take a beating this week, it was Ripple. While currently only down 20%, there was a point where it lost well over half its value in two days.

NEO Stays Positive: Despite all the carnage, NEO is still up about 17% for the week. Way to stay positive in a room full of negativity, NEO!

BitConnect Shuts Down After Ponzi Scheme: Crypto lending site Bitconnect officially closed on January 16th after receiving cease and desist letters from Texas and North Carolina regulators. Many have speculated at the trustworthiness of the site, including famous fund manager Mike Novogratz, who called BitConnect “an old school ponzi”. Surprisingly, the company announced that they will reinstate operations soon, and even stated: “we still expect BitConnect coin (BCC) to gain its value back.”

Leading Hardware Wallet Company Ledger Raises $75 Million: French firm Ledger sold 1 Million wallets in 2017 and 30,000 wallets in 2016, a roughly 33x fold increase. As demand continued to rise, the startup had a tough time delivering a steady supply in a timely manner. With the new round of financing in its pocket, Ledger plans to boost operations so customers don’t have to wait two months to receive their order.

4 years Later, Vircurex Customer’s Want Frozen Funds Back: After a string of hacks in Bitcoin’s infancy days, exchange site Vircurex froze many of its member’s funds. While some of the account holders were returned their funds, one customer is suing the company. With Bitcoin’s recent growth, the frozen accounts are valued at around $50 Million.

The U.S. Department of Veterans Affairs (VA) Eyes Blockchain Tech: According to VA CTO Charles Worthington, “we’re going to be coming to the industry with problems we have, and if you think blockchain is an appropriate solution, bring it to us.” Some issues that plague the VA are interoperability & distributing healthcare data among entities. While he doesn’t believe blockchain can solve the issues overnight, he does believe there is a credible chance blockchain can offer solutions to a myriad of other problems.

Colorado Looks to Blockchain to Improve Data Security: On Tuesday, The Colorado Senate introduced Senate Bill 86 in an effort to improve its antiquated data structure system. In recent years, the U.S. has seen an explosion in cyber attacks (including the infamous WannaCry ransomware attack). The new legislation highlights the vulnerability of the State of Colorado’s government data storage system and seeks to improve the system’s capabilities of resisting identity theft.

Dallas Mavericks to Accept Cryptocurrency: If you’re a basketball fan and crypto user, you now have something that combines both of these interests coming your way. Shark Tank star and Dallas Mavericks team owner Mark Cuban says that next season fans will be able to purchase tickets in Bitcoin. Cuban, who was formerly fairly anti-Bitcoin, seems to have been warmed by the ides of 2017.

Blockchain ETFs Begin: On Wednesday, investors looking to cash in on Bitcoin’s technology will now be able to do so without investing in volatile cryptocurrencies themselves. According to Reuters, investors are able to “purchase shares of companies, such as Hitachi Ltd, Accenture plc, and Overstock.com Inc that may benefit from the digital assets underlying technology.”

[thrive_leads id=‘5219’]

What’s New at CoinCentral?

Yet another exciting week for CoinCentral is in the books. We had some fun putting out some new and awesome guides, covering a much wider variety than usual.

- 3 Common Cryptocurrency Tax “Loopholes” and Why They Don’t Work: Many people in the cryptocurrency are operating under the assumption that they can dodge the IRS come tax season. Learn why this is a mistake.

- What is DragonChain?: Disney + blockchain? Learn more about what DragonChain seeks to accomplish.

- Market Met with Seemingly Annual Massive Correction: This weeks dip was more than just randomness and memes.

- What is FunFair?: Check out how FunFair seeks to change online casino gaming.

- How to Make Money with Bitcoin: There are multiple avenues to make money with Bitcoin.

- Ripple Partners with MoneyGram for Cross-Border Payments: This was big news for XRP investors. Learn more about this valuable partnership.

- What is VeChain Thor?: Blockchain-as-a-Service with a working product. learn more about VeChain Thor.

- What is Zcash?: Completely anonymous or publicly viewable, the choice is yours. Find out what makes Zcash tick.

- What is ChainLink? Learn more about how this project is looking to bridge on-chain and off-chain ecosystems.

- NEO DevCon in San Francisco: NEO is bringing what they consider their “most important conference of the year” to San Francisco January 30th and 31st.

- What is BitClave: This new kid on the block plans on taking the Internet back from the current tech oligarchy.

- What Is Raiden?: An introduction to the world of Raiden, a project looking to bring advanced scalability to the Ethereum blockchain

- Bittrex, Binance, and Others Stop Accepting New Accounts: Here’s why some major exchanges shut their doors to new accounts.

- What is Waltonchain?: Waltonchain combines blockchain with IoT and could play a significant role in paving the way for a much more robust IoT world.

- Explaining Ripples Price Drop: Understanding the FUD that pushed crypto investors to sell Ripple.

- Psychology of Cheap Coins: Exploring the psychological attraction of cheap coins.

- Ripple and R3 Continue Legal Battle: A case about “misrepresentations, omissions, half-truths, and failure to live up to [its] promises.”

This is the last weekly reminder for Blockchain Connect in San Francisco on January 26th, 2018. The conference is next FRIDAY, and many of the influential people behind many of the innovative projects we write about will be speaking. Use the code “Coincentral” for 30% off.

Cryptocurrency News from Around the World

With Crypto Regulations Underway, Korean Official Accused of Insider Trading: According to The Korea Times, chief of the Financial Services Commission Choi Jong-Ku stated “we’ve acknowledged allegations that an FSS official sold crypto-assets based on insider information before the government’s updated announcement to regulate the market. We are looking into this case.” With the recent “crypto craze” and its empowerment of money laundering, South Korea seeks to bring order into the cryptocurrency market.

Leading Japanese Bank to Establish Cryptocurrency Exchange: Mitsubishi UFJ Financial Group, one of the top ten banks in the world, will launch a cryptocurrency and exchange in March. At a value of $2.32 trillion, the companies large-scale plans are set to makes waves in the cryptocurrency community.

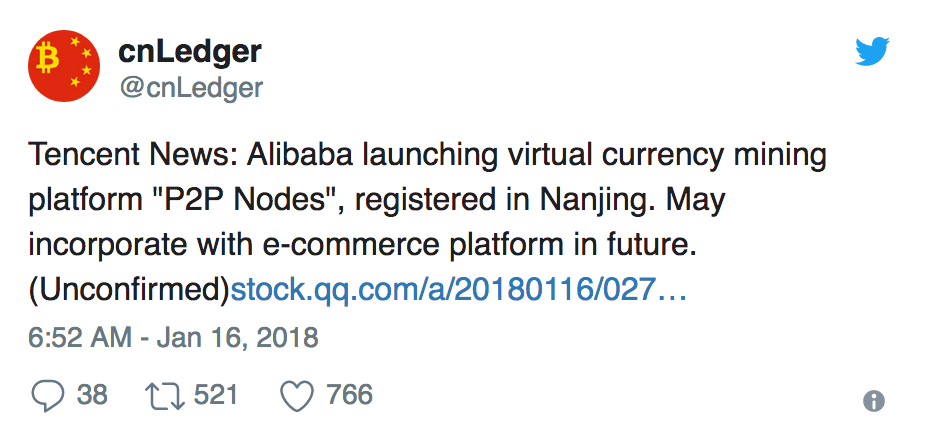

E-commerce giant Alibaba Establishes Crypto Mining Platform: Despite recent news that the Chinese government is attempting to ban all cryptocurrency mining in the country, Alibaba went ahead and did it anyway. Registered in Nanjing, “P2P Nodes” is set to partner with multiple electricity suppliers in the region.

France & Germany Disclose Plans for Bitcoin Regulations: In a joint French-German press conference, French Finance Minister Bruno Le Maire announced the two countries plan to regulate Bitcoin and other cryptocurrencies. Le Maire stated, “we will have a joint Franco-German analysis of the risks linked to bitcoin, regulation proposals and these will be submitted as a joint proposal to our G20 counterparts at the G20 summit in Argentina in March.”

Central Bank of Lithuania Launches “LBChain” to Spark Innovation: As reported on the bank’s official page, LBChain will enable domestic and foreign companies to “develop and test one of the most prospective FinTech innovations – blockchain-based solutions – in the regulatory and technological sandbox platform-service.” Board member Marius Jurgilas hopes the technology will attract talent and investors into the country to accelerate new wave technology.

Israel to Tax ICO’s: On Wednesday, the Israeli government released a proposal to add a value-added-tax (VAT) on ICO’s with a multitude of possible strategies on how to proceed. Unsure of the best avenues to take regarding the measures suggested, the government is asking for public recommendation to optimize the draft.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.