- This Week in Cryptocurrency – Weekly News Recap

- What’s New at CoinCentral?

- More Cryptocurrency News From Around the Web

This Week in Cryptocurrency – Weekly News Recap

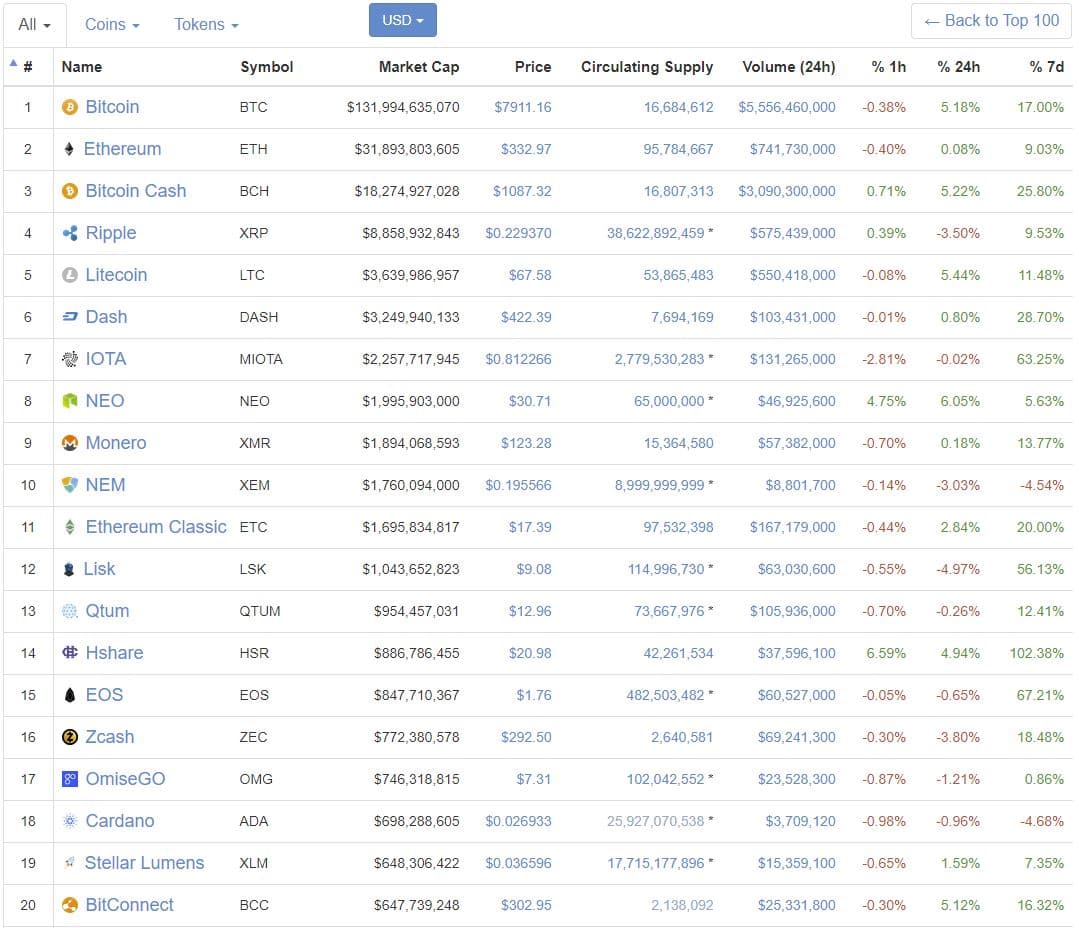

Prices Soar: In the last 7 days, the vast majority of cryptocurrencies have seen healthy price increases.

While early this week some thought Bitcoin Cash was on its way to overtaking Bitcoin, that idea seems to have been put to rest. Yesterday Bitcoin broke $8,000 and at the time of writing this it’s priced at $7,911.16 (+17% in the last 7 days). Sunday, competitor Bitcoin Cash‘s price reached over $2,400, but has since came crashing down to $1,099.42 at press time.

The pump in Bitcoin Cash’s price temporarily put BCH at the number 2 market cap of all cryptocurrencies. Following the dump of BCH, Ethereum currently sits back in the number 2 spot ($332.97, +9.03% last 7 days).

Of current top 10 cryptos, the IOTA cryptocurrency saw the largest price increase (+63.25% in last 7days). Iota, which had only been available to buy on two major exchanges, was added to the chinese OKEX. This week rumors also spread that IOTA was coming to bittrex after “IOTA” was found on one of their APIs, however it has since been removed from the API.

Looking at the top 20 cryptos, Hshares is up the most in the last 7 days (+102.38%).

RIP Bitcoin Classic: For your daily dose of “wait, that still exists?” Bitcoin Classic confirmed that it is shutting down. Tom Zander, Bitcoin Classic release manager praised Bitcoin Cash and said that Bitcoin Classic “fulfilled its promise” of “coming back to the coin Satoshi indicated as his goal.” The shutdown was due to developers claiming that Bitcoin Cash will become the original “Bitcoin” by May 2018.

Square Cash Me Outside: The popular peer-to-peer payment app Square Cash piloted the new feature to buy or sell Bitcoin from within the app. As one of the most popular payment apps, this could be a huge step for the commercialization of Bitcoin.

A Square spokesperson noted, “We’re always listening to our customers and we’ve found that they are interested in using the Cash App to buy Bitcoin. We’re exploring how Square can make this experience faster and easier, and have rolled out this feature to a small number of Cash App customers. We believe cryptocurrency can greatly impact the ability of individuals to participate in the global financial system and we’re excited to learn more here.”

It will be interesting to see if and how other peer-to-peer payment systems such as Venmo and PayPal respond.

What’s New at CoinCentral?

This week the CoinCentral staff was hard at work, as we continue to regularly create more educational content each week.

New cryptocurrency guides made this week:

- Bitcoin Cash vs Bitcoin – Learn what Bitcoin cash is and how it differs from Bitcoin.

- What is Bitshares? – A look into the “industrial grade crypto-equity peer to peer distributed ledger”.

- What is PIVX? – A beginners’ guide to one of the fastest growing privacy coins.

- The Best Fully Anonymous Bitcoin Wallets

We also added a number of resources to answer many of the most common questions related to Ethereum:

[thrive_leads id=’3527′]

More Cryptocurrency News From Around the Web

Zimbabwe Turns to Bitcoin: Amid civil tensions, capital flooded the Zimbabwe Bitcoin market. Zimbabwe’s Golix exchange saw the price per Bitcoin jump to $13,499, nearly double the price it was trading at in other markets. Zimbabwe currently doesn’t have its own currency, adopting the US Dollar and South African Rand since hyperinflation essentially took their official dollar out of commission.

Don’t Mind if I Do: Over the weekend, Bitcoin’s price took a sharp nosedive to under $6,000 amidst the Bitcoin Cash drama. During the dip, one buyer scooped up nearly $20 million worth of Bitcoin. The buyer was later identified as Mike Novogratz, the billionaire who runs a crypto fund called “Galaxy Investment Partners.” Novogratz stated in the Reuters Global 2018 Investment Outlook Summit that “The institutionalization of this space is coming. It’s coming pretty quick.”

Well, that dip paid off in just a few days. Assuming he bought $20 million of Bitcoin at (let’s say) $6,000, he made a profit of *scribbles some math on the back of a napkin* $6,666,666. While a number that might make a few people uneasy, not a bad gain for a few days.

Big Bucks Says No Bubble: Tim Draper, prominent venture capitalist and vocal Bitcoin enthusiast, stated that Bitcoin is not a bubble. Draper said, “This is the greatest technology since the internet.This is a sociological transformation, it’s a movement.’’ What separates Draper from the overly enthusiastic Bitcoin nerd such as myself is the fact that he owns an estimated 30,000 Bitcoins, which is roughly $240,000,000.

Water is the Essence of Wetness: A six-person startup in Austria claims to be able to solve the high energy consumption of cryptocurrency mining by using solely renewable energy. HydroMiner currently runs cryptocurrency servers at two Austrian hydropower mills and utilizes cold Alpine currents to keep their equipment cool. Their plan is to utilize over 2,000 small hydropower stations in Austria, most of which are sitting idle. The company pays owners of the mills about 4.5 cents per kilowatt-hour, far below the estimated 19.3 cent break-even point to mine bitcoins profitably. [Bloomberg]

Wisdom from the East: In a time where most Western nations are pessimistically apprehensive at best when it come to regulating Bitcoin, Japan seems to be years ahead. In April 2017, Bitcoin started being considered official legal payment when 4,500 stores started accepting the coin. Bitcoin signs are displayed prominently throughout shops across the country. Citizens even have the option to pay their utility bills with a special bitcoin discount via a company called Remixpoint. Japan is a very tech-forward nation and views cryptocurrency “regulation” as encouragement of responsible use while safeguarding citizens, whereas most Western nations view “regulation” as protecting themselves from money laundering.

Sneaky, Sneaky Miners: A man named Willem de Groot discovered a hidden cryptocurrency miner within a free cookie consent pop-up script on the website of Albert Heijn, the biggest supermarket chain in the Netherlands. De Groot claims to have found that script running on 243 other websites using the PublicWWW search engine. The miner has since been removed.

Tezos Slapped with Another Lawsuit: In less than a month, Tezos has been slapped with two lawsuits. The one filed this Monday is pertaining to the July fundraiser that brought in $232 million for a project that allegedly did not make it clear to contributors that the end goal would take more than three years. This could just be the second of many, as many other law firms may soon hop on the litigation train.

[thrive_leads id=’3527′]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.